|

Real Interest Rate

The real interest rate is the rate of interest an investor, saver or lender receives (or expects to receive) after allowing for inflation. It can be described more formally by the Fisher equation, which states that the real interest rate is approximately the nominal interest rate minus the inflation rate. If, for example, an investor were able to lock in a 5% interest rate for the coming year and anticipated a 2% rise in prices, they would expect to earn a real interest rate of 3%. The expected real interest rate is not a single number, as different investors have different expectations of future inflation. Since the inflation rate over the course of a loan is not known initially, volatility in inflation represents a risk to both the lender and the borrower. In the case of contracts stated in terms of the nominal interest rate, the real interest rate is known only at the end of the period of the loan, based on the realized inflation rate; this is called the ex-post real inter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Treasury Security

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. government debt has been managed by the Bureau of the Fiscal Service, succeeding the Bureau of the Public Debt. There are four types of marketable Treasury securities: Treasury bills, Treasury notes, Treasury bonds, and Treasury Inflation Protected Securities (TIPS). The government sells these securities in auctions conducted by the Federal Reserve Bank of New York, after which they can be traded in secondary markets. Non-marketable securities include savings bonds, issued to the public and transferable only as gifts; the State and Local Government Series (SLGS), purchaseable only with the proceeds of state and municipal bond sales; and the Government Account Series, purchased by units of the federal government. Treasury securities are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Natural Rate Of Interest

The neutral rate of interest, previously called the natural rate of interest, is the real (net of inflation) interest rate that supports the economy at full employment/maximum output while keeping inflation constant. It cannot be observed directly. Rather, policy makers and economic researchers aim to estimate the neutral rate of interest as a guide to monetary policy, usually using various economic models to help them do so. History Eugen von Böhm-Bawerk used the term "natural interest" in his ''Capital and Interest'' first written in 1880s, but the concept itself was originated by the Swedish economist Knut Wicksell. Wicksell published a study in 1898 defining the natural rate of interest as the rate that would bring an economy in aggregate price equilibrium if all lending were done without reference to money. Wicksell defined the natural rate of interest as "a certain rate of interest on loans which is neutral in respect to commodity prices and tends neither to raise nor t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

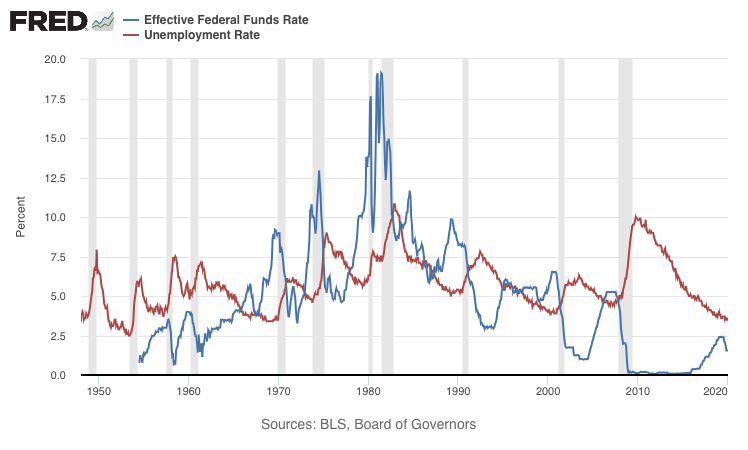

Federal Funds Rate

In the United States, the federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight on an uncollateralized basis. Reserve balances are amounts held at the Federal Reserve to maintain depository institutions' reserve requirements. Institutions with surplus balances in their accounts lend those balances to institutions in need of larger balances. The federal funds rate is an important benchmark in financial markets. The effective federal funds rate (EFFR) is calculated as the effective median interest rate of overnight federal funds transactions during the previous business day. It is published daily by the Federal Reserve Bank of New York. The federal funds target range is determined by a meeting of the members of the Federal Open Market Committee (FOMC) which normally occurs eight times a year about seven weeks apart. The committee may also hold additional meetings an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Funds

In the United States, federal funds are overnight borrowings between banks and other entities to maintain their bank reserves at the Federal Reserve. Banks keep reserves at Federal Reserve Banks to meet their reserve requirements and to clear financial transactions. Transactions in the federal funds market enable depository institutions with reserve balances in excess of reserve requirements to lend reserves to institutions with reserve deficiencies. These loans are usually made for one day only, that is, "overnight". The interest rate at which these deals are done is called the federal funds rate. Federal funds are not collateralized; like eurodollars, they are an unsecured interbank loan. Federal funds transactions by regulated financial institutions neither increase nor decrease total reserves in the banking system as a whole. Instead, they redistribute reserves. Before 2008, this meant that otherwise idle funds could yield a return. (Since 2008, the Fed has paid inte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Open Market Operations

In macroeconomics, an open market operation (OMO) is an activity by a central bank to give (or take) liquidity in its currency to (or from) a bank or a group of banks. The central bank can either buy or sell government bonds (or other financial assets) in the open market (this is where the name was historically derived from) or, in what is now mostly the preferred solution, enter into a repo or secured lending transaction with a commercial bank: the central bank gives the money as a deposit for a defined period and synchronously takes an eligible asset as collateral. Central banks usually use OMO as the primary means of implementing monetary policy. The usual aim of open market operations is—aside from supplying commercial banks with liquidity and sometimes taking surplus liquidity from commercial banks—to manipulate the short-term interest rate and the supply of base money in an economy, and thus indirectly control the total money supply, in effect expanding money or con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often as an attempt to reduce inflation or the interest rate, to ensure price stability and general trust of the value and stability of the nation's currency. Monetary policy is a modification of the supply of money, i.e. "printing" more money, or decreasing the money supply by changing interest rates or removing excess reserves. This is in contrast to fiscal policy, which relies on taxation, government spending, and government borrowing as methods for a government to manage business cycle phenomena such as recessions. Further purposes of a monetary policy are usually to contribute to the stability of gross domestic product, to achieve and maintain low unemployment, and to maintain predictable exchange rates with other currencies. Monetary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Knut Wicksell

Johan Gustaf Knut Wicksell (December 20, 1851 – May 3, 1926) was a leading Swedish economist of the Stockholm school. His economic contributions would influence both the Keynesian and Austrian schools of economic thought. He was married to the noted feminist Anna Bugge. Early life Wicksell was born in Stockholm on December 20, 1851. His father was a relatively successful businessman and real estate broker. He lost both his parents at a relatively early age. His mother died when he was only six, and his father died when he was fifteen. His father's considerable estate allowed him to enroll at the University of Uppsala in 1869 to study mathematics and physics. Education He received his first degree in two years, and he engaged in graduate studies until 1885, when he received his doctorate in mathematics. In 1887, Wicksell received a scholarship to study on the Continent, where he heard lectures by the economist Carl Menger in Vienna. In the following years, his interests ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Physical Investment

In macroeconomics, investment "consists of the additions to the nation's capital stock of buildings, equipment, software, and inventories during a year" or, alternatively, investment spending — "spending on productive physical capital such as machinery and construction of buildings, and on changes to inventories — as part of total spending" on goods and services per year. Krugman, Paul and Robin Wells (2012), 2nd ed. ''Economics'', p. 593. Worth Publishers. The types of investment include residential investment in housing that will provide a flow of housing services over an extended time, non-residential fixed investment in things such as new machinery or factories, human capital investment in workforce education, and inventory investment (the accumulation, intentional or unintentional, of goods inventories) In measures of national income and output, " gross investment" (represented by the variable ) is a component of gross domestic product (), given in the formula , whe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth (e.g. dot-com bubble), and/or by the belief that intrinsic valuation is no longer relevant when making an investment (e.g. Tulip mania). They have appeared in most asset classes, including equities (e.g. Roaring Twenties), commodities (e.g. Uranium bubble), real estate (e.g. 2000s US housing bubble), and even esoteric assets (e.g. Cryptocurrency bubble). Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles (e.g. 1980s Japanese asset bubble and the 2020–21 Everything bubble), are attributed to central banking liquidity (e.g. overuse of the Fed put). In the early stages ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Cycle

Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production. Business cycle fluctuations are usually characterized by general upswings and downturns in a span of macroeconomic variables. The individual episodes of expansion/recession occur with changing duration and intensity over time. Typically their periodicity has a wide range from around 2 to 10 years (the technical phrase "stochastic cycle" is often used in statistics to describe this kind of process.) As in arvey, Trimbur, and van Dijk, 2007, ''Journal of Econometrics'' such flexible knowledge about the frequency of business cycles can actually be included in their mathematical study, using a Bayesian statistical paradigm. There are numerous sources of busines ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Flight

Capital flight, in economics, occurs when assets or money rapidly flow out of a country, due to an event of economic consequence or as the result of a political event such as regime change or economic globalization. Such events could be an increase in taxes on capital or capital holders or the government of the country defaulting on its debt that disturbs investors and causes them to lower their valuation of the assets in that country, or otherwise to lose confidence in its economic strength. This leads to a disappearance of wealth, and is usually accompanied by a sharp drop in the exchange rate of the affected country—depreciation in a variable exchange rate regime, or a forced devaluation in a fixed exchange rate regime. This fall is particularly damaging when the capital belongs to the people of the affected country because not only are the citizens now burdened by the loss in the economy and devaluation of their currency but their assets have lost much of their nominal va ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |