|

Tax Shift

Tax shift or tax swap is a change in taxation that eliminates or reduces one or several taxes and establishes or increases others while keeping the overall revenue the same. Specifically, it is often used to refer to increases in indirect tax and a concomitant cut to direct tax rates, or vice versa. The term can refer to desired shifts, such as towards Pigovian (socially efficient) taxes (typically sin taxes and ecotaxes) as well as (perceived or real) undesired shifts, such as an increase in tax burden on households at the expense of large businesses. Introduced Definition: Tax shift is a kind of economic phenomenon in which the taxpayer transfers the tax burden to the purchaser or supplier by increasing the sales price or depressing the purchase price during the process of commodity exchange. # Tax shift is the redistribution of tax burden. Its economic essence is the redistribution of national income of everyone. The absence of redistribution of national income does not ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation

A tax is a mandatory financial charge or levy imposed on an individual or legal person, legal entity by a governmental organization to support government spending and public expenditures collectively or to Pigouvian tax, regulate and reduce negative Externality, externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct tax, direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat tax, flat percentage rate of taxation on personal annual income, but most progressive tax, scale taxes are progressive based on brackets of yearly income amounts. Most ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Income Tax

A corporate tax, also called corporation tax or company tax or corporate income tax, is a type of direct tax levied on the income or capital of corporations and other similar legal entities. The tax is usually imposed at the national level, but it may also be imposed at state or local levels in some countries. Corporate taxes may be referred to as income tax or capital tax, depending on the nature of the tax. The purpose of corporate tax is to generate revenue for the government by taxing the profits earned by corporations. The tax rate varies from country to country and is usually calculated as a percentage of the corporation's net income or capital. Corporate tax rates may also differ for domestic and foreign corporations. Some countries have tax laws that require corporations to pay taxes on their worldwide income, regardless of where the income is earned. However, most countries have territorial tax systems, which only require corporations to pay taxes on income earned within ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ecological Economics

Ecological economics, bioeconomics, ecolonomy, eco-economics, or ecol-econ is both a transdisciplinary and an interdisciplinary field of academic research addressing the interdependence and coevolution of human economy, economies and natural ecosystems, both intertemporally and spatially. By treating the economy as a subsystem of Earth's larger ecosystem, and by emphasizing the preservation of natural capital, the field of ecological economics is differentiated from environmental economics, which is the mainstream economics, mainstream economic analysis of the environment. One survey of German economists found that ecological and environmental economics are different schools of economic thought, with ecological economists emphasizing strong sustainability and rejecting the proposition that Physical capital, physical (human-made) capital can substitute for natural capital (see the section on #Weak versus strong sustainability, weak versus strong sustainability below). Ecological ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Estate Tax (United States)

In the United States, the estate tax is a federal tax on the transfer of the estate of a person who dies. The tax applies to property that is transferred by will or, if the person has no will, according to state laws of intestacy. Other transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts. The estate tax is part of the federal unified gift and estate tax in the United States. The other part of the system, the gift tax, applies to transfers of property during a person's life. In addition to the federal government, 12 states tax the estate of the deceased. Six states have "inheritance taxes" levied on the person who receives money or property from the estate of the deceased. The estate tax is periodically the subject of political debate. Some opponents have called it the "death tax" [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gift Tax

In economics, a gift tax is the tax on money or property that one living person or corporate entity gives to another. A gift tax is a type of transfer tax that is imposed when someone gives something of value to someone else. The transfer must be gratuitous or the receiving party must pay a lesser amount than the item's full value to be considered a gift. Items received upon the death of another are considered separately under the inheritance tax. Many gifts are not subject to taxation because of exemptions given in tax laws. The gift tax amount varies by jurisdiction, and international comparison of rates is complex and fluid. The process of transferring assets and wealth to the upcoming generations is known as estate planning. It involves planning for transfers at death or during life. One such instrument is the right to transfer assets to another person known as gift-giving, or with the goal of reducing one's taxable wealth when the donor still lives. For fulfilling the cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Self-employment

Self-employment is the state of working for oneself rather than an employer. Tax authorities will generally view a person as self-employed if the person chooses to be recognised as such or if the person is generating income for which a tax return needs to be filed. In the real world, the critical issue for tax authorities is not whether a person is engaged in business activity (called ''trading'' even when referring to the provision of a service) but whether the activity is profitable and therefore potentially taxable. In other words, the trading is likely to be ignored if there is no profit, so occasional and hobby- or enthusiast-based economic activity is generally ignored by tax authorities. Self-employed people are usually classified as a sole proprietor (or sole trader), independent contractor, or as a member of a partnership. Self-employed people generally find their own work rather than being provided with work by an employer and instead earn income from a profession, a tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gains Tax

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property. In South Africa, capital gains tax applies to the disposal of assets by individuals, companies, and trusts, with inclusion rates differing by entity type and with special provisions for primary residences and offshore assets. Not all countries impose a capital gains tax, and most have different rates of taxation for individuals compared to corporations. Countries that do not impose a capital gains tax include Bahrain, Barbados, Belize, the Cayman Islands, the Isle of Man, Jamaica, New Zealand, Sri Lanka, Singapore, and others. In some countries, such as New Zealand and Singapore, professional traders and those who trade frequently are taxed on such profits as a business income. In Sweden, a so-called investment savings account (ISK – ''investeringssparkonto'') wa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax

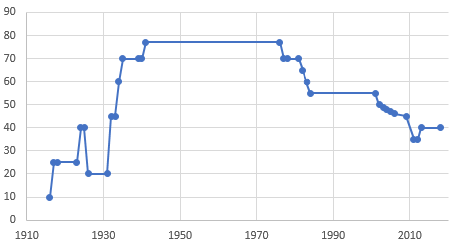

A corporate tax, also called corporation tax or company tax or corporate income tax, is a type of direct tax levied on the income or capital of corporations and other similar legal entities. The tax is usually imposed at the national level, but it may also be imposed at state or local levels in some countries. Corporate taxes may be referred to as income tax or capital tax, depending on the nature of the tax. The purpose of corporate tax is to generate revenue for the government by taxing the profits earned by corporations. The tax rate varies from country to country and is usually calculated as a percentage of the corporation's net income or capital. Corporate tax rates may also differ for domestic and foreign corporations. Some countries have tax laws that require corporations to pay taxes on their worldwide income, regardless of where the income is earned. However, most countries have territorial tax systems, which only require corporations to pay taxes on income earned with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FairTax

FairTax is a flat tax, fixed rate sales tax proposal introduced as bill H.R. 25 in the United States Congress every year since 2005. The ''Fair Tax Act'' calls for elimination of the Internal Revenue Service and repeal the Sixteenth Amendment to the United States Constitution. H.R. 25 would eliminate all Income tax in the United States, federal income taxes (including the alternative minimum tax, corporate tax in the United States, corporate income taxes, and Capital gains tax in the United States, capital gains taxes), payroll tax#United States, payroll taxes (including Federal Insurance Contributions Act tax, Social Security and Medicare taxes), gift taxes, and Estate tax in the United States, estate taxes, replacing federal taxes with a single consumption tax levied on retail sales. The ''Fair Tax Act'' (/) would apply a fixed rate sales tax at the point of sale on all new, final Goods (economics), goods and Services (economics), services purchased for household consumption. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Resource Consumption

Resource consumption is about the consumption of non-renewable, or less often, renewable resources. Specifically, it may refer to: * water consumption * energy consumption ** electric energy consumption ** world energy consumption * natural gas consumption/ gas depletion * oil consumption/ oil depletion * logging/deforestation * fishing/overfishing * land use/ land loss or * resource depletion and * general exploitation and associated environmental degradation Measures of resource consumption are resource intensity and resource efficiency. Industrialization and globalized markets have increased the tendency for overconsumption of resources. The resource consumption rate of a nation does not usually correspond with the primary resource availability, this is called resource curse. Unsustainable consumption by the steadily growing human population may lead to resource depletion and a shrinking of the earth's carrying capacity. See also * Ecological footprint * Jev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Land Value Tax

A land value tax (LVT) is a levy on the value of land (economics), land without regard to buildings, personal property and other land improvement, improvements upon it. Some economists favor LVT, arguing it does not cause economic efficiency, economic inefficiency, and helps reduce economic inequality. A land value tax is a progressive tax, in that the tax burden falls on land owners, because land ownership is correlated with wealth and income. The land value tax has been referred to as "the perfect tax" and the economic efficiency of a land value tax has been accepted since the eighteenth century. Economists since Adam Smith and David Ricardo have advocated this tax because it does not hurt economic activity, and encourages development without subsidies. LVT is associated with Henry George, whose ideology became known as Georgism. George argued that taxing the land value is the most logical source of public revenue because the supply of land is fixed and because public infrastru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carbon Tax

A carbon tax is a tax levied on the carbon emissions from producing goods and services. Carbon taxes are intended to make visible the hidden Social cost of carbon, social costs of carbon emissions. They are designed to reduce greenhouse gas emissions by essentially increasing the price of fossil fuels. This both decreases demand for goods and services that produce high emissions and incentivizes making them less emission intensity, carbon-intensive. When a fossil fuel such as coal, petroleum, or natural gas is burned, most or all of its carbon is converted to . Greenhouse gas emissions cause climate change. This negative externality can be reduced by taxing carbon content at any point in the product cycle. A carbon tax as well as carbon emission trading is used within the carbon price concept. Two common economic alternatives to carbon taxes are tradable permits with Carbon offsets and credits, carbon credits and Subsidy, subsidies. In its simplest form, a carbon tax covers only ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |