|

People's Budget

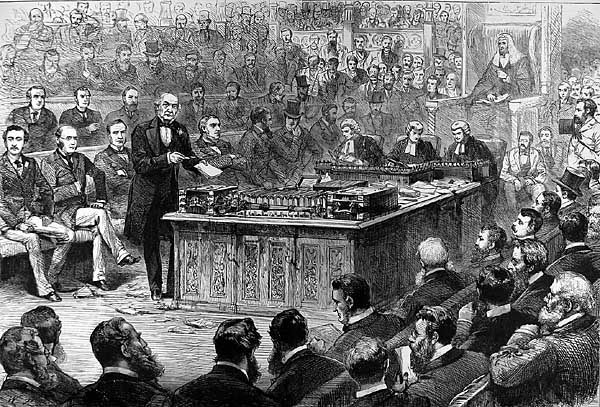

The 1909/1910 People's Budget was a proposal of the Liberal government that introduced unprecedented taxes on the lands and incomes of Britain's wealthy to fund new social welfare programmes, such as non-contributary old age pensions under Old Age Pensions Act 1908. It passed the House of Commons in 1909 but was blocked by the House of Lords for a year and became law in April 1910. It was championed by the Chancellor of the Exchequer, David Lloyd George, and his young ally Winston Churchill, who was then President of the Board of Trade and a fellow Liberal; called the "Terrible Twins" by certain Conservative contemporaries. William Manchester, one of Churchill's biographers, called the People's Budget a "revolutionary concept" because it was the first budget in British history with the expressed intent of redistributing wealth equally amongst the British population. It was a key issue of contention between the Liberal government and the Conservative-dominated House of Lord ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David Lloyd George

David Lloyd George, 1st Earl Lloyd-George of Dwyfor (17 January 1863 – 26 March 1945) was Prime Minister of the United Kingdom from 1916 to 1922. A Liberal Party (United Kingdom), Liberal Party politician from Wales, he was known for leading the United Kingdom of Great Britain and Ireland, United Kingdom during the First World War, for social-reform policies, for his role in the Paris Peace Conference (1919–1920), Paris Peace Conference, and for negotiating the establishment of the Irish Free State. Born in Chorlton-on-Medlock, Manchester, and raised in Llanystumdwy, Lloyd George gained a reputation as an orator and proponent of a Welsh blend of radical Liberal ideas that included support for Welsh devolution, the Disestablishment of the Church in Wales, disestablishment of the Church of England in Wales, equality for labourers and tenant farmers, and reform of land ownership. He won 1890 Caernarvon Boroughs by-election, an 1890 by-election to become the Member of Parliam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Redistribution Of Income And Wealth

Redistribution of income and wealth is the transfer of income and wealth (including physical property) from some individuals to others through a social mechanism such as taxation, welfare, public services, land reform, monetary policies, confiscation, divorce or tort law. The term typically refers to redistribution on an economy-wide basis rather than between selected individuals. Understanding of the phrase varies, depending on personal perspectives, political ideologies and the selective use of statistics. It is frequently used in politics, to refer to perceived redistribution from those who have more to those who have less. Rarely, the term is used to describe laws or policies that cause redistribution in the opposite direction, from the poor to the rich. The phrase is sometimes related to the term ''class warfare'', where the redistribution is alleged to counteract harm caused by high-income earners and the wealthy through means such as unfairness and discrimination. R ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liberal Unionist Party

The Liberal Unionist Party was a British political party that was formed in 1886 by a faction that broke away from the Liberal Party. Led by Lord Hartington (later the Duke of Devonshire) and Joseph Chamberlain, the party established a political alliance with the Conservative Party in opposition to Irish Home Rule. The two parties formed the ten-year-long coalition Unionist Government 1895–1905 but kept separate political funds and their own party organisations until a complete merger between the Liberal Unionist and the Conservative parties was agreed to in May 1912.Ian Cawood, ''The Liberal Unionist Party: A History'' (2012) History Formation The Liberal Unionists owe their origins to the conversion of William Ewart Gladstone to the cause of Irish Home Rule (i.e. limited self-government for Ireland). The 1885 general election had left Charles Stewart Parnell's Irish Nationalists holding the balance of power, and had convinced Gladstone that the Irish wanted and d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hillsdale College

Hillsdale College is a Private university, private, Conservatism in the United States, conservative, Christian liberal arts college in Hillsdale, Michigan, United States. It was founded in 1844 by members of the Free Will Baptists. Women were admitted to the college in 1844, making the college the List of earliest coeducational colleges and universities in the United States, second-oldest coeducational institution in the United States. Hillsdale's required core curriculum includes courses on the Great Books, the Constitution of the United States, U.S. Constitution, theology, biology, chemistry, and physics. Since the late 20th century, in order to opt out of government mandates tied to funding, Hillsdale has declined both state and federal financial support. Instead, Hillsdale depends entirely on private donations to supplement students' tuition. Hillsdale no longer has any denominational affiliation but, according to its website, "the moral tenets of Christianity as commonly und ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Henry George

Henry George (September 2, 1839 – October 29, 1897) was an American political economist, Social philosophy, social philosopher and journalist. His writing was immensely popular in 19th-century America and sparked several reform movements of the Progressive Era. He inspired the economic philosophy known as Georgism, the belief that people should own the value they produce themselves, but that the economic value of land (economics), land (including natural resources) should belong equally to all members of society. George famously argued that a single tax on land values would create a more productive and just society. His most famous work, ''Progress and Poverty'' (1879), sold millions of copies worldwide. The treatise investigates the paradox of increasing inequality and poverty amid economic and technological progress, the business cycle with its cyclic nature of industrialized economies, and the use of rent capture such as land value taxation and other anti-monopoly reforms ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Land Tax

A land value tax (LVT) is a levy on the value of land without regard to buildings, personal property and other improvements upon it. Some economists favor LVT, arguing it does not cause economic inefficiency, and helps reduce economic inequality. A land value tax is a progressive tax, in that the tax burden falls on land owners, because land ownership is correlated with wealth and income. The land value tax has been referred to as "the perfect tax" and the economic efficiency of a land value tax has been accepted since the eighteenth century. Economists since Adam Smith and David Ricardo have advocated this tax because it does not hurt economic activity, and encourages development without subsidies. LVT is associated with Henry George, whose ideology became known as Georgism. George argued that taxing the land value is the most logical source of public revenue because the supply of land is fixed and because public infrastructure improvements would be reflected in (and thus pai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance Tax

International tax law distinguishes between an estate tax and an inheritance tax. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died. However, this distinction is not always observed; for example, the UK's "inheritance tax" is a tax on the assets of the deceased, and strictly speaking is therefore an estate tax. Inheritance taxes vary widely between countries. History There was a steep increase in the number of countries that implemented inheritance taxes throughout the 19th and early 20th century. From 1960 onwards, inheritance taxes declined in prevalence as numerous countries repealed theirs. For historical reasons, the term "death duty" is still used colloquially (though not legally) in the UK and some Commonwealth countries. The estate tax in the United States is sometimes referred as "death tax". Other taxation applied to inherita ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shilling

The shilling is a historical coin, and the name of a unit of modern currency, currencies formerly used in the United Kingdom, Australia, New Zealand, other British Commonwealth countries and Ireland, where they were generally equivalent to 12 pence or one-twentieth of a Pound (currency), pound before being phased out during the 1960s and 1970s. Currently the shilling is used as a currency in five east African countries: Kenyan shilling, Kenya, Tanzanian shilling, Tanzania, Ugandan shilling, Uganda, Somali shilling, Somalia, and the ''de facto'' country of Somaliland shilling, Somaliland. The East African Community additionally plans to introduce an East African shilling. History The word ''shilling'' comes from Anglo-Saxon language, Anglo-Saxon phrase "Scilling", a monetary term meaning literally "twentieth of a pound", from the Proto-Germanic root :wikt:Reconstruction:Proto-Germanic/skiljaną, skiljaną meaning literally "to separate, split, divide", from :wikt:Reconstr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pound Sterling

Sterling (symbol: £; currency code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound is the main unit of sterling, and the word '' pound'' is also used to refer to the British currency generally, often qualified in international contexts as the British pound or the pound sterling. Sterling is the world's oldest currency in continuous use since its inception. In 2022, it was the fourth-most-traded currency in the foreign exchange market, after the United States dollar, the euro, and the Japanese yen. Together with those three currencies and the renminbi, it forms the basket of currencies that calculate the value of IMF special drawing rights. As of late 2022, sterling is also the fourth most-held reserve currency in global reserves. The Bank of England is the central bank for sterling, issuing its own banknotes and regulating issuance of banknotes by private banks in Scotland and Northern Ireland. Sterling banknotes issu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Penny (British Pre-decimal Coin)

The United Kingdom, British £sd, pre-decimal penny was a denomination of Coins of the United Kingdom, sterling coinage worth of one Pound sterling, pound or of one Shilling (British coin), shilling. Its symbol was ''d'', from the Roman denarius. It was a continuation of the earlier Penny (English coin), English penny, and in Scotland it had the same monetary value as one Acts of Union 1707, pre-1707 Scottish shilling, thus the English penny was called in Scottish Gaelic. The penny was originally minted in silver, but from the late 18th century it was minted in copper, and then after 1860 in bronze. The plural of "penny" is "pence" (often added as an unstressed suffix) when referring to an amount of money, and "pennies" when referring to a number of coins. Thus 8''d'' is eightpence or eight pence, but "eight pennies" means specifically eight individual penny coins. Before Decimal Day in 1971, sterling used the Carolingian monetary system (£sd), under which the largest unit w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |