|

Private Equity Secondary Market

In finance, the Private Equity Secondary Market (also often called Private Equity Secondaries or Secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds or the underlying private equity assets (e.g., credit secondaries). Unlike public markets, private-equity interests lack an established trading exchange, making transfers more complex and labor-intensive. Sellers of private-equity investments sell not only their holdings in a fund but also their remaining unfunded commitments. The private-equity asset class is inherently illiquid and is designed for long-term investment by institutional investors, such as pension funds, sovereign wealth funds, insurance companies, endowments, and family offices for wealthy individuals. The secondary market provides these investors with an avenue for liquidity, enabling them to manage their portfolios dynamically. The secondary market reached a transaction volume ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

Private equity (PE) is stock in a private company that does not offer stock to the general public; instead it is offered to specialized investment funds and limited partnerships that take an active role in the management and structuring of the companies. In casual usage "private equity" can refer to these investment firms rather than the companies in which they invest. Private-equity capital (economics), capital is invested into a target company either by an investment management company (private equity firm), a venture capital fund, or an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Private equity can provide working capital to finance a target company's expansion, including the development of new products and services, operational restructuring, management changes, and shifts in ownership and control. As a financial product, a private-equity fund is private capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wall Street Journal

''The Wall Street Journal'' (''WSJ''), also referred to simply as the ''Journal,'' is an American newspaper based in New York City. The newspaper provides extensive coverage of news, especially business and finance. It operates on a subscription model, requiring readers to pay for access to most of its articles and content. The ''Journal'' is published six days a week by Dow Jones & Company, a division of News Corp. As of 2023, ''The'' ''Wall Street Journal'' is the largest newspaper in the United States by print circulation, with 609,650 print subscribers. It has 3.17 million digital subscribers, the second-most in the nation after ''The New York Times''. The newspaper is one of the United States' newspapers of record. The first issue of the newspaper was published on July 8, 1889. The editorial page of the ''Journal'' is typically center-right in its positions. The newspaper has won 39 Pulitzer Prizes. History Founding and 19th century A predecessor to ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deutsche Bank

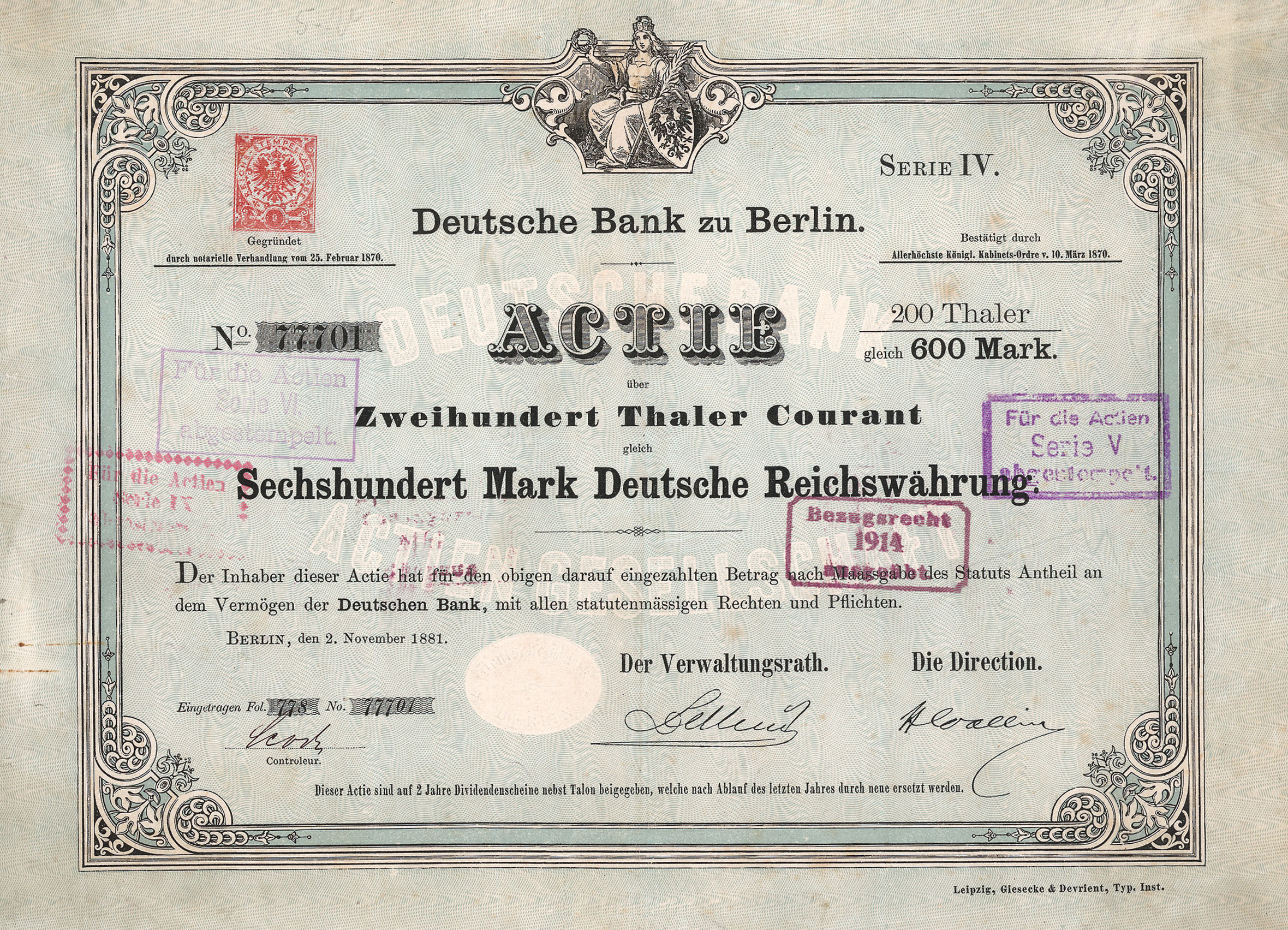

Deutsche Bank AG (, ) is a Germany, German multinational Investment banking, investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange. Deutsche Bank was founded in 1870 in Berlin. From 1929 to 1937, following its merger with Disconto-Gesellschaft, it was known as ''Deutsche Bank und Disconto-Gesellschaft'' or DeDi-Bank. Other transformative acquisitions have included those of Mendelssohn & Co. in 1938, Morgan, Grenfell & Company, Morgan Grenfell in 1990, Bankers Trust in 1998, and Deutsche Postbank in 2010. As of 2018, the bank's network spanned 58 countries with a large presence in Europe, the Americas, and Asia. It is a component of the DAX stock market index and is often referred to as the List of banks in Germany, largest German banking institution, with Deutsche Bank holding the majority stake in DWS Group for combined assets of 2.2 trillion euros, rivaling even Spa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Suisse

Credit Suisse Group AG (, ) was a global Investment banking, investment bank and financial services firm founded and based in Switzerland. According to UBS, eventually Credit Suisse was to be fully integrated into UBS. While the integration was yet to be completed, both banks are operating separately. However, on May 31, 2024, it was announced that Credit Suisse ceased to exist. Headquartered in Zürich, as a standalone firm, it maintained offices in all major financial centres around the world and provided services in investment banking, private banking, asset management, and shared services. It was known for strict Bank secrecy, bank–client confidentiality and Banking in Switzerland, banking secrecy. The Financial Stability Board considered it to be a Systemically important financial institution, global systemically important bank. Credit Suisse was also a primary dealer and Forex counterparty of the Federal Reserve in the United States. Credit Suisse was founded in 185 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neuberger Berman

Neuberger Berman Group LLC is an American private, independent, employee-owned investment management firm. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals. Overview Founded in 1939, Neuberger Berman is a privately held asset management firm, which is 100% owned by its employees. It serves pension plans, charitable organizations, sovereign wealth funds and other institutions, as well as high-net-worth individuals and mutual fund investors, both directly and through financial intermediaries and other partners. The firm has a broad range of investment capabilities, which have enabled it to win numerous public strategic partnership mandates with both leading institutional pension plans and major financial institutions. For its private clients, Neuberger Berman also provides financial planning, fiduciary services, and trust services. Neuberger Berman manages US$474 billion i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Partners Group

Partners Group Holding AG is a Swiss-based global private equity firm with US$152 billion in assets under management in private equity, private infrastructure, private real estate and private debt. The firm manages a broad range of funds, structured products and customised portfolios for an international clientele of institutional investors, private banks, individual investors and other financial institutions. The firm has completed more than 250 private equity investments in portfolio companies. In 2020, Partners Group became a constituent of the Swiss Market Index, an index of the 20 largest stocks in Switzerland. As of 2024, Partners Group is the fifth most-valuable publicly listed private markets firm in the world by market capitalisation. History Early history (1996-2010) Partners Group was co-founded in 1996 by Urs Wietlisbach, Marcel Erni and Alfred Gantner in Zug, Switzerland. Each of the co-founders contributed an equal share to the initial pool in the first year. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pantheon Ventures

Pantheon is a private equity, infrastructure, real assets and debt investor that invests on behalf of over 660 investors, including public and private pension plans, insurance companies, endowments and foundations. Founded in 1982, Pantheon has developed an established reputation in primary, direct co-investment and secondary private assets across all stages and geographies. The firm's investments include customized separate account programs, regional & global primary fund programs, secondaries and co-investment programs. Pantheon manages traditional limited partnership fund vehicles as well as vehicles tailored to the specific requirements of the U.S. private wealth and defined contribution pension markets, and also to investors in UK-listed investment companies, the latter through Pantheon International. Pantheon has over 340 employees with more than US$55 billion in assets under management (as of June 30, 2020). The firm has operated as an affiliate of Affiliated Managers Gro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lexington Partners

Lexington Partners is one of the largest manager of secondary acquisition and co-Investment funds in the world, founded in 1994. Lexington manages approximately $55 billion of which an unprecedented $14 billion was committed to the firm's ninth fund (Lexington Capital Partners IX, closed in January 2020), the largest dedicated secondaries pool of capital ever raised at the time. Lexington Partners is headquartered in New York with offices in Boston, Menlo Park, London, Hong Kong, Santiago, São Paulo and Luxembourg. History Lexington Partners was founded by Brent R. Nicklas.AVCJ Intervie A Private Word With Brent Nickla/ref> Formerly a founding member of Landmark Partners, Nicklas helped pioneer the formation of the secondary market and was involved in some of the earliest secondary deals dating back to 1993. On November 1, 2021, Franklin Templeton announced they would acquire 100.0% of Lexington Partners in a $1.75billion cash deal. This acquisition was finalized on April ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HarbourVest Partners

HarbourVest Partners, LLC is a private equity fund of funds and one of the largest private equity investment managers globally. The firm invests in all types of private equity funds, including venture capital and leveraged buyout funds, and also directly in operating companies. Founded in 1982 as Hancock Venture Partners, a subsidiary of John Hancock Insurance, HarbourVest is based in Boston, Massachusetts with offices in Beijing, Bogota, Seoul, Tel Aviv, Tokyo, Toronto, London, Singapore and Hong Kong. HarbourVest has approximately 80 investment professionals globally and manages approximately $75 billion of investor commitments. Investors in HarbourVest funds include various types of institutional investors such as public and corporate pension funds, endowments, foundations and financial institutions. In June 2024, HarbourVest Partners ranked 47th in Private Equity International's PEI 300 ranking among the world's largest private equity firms. Investments According to t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Coller Capital

Coller Capital is one of the largest global investors in the private equity secondary market ("secondaries"). It was founded in 1990 by the UK-based investor and philanthropist Jeremy Coller. History Coller Capital completed its first notable deal in 1998, when it acquired a $265-m portfolio of limited partnership interests from Shell Oil Company, Shell's US Pensions Trust. ''Secondaries Investor'' magazine observed that the deal was unusual for its size, being at that point the single biggest secondary transaction on record, with Coller betting his entire $240-m eponymous fund. The firm is now among the world’s biggest secondaries specialists. It has raised over $30-billion across nine funds. Some of its transactions are among the largest in the private equity secondary market, including deals of $1-billion without the need for syndication. It has also made single investments as small as $1-million. Although Jeremy Coller did not create secondary investing, both he and hi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Dynamics

icapital.biz Berhad () is a Malaysia's only closed-end listed fund, listed on the Main Board of Bursa Malaysia. The fund is managed by Capital Dynamics Asset Management Sdn Bhd and advised by Capital Dynamics Sdn. Bhd. Capital Dynamics is an independent fund management and investment advisory firm. With locations in Sydney, Singapore, Kuala Lumpur, Shanghai and Hong Kong, Capital Dynamics is Asia’s first global investment house. Locations and Funds *Capital Dynamics (Australia) Ltd., a global fund manager primarily managing the ''i'' Capital International Value Fund, a zero-load, global equity managed investment scheme, licensed in Australia by thAustralian Securities and Investments Commissionand provides individually managed accounts for wholesale investors. *Capital Dynamics (S) Pte. Ltd, a global fund manager; primarily managing the ''i'' Capital Global Fund, an open-end, zero-load global fund and provides individually managed funds for accredited investors. *Capital D ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ardian (company)

Ardian (formerly Axa Private Equity) is a France-based, independent private equity investment company, founded and managed by Dominique Senequier. It is one of the largest European-headquartered private equity funds. The company was originally set up by Dominique Senequier in 1996 as the AXA Group's private equity division, but later gained independence in 2013, and rebranded itself as Ardian. The name Ardian (ar・di・an) was inspired by an ancient European language in which 'hardjan' mean strength, durability, and boldness. Ardian manages assets worth US$150 billion in Europe, North America and Asia, and has fifteen offices (Paris, London, Frankfurt, Milan, Madrid, Zurich, New York, San Francisco, Beijing, Singapore, Tokyo, Jersey, Luxembourg, Santiago, and Seoul). The firm offers a funds of funds, direct funds, infrastructure, private debt and real estate, and manages a direct portfolio of more than 150 companies. Its fund of funds segments owns stakes in over 1500 funds. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |