|

Taxation In The United States

The United States has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. Income tax in the United States, U.S. tax and transfer policies are Progressive tax, progressive and therefore reduce effective income inequality in the United States, income inequality, as rates of tax generally increase as taxable income increases. As a group, the lowest earning workers, especially those with dependents, pay no income taxes and may actually receive a small subsidy from the federal government (from child credits and the Earned Income Tax Credit). Taxes fall m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

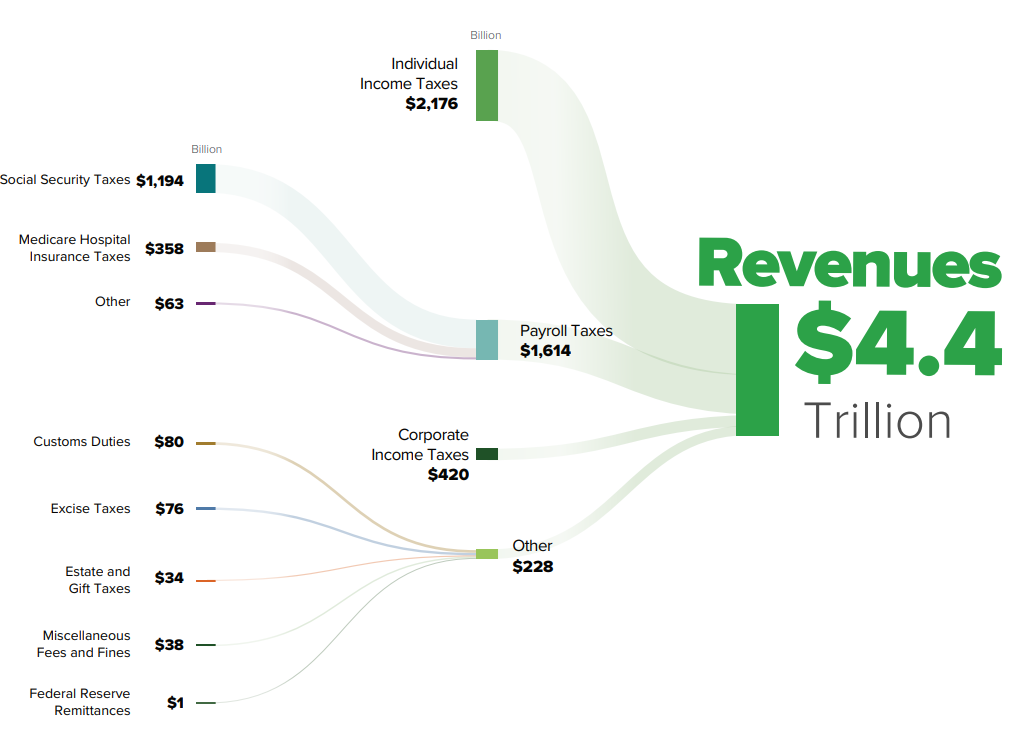

2023 US Federal Revenues

3 (three) is a number, numeral (linguistics), numeral and numerical digit, digit. It is the natural number following 2 and preceding 4, and is the smallest odd prime number and the only prime preceding a square number. It has religious and cultural significance in many societies. Evolution of the Arabic digit The use of three lines to denote the number 3 occurred in many writing systems, including some (like Roman and Chinese numerals) that are still in use. That was also the original representation of 3 in the Brahmic numerals, Brahmic (Indian) numerical notation, its earliest forms aligned vertically. However, during the Gupta Empire the sign was modified by the addition of a curve on each line. The Nāgarī script rotated the lines clockwise, so they appeared horizontally, and ended each line with a short downward stroke on the right. In cursive script, the three strokes were eventually connected to form a glyph resembling a with an additional stroke at the bottom: ३. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Cuts And Jobs Act Of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act (TCJA), that amended the Internal Revenue Code of 1986. The legislation is commonly referred to in media as the Trump Tax Cuts. Major elements of the changes include reducing tax rates for corporations and individuals, increasing the standard deduction and family tax credits, eliminating personal exemptions and making it less beneficial to itemize deductions, limiting state and local tax deduction, deductions for state and local income taxes and property taxes, further limiting the mortgage interest deduction, reducing the alternative minimum tax for individuals and eliminating it for corporations, doubling the estate tax exemption, and reducing the penalty for violating the individual mandate of the Affordable Care Act (ACA) to $0. ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Base

A tax is a mandatory financial charge or levy imposed on an individual or legal person, legal entity by a governmental organization to support government spending and public expenditures collectively or to Pigouvian tax, regulate and reduce negative Externality, externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct tax, direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat tax, flat percentage rate of taxation on personal annual income, but most progressive tax, scale taxes are progressive based on brackets of yearly income amounts. Most ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

20250426 Tax Freedom Day (US)

5 (five) is a number, numeral and digit. It is the natural number, and cardinal number, following 4 and preceding 6, and is a prime number. Humans, and many other animals, have 5 digits on their limbs. Mathematics 5 is a Fermat prime, a Mersenne prime exponent, as well as a Fibonacci number. 5 is the first congruent number, as well as the length of the hypotenuse of the smallest integer-sided right triangle, making part of the smallest Pythagorean triple ( 3, 4, 5). 5 is the first safe prime and the first good prime. 11 forms the first pair of sexy primes with 5. 5 is the second Fermat prime, of a total of five known Fermat primes. 5 is also the first of three known Wilson primes (5, 13, 563). Geometry A shape with five sides is called a pentagon. The pentagon is the first regular polygon that does not tile the plane with copies of itself. It is the largest face any of the five regular three-dimensional regular Platonic solid can have. A conic is determ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Revenue And Spending GDP

A government is the system or group of people governing an organized community, generally a state. In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government is a means by which organizational policies are enforced, as well as a mechanism for determining policy. In many countries, the government has a kind of constitution, a statement of its governing principles and philosophy. While all types of organizations have governance, the term ''government'' is often used more specifically to refer to the approximately 200 independent national governments and subsidiary organizations. The main types of modern political systems recognized are democracies, totalitarian regimes, and, sitting between these two, authoritarian regimes with a variety of hybrid regimes. Modern classification systems also include monarchies as a standalone entity or as a hybrid system of the main three. Historically prevalent form ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxes Revenue By Source Chart History

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat percentage rate of taxation on personal annual income, but most scale taxes are progressive based on brackets of yearly income amounts. Most countries charge a tax on an individual's income and corporate income. Coun ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gift Tax

In economics, a gift tax is the tax on money or property that one living person or corporate entity gives to another. A gift tax is a type of transfer tax that is imposed when someone gives something of value to someone else. The transfer must be gratuitous or the receiving party must pay a lesser amount than the item's full value to be considered a gift. Items received upon the death of another are considered separately under the inheritance tax. Many gifts are not subject to taxation because of exemptions given in tax laws. The gift tax amount varies by jurisdiction, and international comparison of rates is complex and fluid. The process of transferring assets and wealth to the upcoming generations is known as estate planning. It involves planning for transfers at death or during life. One such instrument is the right to transfer assets to another person known as gift-giving, or with the goal of reducing one's taxable wealth when the donor still lives. For fulfilling the cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance Tax

International tax law distinguishes between an estate tax and an inheritance tax. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died. However, this distinction is not always observed; for example, the UK's "inheritance tax" is a tax on the assets of the deceased, and strictly speaking is therefore an estate tax. Inheritance taxes vary widely between countries. History There was a steep increase in the number of countries that implemented inheritance taxes throughout the 19th and early 20th century. From 1960 onwards, inheritance taxes declined in prevalence as numerous countries repealed theirs. For historical reasons, the term "death duty" is still used colloquially (though not legally) in the UK and some Commonwealth countries. The estate tax in the United States is sometimes referred as "death tax". Other taxation applied to inherita ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Customs

Customs is an authority or Government agency, agency in a country responsible for collecting tariffs and for controlling International trade, the flow of goods, including animals, transports, personal effects, and hazardous items, into and out of a country. Traditionally, customs has been considered as the fiscal subject that charges customs duties (i.e. tariffs) and other taxes on import and export. In recent decades, the views on the functions of customs have considerably expanded and now covers three basic issues: taxation, National security, security, and trade facilitation. Each country has its own laws and regulations for the import and export of goods into and out of a country, enforced by their respective customs authorities; the import/export of some goods may be restricted or forbidden entirely. A wide range of penalties are faced by those who break these laws. Overview Taxation The traditional function of customs has been the assessment and collection of custo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the Tax exemption, exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Value-added tax#Comparison with sales tax, Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final good, final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a "resale certificate" by the taxing authority and required to provide the cer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Tax

A property tax (whose rate is expressed as a percentage or per mille, also called ''millage'') is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or Wealth tax, net wealth, taxes on the change of ownership of property through Inheritance tax, inheritance or Gift tax, gift and Financial transaction tax, taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or other Region, geographical region, or a Local government, municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted with a rent tax, which is based ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payroll Tax

Payroll taxes are taxes imposed on employers or employees. They are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital, such as higher education. National payroll tax systems Australia The Australian federal government ( ATO) requires withholding tax on employment income (payroll taxes of the first type), under a system known as pay-as-you-go (PAYG). The individual states impose payroll taxes of the second type. Bermuda In Bermuda, payroll tax accounts for over a third of the annual nation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |