|

State Pension (United Kingdom)

The State Pension is an existing benefit that forms part of the United Kingdom Government's pension arrangements. Benefits vary depending on the age of the individual and their contribution record. Currently anyone can make a claim, provided they have a minimum number of qualifying years of contributions. Background Old State Pension The Old State Pension, consisting of the Basic State Pension (alongside the Graduated Retirement Benefit, the State Earnings-Related Pension Scheme, and the State Second Pension; collectively known as Additional State Pension), is a benefit payable to men born before 6 April 1951, and to women born before 6 April 1953. The maximum amount payable for the Basic State Pension component is £169.50 a week (April 2024 – April 2025). New State Pension The New State Pension is a benefit payable to men born on or after 6 April 1951, and to women born on or after 6 April 1953. The maximum amount payable is £221.20 a week (April 2024 – April 20 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Pensions In The United Kingdom

Pensions in the United Kingdom, whereby United Kingdom tax payers have some of their wages deducted to save for retirement, can be categorised into three major divisions – state, occupational and personal pensions. The state pension is based on years worked, with a full 35-year work history yielding a pension of £203.85 per week. It is linked to the Consumer Prices Index (CPI) rate. Most employees are also enrolled by their employers in either defined contribution or defined benefit pensions which supplement this basic state-provided pension. It's also possible to have a Self-invested personal pension (SIPP). Historically, the "Old Age Pension" was introduced in 1909 in the United Kingdom (which included all of Ireland at that time). Following the passage of the ''Old Age Pensions Act 1908'' a pension of 5/— per week (£, equivalent, using the Consumer Price Index, to £ in ), or 7/6 per week (£, equivalent to £/week in ) for a married couple, was payable to persons with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

R (Delve) V Secretary Of State For Work And Pensions

R, or r, is the eighteenth letter of the Latin alphabet, used in the modern English alphabet, the alphabets of other western European languages and others worldwide. Its name in English is ''ar'' (pronounced ), plural ''ars''. The letter is the eighth most common letter in English and the fourth-most common consonant, after , , and . Name The name of the letter in Latin was (), following the pattern of other letters representing continuants, such as , , , , and . This name is preserved in French and many other languages. In Middle English, the name of the letter changed from to , following a pattern exhibited in many other words such as ''farm'' (compare French ) and ''star'' (compare German ). In Hiberno-English, the letter is called or , somewhat similar to ''oar'', ''ore'', ''orr''. The letter R is sometimes referred to as the 'canine letter', often rendered in English as the dog's letter. This Latin term referred to the Latin that was trilled to sound l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Pension Provision In The United Kingdom

Pensions in the United Kingdom, whereby United Kingdom tax payers have some of their wages deducted to save for retirement, can be categorised into three major divisions – state, occupational and personal pensions. The state pension is based on years worked, with a full 35-year work history yielding a pension of £203.85 per week. It is linked to the Consumer Prices Index (CPI) rate. Most employees are also enrolled by their employers in either defined contribution or defined benefit pensions which supplement this basic state-provided pension. It's also possible to have a Self-invested personal pension (SIPP). Historically, the "Old Age Pension" was introduced in 1909 in the United Kingdom (which included all of Ireland at that time). Following the passage of the ''Old Age Pensions Act 1908'' a pension of 5/— per week (£, equivalent, using the Consumer Price Index, to £ in ), or 7/6 per week (£, equivalent to £/week in ) for a married couple, was payable to persons with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Royal Assent

Royal assent is the method by which a monarch formally approves an act of the legislature, either directly or through an official acting on the monarch's behalf. In some jurisdictions, royal assent is equivalent to promulgation, while in others that is a separate step. Under a modern constitutional monarchy, royal assent is considered little more than a formality. Even in nations such as the United Kingdom, Norway, the Netherlands, Liechtenstein and Monaco which still, in theory, permit their monarch to withhold assent to laws, the monarch almost never does so, except in a dire political emergency or on advice of government. While the power to veto by withholding royal assent was once exercised often by European monarchs, such an occurrence has been very rare since the eighteenth century. Royal assent is typically associated with elaborate ceremony. In the United Kingdom the Sovereign may appear personally in the House of Lords or may appoint Lords Commissioners, who anno ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Green Paper

In the United Kingdom, the Commonwealth countries, Hong Kong, the United States and the European Union, a green paper is a tentative government report and consultation document of policy proposals for debate and discussion. A green paper represents the best that the government can propose on the given issue, but, as it remains uncommitted, it can without loss of face leave its final decision open until it has been able to consider the public reaction to it. Green papers may result in the production of a white paper. They may be seen as grey literature. Canada A green paper in Canada, like a white paper, is an official government document. Green papers tend to be statements not of policy already determined, but of propositions put before the whole nation for discussion. They are produced early in the policy-making process, while ministerial proposals are still being formulated. Many white papers in Canada have been, in effect, green papers, while at least one green paper—that on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

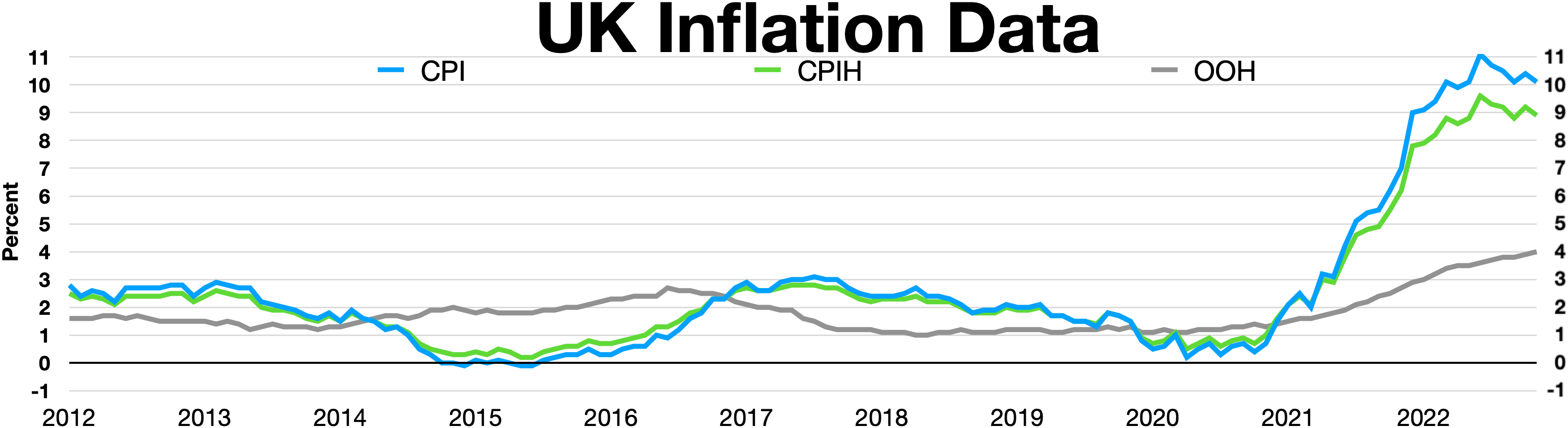

Consumer Price Index (United Kingdom)

The Consumer Price Index (CPI) is the official measure of inflation in consumer prices in the United Kingdom. It is also called the Harmonised Index of Consumer Prices (HICP). History The traditional measure of inflation in the UK for many years was the Retail Prices Index (RPI), which was first calculated in the early 20th century to evaluate the extent to which workers were affected by price changes during the First World War. The main index was described as the Interim Index of Retail Prices from 1947 to 1955. In January 1956, it was rebased and renamed the Index of Retail Prices. In January 1962, this was replaced by the General Index of Retail Prices, which was again rebased at that time. A further rebasing occurred in January 1987, subsequent to the issue of the first index-linked gilts. RPIX An explicit inflation target was first set in October 1992 by Chancellor of the Exchequer Norman Lamont, following the UK's departure from the Exchange Rate Mechanism. Initially, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Pensions Commission

The Pensions Commission was a non-departmental public body in the United Kingdom, reporting to the Secretary of State for Work and Pensions, set up to keep under review the regime for UK private pensions and long-term savings. The commission was announced in thPensions Green Paperpublished in December 2002. It consisted of three Commissioner A commissioner (commonly abbreviated as Comm'r) is, in principle, a member of a commission or an individual who has been given a commission (official charge or authority to do something). In practice, the title of commissioner has evolved to incl ...s and a small secretariat. The chair was Adair Turner, the other members were John Hills and Jeannie Drake. The Commission has now reported and been wound up. A more recent Pensions Commission was set up chaired by John Hutton. Remit The Commission was responsible for looking at how the pension system was developing over time and for making recommendations on whether the pension system shoul ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Department For Work And Pensions

The Department for Work and Pensions (DWP) is a Departments of the Government of the United Kingdom, ministerial department of the Government of the United Kingdom. It is responsible for welfare spending, welfare, pensions and child maintenance policy. As the UK's biggest public service department it administers the State Pension and a range of working age, disability and ill health benefits to around 20 million claimants and customers. It is the second-largest governmental department in terms of employees, and the second largest in terms of expenditure (£228 billion ). The department has two delivery services: Jobcentre Plus administers working age benefits: Universal Credit, Jobseeker's Allowance and Employment and Support Allowance; the Child Maintenance Service provides the statutory child support scheme. DWP also administers State Pension, Pension Credit, disability benefits such as Personal Independence Payment, and support for life events from Maternity Allowance to Berea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Pension Credit

Pension Credit is the principal element of the UK welfare system for people of pension age. It is intended to supplement the UK State Pension, or to replace it (for example, if the claimant did not meet the conditions to claim a State Pension). It was introduced in the UK in 2003 by Gordon Brown, then Chancellor of the Exchequer. It has been subject to a number of changes over its existence, but has the core aim of lifting retired people of limited means out of poverty. Eligibility may be estimated on a government website. Core elements The scheme was introduced to replace the ''Minimum Income Guarantee'', which had been introduced in 1997, also by Gordon Brown. This combined the existing ''applicable amount'' (of benefit) in Income Support, together with the ''Pensioner Premium'', which was itself substantially increased; these changes gave the impression of a new, more generous benefit package aimed at pensioners. Pension Credit has two elements: *The first element, Guarantee ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

State Earnings Related Pension Scheme

The State Earnings Related Pension Scheme (SERPS), originally known as the State Earnings Related Pension Supplement, was a UK Government pension arrangement, to which employees and employers contributed between 6 April 1978 and 5 April 2002, when it was replaced by the State Second Pension. Employees who paid full Class 1 National insurance contribution between 1978 and 2002 earned a SERPS pension. Members of occupational pension schemes could be "contracted out" of SERPS by their employer, in which case they and the employer would pay reduced NI contributions, and they would earn virtually no SERPS pension. General principle The purpose of the scheme was to provide a pension related to earnings, in addition to the basic state pension. The principle was that everyone would receive a SERPS pension of 25 per cent of their earnings above a "lower earning limit" (approximating to the amount of the basic state pension). The scheme was phased in over twenty years so that those ret ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

SunLife

SunLife Ltd is a UK-based financial services company. Founded in 1810, the company is best known for its range of services for people aged 50 and over. SunLife currently offers over 50s life insurance and equity release in the United Kingdom. In 1900, they became the first company to offer life insurance without a medical. SunLife has been part of the Phoenix Group since 2016. SunLife is regulated by the Financial Conduct Authority and their qualifying products are covered by the Financial Services Compensation Scheme. The company is a member of the Data & Marketing Association. Their partners are also members of the Equity Release Council (Key Group) and the Funeral Planning Authority (Dignity Funerals). History 1800 to 1900 SunLife can trace its history back to the establishment of the Sun Life Assurance Society on 28 March 1810, when the Sun Fire Office Board launched a separate company to offer life assurance. The society's first office opened opposite the Bank of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Bank Of England Base Rate

In the United Kingdom, the official bank rate is the rate that the Bank of England charges banks and financial institutions for loans with a maturity of 1 day. It is the Bank of England's key interest rate for enacting monetary policy. It is more analogous to the US discount rate than to the federal funds rate. The security for the lending can be any of a list of eligible securities (commonly gilts) and the transactions are overnight repurchase agreements. Changes are recommended by the Monetary Policy Committee and enacted by the Governor. On 2 August 2018 the Bank of England base rate was increased to 0.75%, but then cut to 0.25% on 11 March 2020, and shortly thereafter to an all-time low of 0.1% on 19 March, as emergency measures during the COVID-19 pandemic. On 15 December 2021, the Monetary Policy Committee voted 8-1 to increase the bank rate to 0.25%, and subsequently increased it thirteen more times to 5.25% on 02 August 2023. As of 21 August 2024 the bank rate sits ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |