|

Tax Cuts And Jobs Act Of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act (TCJA), that amended the Internal Revenue Code of 1986. The legislation is commonly referred to in media as the Trump Tax Cuts. Major elements of the changes include reducing tax rates for corporations and individuals, increasing the standard deduction and family tax credits, eliminating personal exemptions and making it less beneficial to itemize deductions, limiting state and local tax deduction, deductions for state and local income taxes and property taxes, further limiting the mortgage interest deduction, reducing the alternative minimum tax for individuals and eliminating it for corporations, doubling the estate tax exemption, and reducing the penalty for violating the individual mandate of the Affordable Care Act (ACA) to $0. ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the United States Department of the Treasury, Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure funded over a fifth of the Union's war expens ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

529 Plan

A 529 plan, also called a Qualified Tuition Program, is a tax-advantaged investment vehicle in the United States designed to encourage saving for the future higher education expenses of a designated beneficiary. In 2017, K–12 public, private, and religious school tuition were included as qualified expenses for 529 plans along with post-secondary education costs after passage of the Tax Cuts and Jobs Act. Overview 529 plans are named after section 529 of the Internal Revenue Code—. While most plans allow investors from out of state, there can be significant state tax advantages and other benefits, such as matching grant and scholarship opportunities, protection from creditors and exemption from state financial aid calculations for investors who invest in 529 plans in their state of residence. Contributions to 529 college savings plans are made with after-tax dollars. Once money is invested in the account, it grows tax-free, and withdrawals from the plans are not taxed w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reconciliation (United States Congress)

Budget reconciliation is a special parliamentary procedure of the United States Congress set up to expedite the passage of certain federal budget legislation in the Senate. The procedure overrides the Senate's filibuster rules, which may otherwise require a 60-vote supermajority for passage. Bills described as reconciliation bills can pass the Senate by a simple majority of 51 votes or 50 votes plus the vice president's as the tie-breaker. The reconciliation procedure also applies to the House of Representatives, but it has minor significance there, as the rules of the House of Representatives do not have a '' de facto'' supermajority requirement. Because of greater polarization, gridlock, and filibustering in the Senate in recent years, budget reconciliation has come to play an important role in how the United States Congress legislates. Budget reconciliation bills can deal with mandatory spending, revenue, and the federal debt limit, and the Senate can pass one bill per yea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State And Local Tax Deduction

The state and local tax deduction (SALT deduction) is a United States federal itemized deduction that allows taxpayers to deduct certain taxes paid to state and local governments from their adjusted gross income. The SALT deduction is intended to avoid double taxation by allowing taxpayers to deduct state and local taxes from their income that is assessed for federal income tax. Eligible taxes include state and local income taxes and property taxes. The deduction disproportionately benefits wealthy and upper-middle class taxpayers living in areas with comparatively high state and property taxes. The Tax Cuts and Jobs Act of 2017 signed into law by President Donald Trump put a $10,000 cap on the SALT deduction for the years 2018–2025. The Tax Policy Center estimated in 2016 that fully eliminating the SALT deduction would increase federal revenue by nearly $1.3 trillion over 10 years. Definition For US federal income tax purposes, state and local taxes are defined in section ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

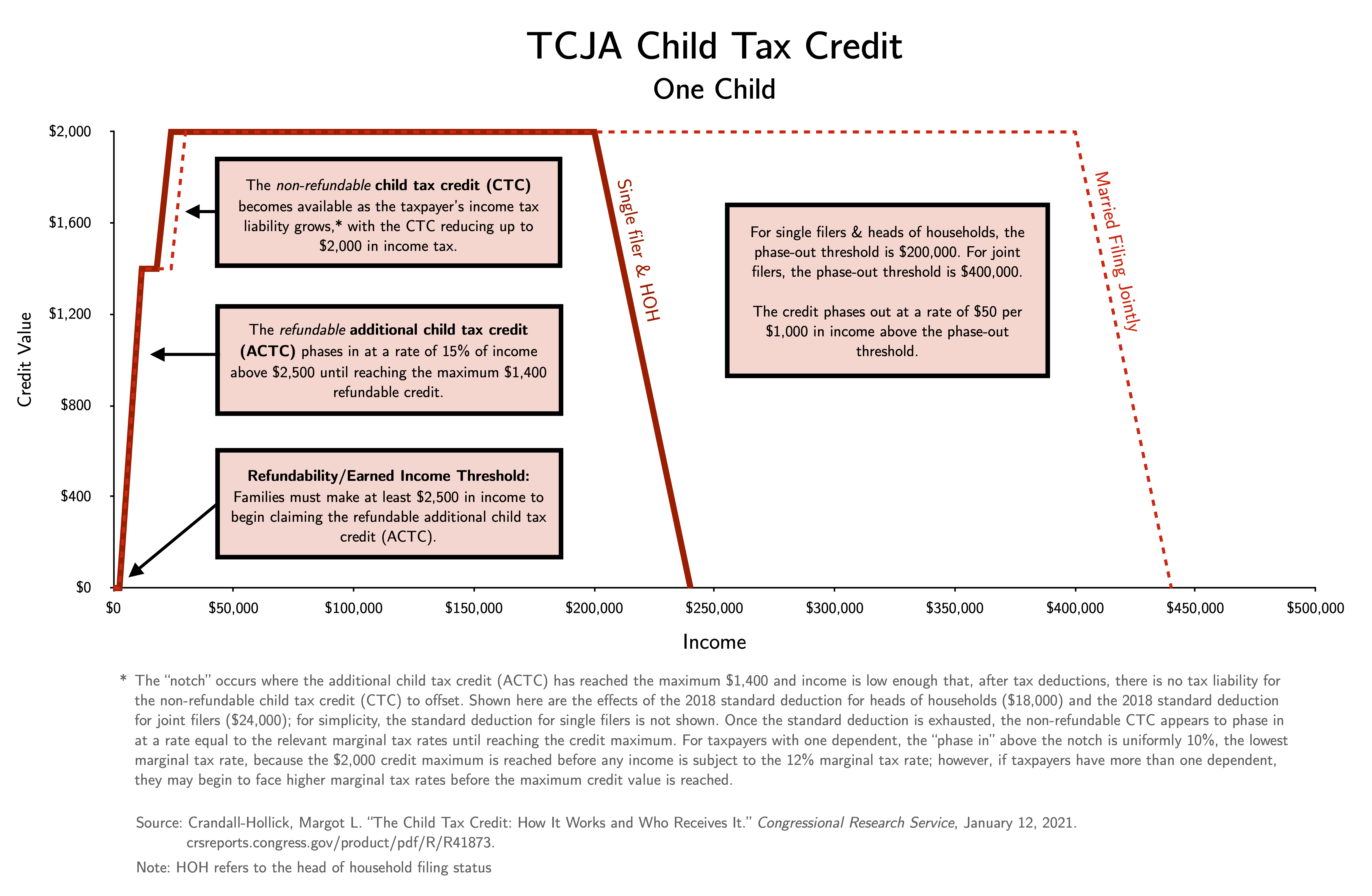

Child Tax Credit (United States)

The United States federal child tax credit (CTC) is a partially-refundable tax credit for parents with Dependant, dependent children. It provides $2,000 in tax relief per qualifying child, with up to $1,600 of that Tax credit#Refundable vs non Refundable, refundable (subject to a refundability threshold, phase-in and phase-out). In 2021, following the passage of the American Rescue Plan Act of 2021, it was temporarily raised to $3,600 per child under the age of 6 and $3,000 per child between the ages of 6 and 17; it was also made fully-refundable and half was paid out as monthly benefits. The CTC is scheduled to revert to a $1,000 credit after 2025. The CTC was estimated to have lifted about 3 million children out of poverty in 2016. A Columbia University study estimated that the expansion of the CTC in the American Rescue Plan Act, 2021 American Rescue Plan Act reduced child poverty by an additional 26%, and would have decreased child poverty by an additional 40% had all eligible ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Chained Consumer Price Index

The United States Chained Consumer Price Index (C-CPI-U), also known as chain-weighted CPI or chain-linked CPI is a time series measure of price levels of consumer goods and services created by the Bureau of Labor Statistics as an alternative to the United States Consumer Price Index, US Consumer Price Index. It is based on the idea that when prices of different goods change at different rates, consumers will adjust their purchasing patterns by purchasing more of products whose relative prices have declined and fewer of those whose relative price has increased. This reduces the cost of living reported, but has no change on the cost of living; it is simply a way of accounting for a microeconomic "substitution effect." The "fixed weight" CPI also takes such substitutions into account, but does so through a periodic adjustment of the "basket of goods" that it represents, rather than through a continuous adjustment in that basket. Application of the chained CPI to federal benefits has be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Itemized Deduction

Under United States tax law, itemized deductions are eligible expenses that individual taxpayers can claim on federal income Tax return (United States), tax returns and which decrease their taxable income, and are claimable in place of a standard deduction, if available. Most taxpayers are allowed a choice between itemized deductions and the standard deduction. After computing their adjusted gross income (AGI), taxpayers can itemize deductions (from a list of allowable items) and subtract those itemized deductions from their AGI amount to arrive at the taxable income. Alternatively, they can elect to subtract the standard deduction for their filing status to arrive at the taxable income. In other words, the taxpayer may generally deduct the total itemized deduction amount or the applicable standard deduction amount, whichever is greater. The choice between the standard deduction and itemizing involves a number of considerations: * Only a taxpayer eligible for the standard deducti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate. Refundable vs. non-refundable A refundable tax credit is one which, if the credit exceeds the taxes due, the government pays back to the taxpayer the difference. In other words, it makes possible a negative tax liability. For example, if a taxpayer has an initial tax liability of $100 and applies a $300 tax credit, then the taxpayer ends with a liability of –$200 and the government refunds to the taxpayer that $200. With a non-refundable tax credit, if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. In this case, the taxpayer from the example would end with a tax liability of $0 (i.e. they could ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. The tax rate that is applied to an individual's or corporation's income is determined by tax laws of the country and can be influenced by many factors such as income level, type of income, and so on. There are several methods used to present a tax rate: statutory, average, marginal, flat, and effective. These rates can also be presented using different definitions applied to a tax base: inclusive and exclusive. Statutory A statutory tax rate is the legally imposed rate. An income tax could have multiple statutory rates for different income levels, where a sales tax may have a flat statutory rate. The statutory tax rate is expressed as a percentage and will always be higher than the effective tax rate. Average An average tax rate is the ratio of the total amount of taxes paid to the total tax base (taxable income or spending), expressed as a percentage. Averag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Bracket

Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer). Essentially, tax brackets are the cutoff values for taxable income—income past a certain point is taxed at a higher rate. Example Imagine that there are three tax brackets: 10%, 20%, and 30%. The 10% rate applies to income from $1 to $10,000; the 20% rate applies to income from $10,001 to $20,000; and the 30% rate applies to all income above $20,000. Under this system, someone earning $10,000 is taxed at 10%, paying a total of $1,000. Someone earning $5,000 pays $500, and so on. Meanwhile, someone who earns $25,000 faces a more complicated calculation. The rate on the first $10,000 is 10%, from $10,001 to $20,000 is 20%, and above that is 30%. Thus, they pay $1,000 for the first $10,000 of income (10%), $2,000 for the second $10,000 of income (20%), and $1,500 for the last $5,000 of income (30%), In total, they pay $4,500, or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Tax Rates 2018

US or Us most often refers to: * ''Us'' (pronoun), the objective case of the English first-person plural pronoun ''we'' * US, an abbreviation for the United States US, U.S., Us, us, or u.s. may also refer to: Arts and entertainment Albums * ''Us'' (Brother Ali album) or the title song, 2009 * ''Us'' (Empress Of album), 2018 * ''Us'' (Mull Historical Society album), 2003 * ''Us'' (Peter Gabriel album), 1992 * ''Us'' (EP), by Moon Jong-up, 2021 * ''Us'', by Maceo Parker, 1974 * ''Us'', mini-album by Peakboy, 2019 Songs * "Us" (James Bay song), 2018 * "Us" (Jennifer Lopez song), 2018 * "Us" (Regina Spektor song), 2004 * "Us" (Gracie Abrams song), 2024 * "Us", by Azealia Banks from '' Fantasea'', 2012 * "Us", by Celine Dion from ''Let's Talk About Love'', 1997 * "Us", by Gucci Mane from '' Delusions of Grandeur'', 2019 * "Us", by Spoon from '' Hot Thoughts'', 2017 Other media * US Festival, two 1980s California music festivals organized by Steve Wozniak * ''Us'' (1991 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |