|

Stress Test (financial)

A stress test, in financial terminology, is an analysis or simulation designed to determine the ability of a given financial instrument or financial institution to deal with an economic crisis. Instead of doing financial projection on a "best estimate" basis, a company or its regulators may do stress testing where they look at how robust a financial instrument is in certain crashes, a form of scenario analysis. They may test the instrument under, for example, the following stresses: * What happens if unemployment rate rises to v% in a specific year? * What happens if equity markets crash by more than w% this year? * What happens if GDP falls by x% in a given year? * What happens if interest rates go up by at least y%? * What if half the instruments in the portfolio terminate their contracts in the fifth year? * What happens if oil prices rise by z%? * What happens if there is a polar vortex event in a particular region? This type of analysis has become increasingly widespread, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

India

India, officially the Republic of India (Hindi: ), is a country in South Asia. It is the List of countries and dependencies by area, seventh-largest country by area, the List of countries and dependencies by population, second-most populous country, and the most populous democracy in the world. Bounded by the Indian Ocean on the south, the Arabian Sea on the southwest, and the Bay of Bengal on the southeast, it shares land borders with Pakistan to the west; China, Nepal, and Bhutan to the north; and Bangladesh and Myanmar to the east. In the Indian Ocean, India is in the vicinity of Sri Lanka and the Maldives; its Andaman and Nicobar Islands share a maritime border with Thailand, Myanmar, and Indonesia. Modern humans arrived on the Indian subcontinent from Africa no later than 55,000 years ago., "Y-Chromosome and Mt-DNA data support the colonization of South Asia by modern humans originating in Africa. ... Coalescence dates for most non-European populations average to betwee ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Systemic Risk

In finance, systemic risk is the risk of collapse of an entire financial system or entire market, as opposed to the risk associated with any one individual entity, group or component of a system, that can be contained therein without harming the entire system.Banking and currency crises and systemic risk George G. Kaufman (World Bank), It can be defined as "financial ''system'' instability, potentially catastrophic, caused or exacerbated by idiosyncratic events or conditions in financial intermediaries". It refers to the risks imposed by ''interlinkage ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Comprehensive Assessment

The Single Supervisory Mechanism (SSM) is the first pillar of the European banking union and is the legislative and institutional framework that grants the European Central Bank (ECB) a leading supervisory role over banks in the EU. The ECB directly supervises the larger banks while it does it indirectly for the smaller ones. Eurozone countries are required to participate, while participation is voluntary for non-eurozone EU member states. In October 2020, two non-Eurozone countries joined the European banking supervision mechanism through a process known as close cooperation: Bulgaria and Croatia. As of early 2021, the SSM directly supervises 115 banks across the Union, representing almost 82% of banking assets of these countries. The SSM, along with the Single Resolution Mechanism are the two central components of the European banking union. Genesis The question of supervising the European banking system arose long before the financial crisis of 2007-2008. Shortly after ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Systemically Important Banks

Certain large banks are tracked and labelled by several authorities as Systemically Important Financial Institutions (SIFIs), depending on the scale and the degree of influence they hold in global and domestic financial markets. Since 2011, the Financial Stability Board (FSB) has published a list of global SIFIs (G-SIFIs), while individual countries also maintain their own lists of Domestic Systemically Important Banks (D-SIBs), also known in Europe as "national SIFIs" (N-SIFIs). In addition, special lists of regional systemically important banks (R-SIBs) also exist. The European Central Bank maintains a list of banks under its supervision known as the Single Supervisory Mechanism (SSM). Background In 2009, as a regulatory response to the revealed vulnerability of the banking sector in the financial crisis of 2007–08, and attempting to come up with a solution to solve the "too big to fail" interdependence between G-SIFIs and the economy of sovereign states, the Financial Sta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Simulation

A simulation is the imitation of the operation of a real-world process or system over time. Simulations require the use of Conceptual model, models; the model represents the key characteristics or behaviors of the selected system or process, whereas the simulation represents the evolution of the model over time. Often, computers are used to execute the computer simulation, simulation. Simulation is used in many contexts, such as simulation of technology for performance tuning or optimizing, safety engineering, testing, training, education, and video games. Simulation is also used with scientific modelling of natural systems or human systems to gain insight into their functioning, as in economics. Simulation can be used to show the eventual real effects of alternative conditions and courses of action. Simulation is also used when the real system cannot be engaged, because it may not be accessible, or it may be dangerous or unacceptable to engage, or it is being designed bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

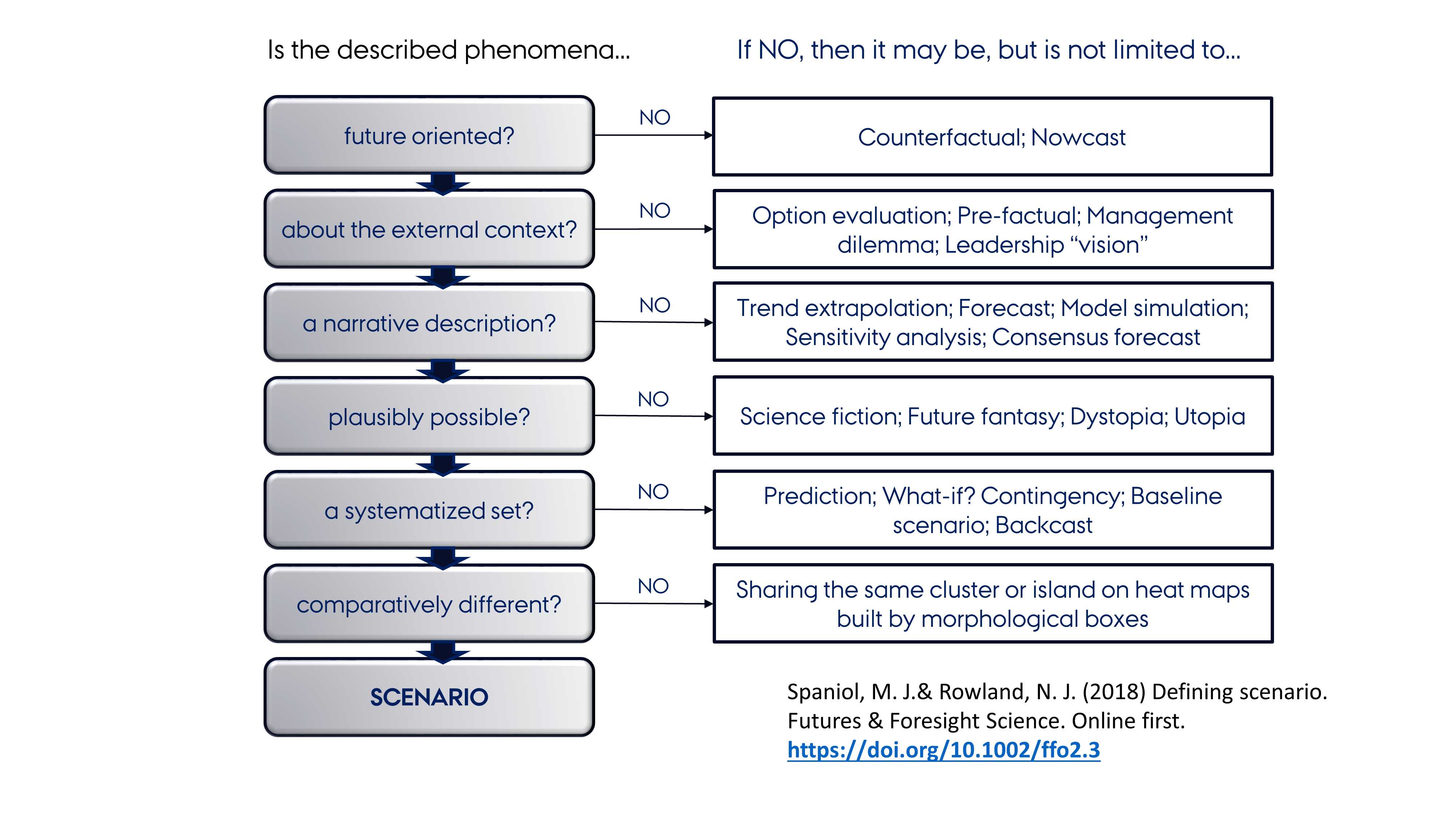

Scenario Analysis

Scenario planning, scenario thinking, scenario analysis, scenario prediction and the scenario method all describe a strategic planning method that some organizations use to make flexible long-term plans. It is in large part an adaptation and generalization of classic methods used by military intelligence. In the most common application of the method, analysts generate simulation games for policy makers. The method combines known facts, such as demographics, geography and mineral reserves, with military, political, and industrial information, and key driving forces identified by considering social, technical, economic, environmental, and political ("STEEP") trends. In business applications, the emphasis on understanding the behavior of opponents has been reduced while more attention is now paid to changes in the natural environment. At Royal Dutch Shell for example, scenario planning has been described as changing mindsets about the exogenous part of the world prior to formulatin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Bank Stress Tests

:''This list covers formal bank stress testing programs, as implemented by major regulators worldwide. It does not cover bank proprietary, internal testing programs.'' A bank stress tests is an analysis of a bank's ability to endure a hypothetical adverse economic scenario. Stress tests became widely used after the 2008 financial crisis. Example For example, in the U.S. in 2012, an adverse scenario used in stress testing was all of the following: * Unemployment at 13 percent * 50 percent drop in equity prices * 21 percent decline in housing prices. Asia * Monetary Authority of Singapore ** Annual Industry-Wide Stress Testing exercise (usually around Q1) * International Monetary Fund ** 2011 and 2012 stress testing of Japan banks, Financial System Stability Assessment Update (FSAP) * China Banking Regulatory Commission ** 2011 CARPLES risk indicators framework * Australian Prudential Regulation Authority ** 2014 industry stress test * Reserve Bank of New Zealand ** 2014 major bank ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CAMELS Rating System

The CAMELS rating is a supervisory rating system originally developed in the U.S. to classify a bank's overall condition. It is applied to every bank and credit union in the U.S. and is also implemented outside the U.S. by various banking supervisory regulators. The ratings are assigned based on a ratio analysis of the financial statements, combined with on-site examinations made by a designated supervisory regulator. In the U.S. these supervisory regulators include the Federal Reserve, the Office of the Comptroller of the Currency, the National Credit Union Administration, the Farm Credit Administration, and the Federal Deposit Insurance Corporation. Ratings are not released to the public but only to the top management to prevent a possible bank run on an institution which receives a CAMELS rating downgrade. Institutions with deteriorating situations and declining CAMELS ratings are subject to ever increasing supervisory scrutiny. Failed institutions are eventually resolved via ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Groupthink

Groupthink is a psychological phenomenon that occurs within a group of people in which the desire for harmony or conformity in the group results in an irrational or dysfunctional decision-making outcome. Cohesiveness, or the desire for cohesiveness, in a group may produce a tendency among its members to agree at all costs. This causes the group to minimize conflict and reach a consensus decision without critical evaluation. Groupthink is a construct of social psychology, but has an extensive reach and influences literature in the fields of communication studies, political science, management, and organizational theory, as well as important aspects of deviant religious cult behaviour. Overview Groupthink is sometimes stated to occur (more broadly) within natural groups within the community, for example to explain the lifelong different mindsets of those with differing political views (such as "conservatism" and "liberalism" in the U.S. political context or the purported benefits o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fedwire

Fedwire (formerly known as the Federal Reserve Wire Network) is a real-time gross settlement funds transfer system operated by the United States Federal Reserve Banks that allows financial institutions to electronically transfer funds between its more than 9,289 participants (as of March 19, 2009). Transfers can only be initiated by the sending bank once they receive the proper wiring instructions for the receiving bank. These instructions include: the receiving bank's routing number, account number, name and dollar amount being transferred. This information is submitted to the Federal Reserve via the Fedwire system. Once the instructions are received and processed, the Fed will debit the funds from the sending bank's reserve account and credit the receiving bank's account. Wire transfers sent via Fedwire are completed the same business day, with many being completed instantly. In conjunction with Clearing House Interbank Payments System (CHIPS), operated by The Clearing House P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Antifragility

Antifragility is a property of systems in which they increase in capability to thrive as a result of stressors, shocks, volatility, noise, mistakes, faults, attacks, or failures. The concept was developed by Nassim Nicholas Taleb in his book, '' Antifragile'', and in technical papers., As Taleb explains in his book, antifragility is fundamentally different from the concepts of resiliency (i.e. the ability to recover from failure) and robustness (that is, the ability to resist failure). The concept has been applied in risk analysis, physics,Naji, A., Ghodrat, M., Komaie-Moghaddam, H., & Podgornik, R. (2014)Asymmetric Coulomb fluids at randomly charged dielectric interfaces: Anti-fragility, overcharging and charge inversion J. Chem. Phys. 141 174704. molecular biology, transportation planning,Levin, J. S., Brodfuehrer, S. P., & Kroshl, W. M. (2014, March)Detecting antifragile decisions and models lessons from a conceptual analysis model of Service Life Extension of aging vehicles In ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |