|

Retirement Planning

Retirement planning, in a financial context, refers to the allocation of savings or revenue for retirement. The goal of retirement planning is to achieve financial independence. The process of retirement planning aims to: *Assess readiness-to-retire given a desired retirement age and lifestyle, i.e., whether one has enough money to retire *Identify actions to improve readiness-to-retire *Acquire financial planning knowledge *Encourage saving practices Obtaining a financial plan Producers such as a financial planner or financial adviser can help clients develop retirement plans, where compensation is either fee-based or commissioned contingent on product sale; see Professional certification in financial services. Such an arrangement is sometimes viewed as in conflict with a consumer's interest, and that the advice rendered cannot be without bias, or at a cost that justifies its value. Consumers can now elect a do it yourself (DIY) approach. For example, retirement web-tools in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retirement

Retirement is the withdrawal from one's position or occupation or from one's active working life. A person may also semi-retire by reducing work hours or workload. Many people choose to retire when they are elderly or incapable of doing their job for health reasons. People may also retire when they are eligible for private or public pension benefits, although some are forced to retire when bodily conditions no longer allow the person to work any longer (by illness or accident) or as a result of legislation concerning their positions. In most countries, the idea of retirement is of recent origin, being introduced during the late-nineteenth and early-twentieth centuries. Previously, low life expectancy, lack of social security and the absence of pension arrangements meant that most workers continued to work until their death. Germany was the first country to introduce retirement benefits in 1889. Nowadays, most developed countries have systems to provide pensions on retirement in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Individual Retirement Account

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. An individual retirement account is a type of individual retirement arrangement as described in IRS Publication 590, ''Individual Retirement Arrangements (IRAs)''. Other arrangements include individual retirement annuities and employer-established benefit trusts. Types There are several types of IRAs: * Traditional IRA – Contributions are mostly tax-deductible (often simplified as "money is deposited before tax" or "contributions are made with pre-tax assets"), no transactions within the IRA are taxed, and withdrawals in retirement are taxed as income (except for those portions of the withdrawal corresponding to contributions that were not deducted). Depending upon the nature ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Bank Of Minneapolis

The Federal Reserve Bank of Minneapolis, located in Minneapolis, Minnesota, Minneapolis, Minnesota, in the United States, covers the 9th District of the Federal Reserve, which is made up of Minnesota, Montana, North Dakota, North and South Dakota, northwestern Wisconsin, and the Upper Peninsula of Michigan. Although its geographical territory is the third largest of the 12 Federal Reserve banks, it serves the smallest population base of the system. It has Federal Reserve Bank of Minneapolis Helena Branch, one branch, which is in Helena, Montana, Helena, Montana. Staff The bank has more than 1,000 staff. Neel Kashkari became the bank's president in 2016, succeeding Narayana Kocherlakota. The Minneapolis Fed has strong ties to the economics department at the University of Minnesota. Economist and Nobel laureate Edward Prescott was affiliated with both institutions for many years. The Bank publishes ''The Region'', a magazine featuring articles about economic policy and intervie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

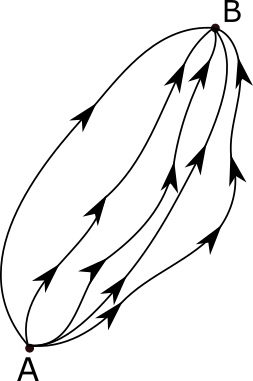

Complexity Science

A complex system is a system composed of many components that may interact with one another. Examples of complex systems are Earth's global climate, organisms, the human brain, infrastructure such as power grid, transportation or communication systems, complex software and electronic systems, social and economic organizations (like cities), an ecosystem, a living cell, and, ultimately, for some authors, the entire universe. The behavior of a complex system is intrinsically difficult to model due to the dependencies, competitions, relationships, and other types of interactions between their parts or between a given system and its environment. Systems that are "complex" have distinct properties that arise from these relationships, such as nonlinearity, emergence, spontaneous order, adaptation, and feedback loops, among others. Because such systems appear in a wide variety of fields, the commonalities among them have become the topic of their independent area of research. In many c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neoclassical Economics

Neoclassical economics is an approach to economics in which the production, consumption, and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a good or service is determined through a hypothetical maximization of utility by income-constrained individuals and of profits by firms facing production costs and employing available information and factors of production. This approach has often been justified by appealing to rational choice theory. Neoclassical economics is the dominant approach to microeconomics and, together with Keynesian economics, formed the neoclassical synthesis which dominated mainstream economics as "neo-Keynesian economics" from the 1950s onward. Classification The term was originally introduced by Thorstein Veblen in his 1900 article "Preconceptions of Economic Science", in which he related marginalists in the tradition of Alfred Marshall ''et al.'' to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monte Carlo Method

Monte Carlo methods, or Monte Carlo experiments, are a broad class of computational algorithms that rely on repeated random sampling to obtain numerical results. The underlying concept is to use randomness to solve problems that might be deterministic in principle. The name comes from the Monte Carlo Casino in Monaco, where the primary developer of the method, mathematician Stanisław Ulam, was inspired by his uncle's gambling habits. Monte Carlo methods are mainly used in three distinct problem classes: optimization, numerical integration, and generating draws from a probability distribution. They can also be used to model phenomena with significant uncertainty in inputs, such as calculating the risk of a nuclear power plant failure. Monte Carlo methods are often implemented using computer simulations, and they can provide approximate solutions to problems that are otherwise intractable or too complex to analyze mathematically. Monte Carlo methods are widely used in va ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Risk

Financial risk is any of various types of risk associated with financing, including financial transactions that include company loans in risk of default. Often it is understood to include only downside risk, meaning the potential for financial loss and uncertainty about its extent. Modern portfolio theory initiated by Harry Markowitz in 1952 under his thesis titled "Portfolio Selection" is the discipline and study which pertains to managing market and financial risk. In modern portfolio theory, the variance (or standard deviation In statistics, the standard deviation is a measure of the amount of variation of the values of a variable about its Expected value, mean. A low standard Deviation (statistics), deviation indicates that the values tend to be close to the mean ( ...) of a portfolio is used as the definition of risk. Types According to Bender and Panz (2021), financial risks can be sorted into five different categories. In their study, they apply an algorith ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Determinism

Determinism is the Metaphysics, metaphysical view that all events within the universe (or multiverse) can occur only in one possible way. Deterministic theories throughout the history of philosophy have developed from diverse and sometimes overlapping motives and considerations. Like Eternalism (philosophy of time), eternalism, determinism focuses on particular events rather than the future as a concept. Determinism is often contrasted with free will, although some philosophers claim that the two are compatibilism, compatible. A more extreme antonym of determinism is indeterminism, or the view that events are not deterministically caused but rather occur due to random chance. Historically, debates about determinism have involved many philosophical positions and given rise to multiple varieties or interpretations of determinism. One topic of debate concerns the scope of determined systems. Some philosophers have maintained that the entire universe is a single determinate system ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Class (computer Science)

In object-oriented programming, a class defines the shared aspects of objects created from the class. The capabilities of a class differ between programming languages, but generally the shared aspects consist of state ( variables) and behavior ( methods) that are each either associated with a particular object or with all objects of that class. Object state can differ between each instance of the class whereas the class state is shared by all of them. The object methods include access to the object state (via an implicit or explicit parameter that references the object) whereas class methods do not. If the language supports inheritance, a class can be defined based on another class with all of its state and behavior plus additional state and behavior that further specializes the class. The specialized class is a ''sub-class'', and the class it is based on is its ''superclass''. Attributes Object lifecycle As an instance of a class, an object is constructed from a class via '' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Defined Benefit Pension Plan

Defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum, or combination thereof on retirement that depends on an employee's earnings history, tenure of service and age, rather than depending directly on individual investment returns. Traditionally, many governmental and public entities, as well as a large number of corporations, provide defined benefit plans, sometimes as a means of compensating workers in lieu of increased pay.Lemke and Lins, ''ERISA for Money Managers'', §1:1 (Thomson West, 2013). A defined benefit plan is 'defined' in the sense that the benefit formula is defined and known in advance. Conversely, for a " defined contribution retirement saving plan," the formula for computing the employer's and employee's contributions is defined and known in advance, but the benefit to be paid out is not known in advance. In the United States, specifies a defined benefit plan to be any pension p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Flow

Cash flow, in general, refers to payments made into or out of a business, project, or financial product. It can also refer more specifically to a real or virtual movement of money. *Cash flow, in its narrow sense, is a payment (in a currency), especially from one central bank account to another. The term 'cash flow' is mostly used to describe payments that are expected to happen in the future, are thus uncertain, and therefore need to be forecast with cash flows. *A cash flow is determined by its time , nominal amount , currency , and account ; symbolically, . Cash flows are narrowly interconnected with the concepts of value, interest rate, and liquidity. A cash flow that shall happen on a future day can be transformed into a cash flow of the same value in . This transformation process is known as discounting, and it takes into account the time value of money by adjusting the nominal amount of the cash flow based on the prevailing interest rates at the time. Cash flow analy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |