|

Receipt

A receipt (also known as a packing list, packing slip, packaging slip, (delivery) docket, shipping list, delivery list, bill of the parcel, Manifest (transportation), manifest, or customer receipt) is a document acknowledging that something has been received, such as money or property in payment following a sale or other transfer of goods or provision of a service. All receipts must have the date of purchase on them. If the recipient of the payment is legally required to collect sales tax or Value-added tax, VAT from the customer, the amount would be added to the receipt, and the collection would be deemed to have been on behalf of the relevant tax authority. In many countries, a retailer is required to include the sales tax or VAT in the displayed price of goods sold, from which the tax amount would be calculated at the point of sale and remitted to the tax authorities in due course. Similarly, amounts may be deducted from amounts payable, as in the case of Withholding tax, ta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Register

A cash register, sometimes called a till or automated money handling system, is a mechanical or electronic device for registering and calculating transactions at a point of sale. It is usually attached to a Cash register#Cash drawer, drawer for storing cash and other valuables. A modern cash register is usually attached to a printer that can print out receipts for record-keeping purposes. History An early mechanical cash register was invented by James Ritty and John Birch following the American Civil War. James was the owner of a Bar (establishment), saloon in Dayton, Ohio, Dayton, Ohio, US, and wanted to stop employees from pilfering his profits. The Ritty Model I was invented in 1879 after seeing a tool that counted the revolutions of the propeller on a steamship. With the help of James' brother John Ritty, they patented it in 1879. It was called ''Ritty's Incorruptible Cashier'' and it was invented to stop cashiers from pilfering and eliminate employee theft and embezzlemen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bill Of Lading

A bill of lading () (sometimes abbreviated as B/L or BOL) is a document issued by a common carrier, carrier (or their Law of agency, agent) to acknowledge receipt of cargo for shipment. Although the term is historically related only to Contract of carriage, carriage by sea, a bill of lading may today be used for any type of carriage of goods. Bills of lading are one of three crucial documents used in international trade to ensure that exporters receive payment and importers receive the merchandise. The other two documents are a insurance policy, policy of insurance and an invoice. Whereas a bill of lading is negotiable, both a policy and an invoice are assignment (law), assignable. In international trade outside the United States, bills of lading are distinct from waybills in that the latter are not transferable and do not confer title. Nevertheless, the UK Carriage of Goods by Sea Act 1992 grants "all rights of suit under the contract of carriage" to the lawful holder of a bill ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Point Of Sale

The point of sale (POS) or point of purchase (POP) is the time and place at which a retail transaction is completed. At the point of sale, the merchant calculates the amount owed by the customer, indicates that amount, may prepare an invoice for the customer (which may be a cash register printout), and indicates the options for the customer to make payment. It is also the point at which a customer makes a payment to the merchant in exchange for goods or after provision of a service. After receiving payment, the merchant may issue a receipt, as proof of transaction, which is usually printed but can also be dispensed with or sent electronically. To calculate the amount owed by a customer, the merchant may use various devices such as weighing scales, barcode scanners, and cash registers (or the more advanced "POS cash registers", which are sometimes also called "POS systems"). To make a payment, payment terminals, touch screens, and other hardware and software options are avail ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value-added Tax

A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)) is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a sales tax. VAT is an indirect tax, because the consumer who ultimately bears the burden of the tax is not the entity that pays it. Specific goods and services are typically exempted in various jurisdictions. Products exported to other countries are typically exempted from the tax, typically via a rebate to the exporter. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the customer. VAT raises about a fifth of total tax revenues worldwide and among the members of the Organisation for Economic Co-operation and Development (OECD). As of January 2025, 175 of the Member states of the United Nations, 193 countries with UN membership employ a VAT, including all OECD members except the Tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Invoice

An invoice, bill, tab, or bill of costs is a commercial document that includes an itemized list of goods or services furnished by a seller to a buyer relating to a sale transaction, that usually specifies the price and terms of sale, quantities, and agreed-upon prices and terms of sale for products or services the seller had provided the buyer. Payment terms are usually stated on the invoice. These may specify that the buyer has a maximum number of days to pay and is sometimes offered a discount if paid before the due date. The buyer could have already paid for the products or services listed on the invoice. To avoid confusion and consequent unnecessary communications from buyer to seller, some sellers clearly state in large and capital letters on an invoice whether it has already been paid. From a seller's point of view, an invoice is a ''sales invoice''. From a buyer's point of view, an invoice is a ''purchase invoice''. The document indicates the buyer and seller, but ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the Tax exemption, exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Value-added tax#Comparison with sales tax, Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final good, final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a "resale certificate" by the taxing authority and required to provide the cer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discounts And Allowances

Discounts are reductions applied to the basic sale price of goods or services. Allowances against price may have a similar effect Discounting practices operate within both business-to-business and business-to-consumer contexts.Iyengar, R. and Jedidi, K.A Conjoint Model of Quantity Discounts ''Marketing Science'', Volume. 31, No. 2, March–April 2012, pp 334-350, , accessed on 21 January 2025 Discounts can occur anywhere in the distribution channel, modifying either the manufacturer's list price (determined by the manufacturer and often printed on the package), the retail price (set by the retailer and often attached to the product with a sticker), or a quoted price specific to a potential buyer, often given in written form. There are many purposes for discounting, including to increase short-term sales, to move out-of-date stock, to reward valuable customers, to encourage distribution channel members to perform a function, or to otherwise reward behaviors that benefit the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Card

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner (the cardholder) to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer with a payment terminal and access automated teller machines (ATMs). Such cards are known by a variety of names, including bank cards, ATM cards, client cards, key cards or cash cards. There are a number of types of payment cards, the most common being credit cards, debit cards, charge cards, and prepaid cards. Most commonly, a payment card is electronically linked to an account or accounts belonging to the cardholder. These accounts may be deposit accounts or loan or credit accounts, and the card is a means of authenticating the cardholder. However, stored-value cards store money on the card itself and are not necessarily linked to an account at a financial institution. The largest global card pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment

A payment is the tender of something of value, such as money or its equivalent, by one party (such as a person or company) to another in exchange for goods or services provided by them, or to fulfill a legal obligation or philanthropy desire. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Whilst payments are often made voluntarily, some payments are compulsory, such as payment of a fine. Payments can be effected in a number of ways, for example: * the use of money, whether through cash, cheque, mobile payment or bank transfers. * the transfer of anything of value, such as stock, or using barter, the exchange of one good or service for another. In general, payees are at liberty to determine what method of payment they will accept; though normally laws require the payer to accept the country's legal tender up to a prescribed limit. Payment is most commonly affected in the local currency of the payee unless ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Delivery Order

A delivery order (abbreviated D/O"小提�," MSN Encarta World English Dictionary orth American Edition 2007. Microsoft Corporation. Accessed 5 July 2007Archived 2009-10-31.) is a document from a consignee, or an owner or his agent of freight carrier which orders the release of the transportation of cargo to another party. Usually the written order permits the direct delivery of goods to a warehouseman, carrier or other person who in the course of their ordinary business issues warehouse receipts or bills of lading.Dalton, Clark. "Uniform Law Conference of Canada - Proceedings of Annual Meetings." Uniform Law Conference of Canada. Aug. 1995. Uniform Law Conference of Canada. Accessed 5 July 2007 (http://www.ulcc.ca/en/poam2/index.cfm?sec=1995⊂=1995af). According to the Uniform Commercial Code The Uniform Commercial Code (UCC), first published in 1952, is one of a number of uniform acts that have been established as law with the goal of harmonizing the laws of sales and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

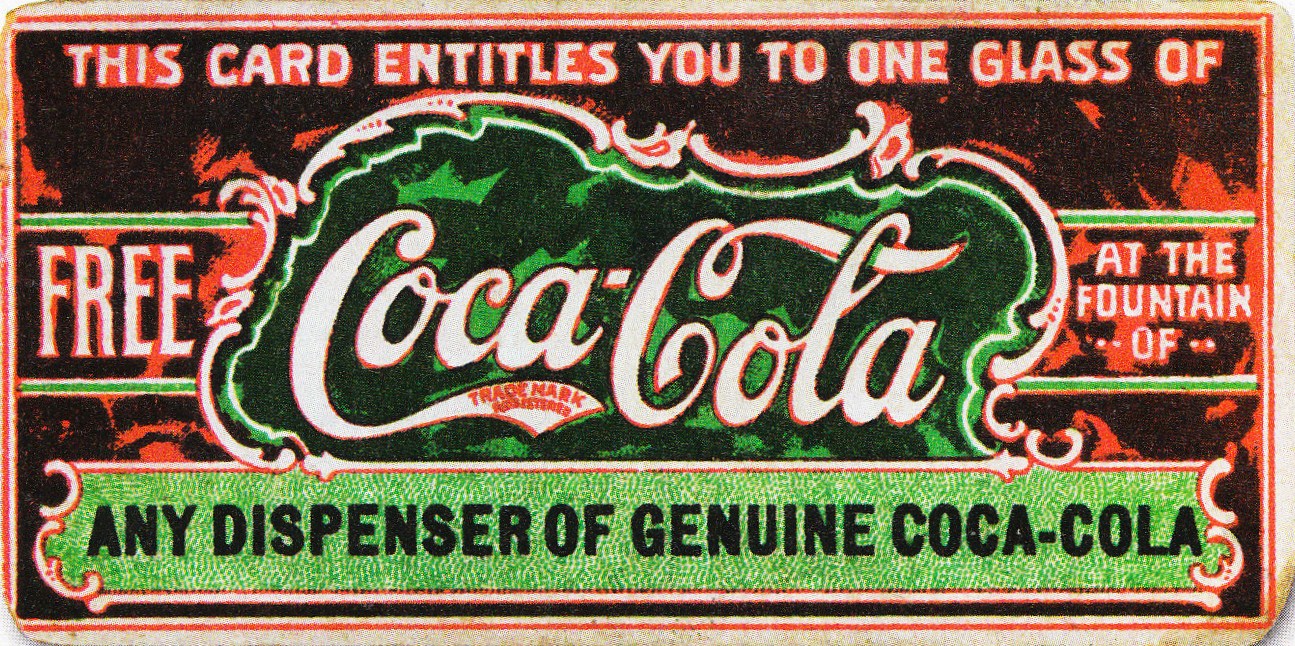

Coupons

In marketing, a coupon is a ticket or document that can be redeemed for a financial discount or rebate when purchasing a product. Customarily, coupons are issued by manufacturers of consumer packaged goods or by retailers, to be used in retail stores as a part of sales promotions. They are often widely distributed through mail, coupon envelopes, magazines, newspapers, the Internet (social media, email newsletter), directly from the retailer, and mobile devices such as cell phones. ''The New York Times'' reported "more than 900 manufacturers' coupons were distributed" per household, and that "the United States Department of Agriculture estimates that four families in five use coupons. "Only about 4 percent" of coupons received were redeemed. Coupons can be targeted selectively to regional markets in which price competition is great. Most coupons have an expiration date, although American military commissaries overseas honor manufacturers' coupons for up to six months p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |