|

PAYGO

PAYGO (Pay As You GO) is the practice of financing expenditures with Collective investment scheme, funds that are currently available rather than borrowed. Budgeting The PAYGO compels new spending or tax changes not to add to the federal debt. Not to be confused with pay-as-you-go financing, which is when a government saves up money to fund a specific project. Under the PAYGO rules, a new proposal must either be "budget neutral" or offset with savings derived from existing funds. The goal of this is to require those in control of the budget to engage in the diligence of prioritizing expenses and exercising fiscal restraint. An important example of such a system is the use of PAYGO in both the statutes of the U.S. Government and the rules in the U.S. Congress. First enacted as part of the Budget Enforcement Act of 1990 (which was incorporated as Title XIII of the Omnibus Budget Reconciliation Act of 1990), PAYGO required all increases in direct spending or revenue decreases to be o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Budget Enforcement Act Of 1990

The Budget Enforcement Act of 1990 (BEA) (, title XIII; ; codified as amended at scattered sections of 2 United States Code, U.S.C. & ) was enacted by the Congress of the United States, United States Congress as title XIII of the Omnibus Budget Reconciliation Act of 1990, to enforce the Government budget deficit, deficit reduction accomplished by that law by revising the federal budget control procedures originally enacted by the Gramm–Rudman–Hollings Balanced Budget Act. The BEA created two new budget control processes: a set of caps on annually-appropriated discretionary spending, and a "pay-as-you-go" or "PAYGO" process for entitlements and taxes. Legislative history The predecessor to the BEA, Gramm–Rudman–Hollings Balanced Budget Act, Gramm-Rudman-Hollings, was originally enacted in 1985 and set overall deficit targets as a way to force Congress to enact future deficit reduction. If these deficit targets were not met, the president was required issue a Budget sequest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Statutory Pay-As-You-Go Act Of 2010

The Statutory Pay-As-You-Go Act of 2010, Title I of , is a public law passed by the 111th United States Congress and signed by US President Barack Obama on February 12, 2010. The act reinstated pay-as-you-go budgeting rules used in Congress from 1990 until 2002, ensuring that most new spending is offset by spending cuts or added revenue elsewhere (with several major policy exemptions). Legislative history The Act was introduced in the House of Representatives on June 17, 2009, by Majority Leader Steny Hoyer ( D-Maryland) and has been cosponsored by 169 of the 257 House Democrats. The Act had initially passed the House of Representatives 265–166 as a standalone bill in July 2009, then was attached in the Senate to legislation raising the debt limit to $14.3 trillion. A majority of 241 Democrats supported the bill while a majority of 153 Republicans opposed it. In the Senate, the amendment attaching pay-as-you-go language to the debt-limit increase passed on a party-line vo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Pension Systems - Repartition-PAYGO Vs Capitalization

A pension (; ) is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be either a " defined benefit plan", where defined periodic payments are made in retirement and the sponsor of the scheme (e.g. the employer) must make further payments into the fund if necessary to support these defined retirement payments, or a " defined contribution plan", under which defined amounts are paid in during working life, and the retirement payments are whatever can be afforded from the fund. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms " retirement plan" and " superannuation" tend to refer to a pension granted upon retirement of the individual; the terminolog ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Federal Debt

A country's gross government debt (also called public debt or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt. In 2020, the value of government debt worldwide was $87.4 US trillion, or 99% measured as a share of gross domestic product (GDP). Government debt accounted for almost 40% of all debt (which includes corporate and household debt), the highest share since the 1960s. The rise in government debt since 2007 is largely attributable to stimulus measures during the Great Recession, and the COVID-19 recession. Governments may take on debt when the government's spending desires do not match government revenue flows. Taking deb ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Omnibus Budget Reconciliation Act Of 1990

The Omnibus Budget Reconciliation Act of 1990 (OBRA-90; ) is a United States statute enacted pursuant to the budget reconciliation process to reduce the United States federal budget deficit. The Act included the Budget Enforcement Act of 1990 which established the "pay-as-you-go" or "PAYGO" process for discretionary spending and taxes. The Act was signed into law by President George H. W. Bush on November 5, 1990, counter to his 1988 campaign promise not to raise taxes. This became an issue in the presidential election of 1992. Provisions The Act increased individual income tax rates. The top statutory tax rate increased from 28% to 31%, and the individual alternative minimum tax rate increased from 21% to 24%. The capital gains rate was capped at 28%. The value of high income itemized deductions was limited: reduced by 3% times the extent to which AGI exceeds $100,000. It temporarily created the personal exemption phase out applicable to the range of taxable income between $ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Social Security Trust Fund

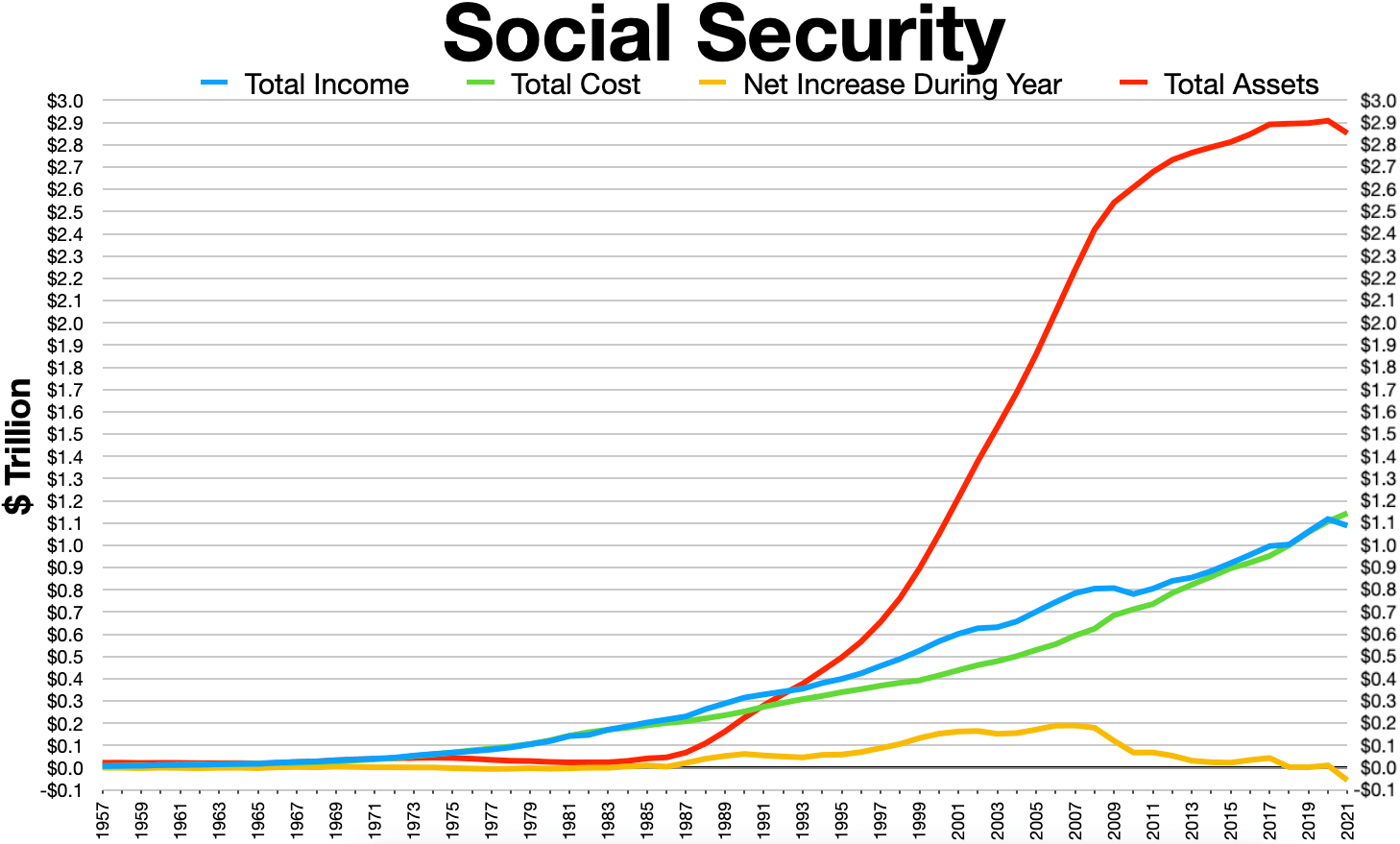

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund (collectively, the Social Security Trust Fund or Trust Funds) are trust funds that provide for payment of Social Security (Old-Age, Survivors, and Disability Insurance; OASDI) benefits administered by the United States Social Security Administration. The Social Security Administration collects payroll taxes and uses the money collected to pay Old-Age, Survivors, and Disability Insurance benefits by way of trust funds. When the program runs a surplus, the excess funds increase the value of the Trust Fund. As of 2021, the Trust Fund contained (or alternatively, was owed) $2.908 trillion. The Trust Fund is required by law to be invested in non-marketable securities issued and guaranteed by the "full faith and credit" of the federal government. These securities earn a market rate of interest. Excess funds are used by the government for non-Social Security purposes, creating the obliga ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Fiscal Responsibility Act Of 2023

On January 19, 2023, the United States hit its United States debt ceiling, debt ceiling, leading to a debt-ceiling crisis, part of an ongoing political debate within United States Congress, Congress about United States federal budget, federal government spending and the National debt of the United States, national debt that the U.S. government accrues. In response, Janet Yellen, the United States secretary of the treasury, secretary of the treasury, began enacting temporary "extraordinary measures". On May 1, 2023, Yellen warned these measures could be exhausted as early as June 1, 2023; this date was later pushed to June 5. The debt ceiling had been increased multiple times through December 2021 since the 2013 United States debt-ceiling crisis, 2013 debt-ceiling standoff, each time without budgetary preconditions attached. In the 2023 impasse, Republicans proposed cutting spending back to 2022 levels as a precondition to raising the debt ceiling, while Democrats insisted on a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Expenditure

An expense is an item requiring an outflow of money, or any form of fortune in general, to another person or group as payment for an item, service, or other category of costs. For a tenant, rent is an expense. For students or parents, tuition is an expense. Buying food, clothing, furniture, or an automobile is often referred to as an expense. An expense is a cost that is "paid" or " remitted", usually in exchange for something of value. Something that seems to cost a great deal is "expensive". Something that seems to cost little is "inexpensive". "Expenses of the table" are expenses for dining, refreshments, a feast, etc. In accounting, ''expense'' is any specific outflow of cash or other valuable assets from a person or company to another person or company. This outflow is generally one side of a trade for products or services that have equal or better current or future value to the buyer than to the seller. Technically, an expense is an event in which a proprietary stake is di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

2007 U

7 (seven) is the natural number following 6 and preceding 8. It is the only prime number preceding a cube (algebra), cube. As an early prime number in the series of positive integers, the number seven has symbolic associations in religion, mythology, superstition and philosophy. The seven classical planets resulted in seven being the number of days in a week. 7 is often considered lucky in Western culture and is often seen as highly symbolic. Evolution of the Arabic digit For early Brahmi numerals, 7 was written more or less in one stroke as a curve that looks like an uppercase vertically inverted (ᒉ). The western Arab peoples' main contribution was to make the longer line diagonal rather than straight, though they showed some tendencies to making the digit more rectilinear. The eastern Arab peoples developed the digit from a form that looked something like 6 to one that looked like an uppercase V. Both modern Arab forms influenced the European form, a two-stroke form cons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Government Finances In The United States

A government is the system or group of people governing an organized community, generally a state. In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government is a means by which organizational policies are enforced, as well as a mechanism for determining policy. In many countries, the government has a kind of constitution, a statement of its governing principles and philosophy. While all types of organizations have governance, the term ''government'' is often used more specifically to refer to the approximately 200 independent national governments and subsidiary organizations. The main types of modern political systems recognized are democracies, totalitarian regimes, and, sitting between these two, authoritarian regimes with a variety of hybrid regimes. Modern classification systems also include monarchies as a standalone entity or as a hybrid system of the main three. Historically prevalent forms ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Generational Accounting

Generational accounting is a method of measuring the fiscal burdens facing current and future generations. Generational accounting considers how much each adult generation, on a per person basis, is likely to pay in future taxes net of transfer payments, over the rest of their lives. Laurence Kotlikoff's individual and co-authored work on the relativity of fiscal language demonstrates that conventional fiscal measures, including the government's deficit, are not well defined from the perspective of economic theory. Instead, their measurement reflects economically arbitrary fiscal labeling conventions. "Economics labeling problem," as Kotlikoff calls it, has led to gross misreadings of the fiscal positions of different countries. This starts with the United States, which has a relatively small debt-to-GDP ratio, but is, arguably, in worse fiscal shape than any developed country. Kotlikoff's identification of economics labeling problem, beginning with his 1984 ''Deficit Delusion ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Federal Insurance Contributions Act Tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) tax payable by both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers. Calculation Overview The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code. Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court ruled in '' Fle ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |