|

Backwardation

Normal backwardation, also sometimes called backwardation, is the market condition where the price of a commodity's forward contract, forward or futures contract is trading below the ''expected'' spot price at contract maturity. The resulting futures or forward curve would ''typically'' be downward sloping (i.e. "inverted"), since contracts for further dates would typically trade at even lower prices. In practice, the expected future spot price is unknown, and the term "backwardation" may refer to "positive basis", which occurs when the current spot price exceeds the price of the future. The opposite market condition to normal backwardation is known as contango. Contango refers to "negative basis" where the future price is trading above the expected spot price. Note: In industry parlance backwardation may refer to the situation that futures prices are below the ''current'' spot price. Backwardation occurs when the difference between the forward price and the spot price is less ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contango

Contango is a situation in which the futures contract, futures price (or forward contract, forward price) of a commodity is higher than the spot price. In a contango situation, arbitrageurs or speculators are "willing to pay more for a commodity [to be received] at some point in the future than to purchase the commodity immediately. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today." On the other side of the trade, Hedge (finance), hedgers (commodity producers and commodity holders) are happy to sell futures contracts and accept the higher-than-expected returns. A contango market is also known as a ''normal market'' or ''carrying cost, carrying-cost market''. The opposite market condition to contango is known as backwardation. "A market is 'in backwardation' when the futures price is below the spot price for a particular commodity. This is favorable for inves ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forward Contract

In finance, a forward contract, or simply a forward, is a non-standardized contract between two parties to buy or sell an asset at a specified future time at a price agreed on in the contract, making it a type of derivative instrument.John C Hull'', Options, Futures and Other Derivatives (6th edition)'', Prentice Hall: New Jersey, USA, 2006, 3 The party agreeing to buy the underlying asset in the future assumes a long position, and the party agreeing to sell the asset in the future assumes a short position. The price agreed upon is called the ''delivery price'', which is equal to the forward price at the time the contract is entered into. The price of the underlying instrument, in whatever form, is paid before control of the instrument changes. This is one of the many forms of buy/sell orders where the time and date of trade is not the same as the value date where the securities themselves are exchanged. Forwards, like other derivative securities, can be used to hedge ris ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contract

In finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The item transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price'' or ''delivery price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a Derivative (finance), derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the Long (finance), long position holder and the selling party is said to be the Short (finance), short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Spot Price

In finance, a spot contract, spot transaction, or simply spot, is a contract of buying or selling a commodity, security or currency for immediate settlement (payment and delivery) on the spot date, which is normally two business days after the trade date. The settlement price (or rate) is called spot price (or spot rate). A spot contract is in contrast with a forward contract or futures contract where contract terms are agreed now but delivery and payment will occur at a future date. Spot prices and future price expectations Depending on the item being traded, spot prices can indicate market expectations of future price movements in different ways. For a security or non-perishable commodity (e.g. silver), the spot price reflects market expectations of future price movements. In theory, the difference in spot and forward prices should be equal to the finance charges, plus any earnings due to the holder of the security, according to the cost of carry model. For example, on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forward Curve

The forward curve is a function graph in finance that defines the prices at which a contract for future delivery or payment can be concluded today. For example, a futures contract forward curve is prices being plotted as a function of the amount of time between now and the expiry date of the futures contract (with the spot price being the price at time zero). The forward curve represents a term structure of prices. Forward interest rate A forward interest rate is a type of interest rate that is specified for a loan that will occur at a specified future date. As with current interest rates, forward interest rates include a term structure which shows the different forward rates offered to loans of different maturities. According to the unbiased expectations hypothesis, forward interest rates predict spot interest rates at the time the loan is actually made, but many analysts dispute whether this is true, as it ignores durational risk. This figure is part of the lending & credit i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sumitomo Copper Affair

The Sumitomo copper affair refers to a metal trading scandal in 1996 involving Yasuo Hamanaka, the chief copper trader of the Japanese trading house Sumitomo Corporation (Sumitomo). The scandal involves unauthorized trading over a 10-year period by Hamanaka, which led Sumitomo to announce US$1.8 billion in related losses in 1996 when Hamanaka's trading was discovered, and more related losses subsequently. The scandal also involved Hamanaka's attempts to Cornering the market, corner the entire world's copper market through LME Copper futures contracts on the London Metal Exchange, London Metal Exchange (LME). The affair was a major scandal which is at times compared in magnitude to the Silver Thursday scandal, involving the Hunt family's attempt to corner the world's silver markets. It currently ranks in the List of trading losses, top 10 trading losses in financial history. Hamanaka's decade of unauthorized trading Hamanaka and his superior, Saburo Shimizu, began speculating witho ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Convenience Yield

A convenience yield is an implied return on holding inventories. It is an adjustment to the cost of carry in the non-arbitrage pricing formula for forward prices in markets with trading constraints. Let F_ be the forward price of an asset with initial price S_t and maturity T. Suppose that r is the continuously compounded interest rate for one year. Then, the non-arbitrage pricing formula should be F_ = S_t \cdot e^ However, this relationship does not hold in most commodity markets, partly because of the inability of investors and speculators to short the underlying asset, S_t. Instead, there is a correction to the forward pricing formula given by the convenience yield c. Hence F_ = S_t \cdot e^ This makes it possible for backwardation Normal backwardation, also sometimes called backwardation, is the market condition where the price of a commodity's forward contract, forward or futures contract is trading below the ''expected'' spot price at contract maturity. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short Selling

In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. This is the opposite of the more common Long (finance), long Position (finance), position, where the investor will profit if the market value of the asset rises. An investor that sells an asset short is, as to that asset, a short seller. There are a number of ways of achieving a short position. The most basic is physical selling short or short-selling, by which the short seller Securities lending, borrows an asset (often a security (finance), security such as a share (finance), share of stock or a bond (finance), bond) and sells it. The short seller must later buy the same amount of the asset to return it to the lender. If the market price of the asset has fallen in the meantime, the short seller will have made a profit equal to the difference in price. Conversely, if the price has risen then the short seller will bear a loss. The short seller ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London Stock Exchange

The London Stock Exchange (LSE) is a stock exchange based in London, England. the total market value of all companies trading on the LSE stood at US$3.42 trillion. Its current premises are situated in Paternoster Square close to St Paul's Cathedral. Since 2007, it has been part of the London Stock Exchange Group (LSEG, which the exchange also lists (ticker symbol LSEG)). Despite a post-Brexit exodus of stock listings from the LSE, it was the most valued stock exchange in Europe as of 2023. According to the 2020 Office for National Statistics report, approximately 12% of UK-resident individuals reported having investments in stocks and shares. According to a 2020 Financial Conduct Authority report, approximately 15% of British adults reported having investments in stocks and shares. History Coffee House The Royal Exchange, London, Royal Exchange had been founded by the English financier Thomas Gresham and Sir Richard Clough on the model of the The Belgian bourse of Antwerp, An ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

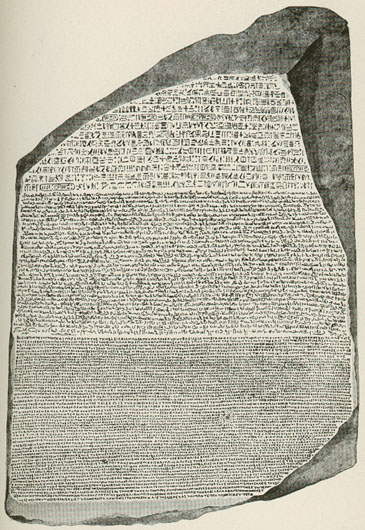

Encyclopædia Britannica

The is a general knowledge, general-knowledge English-language encyclopaedia. It has been published by Encyclopædia Britannica, Inc. since 1768, although the company has changed ownership seven times. The 2010 version of the 15th edition, which spans 32 volumes and 32,640 pages, was the last printed edition. Since 2016, it has been published exclusively as an online encyclopedia, online encyclopaedia. Printed for 244 years, the ''Britannica'' was the longest-running in-print encyclopaedia in the English language. It was first published between 1768 and 1771 in Edinburgh, Scotland, in three volumes. The encyclopaedia grew in size; the second edition was 10 volumes, and by its fourth edition (1801–1810), it had expanded to 20 volumes. Its rising stature as a scholarly work helped recruit eminent contributors, and the 9th (1875–1889) and Encyclopædia Britannica Eleventh Edition, 11th editions (1911) are landmark encyclopaedias for scholarship and literary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset (or contingent liability) and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in '' over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |