|

Volatility Risk

Volatility risk is the risk of an adverse change of price, due to changes in the volatility of a factor affecting that price. It usually applies to derivative instruments, and their portfolios, where the volatility of the underlying asset is a major influencer of option prices. Menachem Brenner, Ernest Y. Ou, Jin E. Zhang (2006)"Hedging volatility risk" ''Journal of Banking & Finance'' 30 (2006) 811–821 It is also relevant to portfolios of basic assets, and to foreign currency trading. Volatility risk can be managed by hedging with appropriate financial instruments. These are volatility swaps, variance swaps, conditional variance swaps, variance options, VIX futures for equities, and (with some construction) caps, floors and swaptions for interest rates. Here, the hedge-instrument is sensitive to the same source of volatility as the asset being protected (i.e. the same stock, commodity, or interest rate etc.). The position is then established such that a change i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Risk

Financial risk is any of various types of risk associated with financing, including financial transactions that include company loans in risk of default. Often it is understood to include only downside risk, meaning the potential for financial loss and uncertainty about its extent. Modern portfolio theory initiated by Harry Markowitz in 1952 under his thesis titled "Portfolio Selection" is the discipline and study which pertains to managing market and financial risk. In modern portfolio theory, the variance (or standard deviation In statistics, the standard deviation is a measure of the amount of variation of the values of a variable about its Expected value, mean. A low standard Deviation (statistics), deviation indicates that the values tend to be close to the mean ( ...) of a portfolio is used as the definition of risk. Types According to Bender and Panz (2021), financial risks can be sorted into five different categories. In their study, they apply an algorith ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swaptions

A swaption is an option granting its owner the right but not the obligation to enter into an underlying swap. Although options can be traded on a variety of swaps, the term "swaption" typically refers to options on interest rate swaps. Types There are two types of swaption contracts (analogous to put and call options): *A payer swaption gives the owner of the swaption the right to enter into a swap where they pay the fixed leg and receive the floating leg. *A receiver swaption gives the owner of the swaption the right to enter into a swap in which they will receive the fixed leg, and pay the floating leg. In addition, a "straddle" refers to a combination of a receiver and a payer option on the same underlying swap. The buyer and seller of the swaption agree on: *The premium (price) of the swaption *Length of the option period (which usually ends two business days prior to the start date of the underlying swap), *The terms of the underlying swap, including: **Notional amount (wi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value At Risk

Value at risk (VaR) is a measure of the risk of loss of investment/capital. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. VaR is typically used by firms and regulators in the financial industry to gauge the amount of assets needed to cover possible losses. For a given portfolio, time horizon, and probability ''p'', the ''p'' VaR can be defined informally as the maximum possible loss during that time after excluding all worse outcomes whose combined probability is at most ''p''. This assumes mark-to-market pricing, and no trading in the portfolio. For example, if a portfolio of stocks has a one-day 5% VaR of $1 million, that means that there is a 0.05 probability that the portfolio will fall in value by $1 million or more over a one-day period if there is no trading. Informally, a loss of $1 million or more on this portfolio is expected on 1 day out of 20 days (because of 5% p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Risk

Market risk is the risk of losses in positions arising from movements in market variables like prices and volatility. There is no unique classification as each classification may refer to different aspects of market risk. Nevertheless, the most commonly used types of market risk are: * '' Equity risk'', the risk that stock or stock indices (e.g. Euro Stoxx 50, etc.) prices or their implied volatility will change. * ''Interest rate risk'', the risk that interest rates (e.g. Libor, Euribor, etc.) or their implied volatility will change. * '' Currency risk'', the risk that foreign exchange rates (e.g. EUR/USD, EUR/GBP, etc.) or their implied volatility will change. * '' Commodity risk'', the risk that commodity prices (e.g. corn, crude oil) or their implied volatility will change. * '' Margining risk'' results from uncertain future cash outflows due to margin calls covering adverse value changes of a given position. * '' Shape risk'' * '' Holding period risk'' * '' Basi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility Smile

Volatility smiles are implied volatility patterns that arise in pricing financial options. It is a parameter (implied volatility) that is needed to be modified for the Black–Scholes formula to fit market prices. In particular for a given expiration, options whose strike price differs substantially from the underlying asset's price command higher prices (and thus implied volatilities) than what is suggested by standard option pricing models. These options are said to be either deep in-the-money or out-of-the-money. Graphing implied volatilities against strike prices for a given expiry produces a skewed "smile" instead of the expected flat surface. The pattern differs across various markets. Equity options traded in American markets did not show a volatility smile before the Crash of 1987 but began showing one afterwards. It is believed that investor reassessments of the probabilities of fat-tail have led to higher prices for out-of-the-money options. This anomaly implies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Risk Management

Financial risk management is the practice of protecting Value (economics), economic value in a business, firm by managing exposure to financial risk - principally credit risk and market risk, with more specific variants as listed aside - as well as some aspects of operational risk. As for risk management more generally, financial risk management requires identifying the sources of risk, measuring these, and crafting plans to mitigation, mitigate them. See for an overview. Financial risk management as a "science" can be said to have been bornW. Kenton (2021)"Harry Markowitz" investopedia.com with modern portfolio theory, particularly as initiated by Professor Harry Markowitz in 1952 with his article, "Portfolio Selection"; see . The discipline can be qualitative and quantitative; as a specialization of risk management, however, financial risk management focuses more on when and how to Hedge (finance), hedge, often using financial instruments to manage costly exposures to risk. * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Straddle

In finance, a straddle strategy involves two transactions in options on the same underlying, with opposite positions. One holds long risk, the other short. As a result, it involves the purchase or sale of particular option derivatives that allow the holder to profit based on how much the price of the underlying security moves, regardless of the ''direction'' of price movement. A straddle involves buying a call and put with same strike price and expiration date. If the stock price is close to the strike price at expiration of the options, the straddle leads to a loss. However, if there is a sufficiently large move in either direction, a significant profit will result. A straddle is appropriate when an investor is expecting a large move in a stock price but does not know in which direction the move will be. A straddle made from the ''purchase'' of options is known as a long straddle, bottom straddle, or straddle purchase, while the reverse position, made from the ''sale'' of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Options Strategy

Option strategies are the simultaneous, and often mixed, buying or selling of one or more Option (finance), options that differ in one or more of the options' variables. Call options, simply known as Calls, give the buyer a right to buy a particular stock at that option's strike price. Opposite to that are Put options, simply known as Puts, which give the buyer the right to sell a particular stock at the option's strike price. This is often done to gain exposure to a specific type of opportunity or risk while eliminating other risks as part of a trading strategy. A very straightforward strategy might simply be the buying or selling of a single option; however, option strategies often refer to a combination of simultaneous buying and or selling of options. Options strategies allow traders to profit from movements in the underlying assets based on market sentiment (i.e., bullish, bearish or neutral). In the case of neutral strategies, they can be further classified into those that ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Greeks (finance)

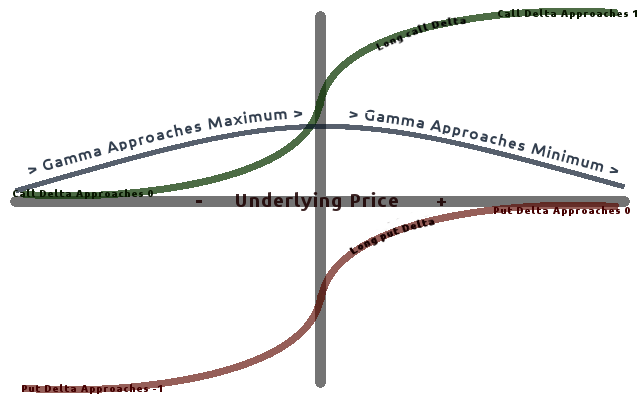

In mathematical finance, the Greeks are the quantities (known in calculus as partial derivatives; first-order or higher) representing the sensitivity of the price of a derivative instrument such as an option to changes in one or more underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model (a relatively simple idealised mode ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset (or contingent liability) and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in '' over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |