|

Bootstrapping (finance)

In finance, bootstrapping is a method for constructing a ( zero-coupon) fixed-income yield curve from the prices of a set of coupon-bearing products, e.g. bonds and swaps. A ''bootstrapped curve'', correspondingly, is one where the prices of the instruments used as an ''input'' to the curve, will be an exact ''output'', when these same instruments are valued using this curve. Here, the term structure of spot returns is recovered from the bond yields by solving for them recursively, by forward substitution: this iterative process is called the ''bootstrap method''. The usefulness of bootstrapping is that using only a few carefully selected zero-coupon products, it becomes possible to derive par swap rates (forward and spot) for ''all'' maturities given the solved curve. Methodology As stated above, the selection of the input securities is important, given that there is a general lack of data points in a yield curve (there are only a fixed number of products in the market). More ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability asse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zero-coupon Bond

A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US savings bonds, long-term zero-coupon bonds, and any type of coupon bond that has been stripped of its coupons. Zero coupon and deep discount bonds are terms that are used interchangeably. In contrast, an investor who has a regular bond receives income from coupon payments, which are made semi-annually or annually. The investor also receives the principal or face value of the investment when the bond matures. Some zero coupon bonds are inflation indexed, and the amount of money that will be paid to the bond holder is calculated to have a set amount of purchasing power, rather than a se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical fina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Economics

Financial economics, also known as finance, is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on ''both sides'' of a trade".William F. Sharpe"Financial Economics", in Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus: Merton H. Miller, (1999). The History of Finance: An Eyewitness Account, ''Journal of Portfolio Management''. Summer 1999. asset pricing, commonly known as "Investments", and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance. The subject is concerned with "the allocation and deployment of economic resources, both spatially and across time, in an uncertain environment".See Fama and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leveraged Buyout

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money (leverage) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company. The use of debt, which normally has a lower cost of capital than equity, serves to reduce the overall cost of financing the acquisition. The cost of debt is lower because interest payments often reduce corporate income tax liability, whereas dividend payments normally do not. This reduced cost of financing allows greater gains to accrue to the equity, and, as a result, the debt serves as a lever to increase the returns to the equity. The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short-rate Model

A short-rate model, in the context of interest rate derivatives, is a mathematical model that describes the future evolution of interest rates by describing the future evolution of the short rate, usually written r_t \,. The short rate Under a short rate model, the stochastic state variable is taken to be the instantaneous spot rate. The short rate, r_t \,, then, is the ( continuously compounded, annualized) interest rate at which an entity can borrow money for an infinitesimally short period of time from time t. Specifying the current short rate does not specify the entire yield curve. However, no-arbitrage arguments show that, under some fairly relaxed technical conditions, if we model the evolution of r_t \, as a stochastic process under a risk-neutral measure Q, then the price at time t of a zero-coupon bond maturing at time T with a payoff of 1 is given by : P(t,T) = \operatorname^Q\left \mathcal_t \right where \mathcal is the natural filtration for the process. The inte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multi-curve Framework

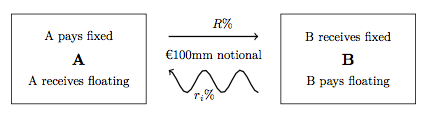

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index. The most common IRS is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Support Annex

A Credit Support Annex, or CSA, is a legal document which regulates credit support (collateral) for derivative transactions. It is one of the four parts that make up an ISDA Master Agreement but is not mandatory. It is possible to have an ISDA agreement without a CSA but normally not a CSA without an ISDA. Essentially, a CSA defines the terms or rules under which collateral is posted or transferred between swap counterparties to mitigate the credit risk arising from "in the money" derivative positions. If on any Valuation Date, the Delivery Amount equals or exceeds the Pledgor's Minimum Transfer Amount, the Pledgor must transfer Eligible Collateral with a Value at least equal to the Delivery Amount. The Delivery Amount is the amount the Credit Support Amount exceeds the Value of all posted Collateral held by the Secured Party. The Credit Support Amount is the Secured Party's Exposure plus Pledgor's Independent Amounts minus Secured Party's Independent Amounts minus the Pledgor's Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overnight Rate

The overnight rate is generally the interest rate that large banks use to borrow and lend from one another in the overnight market. In some countries (the United States, for example), the overnight rate may be the rate targeted by the central bank to influence monetary policy. In most countries, the central bank is also a participant on the overnight lending market, and will lend or borrow money to some group of banks. There may be a published overnight rate that represents an average of the rates at which banks lend to each other; certain types of overnight operations may be limited to qualified banks. The precise name of the overnight rate will vary from country to country. Background Throughout the course of a day, banks will transfer money to each other, to foreign banks, to large clients, and other counterparties on behalf of clients or on their own account. At the end of each working day, a bank may have a surplus or shortage of funds (or a shortage or excess reserves in fra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Libor

The London Inter-Bank Offered Rate is an interest-rate average calculated from estimates submitted by the leading banks in London. Each bank estimates what it would be charged were it to borrow from other banks. The resulting average rate is usually abbreviated to Libor () or LIBOR, or more officially to ICE LIBOR (for Intercontinental Exchange LIBOR). It was formerly known as BBA Libor (for British Bankers' Association Libor or the trademark bba libor) before the responsibility for the administration was transferred to Intercontinental Exchange. It is the primary benchmark, along with the Euribor, for short-term interest rates around the world. Libor was phased out at the end of 2021, and market participants are being encouraged to transition to risk-free interest rates. As of late 2022, parts of it have been discontinued, and the rest is scheduled to end within 2023; the Secured Overnight Financing Rate (SOFR) is its replacement. Libor rates are calculated for five currenci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overnight Indexed Swap

An overnight indexed swap (OIS) is an interest rate swap (''IRS'') over some given term, e.g. 10Y, where the periodic fixed payments are tied to a given fixed rate while the periodic floating payments are tied to a floating rate calculated from a daily compounded overnight rate over the floating coupon period. Note that the OIS term is not overnight; it is the underlying reference rate that is an overnight rate. The exact compounding formula depends on the type of such overnight rate. The index rate is typically the rate for overnight lending between banks, either non-secured or secured, for example the Federal funds rate or SOFR for US dollar, €STR (formerly EONIA) for Euro or SONIA for sterling. The fixed rate of OIS is typically an interest rate considered less risky than the corresponding interbank rate (LIBOR) because there is limited counterparty risk. The LIBOR–OIS spread is the difference between IRS rates, based on the LIBOR, and OIS rates, based on overnight rates ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multi-curve Framework

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index. The most common IRS is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.png)