|

Transaction Cost Analysis

Transaction cost analysis (TCA), as used by institutional investors, is defined by the ''Financial Times'' as "the study of trade prices to determine whether the trades were arranged at favourable prices – low prices for purchases and high prices for sales". It is often split into two parts – pre-trade and post-trade. Recent regulations, such as the European Markets in Financial Instruments Directive, have required institutions to achieve best execution. Pre-trade Pre-trade analysis is the process of taking known parameters of a planned trade and determining an execution strategy that will minimize the cost of transacting for a given level of acceptable risk. It is not possible to reduce both projected risk and cost past a certain efficient frontier, since reducing risk tolerance requires limiting market exposure and thus trading faster. In this situation, market impact cost is much greater than for trades that accept greater risk and are executed more slowly. Effect on Finan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

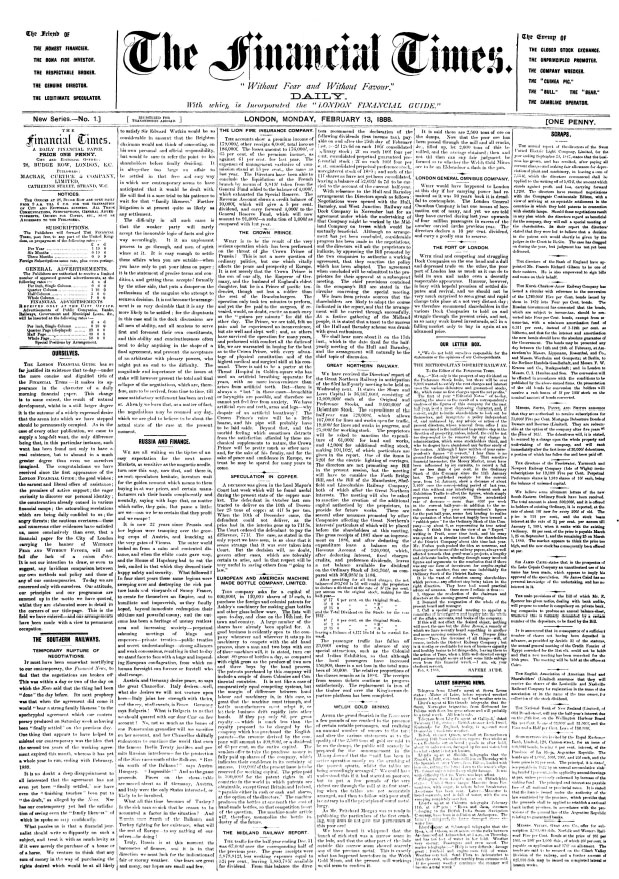

Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million ( US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a " Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sher ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Execution Management System

An Execution management system, or EMS, is an application utilized by traders designed to display market data and provide seamless and fast access to trading destinations for the purpose of transacting orders. This application contains broker provided and independent algorithms such as TWAP and VWAP, global market data and technology that is able to help predict certain market conditions.Daniel SafarikExecution Management Systems: From the Street and on the Block ''financetech.com'', September , 2006 One of the important features of EMS is the capacity to manage orders across multiple trading destinations such as stock exchanges, stock brokerage firms, crossing networks and electronic communication networks. In addition to commercial vendors, a few open-source projects can be counted in as EMS, although their breadth varies. See also *Algorithmic trading *Dark liquidity *Electronic trading platform *High-frequency trading *Order management system *Single-dealer platform A singl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Capitalization

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders. Market capitalization is equal to the market price per common share multiplied by the number of common shares outstanding. Since outstanding stock is bought and sold in public markets, capitalization could be used as an indicator of public opinion of a company's net worth and is a determining factor in some forms of stock valuation. Description Market capitalization is sometimes used to rank the size of companies. It measures only the equity component of a company's capital structure, and does not reflect management's decision as to how much debt (or leverage) is used to finance the firm. A more comprehensive measure of a firm's size is enterprise value (EV), which gives effect to outstanding debt, preferred stock, and other factors. For insurance firms, a value called the embedded value (EV) has been used. It is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Region

In geography, regions, otherwise referred to as zones, lands or territories, are areas that are broadly divided by physical characteristics ( physical geography), human impact characteristics ( human geography), and the interaction of humanity and the environment (environmental geography). Geographic regions and sub-regions are mostly described by their imprecisely defined, and sometimes transitory boundaries, except in human geography, where jurisdiction areas such as national borders are defined in law. Apart from the global continental regions, there are also hydrospheric and atmospheric regions that cover the oceans, and discrete climates above the land and water masses of the planet. The land and water global regions are divided into subregions geographically bounded by large geological features that influence large-scale ecologies, such as plains and features. As a way of describing spatial areas, the concept of regions is important and widely used among the many branch ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sector (economy)

One classical breakdown of economic activity distinguishes three sectors: * Primary: involves the retrieval and production of raw-material commodities, such as corn, coal, wood or iron. Miners, farmers and fishermen are all workers in the primary sector. * Secondary: involves the transformation of raw or intermediate materials into goods, as in steel into cars, or textiles into clothing. Builders and dressmakers work in the secondary sector. * Tertiary: involves the supplying of services to consumers and businesses, such as babysitting, cinemas or banking. Shopkeepers and accountants work in the tertiary sector. In the 20th century, economists began to suggest that traditional tertiary services could be further distinguished from " quaternary" and quinary service sectors. Economic activity in the hypothetical quaternary sector comprises information- and knowledge-based services, while quinary services include industries related to human services and hospitality. Economi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by ''σ'') is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn calculated using the sum of s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transaction Cost

In economics and related disciplines, a transaction cost is a cost in making any economic trade when participating in a market. Oliver E. Williamson defines transaction costs as the costs of running an economic system of companies, and unlike production costs, decision-makers determine strategies of companies by measuring transaction costs and production costs. Transaction costs are the total costs of making a transaction, including the cost of planning, deciding, changing plans, resolving disputes, and after-sales. Therefore, the transaction cost is one of the most significant factors in business operation and management. Oliver E. Williamson's ''Transaction Cost Economics'' popularized the concept of transaction costs. Douglass C. North argues that institutions, understood as the set of rules in a society, are key in the determination of transaction costs. In this sense, institutions that facilitate low transaction costs, boost economic growth.North, Douglass C. 1992. “Tran ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Delay Cost

Delay (from Latin: dilatio) may refer to: Arts, entertainment, and media * ''Delay 1968'', a 1981 album by German experimental rock band Can * '' The Delay'', a 2012 Uruguayan film People * B. H. DeLay (1891–1923), American aviator and actor * Dorothy DeLay (1917–2002), American violin instructor * Florence Delay (born 1941), French academician and actor * Jan Delay (born 1976), German musician * Jason Delay (born 1995), American baseball player * Jean Delay (1907–1987), French psychiatrist, neurologist, and writer * Paul deLay (1952–2007), American blues musician * Tom DeLay (born 1947), American politician * Vladislav Delay (born 1976), Finnish musician Science and technology Computing and telecommunication * Delay (audio effect), a technology for producing delayed playback of an audio signal * Delay (programming), a programming language construct for delaying evaluation of an expression * Analog delay line, used to delay a signal * Broadcast delay, a practice ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Implicit Cost

In economics, an implicit cost, also called an imputed cost, implied cost, or notional cost, is the opportunity cost equal to what a firm must give up in order to use a factor of production for which it already owns and thus does not pay rent. It is the opposite of an explicit cost, which is borne directly. In other words, an implicit cost is any cost that results from using an asset instead of renting it out, selling it, or using it differently. The term also applies to foregone income from choosing not to work. Implicit costs also represent the divergence between economic profit (total revenues minus total costs, where total costs are the sum of implicit and explicit costs) and accounting profit (total revenues minus only explicit costs). Since economic profit includes these extra opportunity costs, it will always be less than or equal to accounting profit. Lipsey (1975) uses the example of a firm sitting on an expensive plot worth $10,000 a month in rent which it bought for a m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Explicit Cost

An explicit cost is a direct payment made to others in the course of running a business, such as wage, rent and materials, as opposed to '' implicit costs'', where no actual payment is made. It is possible still to underestimate these costs, however: for example, pension contributions and other "perks" must be taken into account when considering the cost of labour. Explicit costs are taken into account along with implicit ones when considering economic profit. Accounting profit Profit, in accounting, is an income distributed to the owner in a profitable market production process (business). Profit is a measure of profitability which is the owner's major interest in the income-formation process of market production ... only takes explicit costs into account. References {{DEFAULTSORT:Explicit Cost Costs ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Best Execution

Best execution refers to the duty of an investment services firm (such as a stock broker) executing orders on behalf of customers to ensure the best execution possible for their customers' orders. Some of the factors the broker must consider when seeking best execution of their customers' orders include: the opportunity to get a better price than what Is currently quoted, and the likelihood and speed of execution. In Europe, there has been an attempt to define "best execution" within the Markets in Financial Instruments Directive (MiFID), which introduces the principle that, when carrying out transactions on their clients' behalf, "investment firms halltake all sufficient steps to obtain, when executing orders, the best possible result for their clients taking into account price, costs, speed, likelihood of execution and settlement, size, nature or any other consideration relevant to the execution of the order. Nevertheless, where there is a specific instruction from the client th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |