|

Revenue Act Of 1926

The United States Revenue Act of 1926, , reduced inheritance and personal income taxes, cancelled many excise imposts, eliminated the gift tax and ended public access to federal income tax returns. The most notable parts of the Act were that maximum tax rates on inheritances and large estates were halved, as were income taxes for the wealthiest. As a consequence, taxes on the wealthy were greatly reduced. To garner political support for such massive tax cuts for the wealthy, the Act also provided small tax cuts across the board. Passed by the 69th Congress, it was signed into law by President Calvin Coolidge Calvin Coolidge (born John Calvin Coolidge Jr.; ; July 4, 1872January 5, 1933) was the 30th president of the United States, serving from 1923 to 1929. A Republican Party (United States), Republican lawyer from Massachusetts, he previously .... The act was applicable to incomes for 1925 and thereafter. Tax on Corporations A rate of 13.5 percent was levied on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 contiguous states border Canada to the north and Mexico to the south, with the semi-exclave of Alaska in the northwest and the archipelago of Hawaii in the Pacific Ocean. The United States asserts sovereignty over five Territories of the United States, major island territories and United States Minor Outlying Islands, various uninhabited islands in Oceania and the Caribbean. It is a megadiverse country, with the world's List of countries and dependencies by area, third-largest land area and List of countries and dependencies by population, third-largest population, exceeding 340 million. Its three Metropolitan statistical areas by population, largest metropolitan areas are New York metropolitan area, New York, Greater Los Angeles, Los Angel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance Tax

International tax law distinguishes between an estate tax and an inheritance tax. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died. However, this distinction is not always observed; for example, the UK's "inheritance tax" is a tax on the assets of the deceased, and strictly speaking is therefore an estate tax. Inheritance taxes vary widely between countries. History There was a steep increase in the number of countries that implemented inheritance taxes throughout the 19th and early 20th century. From 1960 onwards, inheritance taxes declined in prevalence as numerous countries repealed theirs. For historical reasons, the term "death duty" is still used colloquially (though not legally) in the UK and some Commonwealth countries. The estate tax in the United States is sometimes referred as "death tax". Other taxation applied to inherita ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when the barrel was tapped it would destroy the stamp. An excise, or excise tax, is any duty (economics), duty on manufactured goods (economics), goods that is normally levied at the moment of manufacture for internal consumption rather than at sale. It is therefore a fee that must be paid in order to consume certain products. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the ''border'', while excise is levied on goods that came into existence ''inland''. An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Government Of The United States

The Federal Government of the United States of America (U.S. federal government or U.S. government) is the Federation#Federal governments, national government of the United States. The U.S. federal government is composed of three distinct branches: United States Congress, legislative, President of the United States, executive, and Federal judiciary of the United States, judicial. Powers of these three branches are defined and vested by the Constitution of the United States, U.S. Constitution, which has been in continuous effect since May 4, 1789. The powers and duties of these branches are further defined by Act of Congress, Acts of Congress, including the creation of United States federal executive departments, executive departments and courts subordinate to the Supreme Court of the United States, U.S. Supreme Court. In the Federalism in the United States, federal division of power, the federal government shares sovereignty with each of the 50 states in their respective t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

69th United States Congress

The 69th United States Congress was a meeting of the legislative branch of the United States federal government, consisting of the United States Senate and the United States House of Representatives. It met in Washington, D.C. from March 4, 1925, to March 4, 1927, during the third and fourth years of Presidency of Calvin Coolidge, Calvin Coolidge's presidency. The apportionment of seats in the United States House of Representatives, House of Representatives was based on the 1910 United States census. The Republican Party (United States), Republicans made modest gains in maintaining their majority in both chambers, and with the election of U.S. President, President Calvin Coolidge to his own term in office, the Republicans maintained an overall federal government government trifecta#United States, trifecta. Major events A special session of the Senate was called by President Coolidge on February 14, 1925. * Impeachment of Judge George W. English — On April 1, 1926, the House o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

President Of The United States

The president of the United States (POTUS) is the head of state and head of government of the United States. The president directs the Federal government of the United States#Executive branch, executive branch of the Federal government of the United States, federal government and is the Powers of the president of the United States#Commander-in-chief, commander-in-chief of the United States Armed Forces. The power of the presidency has grown since the first president, George Washington, took office in 1789. While presidential power has ebbed and flowed over time, the presidency has played an increasing role in American political life since the beginning of the 20th century, carrying over into the 21st century with some expansions during the presidencies of Presidency of Franklin D. Roosevelt, Franklin D. Roosevelt and Presidency of George W. Bush, George W. Bush. In modern times, the president is one of the world's most powerful political figures and the leader of the world's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

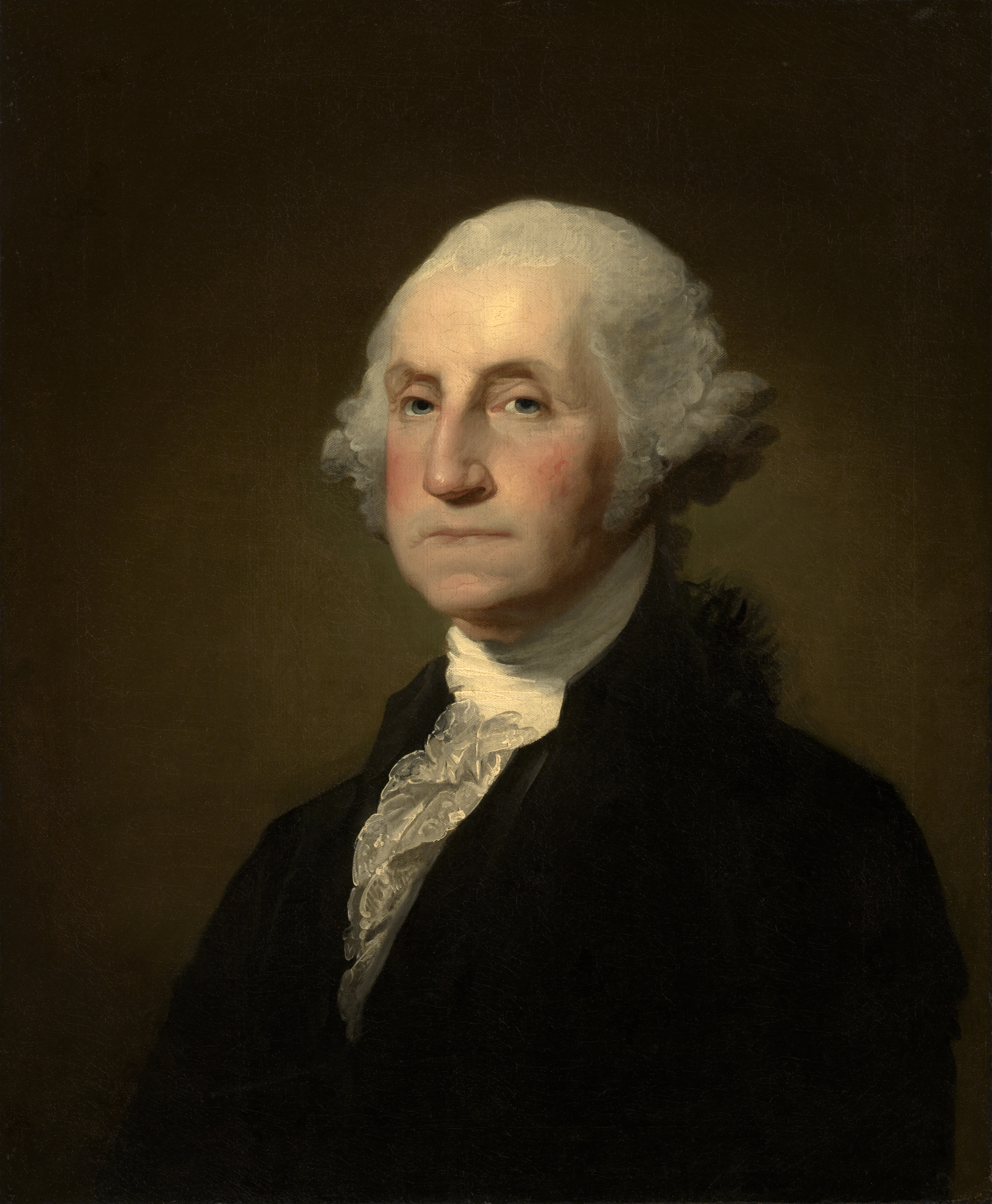

Calvin Coolidge

Calvin Coolidge (born John Calvin Coolidge Jr.; ; July 4, 1872January 5, 1933) was the 30th president of the United States, serving from 1923 to 1929. A Republican Party (United States), Republican lawyer from Massachusetts, he previously served as the 29th Vice President of the United States, vice president from 1921 to 1923 under President Warren G. Harding, and as the 48th governor of Massachusetts from 1919 to 1921. Coolidge gained a reputation as a Libertarian conservatism, small-government conservative with a taciturn personality and dry sense of humor that earned him the nickname "Silent Cal". Coolidge began his career as a member of the Massachusetts House of Representatives, Massachusetts State House. He rose up the ranks of Massachusetts politics and was elected governor 1918 Massachusetts gubernatorial election, in 1918. As governor, Coolidge ran on the record of fiscal conservatism, strong support for women's suffrage, and vague opposition to Prohibition in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Federal Taxation Legislation

United may refer to: Places * United, Pennsylvania, an unincorporated community * United, West Virginia, an unincorporated community Arts and entertainment Films * ''United'' (2003 film), a Norwegian film * ''United'' (2011 film), a BBC Two film * ''The United'' (film), an unreleased Arabic-language film Literature * ''United!'' (novel), a 1973 children's novel by Michael Hardcastle Music * United (band), Japanese thrash metal band formed in 1981 Albums * ''United'' (Commodores album), 1986 * ''United'' (Dream Evil album), 2006 * ''United'' (Marvin Gaye and Tammi Terrell album), 1967 * ''United'' (Marian Gold album), 1996 * ''United'' (Phoenix album), 2000 * ''United'' (Woody Shaw album), 1981 Songs * "United" (Judas Priest song), 1980 * "United" (Prince Ital Joe and Marky Mark song), 1994 * "United" (Robbie Williams song), 2000 * "United", a song by Danish duo Nik & Jay featuring Lisa Rowe * "United (Who We Are)", a song by XO-IQ, featured in the television ser ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1926 In American Law

Nineteen or 19 may refer to: * 19 (number) * One of the years 19 BC, AD 19, 1919, 2019 Films * ''19'' (film), a 2001 Japanese film * ''Nineteen'' (1987 film), a 1987 science fiction film * ''19-Nineteen'', a 2009 South Korean film * ''Diciannove'', a 2024 Italian drama film informally referred to as "Nineteen" in some sources Science * Potassium, an alkali metal * 19 Fortuna, an asteroid Music * 19 (band), a Japanese pop music duo Albums * ''19'' (Adele album), 2008 * ''19'', a 2003 album by Alsou * ''19'', a 2006 album by Evan Yo * ''19'', a 2018 album by MHD * ''19'', one half of the double album ''63/19'' by Kool A.D. * ''Number Nineteen'', a 1971 album by American jazz pianist Mal Waldron * ''XIX'' (EP), a 2019 EP by 1the9 Songs * "19" (song), a 1985 song by British musician Paul Hardcastle * "Stone in Focus", officially "#19", a composition by Aphex Twin * "Nineteen", a song from the 1992 album ''Refugee'' by Bad4Good * "Nineteen", a song from the 2001 al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |