|

Carrying Charge

The cost of carry or carrying charge is the cost of holding a security or a physical commodity over a period of time. The carrying charge includes insurance, storage and interest on the invested funds as well as other incidental costs. In interest rate futures markets, it refers to the differential between the yield on a cash instrument and the cost of the funds necessary to buy the instrument. If long, the cost of carry is the cost of interest paid on a margin account. Conversely, if short, the cost of carry is the cost of paying dividends, or rather the opportunity cost; the cost of purchasing a particular security rather than an alternative. For most investments, the cost of carry generally refers to the risk-free interest rate that could be earned by investing currency in a theoretically safe investment vehicle such as a money market account minus any future cash flows that are expected from holding an equivalent instrument with the same risk (generally expressed in percentag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security (finance)

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equity and fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or " book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a securi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Parity

Interest rate parity is a no-arbitrage condition representing an equilibrium state under which investors compare interest rates available on bank deposits in two countries. The fact that this condition does not always hold allows for potential opportunities to earn riskless profits from covered interest arbitrage. Two assumptions central to interest rate parity are capital mobility and perfect substitutability of domestic and foreign assets. Given foreign exchange market equilibrium, the interest rate parity condition implies that the expected return on domestic assets will equal the exchange rate-adjusted expected return on foreign currency assets. Investors then cannot earn arbitrage profits by borrowing in a country with a lower interest rate, exchanging for foreign currency, and investing in a foreign country with a higher interest rate, due to gains or losses from exchanging back to their domestic currency at maturity. Interest rate parity takes on two distinctive forms: ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

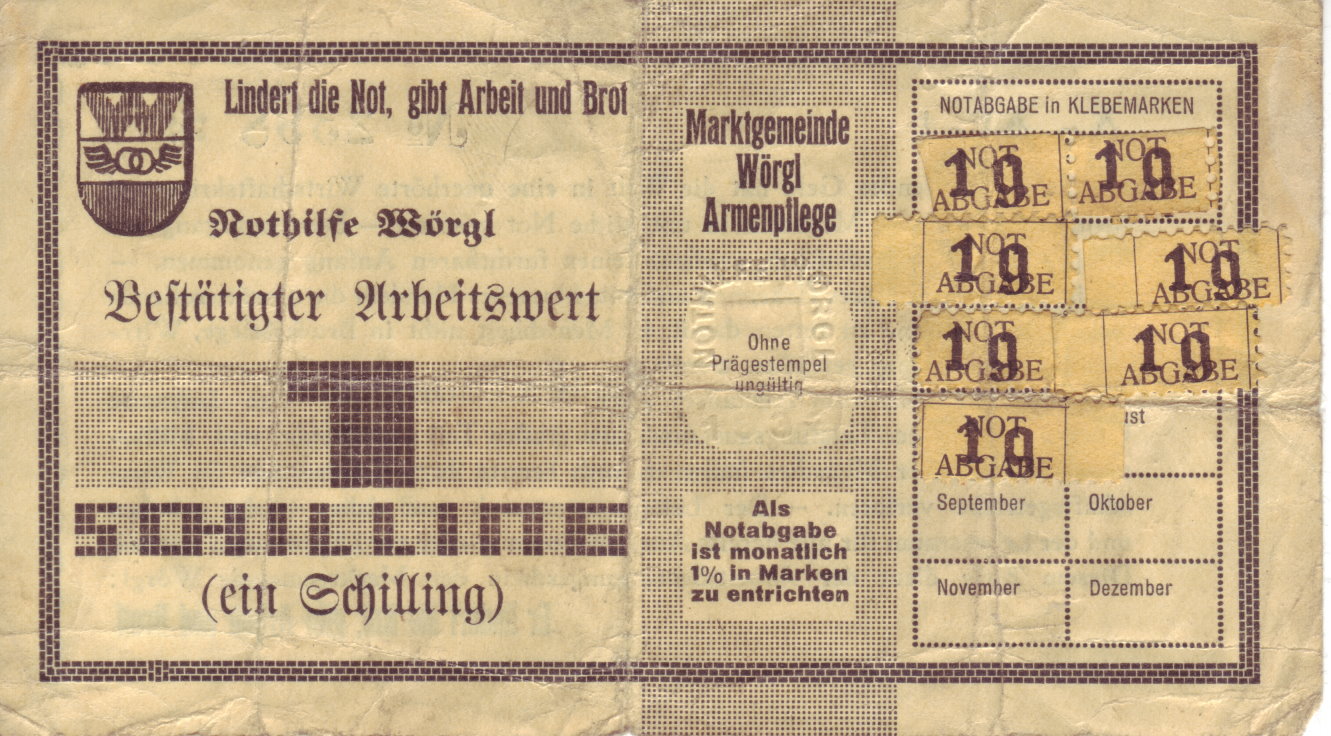

Demurrage Currency

Demurrage currency, also known as depreciating money or stamp scrip in its paper money form, is a type of money that is designed to gradually lose purchasing power at a flat constant rate. Unlike traditional money, demurrage is designed to only be a ''temporary'' store of value. Demurrage money functions primarily as a medium of exchange and unit of account. In some cases, demurrage currencies have been employed as emergency currencies, intended to keep the circular flow of income running throughout the economy during recessions and times of war, due to their faster circulation velocities. Demurrage is sometimes cited as economically advantageous, usually in the context of complementary currency systems. The German-Argentine economist, Silvio Gesell, advocated for demurrage currency as part of the Freiwirtschaft economic system. He referred to demurrage as '' Freigeld'' 'free money' — "free" because it would be freed from hoarding and interest. Gesell theorized that Freigeld ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contango

Contango is a situation in which the futures contract, futures price (or forward contract, forward price) of a commodity is higher than the spot price. In a contango situation, arbitrageurs or speculators are "willing to pay more for a commodity [to be received] at some point in the future than to purchase the commodity immediately. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today." On the other side of the trade, Hedge (finance), hedgers (commodity producers and commodity holders) are happy to sell futures contracts and accept the higher-than-expected returns. A contango market is also known as a ''normal market'' or ''carrying cost, carrying-cost market''. The opposite market condition to contango is known as backwardation. "A market is 'in backwardation' when the futures price is below the spot price for a particular commodity. This is favorable for inves ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Covered Interest Arbitrage

Covered interest arbitrage is an arbitrage trading strategy whereby an investor capitalizes on the interest rate differential between two countries by using a forward contract to ''cover'' (eliminate exposure to) exchange rate risk. Using forward contracts enables arbitrageurs such as individual investors or banks to make use of the forward premium (or discount) to earn a riskless profit from discrepancies between two countries' interest rates. The opportunity to earn riskless profits arises from the reality that the interest rate parity condition does not constantly hold. When spot and forward exchange rate markets are not in a state of equilibrium, investors will no longer be indifferent among the available interest rates in two countries and will invest in whichever currency offers a higher rate of return. Economists have discovered various factors which affect the occurrence of deviations from covered interest rate parity and the fleeting nature of covered interest arbitrage oppo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Parity

Interest rate parity is a no-arbitrage condition representing an equilibrium state under which investors compare interest rates available on bank deposits in two countries. The fact that this condition does not always hold allows for potential opportunities to earn riskless profits from covered interest arbitrage. Two assumptions central to interest rate parity are capital mobility and perfect substitutability of domestic and foreign assets. Given foreign exchange market equilibrium, the interest rate parity condition implies that the expected return on domestic assets will equal the exchange rate-adjusted expected return on foreign currency assets. Investors then cannot earn arbitrage profits by borrowing in a country with a lower interest rate, exchanging for foreign currency, and investing in a foreign country with a higher interest rate, due to gains or losses from exchanging back to their domestic currency at maturity. Interest rate parity takes on two distinctive forms: ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carrying Charge

The cost of carry or carrying charge is the cost of holding a security or a physical commodity over a period of time. The carrying charge includes insurance, storage and interest on the invested funds as well as other incidental costs. In interest rate futures markets, it refers to the differential between the yield on a cash instrument and the cost of the funds necessary to buy the instrument. If long, the cost of carry is the cost of interest paid on a margin account. Conversely, if short, the cost of carry is the cost of paying dividends, or rather the opportunity cost; the cost of purchasing a particular security rather than an alternative. For most investments, the cost of carry generally refers to the risk-free interest rate that could be earned by investing currency in a theoretically safe investment vehicle such as a money market account minus any future cash flows that are expected from holding an equivalent instrument with the same risk (generally expressed in percentag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carry (investment)

The carry of an asset is the return obtained from holding it (if positive), or the cost of holding it (if negative) (see also Cost of carry). For instance, commodities are usually negative carry assets, as they incur storage costs or may suffer from depreciation. (Imagine corn or wheat sitting in a silo somewhere, not being sold or eaten.) But in some circumstances, appropriately hedged commodities can be positive carry assets if the forward/futures market is willing to pay sufficient premium for future delivery. This can also refer to a trade with more than one leg, where you earn the spread between borrowing a low carry asset and lending a high carry one; such as gold during a financial crisis, due to its safe haven quality. Carry trades are not usually arbitrages: pure arbitrages make money no matter what; carry trades make money only if nothing changes against the carry's favor. Interest rates carry trade/maturity transformation For instance, the traditional revenue ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

E-mini

E-minis are futures contracts that represent a fraction of the value of standard futures. They are traded primarily on the Chicago Mercantile Exchange. As of April, 2011, CME lists 44 unique E-mini contracts, of which approximately 10 have average daily trading volumes of over 1,000 contracts. Some E-mini contracts provide trading advantages, including high liquidity, greater affordability for individual investors due to lower margin requirements than the full-size contracts, and round-the-clock trading 23.25 hours a day from Sunday afternoon to Friday afternoon. Under U.S. tax law, E-minis may qualify as 1256 Contracts, and benefit from several tax advantages as well. The risk of loss is also amplified by the higher leverage. Symbology Most E-mini futures expire quarterly (with the exception of agricultural products), in March, June, September, and December. An E-mini future symbol is formed by starting with the root symbol and adding the expiration month letter (the same as f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividend

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex-dividend date, though more often than not it may open higher. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business (called retained earnings). The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash (usually by bank transfer) or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets. The dividend received by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $49.8 trillion as of March 31, 2025. The S&P 500 index is a Free-float weighted/ capitalization-weighted index. As of April 2025, the ten largest companies on the list of S&P 500 companies accounted for approximately 35% of the market capitalization of the index and were, in order of highest to lowest weighting: Apple (6.4%), Microsoft (6.2%), Nvidia (6.0%), Amazon.com (3.8%), Alphabet (3.6%, including both class A & C shares), Meta Platforms (2.7%), Berkshire Hathaway (2.0%), Broadcom (1.8%), Tesla (1.6%), and JPMorgan Chase (1.4%). The components that have increased their dividends in 25 consecutive ye ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |