|

Chargeback

A chargeback is a return of money to a Payment, payer of a transaction, especially a credit card transaction. Most commonly the payer is a consumer. The chargeback reverses a Electronic funds transfer, money transfer from the consumer's bank account, line of credit, or credit card. The chargeback is ordered by the bank that Issuing bank, issued the consumer's payment card. In the distribution industry, a chargeback occurs when the supplier sells a product at a higher price to the distributor than the price they have set with the end user. The distributor submits a chargeback to the supplier so they can recover the money lost in the transaction. United States overview The chargeback mechanism exists primarily for consumer protection. Holders of credit cards issued in the United States are afforded reversal rights by Regulation Z of the Truth in Lending Act. United States debit card holders are guaranteed reversal rights by Regulation E of the Electronic Fund Transfer Act. Simila ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Friendly Fraud

Friendly fraud, also known as chargeback fraud, occurs when a consumer makes an online shopping purchase with their own credit card, and then requests a chargeback from the issuing bank after receiving the purchased goods or services. Once approved, the chargeback cancels the financial transaction, and the consumer receives a refund of the money they spent. Dependent on the payment method used, the merchant can be accountable when a chargeback occurs. History Friendly fraud has been widespread on the Internet, affecting both the sale of physical products and digital transactions. To combat digital transaction fraud, Stored-value card, prepaid cards have been offered as an effective alternative to ensure customer payment. MasterCard was sued in 2003 by an Internet vendor for having credit card policies and fees that have made Internet vendors especially vulnerable targets of friendly fraud. Internet vendors typically have to pay much of the losses when a fraudulent transaction li ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chargeback Insurance

{{More citations needed, date=December 2008Chargeback insurance is an insurance product that protects a merchant who accepts credit cards. The insurance protects the merchant against fraud in a transaction where the use of the credit card was unauthorized, and covers claims arising out of the merchant's liability to the service bank. The phrase chargeback insurance is also sometimes used to describe the guarantee provided by online fraud prevention companies such as Vesta, ClearSale, Forter, Riskified and Signifyd. Unlike with card present transactions, where the merchant is not liable for the cost of fraudulent transactions (unless they do not meet technological security requirements such as EMV), merchants are liable for card not present transactions which turn out to be fraudulent. For this reason, online fraud prevention companies who offer decisions (meaning, they provide an approve or decline decision for orders) rather than scores (where the merchant must themselves deci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Acquiring Bank

An acquiring bank (also known simply as an acquirer) is a bank or financial institution that processes credit or debit card payments on behalf of a merchant. The acquirer allows merchants to accept credit card payments from card issuers such as Visa, MasterCard, Discover, China UnionPay, American Express. The acquiring bank enters into a contract with a merchant and offers it a merchant account. This arrangement provides the merchant with a line of credit. Under the agreement, the acquiring bank exchanges funds with issuing banks on behalf of the merchant and pays the merchant for its daily payment-card activity's net balance — that is, gross sales minus reversals, interchange fees, and acquirer fees. Acquirer fees are an additional markup added to association interchange fees by the acquiring bank, and those fees vary at the acquirer's discretion. Risks The acquiring bank accepts the risk that the merchant will remain solvent. The main source of risk to the acquiring ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Card Not Present Transaction

A card-not-present transaction (CNP, mail order / telephone order, MO/TO) is a payment card transaction made where the cardholder does not or cannot physically present the card for a merchant's visual examination at the time that an order is given and payment effected. It is most commonly used for payments made over the Internet, but can also be used with mail-order transactions by mail or fax, or over the telephone. Card-not-present transactions are a major route for credit card fraud, because it is difficult for a merchant to verify that the actual cardholder is indeed authorizing a purchase. If a fraudulent CNP transaction is reported, the acquiring bank hosting the merchant account that received the money from the fraudulent transaction must make restitution to the cardholder, which is called a chargeback. In addition, the merchant account would be assessed a chargeback fee by the acquiring bank. This is the opposite of a card present transaction, when the issuer of the c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Visa Inc

Visa Inc. () is an American multinational payment card services corporation headquartered in San Francisco, California. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. Visa does not issue cards, extend credit, or set rates and fees for consumers; rather, Visa provides financial institutions with Visa-branded payment products that they then use to offer credit, debit, prepaid and cash access programs to their customers. In 2015, the Nilson Report, a publication that tracks the credit card industry, found that Visa's global network (known as VisaNet) processed 100 billion transactions during 2014 with a total volume of US$6.8 trillion. This article is authored by a ''Forbes'' staff member. Visa was founded in 1958 by Bank of America (BofA) as the BankAmericard credit card program. Available through SpringerLink. In response to competitor Master Charge (now Mastercard ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PayPal

PayPal Holdings, Inc. is an American multinational financial technology company operating an online payments system in the majority of countries that support E-commerce payment system, online money transfers; it serves as an electronic alternative to traditional Banknote, paper methods such as cheque, checks and money orders. The company operates as a payment processor for online vendors, auction sites and many other commercial and company users, for which it charges an international addition bank charges fee. Established in 1998 as Confinity, PayPal went public through an initial public offering, IPO in 2002. It became a wholly owned subsidiary of eBay later that year, valued at $1.5 billion. In 2015 eBay corporate spin-off, spun off PayPal to its shareholders, and PayPal became an independent company again. The company was ranked 143rd on the 2022 Fortune 500, ''Fortune'' 500 of the largest United States corporations by revenue. Since 2023, PayPal is a member of the MACH Al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Service Provider

A payment service provider (PSP) is a third-party company that allows businesses to accept electronic payments, such as credit card and debit card payments. PSPs act as intermediaries between those who make payments, i.e. consumers, and those who accept them, i.e. retailers. They will often provide merchant services and act as a payment gateway or payment processor for e-commerce and brick and mortar businesses. They may also offer risk management services for card and bank based payments, transaction payment matching, digital wallets, reporting, fund remittance, currency exchange and fraud protection. The PSP will typically provide software to integrate with e-commerce websites or point of sale systems. Operation PSPs establish technical connections with acquiring banks and card networks, enabling merchants to accept different payment methods without the need to partner with a particular bank. They fully manage payment processing and external network relationships, ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Solvency

Solvency, in finance or business, is the degree to which the current assets of an individual or entity exceed the current liabilities of that individual or entity. Solvency can also be described as the ability of a corporation to meet its long-term fixed expenses and to accomplish long-term expansion and growth. This is best measured using the net liquid balance (NLB) formula. In this formula, solvency is calculated by adding cash and cash equivalents to short-term investments, then subtracting notes payable. There exist cryptographic schemes for both proofs of liabilities and assets, especially in the blockchain space. See also * Accounting liquidity * Debt ratio * Going concern * Insolvency * Quick ratio Notes References * * * * * External links *{{Wiktionary-inline Financial economics ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Transaction

A financial transaction is an Contract, agreement, or communication, between a buyer and seller to exchange goods, Service (economics), services, or assets for payment. Any transaction involves a change in the status of the finances of two or more businesses or individuals. A financial transaction always involves one or more financial asset, most commonly money or another valuable item such as gold or silver. There are many types of financial transactions. The most common type, purchases, occur when a good, service, or other commodity is sold to a consumer in exchange for money. Most purchases are made with cash payments, including Cash, physical currency, debit cards, or cheques. The other main form of payment is credit, which gives immediate access to funds in exchange for repayment at a later date. History There is no evidence to support the theory that ancient civilizations worked on systems of barter. Instead, most historians believe that ancient cultures worked on princi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-sufficient Funds

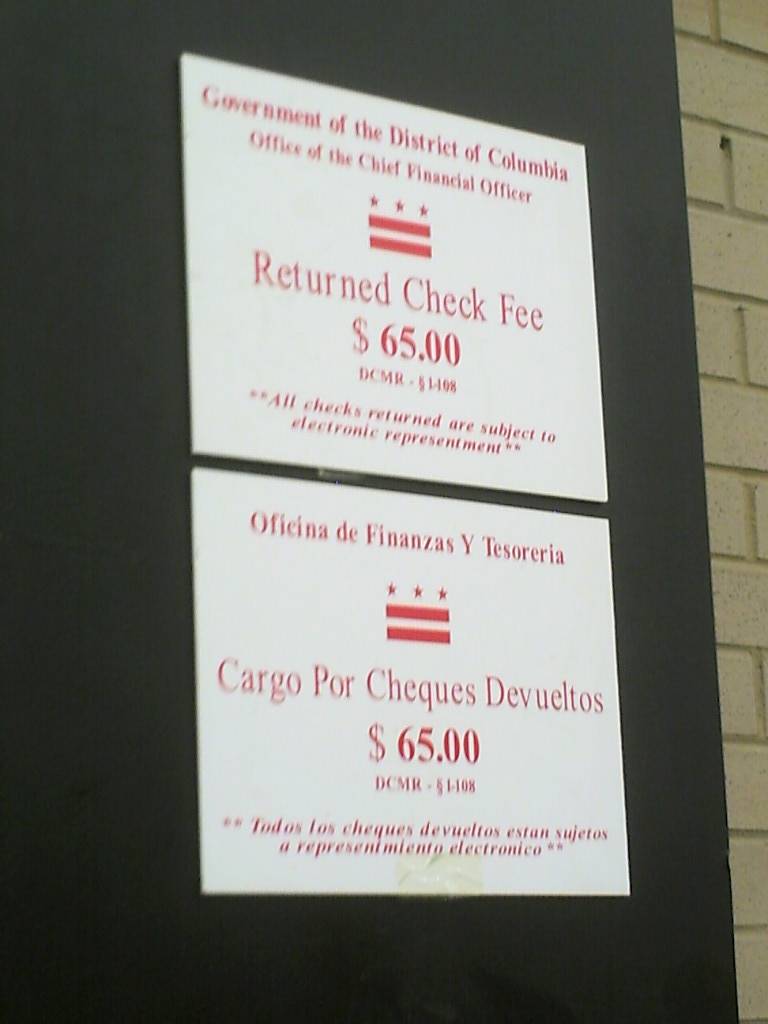

A dishonoured cheque (US spelling: dishonored check) is a cheque that the bank on which it is drawn declines to pay ("honour"). There are a number of reasons why a bank might refuse to honour a cheque, with non-sufficient funds (NSF) being the most common, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF cheque may be referred to as a bad cheque, dishonoured cheque, bounced cheque, cold cheque, rubber cheque, returned item, or hot cheque. Lost or bounced cheques result in late payments and affect the relationship with customers. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed "Present again", by which time the funds should have cleared. When more than one cheque is presented fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |