|

Split Payment

Split payment (also split payment transaction, or split tender) is the financial term for the act of splitting (dividing) a single and full amount of payment in two or more simultaneous transactions made by different payment methods and/or enable several individuals to jointly contribute part of the order total. For example: split payment of a $100 to a retail shop can be done when the customer pays $50 in cash and $50 by credit card. Same goes for $50 credit card for both parties. Split payment is not the same as an installment purchase (a.k.a. hire purchase), where payments are done periodically with the same payment method. History With the era of global trade, the financial possibilities grew and with them the challenges of collecting payments. The global markets made open and the consumer gained an increased buying power. In local and international transaction merchants are required to provide consumers with multiple payment options - this is not only a service required by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment

A payment is the tender of something of value, such as money or its equivalent, by one party (such as a person or company) to another in exchange for goods or services provided by them, or to fulfill a legal obligation or philanthropy desire. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Whilst payments are often made voluntarily, some payments are compulsory, such as payment of a fine. Payments can be effected in a number of ways, for example: * the use of money, whether through cash, cheque, mobile payment or bank transfers. * the transfer of anything of value, such as stock, or using barter, the exchange of one good or service for another. In general, payees are at liberty to determine what method of payment they will accept; though normally laws require the payer to accept the country's legal tender up to a prescribed limit. Payment is most commonly affected in the local currency of the payee unless ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hire Purchase

A hire purchase (HP), also known as an installment plan, is an arrangement whereby a customer agrees to a contract to acquire an asset by paying an initial installment (e.g., 40% of the total) and repaying the balance of the price of the asset plus interest over a period of time. Other analogous practices are described as closed-end leasing or rent-to-own. The hire purchase agreement was developed in the United Kingdom in the 19th century to allow customers with a cash shortage to make an expensive purchase they otherwise would have to delay or forgo. For example, in cases where a buyer cannot afford to pay the asked price for an item of property as a lump sum but can afford to pay a percentage as a deposit, a hire-purchase contract allows the buyer to hire the goods for a monthly rent. When a sum equal to the original full price plus interest has been paid in equal installments, the buyer may then exercise an option to buy the goods at a predetermined price (usually a nominal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Buying Power

Bargaining power is the relative ability of parties in a negotiation (such as bargaining, contract writing, or making an agreement) to exert influence over each other in order to achieve favourable terms in an agreement. This power is derived from various factors such as each party’s alternatives to the current deal, the value of what is being negotiated, and the urgency of reaching an agreement. A party's bargaining power can significantly shift the outcome of negotiations, leading to more advantageous positions for those who possess greater leverage. If both parties are on an equal footing in a debate, then they will have equal bargaining power, such as in a perfectly competitive market, or between an evenly matched monopoly and monopsony. In many cases, bargaining power is not static and can be enhanced through strategic actions such as improving one's alternatives, increasing the perceived value of one's offer, or altering the negotiation timeline. A party's bargaining pow ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

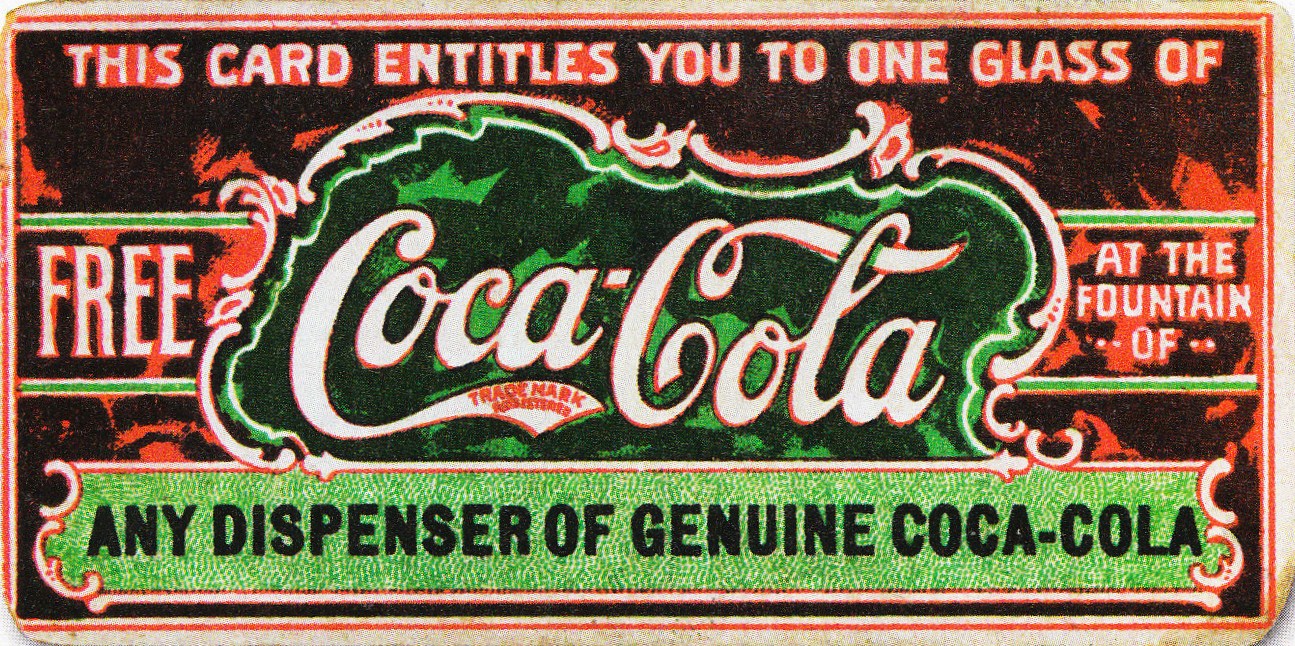

Coupon

In marketing, a coupon is a ticket or document that can be redeemed for a financial discount or rebate when purchasing a product. Customarily, coupons are issued by manufacturers of consumer packaged goods or by retailers, to be used in retail stores as a part of sales promotions. They are often widely distributed through mail, coupon envelopes, magazines, newspapers, the Internet (social media, email newsletter), directly from the retailer, and mobile devices such as cell phones. ''The New York Times'' reported "more than 900 manufacturers' coupons were distributed" per household, and that "the United States Department of Agriculture estimates that four families in five use coupons. "Only about 4 percent" of coupons received were redeemed. Coupons can be targeted selectively to regional markets in which price competition is great. Most coupons have an expiration date, although American military commissaries overseas honor manufacturers' coupons for up to six months pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Methods

A payment is the tender of something of value, such as money or its equivalent, by one party (such as a person or company) to another in exchange for goods or services provided by them, or to fulfill a legal obligation or philanthropy desire. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Whilst payments are often made voluntarily, some payments are compulsory, such as payment of a fine. Payments can be effected in a number of ways, for example: * the use of money, whether through cash, cheque, mobile payment or bank transfers. * the transfer of anything of value, such as stock, or using barter, the exchange of one good or service for another. In general, payees are at liberty to determine what method of payment they will accept; though normally laws require the payer to accept the country's legal tender up to a prescribed limit. Payment is most commonly affected in the local currency of the payee unless the partie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Processes

A business process, business method, or business function is a collection of related, structured activities or tasks performed by people or equipment in which a specific sequence produces a service or product (that serves a particular business goal) for a particular customer or customers. Business processes occur at all organizational levels and may or may not be visible to the customers. A business process may often be visualized (modeled) as a flowchart of a sequence of activities with interleaving decision points or as a process matrix of a sequence of activities with relevance rules based on data in the process. The benefits of using business processes include improved customer satisfaction and improved agility for reacting to rapid market change. Process-oriented organizations break down the barriers of structural departments and try to avoid functional silos. Overview A business process begins with a mission objective (an external event) and ends with achievement of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internet

The Internet (or internet) is the Global network, global system of interconnected computer networks that uses the Internet protocol suite (TCP/IP) to communicate between networks and devices. It is a internetworking, network of networks that consists of Private network, private, public, academic, business, and government networks of local to global scope, linked by a broad array of electronic, Wireless network, wireless, and optical networking technologies. The Internet carries a vast range of information resources and services, such as the interlinked hypertext documents and Web application, applications of the World Wide Web (WWW), email, electronic mail, internet telephony, streaming media and file sharing. The origins of the Internet date back to research that enabled the time-sharing of computer resources, the development of packet switching in the 1960s and the design of computer networks for data communication. The set of rules (communication protocols) to enable i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IT Systems

Information technology (IT) is a set of related fields within information and communications technology (ICT), that encompass computer systems, software, programming languages, data processing, data and information processing, and storage. Information technology is an application of computer science and computer engineering. The term is commonly used as a synonym for computers and computer networks, but it also encompasses other information distribution technologies such as television and telephones. Several products or services within an economy are associated with information technology, including computer hardware, software, electronics, semiconductors, internet, Telecommunications equipment, telecom equipment, and e-commerce.. An information technology system (IT system) is generally an information system, a communications system, or, more specifically speaking, a Computer, computer system — including all Computer hardware, hardware, software, and peripheral equipment � ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Point Of Sale

The point of sale (POS) or point of purchase (POP) is the time and place at which a retail transaction is completed. At the point of sale, the merchant calculates the amount owed by the customer, indicates that amount, may prepare an invoice for the customer (which may be a cash register printout), and indicates the options for the customer to make payment. It is also the point at which a customer makes a payment to the merchant in exchange for goods or after provision of a service. After receiving payment, the merchant may issue a receipt, as proof of transaction, which is usually printed but can also be dispensed with or sent electronically. To calculate the amount owed by a customer, the merchant may use various devices such as weighing scales, barcode scanners, and cash registers (or the more advanced "POS cash registers", which are sometimes also called "POS systems"). To make a payment, payment terminals, touch screens, and other hardware and software options are avail ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |