|

Barriers To Exit

In economics, barriers to exit are obstacles in the path of a firm that wants to leave a given market or industrial sector. These obstacles often have associated costs, prohibiting the firm from leaving the market. If the barriers of exit are significant, a firm may be forced to continue competing in a market. This forced stay in the market occurs when the costs of leaving a market are higher than costs incurred by continuing in the market. Sometimes, when firms operate at low profit or at loss, they still choose to compete with others. Major factors of this decision making is high barriers to exit. Definitions There are various definitions of "barrier to exit", this means the absence of one common approach to define barriers to exit. In 1976, Porter defines "exit barriers" as "adverse structural, strategic and managerial factors that keep firms in business even when they earn low or negative returns.” In 1989, Gilbert used the definition “costs or forgone profits that a f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is the social science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyzes what's viewed as basic elements in the economy, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyzes the economy as a system where production, consumption, saving, and investment interact, and factors affecting it: employment of the resources of labour, capital, and land, currency inflation, economic growth, and public policies that have impact on glossary of economics, these elements. Other broad distinctions within economics include those between positive economics, desc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market (economics)

In economics, a market is a composition of systems, institutions, procedures, social relations or infrastructures whereby parties engage in exchange. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services (including labour power) to buyers in exchange for money. It can be said that a market is the process by which the prices of goods and services are established. Markets facilitate trade and enable the distribution and allocation of resources in a society. Markets allow any tradeable item to be evaluated and priced. A market emerges more or less spontaneously or may be constructed deliberately by human interaction in order to enable the exchange of rights (cf. ownership) of services and goods. Markets generally supplant gift economies and are often held in place through rules and customs, such as a booth fee, competitive pricing, and source of goods for sale (local produce or stock registration). Markets can dif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Industrial Sector

In macroeconomics, the secondary sector of the economy is an economic sector in the three-sector theory that describes the role of manufacturing. It encompasses industries that produce a finished, usable product or are involved in construction. This sector generally takes the output of the primary sector (i.e. raw materials) and creates finished goods suitable for sale to domestic businesses or consumers and for export (via distribution through the tertiary sector). Many of these industries consume large quantities of energy, require factories and use machinery; they are often classified as light or heavy based on such quantities. This also produces waste materials and waste heat that may cause environmental problems or pollution (see negative externalities). Examples include textile production, car manufacturing, and handicraft. Manufacturing is an important activity in promoting economic growth and development. Nations that export manufactured products tend to generate h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Competition

Competition is a rivalry where two or more parties strive for a common goal which cannot be shared: where one's gain is the other's loss (an example of which is a zero-sum game). Competition can arise between entities such as organisms, individuals, economic and social groups, etc. The rivalry can be over attainment of any exclusive goal, including Recognition (sociology), recognition: Competition occurs in nature, between living organisms which co-exist in the same natural environment, environment. Animals compete over water supplies, food, mates, and other resource (biology), biological resources. Humans usually Survival of the fittest, compete for food and mates, though when these needs are met deep rivalries often arise over the pursuit of wealth, power, prestige, and celebrity, fame when in a static, repetitive, or unchanging environment. Competition is a major tenet of market economy, market economies and business, often associated with business competition as companies a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

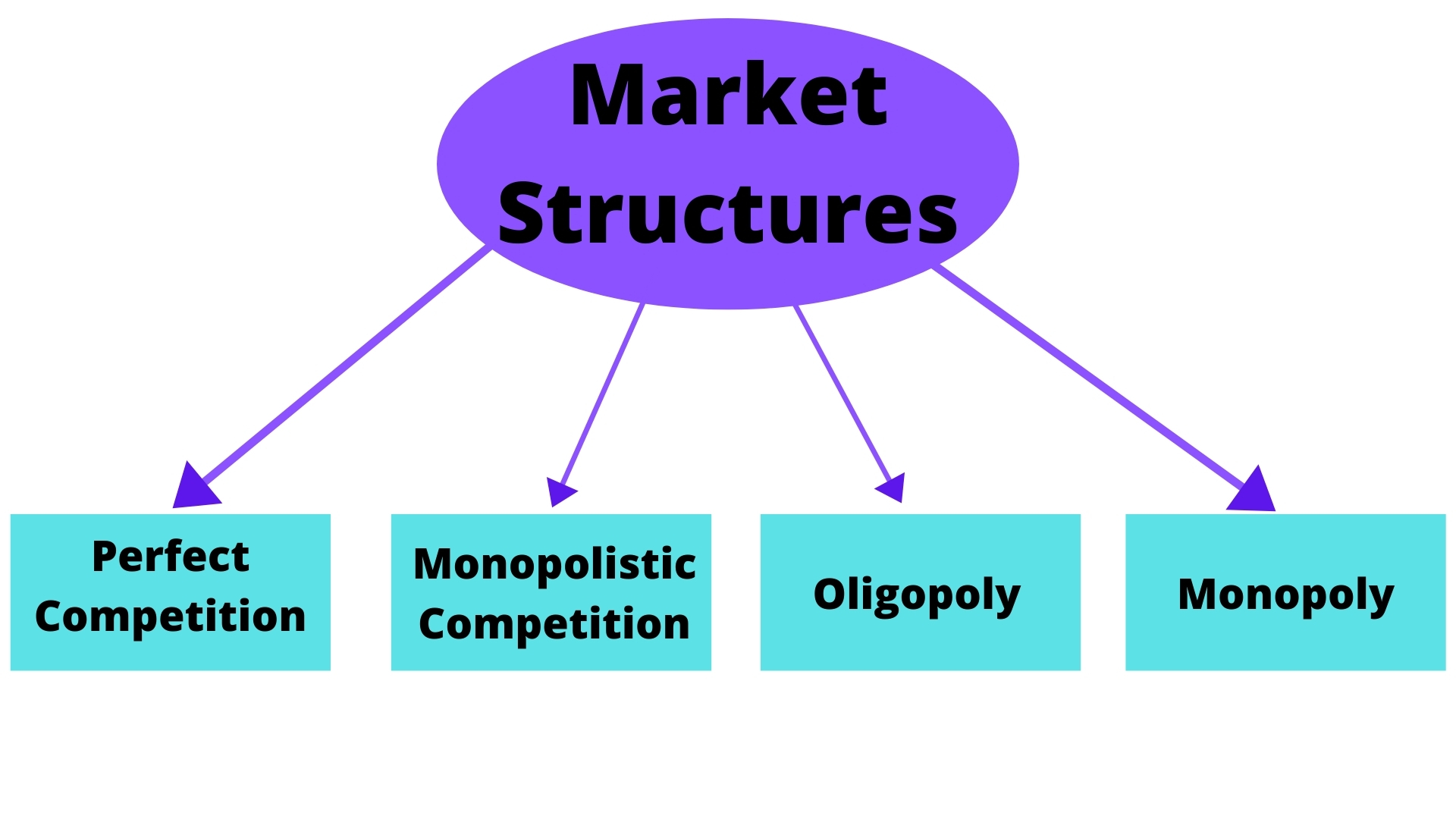

Perfect Competition

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In Economic model, theoretical models where conditions of perfect competition hold, it has been demonstrated that a Market (economics), market will reach an Economic equilibrium, equilibrium in which the quantity supplied for every Goods and services, product or service, including Workforce, labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum. Perfect competition provides both allocative efficiency and productive efficiency: * Such markets are ''allocatively efficient'', as output will always occur where marginal cost is equal to average revenue i.e. price (MC = AR). In perfect competition, any Profit maximization, profit-maximizing producer faces a market price equal to its marginal cost (P = MC). This implies that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perfect Competition

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In Economic model, theoretical models where conditions of perfect competition hold, it has been demonstrated that a Market (economics), market will reach an Economic equilibrium, equilibrium in which the quantity supplied for every Goods and services, product or service, including Workforce, labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum. Perfect competition provides both allocative efficiency and productive efficiency: * Such markets are ''allocatively efficient'', as output will always occur where marginal cost is equal to average revenue i.e. price (MC = AR). In perfect competition, any Profit maximization, profit-maximizing producer faces a market price equal to its marginal cost (P = MC). This implies that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopolistic Competition

Monopolistic competition is a type of imperfect competition such that there are many producers competing against each other, but selling products that are differentiated from one another (e.g. by branding or quality) and hence are not perfect substitutes. In monopolistic competition, a company takes the prices charged by its rivals as given and ignores the impact of its own prices on the prices of other companies. If this happens in the presence of a coercive government, monopolistic competition will fall into government-granted monopoly. Unlike perfect competition, the company maintains spare capacity. Models of monopolistic competition are often used to model industries. Textbook examples of industries with market structures similar to monopolistic competition include restaurants, cereals, clothing, shoes, and service industries in large cities. The "founding father" of the theory of monopolistic competition is Edward Hastings Chamberlin, who wrote a pioneering book on the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Barriers To Entry

In theories of competition in economics, a barrier to entry, or an economic barrier to entry, is a fixed cost that must be incurred by a new entrant, regardless of production or sales activities, into a market that incumbents do not have or have not had to incur. Because barriers to entry protect incumbent firms and restrict competition in a market, they can contribute to distortionary prices and are therefore most important when discussing antitrust policy. Barriers to entry often cause or aid the existence of monopolies and oligopolies, or give companies market power. Barriers of entry also have an importance in industries. First of all it is important to identify that some exist naturally, such as brand loyalty. Governments can also create barriers to entry to meet consumer protection laws, protecting the public. In other cases it can also be due to inherent scarcity of public resources needed to enter a market. Definitions Various conflicting definitions of "barrier to entr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Power

In economics, market power refers to the ability of a firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market power occurs if a firm does not face a perfectly elastic demand curve and can set its price (P) above marginal cost (MC) without losing revenue.Syverson, C. (2019). Macroeconomics and Market Power. The Journal of Economic Perspectives, 33(3), 23-43. https://doi.org/10.1257/jep.33.3.23 This indicates that the magnitude of market power is associated with the gap between P and MC at a firm's profit maximising level of output. Such propensities contradict perfectly competitive markets, where market participants have no market power, P = MC and firms earn zero economic profit. Market participants in perfectly competitive markets are consequently referred to as 'price takers', whereas market participants that exhibit market power are referred to as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Switching Barriers

Switching costs or switching barriers are terms used in microeconomics, strategic management, and marketing. They may be defined as the disadvantages or expenses consumers feel they experience, along with the economic and psychological costs of switching from one alternative to another. For example, when telephone service providers also offer Internet access as a package deal they are adding value to their service. A barrier to switching is then formed as swapping internet services providers is a time consuming effort. There are a range of different switching costs that fall under three main categories: procedural switching barriers, financial switching barriers, and relational switching barriers. Procedural switching barriers refer to the time and resources associated with changing to a new provider; financial switching barriers refer to the loss of financially measurable resources; and relational switching barriers look at the emotional inconvenience from the breaking of bonds and l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopoly (economics)

A monopoly (from Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterized by a lack of economic competition to produce the good or service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb ''monopolise'' or ''monopolize'' refers to the ''process'' by which a company gains the ability to raise prices or exclude competitors. In economics, a monopoly is a single seller. In law, a monopoly is a business ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |