|

Self-employment Tax

Self-employment is the state of working for oneself rather than an employer. Tax authorities will generally view a person as self-employed if the person chooses to be recognised as such or if the person is generating income for which a tax return needs to be filed. In the real world, the critical issue for tax authorities is not whether a person is engaged in business activity (called ''trading'' even when referring to the provision of a service) but whether the activity is profitable and therefore potentially taxable. In other words, the trading is likely to be ignored if there is no profit, so occasional and hobby- or enthusiast-based economic activity is generally ignored by tax authorities. Self-employed people are usually classified as a sole proprietor (or sole trader), independent contractor, or as a member of a partnership. Self-employed people generally find their own work rather than being provided with work by an employer and instead earn income from a profession, a tra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

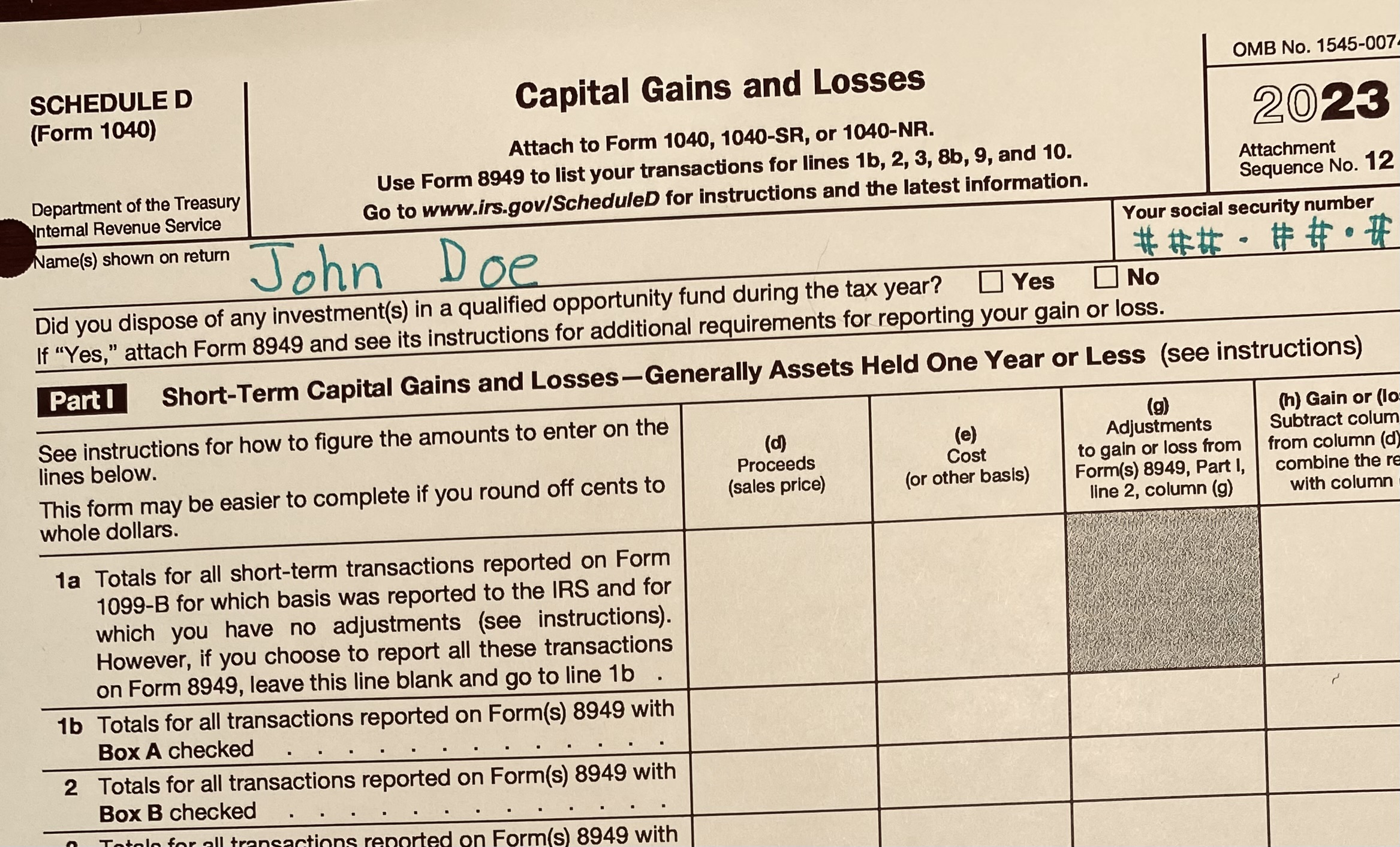

Tax Return

A tax return is a form on which a person or organization presents an account of income and circumstances, used by the tax authorities to determine liability for tax. Tax returns are usually processed by each country's tax authority, known as a revenue service, such as the Internal Revenue Service in the United States, the State Taxation Administration in China, and HM Revenue and Customs in the United Kingdom. Preparing the tax return A tax return reports income, expenses, tax payments made during the year and other relevant information to the taxing authority. It helps to determine whether a tax refund is due. This will depend on whether a person has overpaid on taxes, or was late in paying tax for previous years. A person or organization may not be required to file a tax return depending on circumstances, which are different in each country. Generally, a tax return does not need to be filed if income is less than a certain amount, but other factors such as the type of in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

401(k)

In the United States, a 401(k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection 401(k) of the U.S. Internal Revenue Code. Periodic employee contributions come directly out of their paychecks, and may be matched by the employer. This pre-tax option is what makes 401(k) plans attractive to employees, and many employers offer this option to their (full-time) workers. 401(k) payable is a general ledger account that contains the amount of 401(k) plan pension payments that an employer has an obligation to remit to a pension plan administrator. This account is classified as a payroll liability, since the amount owed should be paid within one year. There are two types: traditional and Roth 401(k). For Roth accounts, contributions and withdrawals have no impact on income tax. For traditional accounts, contributions may be deducted from taxable income and withdrawals are added to taxable income. There are limits to contribut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unlimited Company

An unlimited company or private unlimited company is a hybrid company (corporation) incorporated with or without a share capital (and similar to its limited company counterpart) but where the legal liability of the members or shareholders is not limited: that is, its members or shareholders have a joint and several non-limited obligation to meet any insufficiency in the assets of the company to enable settlement of any outstanding financial liability in the event of the company's formal liquidation. Characteristics The joint and several non-limited liability of the members or shareholders of such an unlimited company to meet any insufficiency in the assets of the company (to settle its outstanding liabilities if any exist) applies only upon the formal liquidation of the company. Therefore, prior to any such formal liquidation of the company, any creditors or security holders of the company may have recourse only to the assets of the company, not those of its members or shareho ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Liability Partnership

A limited liability partnership (LLP) is a partnership in which some or all partners (depending on the jurisdiction) have limited liabilities. It therefore can exhibit aspects of both partnerships and corporations. In an LLP, each partner is not responsible or liable for another partner's misconduct or negligence. This distinguishes an LLP from a traditional partnership under the UK Partnership Act 1890, in which each partner has joint (but not several) liability. In an LLP, some or all partners have a form of limited liability similar to that of the shareholders of a corporation. Depending on the jurisdiction, however, the limited liability may extend only to the negligence or misconduct of the other partners, and the partners may be personally liable for other liabilities of the firm or partners. Unlike corporate shareholders, the partners have the power to manage the business directly. In contrast, corporate shareholders must elect a board of directors under the laws of v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sole Trader

A sole proprietorship, also known as a sole tradership, individual entrepreneurship or proprietorship, is a type of enterprise owned and run by only one person and in which there is no legal distinction between the owner and the business entity. A sole trader does not necessarily work alone and may employ other people. The sole trader receives all profits (subject to taxation specific to the business) and has unlimited responsibility for all losses and debts. Every asset of the business is owned by the proprietor, and all debts of the business are that of the proprietor; the business is not a separate legal entity. The arrangement is a "sole" proprietorship in contrast with a partnership, which has at least two owners. Sole proprietors may use a trade name or business name other than their legal name. They may have to trademark their business name legally if it differs from their own legal name, with the process varying depending upon country of residence. Advantages and disadv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Self-employment In The UK, 2008 To 2014

Self-employment is the state of working for oneself rather than an employer. Tax authorities will generally view a person as self-employed if the person chooses to be recognised as such or if the person is generating income for which a tax return needs to be filed. In the real world, the critical issue for tax authorities is not whether a person is engaged in business activity (called ''trading'' even when referring to the provision of a service) but whether the activity is profitable and therefore potentially taxable. In other words, the trading is likely to be ignored if there is no profit, so occasional and hobby- or enthusiast-based economic activity is generally ignored by tax authorities. Self-employed people are usually classified as a sole proprietorship, sole proprietor (or sole trader), independent contractor, or as a member of a partnership. Self-employed people generally find their own work rather than being provided with work by an employer and instead earn income from ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Foundation For The Improvement Of Living And Working Conditions

The European Foundation for the Improvement of Living and Working Conditions (Eurofound) is an agency of the European Union which focuses on managing research, gathering information, and communicating its findings. It was set up in May 1975 by the European Council to help improve living and working conditions across Europe, and was one of the first bodies established to work on a specific subset of EU policy. It is headquartered at Wyattville Road, Loughlinstown, County Dublin, D18 KP65, Ireland. Governance The foundation is overseen by a Management Board, executive director, and deputy director. The Executive Board meets once a year to set budgets and policy, and to decide on one-year and four-year work programmes. The current director, Ivailo Kalfin, was appointed in June 2021. The deputy director is Maria Jepsen. The foundation budget (21,8M euros in 2021) comes from the general European Commission The European Commission (EC) is the primary Executive (government), e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Treaty On The Functioning Of The European Union

The Treaty on the Functioning of the European Union (TFEU) is one of two treaties forming the constitutional basis of the European Union (EU), the other being the Treaty on European Union (TEU). It was previously known as the Treaty Establishing the European Community (TEC). The Treaty originated as the Treaty of Rome (fully the ''Treaty establishing the European Economic Community''), which brought about the creation of the European Economic Community (EEC), the best-known of the European Communities (EC). It was signed on 25 March 1957 by Belgium, France, Italy, Luxembourg, the Netherlands and West Germany and came into force on 1 January 1958. It remains one of the two most important treaties in the modern-day European Union (EU). Its name has been amended twice since 1957. The Maastricht Treaty of 1992 removed the word "economic" from the Treaty of Rome's official title and, in 2009, the Treaty of Lisbon renamed it the "Treaty on the Functioning of the European Union" ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Commission

The European Commission (EC) is the primary Executive (government), executive arm of the European Union (EU). It operates as a cabinet government, with a number of European Commissioner, members of the Commission (directorial system, informally known as "commissioners") corresponding to two thirds of the number of Member state of the European Union, member states, unless the European Council, acting unanimously, decides to alter this number. The current number of commissioners is 27, including the president. It includes an administrative body of about 32,000 European civil servants. The commission is divided into departments known as Directorate-General, Directorates-General (DGs) that can be likened to departments or Ministry (government department), ministries each headed by a director-general who is responsible to a commissioner. Currently, there is one member per European Union member state, member state, but members are bound by their oath of office to represent the genera ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Poverty

Poverty is a state or condition in which an individual lacks the financial resources and essentials for a basic standard of living. Poverty can have diverse Biophysical environment, environmental, legal, social, economic, and political causes and effects. When evaluating poverty in statistics or economics there are two main measures: ''absolute poverty'' which compares income against the amount needed to meet basic needs, basic personal needs, such as food, clothing, and Shelter (building), shelter; secondly, ''relative poverty'' measures when a person cannot meet a minimum level of living standards, compared to others in the same time and place. The definition of ''relative poverty'' varies from one country to another, or from one society to another. Statistically, , most of the world's population live in poverty: in Purchasing Power Parity, PPP dollars, 85% of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bureau Of Economic Analysis

The Bureau of Economic Analysis (BEA) of the United States Department of Commerce is a U.S. government agency that provides official macroeconomic and industry statistics, most notably reports about the gross domestic product (GDP) of the United States and its jurisdictions. They also provide information about personal income, corporate profits, and government spending in their National Income and Product Accounts (NIPAs). The BEA is one of the principal agencies of the U.S. Federal Statistical System. Its stated mission is to "promote a better understanding of the U.S. economy by providing the most timely, relevant, and accurate economic data in an objective and cost-effective manner". BEA has about 500 employees and an annual budget of approximately $101 million. National accounts BEA's national economic statistics (National Economic Accounts) provide a comprehensive view of U.S. production, consumption, investment, exports and imports, and income and saving. These stat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pennsylvania State University

The Pennsylvania State University (Penn State or PSU) is a Public university, public Commonwealth System of Higher Education, state-related Land-grant university, land-grant research university with campuses and facilities throughout Pennsylvania, United States. Founded in 1855 as Farmers' High School of Pennsylvania, Penn State was named the state's first land-grant university eight years later, in 1863. Its primary campus, known as Penn State University Park, is located in State College, Pennsylvania, State College and College Township, Pennsylvania, College Township. Penn State enrolls more than 89,000 students, of which more than 74,000 are undergraduates and more than 14,000 are postgraduates. In addition to its land-grant designation, the university is a National Sea Grant College Program, sea-grant, National Space Grant College and Fellowship Program, space-grant, and one of only six Sun Grant Association, sun-grant universities. It is Carnegie Classification of Instit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |