|

Tax Relief, Unemployment Insurance Reauthorization, And Job Creation Act Of 2010

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (), also known as the 2010 Tax Relief Act, was passed by the United States Congress on December 16, 2010, and signed into law by President Barack Obama on December 17, 2010. The Act centers on a temporary, two-year reprieve from the sunset provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) and the Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA), together known as the "Bush tax cuts." Income taxes would have returned to Clinton administration-era rates in 2011 had Congress not passed this law. The Act also extends some provisions from the American Recovery and Reinvestment Act of 2009 (ARRA or 'the Stimulus'). The act also includes several other tax- and economy-related measures intended to have a new stimulatory effect, mostly notably an extension of unemployment benefits and a one-year reduction in the FICA payroll tax, as part of a compromise a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Growth And Tax Relief Reconciliation Act Of 2001

The Economic Growth and Tax Relief Reconciliation Act of 2001 was a major piece of tax legislation passed by the 107th United States Congress and signed by President George W. Bush. It is also known by its abbreviation EGTRRA (often pronounced "egg-tra" or "egg-terra"), and is often referred to as one of the two "Bush tax cuts". Bush had made tax cuts the centerpiece of his campaign in the 2000 presidential election, and he introduced a major tax cut proposal shortly after taking office. Though a handful of Democrats supported the bill, most support came from congressional Republicans. The bill was passed by Congress in May 2001, and signed into law by Bush on June 7, 2001. Due to the narrow Republican majority in the United States Senate, EGTRRA was passed using the reconciliation process, which bypasses the Senate filibuster. EGTRRA lowered federal income tax rates, reducing the top tax rate from 39.6 percent to 35 percent and reducing rates for several other tax brackets ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Whitehouse

Whitehouse may refer to: People * Charles S. Whitehouse (1921-2001), American diplomat * Cornelius Whitehouse (1796–1883), English engineer and inventor * E. Sheldon Whitehouse (1883-1965), American diplomat * Elliott Whitehouse (born 1993), English footballer * Eula Whitehouse (1892–1974), American botanist * Frederick William Whitehouse (1900–1973), Australian geologist * Jimmy Whitehouse (footballer, born 1924) (1924-2005), English footballer * Mary Whitehouse (1910–2001), British Christian morality campaigner * Morris H. Whitehouse (1878–1944), American architect * Paul Whitehouse (born 1958), Welsh comedian and actor * Paul Whitehouse (police officer) (born 1944) * Sheldon Whitehouse (born 1955), American politician from the state of Rhode Island * Wildman Whitehouse (1816–1890), English surgeon and chief electrician for the transatlantic telegraph cable Places ;in the United Kingdom * Whitehouse, Aberdeenshire, location of the Whitehouse railway stati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earned Income Tax Credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient's income and number of children. Low income adults with no children are eligible. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met.Tax Year 2020 1040 and 1040-SR Instructions, including the instructions for Schedules 1 through 3 Rules for EIC begin on page 40 for 2020 Tax Year. EITC phases in slowly, has a medium-length plateau, and phases out more slowly than it was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

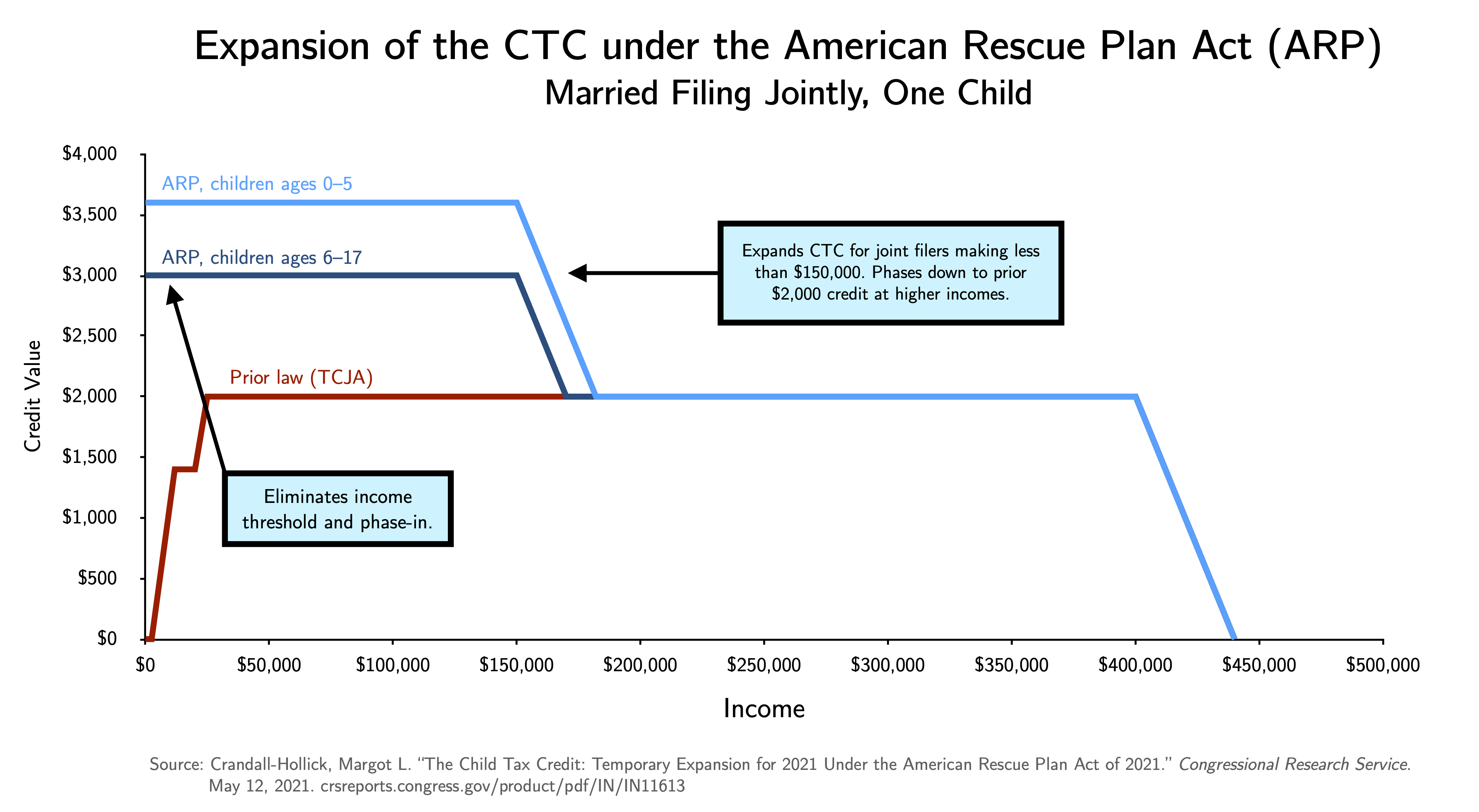

Child Tax Credit

A child tax credit (CTC) is a tax credit for parents with dependent children given by various countries. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayer's income level. For example, in the United States, only families making less than $400,000 per year may claim the full CTC. Similarly, in the United Kingdom, the tax credit is only available for families making less than £42,000 per year. Germany Germany has a programme called the which, despite technically being a tax exemption and not a tax credit, functions similarly. The child allowance is an allowance in German tax law, in which a certain amount of money is tax-free in the taxation of parents. In the income tax fee paid, child benefit and tax savings through the child tax credit are compared against each other, and the parents pay whichever results in the lesser amount of tax. United Kingdom In the United Kingdom, a family with children and an income below about ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Atlanta Journal-Constitution

''The Atlanta Journal-Constitution'' is the only major daily newspaper in the metropolitan area of Atlanta, Georgia. It is the flagship publication of Cox Enterprises. The ''Atlanta Journal-Constitution'' is the result of the merger between ''The Atlanta Journal'' and ''The Atlanta Constitution''. The two staffs were combined in 1982. Separate publication of the morning ''Constitution'' and the afternoon ''Journal'' ended in 2001 in favor of a single morning paper under the ''Journal-Constitution'' name. The ''Atlanta Journal-Constitution'' has its headquarters in the Atlanta suburb of Dunwoody, Georgia. It was formerly co-owned with television flagship WSB-TV and six radio stations, which are located separately in midtown Atlanta; the newspaper remained part of Cox Enterprises, while WSB became part of an independent Cox Media Group. ''The Atlanta Journal'' ''The Atlanta Journal'' was established in 1883. Founder E. F. Hoge sold the paper to Atlanta lawyer Hoke Smith in 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unemployment Extension

An unemployment extension occurs when regular unemployment benefits are exhausted and extended for additional weeks. Unemployment extensions are created by passing new legislation at the federal level, often referred to as an "unemployment extension bill". This new legislation is introduced and passed during times of high or above average unemployment rates. Unemployment extensions are set during a date range in order to estimate their federal cost. After expiration, the unemployment data is re-evaluated, and new legislation may be proposed and passed to further extend them. United States In the United States, there is a standard of 26 weeks of unemployment compensation, known as "regular unemployment insurance (UI) benefits". As of December 2020, the U.S. has three programs for extending unemployment benefits:Texas Workforce Co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alternative Minimum Tax

The alternative minimum tax (AMT) is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals, estates, and trusts. As of tax year 2018, the AMT raises about $5.2 billion, or 0.4% of all federal income tax revenue, affecting 0.1% of taxpayers, mostly in the upper income ranges. An alternative minimum taxable income (AMTI) is calculated by taking the ordinary income and adding disallowed items and credits such as state and local tax deductions, interest on private-activity municipal bonds, the bargain element of incentive stock options, foreign tax credits, and home equity loan interest deductions. This broadens the base of taxable items. Many deductions, such as mortgage home loan interest and charitable deductions, are still allowed under AMT. The AMT is then imposed on this AMTI at a rate of 26% or 28%, with a much higher exemption than the regular income tax. The Tax Cuts and Jobs Act of 2017 (TCJA) reduced the fracti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting Today

''Accounting Today'' is a trade magazine servicing the public accounting profession in the United States. Started in 1987, it grew to a circulation of more than 30,000. The parent company of ''Accounting Today'' is SourceMedia. With over 400 employees Source Media is the publisher of more than 30 periodical brands including several major financial magazines. SourceMedia publications include ''American Banker'', ''The Bond Buyer'', ''Employee Benefit News'', and ''Financial Planning''. ''Accounting Today'' is one of SourceMedia's flagship products, and in 2009 the company merged the brand with two of their other existing accounting titles, ''Accounting Technology'' and ''Practical Accountant''. This increased the brand's print circulation to its current level, as of October 2012, of about 60,000.http://www03.entrepreneur.com/tradejournals/article/203026182.html ''Accounting Today's'' website is at accountingtoday.com. Accounting Today's web site tracks related accounting news and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gawker

''Gawker'' is an American blog founded by Nick Denton and Elizabeth Spiers and based in New York City focusing on celebrities and the media industry. According to SimilarWeb, the site had over 23 million visits per month as of 2015. Founded in 2003, ''Gawker'' was the flagship blog for Denton's Gawker Media. Gawker Media also managed other blogs such as ''Jezebel'', ''io9'', ''Deadspin'' and '' Kotaku''. ''Gawker'' came under scrutiny for posting videos, communications and other content that violated copyrights or the privacy of its owners, or was illegally obtained. ''Gawker'' publication of a sex tape featuring Hulk Hogan led Hogan to sue the company for invasion of privacy. Hogan received financial support from billionaire investor Peter Thiel, who had been outed by Gawker against his wishes. On June 10, 2016, ''Gawker'' filed for bankruptcy after being ordered to pay Hogan $140 million in damages. On August 18, 2016, Gawker Media announced that its namesake blog would be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

KUSI-TV

KUSI-TV (channel 51) is an independent television station in San Diego, California, United States. It is the sole property of locally based McKinnon Broadcasting Company. KUSI-TV's studios are located on Viewridge Avenue (near I-15) in the Kearny Mesa section of San Diego, and its transmitter is located southeast of Spring Valley. The station operates low-power translator K12PO in Temecula (part of the Los Angeles market). After a 15-year dispute over permit ownership that almost derailed the launch of the station on multiple occasions, KUSI began broadcasting in 1982 as a partnership between United States International University and McKinnon. It was the first independent station built in San Diego proper. Financial and accreditation problems at USIU led to the sale of its stake to McKinnon in 1990, with McKinnon exercising veto power to block any sale to another entity. McKinnon then started KUSI's news department, which has since grown to produce newscasts throughout th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Insurance Contributions Act Tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) contribution directed towards both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers. Calculation Overview The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code. Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court rule ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clinton Administration

Bill Clinton's tenure as the 42nd president of the United States began with his first inauguration on January 20, 1993, and ended on January 20, 2001. Clinton, a Democrat from Arkansas, took office following a decisive election victory over Republican incumbent president George H. W. Bush and independent businessman Ross Perot in 1992. Four years later, in 1996, he defeated Perot again (then as the nominee of the Reform Party) and Republican nominee Bob Dole, to win re-election; in neither ballot did he obtain a majority of the popular vote. Clinton was succeeded by Republican George W. Bush, who won the 2000 presidential election. The nation experienced an extended period of economic prosperity during the Clinton presidency. While the economy remained strong, his presidency oscillated dramatically from high to low and back again, which historian Gil Troy characterized in six Acts. Act I in early 1993 was "Bush League" with amateurish distractions. By mid-1993 Clinton ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)