|

Subsidy Roll

Subsidy rolls are records of taxation in England made between the 12th and 17th centuries. They are often valuable sources of historical information. The lists are arranged by county, and the description of each document indicates the area covered, usually by hundred 100 or one hundred (Roman numerals, Roman numeral: C) is the natural number following 99 (number), 99 and preceding 101 (number), 101. In mathematics 100 is the square of 10 (number), 10 (in scientific notation it is written as 102). The standar ... or wapentake. The 1332 subsidy was the first for which many assessments survive. It was primarily confined to prosperous householders. The poll tax returns of 1378–80, which in theory covered all male adults except the itinerant and the very poor, give occupations and the relationships between members of the household. The subsidies of 1532–1535 again covered extensively the householders of middling and higher status. The best known surviving assessments are pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation

A tax is a mandatory financial charge or levy imposed on an individual or legal person, legal entity by a governmental organization to support government spending and public expenditures collectively or to Pigouvian tax, regulate and reduce negative Externality, externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct tax, direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat tax, flat percentage rate of taxation on personal annual income, but most progressive tax, scale taxes are progressive based on brackets of yearly income amounts. Most ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

England

England is a Countries of the United Kingdom, country that is part of the United Kingdom. It is located on the island of Great Britain, of which it covers about 62%, and List of islands of England, more than 100 smaller adjacent islands. It shares Anglo-Scottish border, a land border with Scotland to the north and England–Wales border, another land border with Wales to the west, and is otherwise surrounded by the North Sea to the east, the English Channel to the south, the Celtic Sea to the south-west, and the Irish Sea to the west. Continental Europe lies to the south-east, and Ireland to the west. At the 2021 United Kingdom census, 2021 census, the population was 56,490,048. London is both List of urban areas in the United Kingdom, the largest city and the Capital city, capital. The area now called England was first inhabited by modern humans during the Upper Paleolithic. It takes its name from the Angles (tribe), Angles, a Germanic peoples, Germanic tribe who settled du ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hundred (administrative Division)

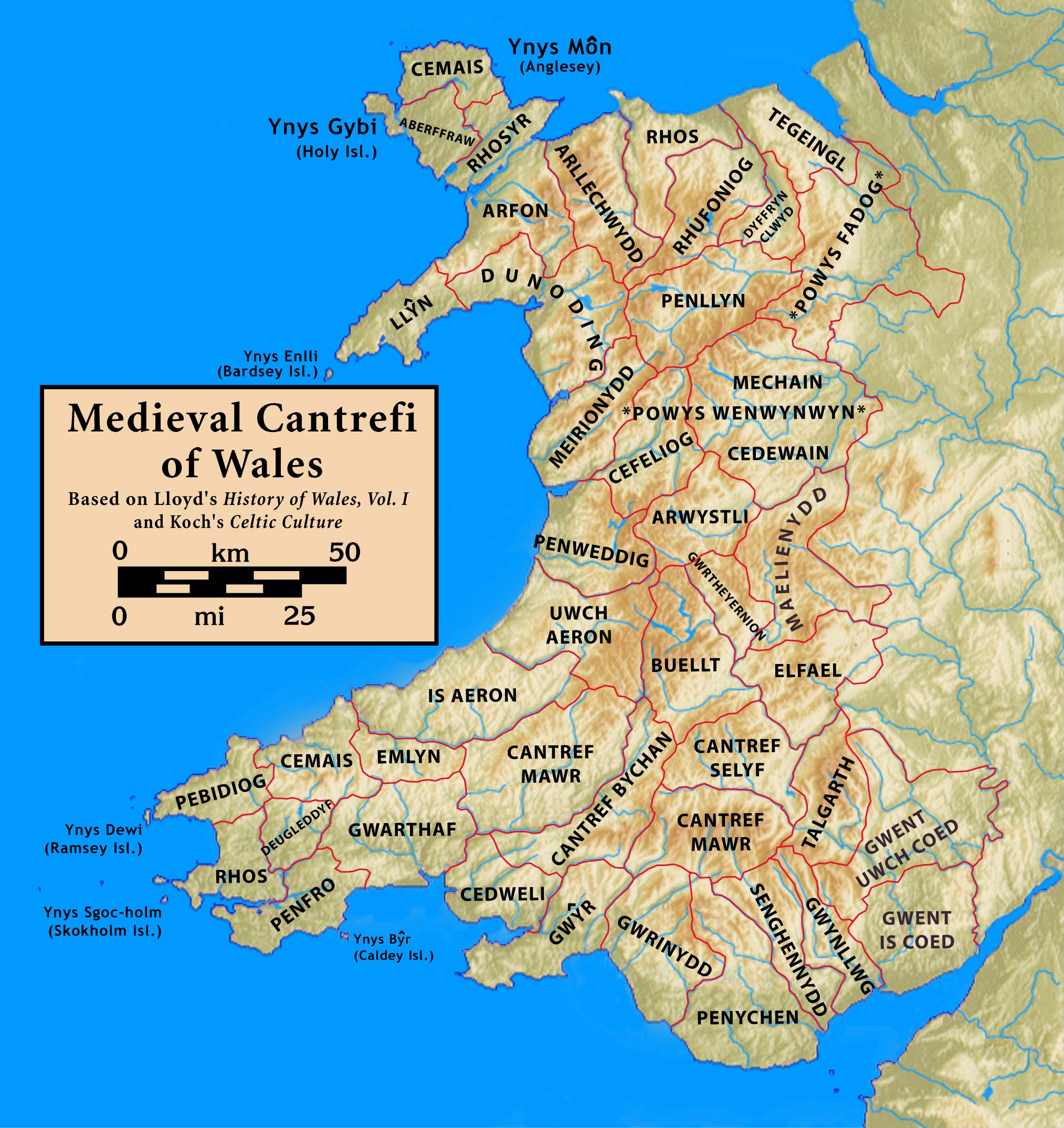

A hundred is an administrative division that is geographically part of a larger region. It was formerly used in England, Wales, some parts of the United States, Denmark, Sweden, Finland, Norway, and in Cumberland County in the British Colony of New South Wales. It is still used in other places, including in Australia (in South Australia and the Northern Territory). Other terms for the hundred in English and other languages include '' wapentake'', ''herred'' (Danish and Bokmål Norwegian), ''herad'' ( Nynorsk Norwegian), ''härad'' or ''hundare'' (Swedish), ''Harde'' (German), ''hiird'' ( North Frisian), ''kihlakunta'' (Finnish), and ''cantref'' (Welsh). In Ireland, a similar subdivision of counties is referred to as a barony, and a hundred is a subdivision of a particularly large townland (most townlands are not divided into hundreds). Etymology The origin of the division of counties into hundreds is described by the ''Oxford English Dictionary'' (''OED'') as "exceedingly obsc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chimney Money

A hearth tax was a property tax in certain countries during the Middle Ages, medieval and early modern period, levied on each hearth, thus by proxy on wealth. It was calculated based on the number of hearths, or fireplaces, within a municipal area and is considered among the first types of progressive tax. Hearth tax was levied in the Byzantine Empire from the 9th century, France and England from the 14th century, and finally in Scotland and Ireland in the 17th century. History Byzantine Empire In the Byzantine Empire a tax on hearths, known as ''kapnikon'', was first explicitly mentioned for the reign of Nicephorus I (802–811), although its context implies that it was already then old and established and perhaps it should be taken back to the 7th century AD. Kapnikon was a tax levied on households without exceptions for the poor.Haldon, John F. (1997) ''Byzantium in the Seventh Century: the Transformation of a Culture''. Cambridge University Press. France In the 1340s especi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

British Record Society

The British Record Society is a British learned society that focuses on publishing historic records, or, more specifically, indexes to such records. In recent years, the Society has concentrated on the publication of name indexes to English probate records, and the texts of 17th-century Hearth Tax returns. Foundation and early history The Society was founded in 1889 to take over the Index Library, which had begun life the previous year as W. P. W. Phillimore's private scheme for the publication of indexes to British public records, now the brief of the List and Index Society. The Society was also always interested in record conservation, and to act as what would now be called a pressure group for archives and their users, pushing for the creation of county record offices and county record societies. The inception of an official series of Lists and Indexes in 1892 reduced the need for private publication of indexes to records in the Public Record Office. The Society consequently ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

History Of Taxation In The United Kingdom

300px, ''The Friend of the People; & his Petty New Tax Gatherer paying John Bull a visit'' (1806), James Gillray , alt=A satirical cartoon by James Gilroy. John Bull, speaking from a first floor window, says "TAXES? TAXES? TAXES? why how an I to get money to pay them all? I shall very soon have neither a House nor Hole to put my head in! The history of taxation in the United Kingdom includes the history of all collections by governments under law, in money or in kind, including collections by monarchs and lesser feudal lords, levied on persons or property subject to the government, with the primary purpose of raising revenue. Background Prior to the formation of the Kingdom of Great Britain in 1707 and the United Kingdom in 1801, taxation had been levied in the countries that joined to become the UK. For example, in England, King John introduced an export tax on wool in 1203 and King Edward I introduced taxes on wine in 1275. Also in England, a Poor Law tax was established ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |