|

Sugary Drink Tax

A sugary drink tax, soda tax, or sweetened beverage tax (SBT) is a tax or surcharge (food-related fiscal policy) designed to reduce consumption of sweetened beverages by making them more expensive to purchase. Drinks covered under a soda tax often include carbonated soft drinks, sports drinks and energy drinks. Fruit juices without added sugar are usually excluded, despite similar sugar content, though there is some debate on including them. This policy intervention is an effort to decrease obesity and the health impacts related to being overweight. The tax is a matter of public debate in many countries and beverage producers like Coca-Cola often oppose it. Advocates such as national medical associations and the World Health Organization promote the tax as an example of a Pigouvian tax, aimed to discourage unhealthy diets and offset the growing economic costs of obesity. Design Tax design approaches include direct taxes on the product and indirect taxes. Indirect taxes in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Coca-Cola In Israel

Coca-Cola, or Coke, is a cola soft drink manufactured by the Coca-Cola Company. In 2013, Coke products were sold in over 200 countries and territories worldwide, with consumers drinking more than 1.8 billion company beverage servings each day. Coca-Cola ranked No. 94 in the 2024 Fortune 500, ''Fortune'' 500 list of the List of largest companies in the United States by revenue, largest United States corporations by revenue. Based on Interbrand's "best global brand" study of 2023, Coca-Cola was the world's List of most valuable brands, sixth most valuable brand. Originally marketed as a temperance bar, temperance drink and intended as a patent medicine, Coca-Cola was invented in the late 19th century by John Stith Pemberton in Atlanta, Georgia. In 1888, Pemberton sold the ownership rights to Asa Griggs Candler, a businessman, whose marketing tactics led Coca-Cola to its dominance of the global soft-drink market throughout the 20th and 21st centuries. The name refers to t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

France

France, officially the French Republic, is a country located primarily in Western Europe. Overseas France, Its overseas regions and territories include French Guiana in South America, Saint Pierre and Miquelon in the Atlantic Ocean#North Atlantic, North Atlantic, the French West Indies, and List of islands of France, many islands in Oceania and the Indian Ocean, giving it Exclusive economic zone of France, one of the largest discontiguous exclusive economic zones in the world. Metropolitan France shares borders with Belgium and Luxembourg to the north; Germany to the northeast; Switzerland to the east; Italy and Monaco to the southeast; Andorra and Spain to the south; and a maritime border with the United Kingdom to the northwest. Its metropolitan area extends from the Rhine to the Atlantic Ocean and from the Mediterranean Sea to the English Channel and the North Sea. Its Regions of France, eighteen integral regions—five of which are overseas—span a combined area of and hav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pigovian Tax

A Pigouvian tax (also spelled Pigovian tax) is a tax on any market activity that generates negative externalities (i.e., external costs incurred by third parties that are not included in the market price). It is a method that tries to internalize negative externalities to achieve the Nash equilibrium and optimal Pareto efficiency. The tax is normally set by the government to correct an undesirable or inefficient market outcome (a market failure) and does so by being set equal to the external marginal cost of the negative externalities. In the presence of negative externalities, social cost includes private cost and external cost caused by negative externalities. This means the social cost of a market activity is not covered by the private cost of the activity. In such a case, the market outcome is not efficient and may lead to over-consumption of the product. Often-cited examples of negative externalities are environmental pollution and increased public healthcare costs assoc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Externalities

In economics, an externality is an indirect cost (external cost) or indirect benefit (external benefit) to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced components that are involved in either consumer or producer consumption. Air pollution from motor vehicles is one example. The cost of air pollution to society is not paid by either the producers or users of motorized transport. Water pollution from mills and factories are another example. All (water) consumers are made worse off by pollution but are not compensated by the market for this damage. The concept of externality was first developed by Alfred Marshall in the 1890s and achieved broader attention in the works of economist Arthur Pigou in the 1920s. The prototypical example of a negative externality is environmental pollution. Pigou argued that a tax, equal to the marginal damage or marginal external cost, (later called a "Pigou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Elasticity Of Supply

The price elasticity of supply (PES or Es) is commonly known as “a measure used in economics to show the responsiveness, or elasticity, of the quantity supplied of a good or service to a change in its price.” Price elasticity of supply, in application, is the percentage change of the quantity supplied resulting from a 1% change in price. Alternatively, PES is the percentage change in the quantity supplied divided by the percentage change in price. When PES is less than one, the supply of the good can be described as ''inelastic.'' When price elasticity of supply is greater than one, the supply can be described as ''elastic''.Png, Ivan (1999). pp. 129–32. An elasticity of zero indicates that quantity supplied does not respond to a price change: the good is "fixed" in supply. Such goods often have no labor component or are not produced, limiting the short run prospects of expansion. If the elasticity is exactly one, the good is said to be ''unit-elastic''. Differing from pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

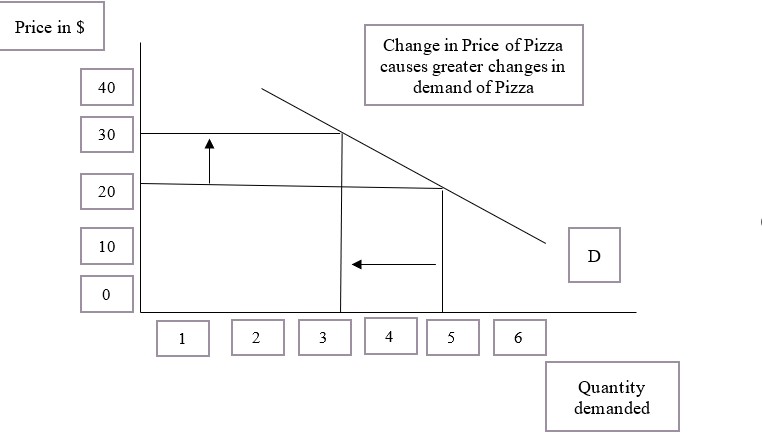

Price Elasticity Of Demand

A good's price elasticity of demand (E_d, PED) is a measure of how sensitive the quantity demanded is to its price. When the price rises, quantity demanded falls for almost any good ( law of demand), but it falls more for some than for others. The price elasticity gives the percentage change in quantity demanded when there is a one percent increase in price, holding everything else constant. If the elasticity is −2, that means a one percent price rise leads to a two percent decline in quantity demanded. Other elasticities measure how the quantity demanded changes with other variables (e.g. the income elasticity of demand for consumer income changes). Price elasticities are negative except in special cases. If a good is said to have an elasticity of 2, it almost always means that the good has an elasticity of −2 according to the formal definition. The phrase "more elastic" means that a good's elasticity has greater magnitude, ignoring the sign. Veblen and Giffen goods are t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

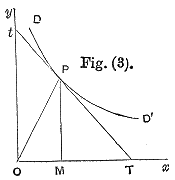

Elasticity (economics)

In economics, elasticity measures the responsiveness of one economic variable to a change in another. For example, if the price elasticity of the demand of a good is −2, then a 10% increase in price will cause the quantity demanded to fall by 20%. Elasticity in economics provides an understanding of changes in the behavior of the buyers and sellers with price changes. There are two types of elasticity for demand and supply, one is inelastic demand and supply and the other one is elastic demand and supply. Introduction The concept of price elasticity was first cited in an informal form in the book ''Principles of Economics (Marshall book), Principles of Economics'' published by the author Alfred Marshall in 1890. Subsequently, a major study of the price elasticity of supply and the price elasticity of demand for US products was undertaken by Joshua Levy and Trevor Pollock in the late 1960s. Elasticity is an important concept in neoclassical economic theory, and enables in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Augmented Synthetic Control Estimates For Composite Changes In Sugar-Sweetened Beverage (SSB) Price And Sales Volume

Augment or augmentation may refer to: Language *Augment (Indo-European), a syllable added to the beginning of the word in certain Indo-European languages *Augment (Bantu languages), a morpheme that is prefixed to the noun class prefix of nouns in certain Bantu languages *Augment, a name sometimes given to the verbal ''ō-'' prefix in Nahuatl grammar Technology * Augmentation (obstetrics), the process by which the first and/or second stages of an already established labour is accelerated or potentiated by deliberate and artificial means *Augmentation (pharmacology), the combination of two or more drugs to achieve better treatment results *Augmented reality, a live view of a physical, real-world environment whose elements are ''augmented'' by computer-generated sensory input *Augmented cognition, a research field that aims at creating revolutionary human-computer interactions *Augment (Tymshare), a hypertext system derived from Douglas Engelbart's oN-Line System, renamed "Augment" ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Lancet

''The Lancet'' is a weekly peer-reviewed general medical journal, founded in England in 1823. It is one of the world's highest-impact academic journals and also one of the oldest medical journals still in publication. The journal publishes original research articles, review articles ("seminars" and "reviews"), editorials, book reviews, correspondence, as well as news features and case reports. ''The Lancet'' has been owned by Elsevier since 1991, and its editor-in-chief since 1995 has been Richard Horton. The journal has editorial offices in London, New York City, and Beijing. History ''The Lancet'' was founded in 1823 by Thomas Wakley, an English surgeon who named it after the surgical instrument called a lancet (scalpel). According to BBC, the journal was initially considered to be radical following its founding. Members of the Wakley family retained editorship of the journal until 1908. In 1921, ''The Lancet'' was acquired by Hodder & Stoughton. Elsevier acquire ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress. Inspired by California's California Legislative Analyst's Office, Legislative Analyst's Office that manages the state budget in a strictly nonpartisan fashion, the CBO was created as a nonpartisan agency by the Congressional Budget and Impoundment Control Act of 1974. Whereas politicians on both sides of the aisle have criticized the CBO when its estimates have been politically inconvenient, economists and other academics overwhelmingly reject that the CBO is partisan or that it fails to produce credible forecasts. There is a consensus among economists that "adjusting for legal restrictions on what the CBO can assume about future legislation and events, the CBO has historically issued credible forecasts of the effects of both Democratic and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Department Of Health And Human Services

The United States Department of Health and Human Services (HHS) is a cabinet-level executive branch department of the US federal government created to protect the health of the US people and providing essential human services. Its motto is "Improving the health, safety, and well-being of America". Before the separate federal Department of Education was created in 1979, it was called the Department of Health, Education, and Welfare (HEW). HHS is administered by the secretary of health and human services, who is appointed by the president with the advice and consent of the United States Senate. The United States Public Health Service Commissioned Corps, the uniformed service of the PHS, is led by the surgeon general who is responsible for addressing matters concerning public health as authorized by the secretary or by the assistant secretary for health in addition to his or her primary mission of administering the Commissioned Corps. History Federal Security Agency ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tobacco Taxes

Tobacco smoking is the practice of burning tobacco and ingesting the resulting smoke. The smoke may be inhaled, as is done with cigarettes, or released from the mouth, as is generally done with pipes and cigars. The practice is believed to have begun as early as 5000–3000 BC in Mesoamerica and South America. Tobacco was introduced to Eurasia in the late 17th century by European colonists, where it followed common trade routes. The practice encountered criticism from its first import into the Western world onward but embedded itself in certain strata of several societies before becoming widespread upon the introduction of automated cigarette-rolling apparatus. Smoking is the most common method of consuming tobacco, and tobacco is the most common substance smoked. The agricultural product is often mixed with additives and then combusted. The resulting smoke, which contains various active substances, the most significant of which is the addictive psychostimulant drug nicotine (a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |