|

National Insurance

National Insurance (NI) is a fundamental component of the welfare state in the United Kingdom. It acts as a form of social security, since payment of NI contributions establishes entitlement to certain state benefits for workers and their families. Introduced by the National Insurance Act 1911 and expanded by the Attlee ministry in 1948, the system has been subjected to numerous amendments in succeeding years. Initially, it was a contributory form of insurance against illness and unemployment, and eventually provided retirement pensions and other benefits. Currently, workers pay contributions from the age of sixteen years, until the age they become eligible for the State Pension. Contributions are due from employed people earning at or above a threshold called the Lower Earnings Limit, the value of which is reviewed each year. Self-employed people contribute through a percentage of net profits above a threshold, which is reviewed periodically. Individuals may also make volunt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare State In The United Kingdom

The welfare state of the United Kingdom began to evolve in the 1900s and early 1910s, and comprises expenditures by the government of the United Kingdom of Great Britain and Northern Ireland intended to improve health, education, employment and social security. The British system has been classified as a liberal welfare state system. History Before the official establishment of the modern welfare state, clear examples of social welfare existed to help the poor and vulnerable within British society. A key date in the welfare state's history is 1563; when Queen Elizabeth I's government encouraged the wealthier members of society to give to the poor, by passing the Poor Act 1562. The welfare state in the modern sense was anticipated by the Royal Commission into the Operation of the Poor Laws 1832 which found that the Poor Relief Act 1601 (a part of the English Poor laws) was subject to widespread abuse and promoted squalor, idleness and criminality in its recipients, compared ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Actuary's Department

The Government Actuary's Department (GAD) provides actuarial solutions including risk analysis, modelling and advice to support the UK public sector. It is a department of the Government of the United Kingdom. History In 1912 the Government appointed a chief actuary to the National Health Insurance Joint Committee, following the Old Age Pensions Act 1908 and the National Insurance Act 1911 The National Insurance Act 1911 (1 & 2 Geo. 5. c. 55) created National Insurance, originally a system of health insurance for industrial workers in Great Britain based on contributions from employers, the government, and the workers themselves. .... As the role of the Chief Actuary expanded, the post of Government Actuary was created in 1917. The Government Actuary's Department was formed 2 years later. The role of GAD within government expanded significantly in the 1940s and 1950s, coinciding with an expansion of the state's role in pensions, social security and health care. By the 19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bereavement Support Payment

In the United Kingdom, Bereavement Support Payments (also known as bereavement benefits) are paid to the husband/wife or partner of a person who has died in the previous 21 months. It replaced Bereavement Payment and Bereavement Allowance in April 2017, which had previously replaced Widow's benefit in April 2001. It is a social security benefit that is designed to support people who have recently lost their spouse, and need some financial support to help them get back on their feet. A similar benefit is provided in Malta in accordance to the ''Widows and Orphans Pension Act'' of 1927. The qualifying conditions are as follows: * the deceased partner must have paid National Insurance contributions for at least 25 weeks in one tax year since 6 April 1975. Bereavement Support Payment consists of 2 parts, firstly: *a bereavement payment of £3,500 which is a one off tax free lump sum, provided the claimant was receiving Child Benefit; otherwise the payment is £2,500 ::::(formerly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Returns In The United Kingdom

In the United Kingdom, a tax return is a document that must be filed with HM Revenue & Customs declaring liability for taxation. Different bodies must file different returns with respect to various forms of taxation. The main returns currently in use are: *SA100 for individuals paying income tax *SA800 for partnerships *SA900 for trusts and estates of deceased persons *CT600 for companies paying corporation tax *VAT100 for value added tax Income tax self-assessment Most employees paying tax under the PAYE system are not required to file a tax return, because the PAYE system operates to withhold the correct amount of tax from their wages or salaries. However, some taxpayers, including employees, may have income that has not been taxed at source and needs to be declared to HMRC, usually by submitting a self assessment tax return. Legally, a tax payer is obliged to submit a tax return when HMRC request one by sending a notice to file a tax return, either because the tax payer ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bereavement Benefit

In the United Kingdom, Bereavement Support Payments (also known as bereavement benefits) are paid to the husband/wife or partner of a person who has died in the previous 21 months. It replaced Bereavement Payment and Bereavement Allowance in April 2017, which had previously replaced Widow's benefit in April 2001. It is a social security benefit that is designed to support people who have recently lost their spouse, and need some financial support to help them get back on their feet. A similar benefit is provided in Malta in accordance to the ''Widows and Orphans Pension Act'' of 1927. The qualifying conditions are as follows: * the deceased partner must have paid National Insurance contributions for at least 25 weeks in one tax year since 6 April 1975. Bereavement Support Payment consists of 2 parts, firstly: *a bereavement payment of £3,500 which is a one off tax free lump sum, provided the claimant was receiving Child Benefit; otherwise the payment is £2,500 ::::(formerly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employment And Support Allowance

Employment and Support Allowance (ESA) is a United Kingdom welfare payment for adults younger than the State Pension age who are having difficulty finding work because of their long-term medical condition or a disability. It is a basic income-replacement benefit paid in lieu of wages. It is currently being phased out and replaced with Universal Credit for claimants on low incomes, although the contribution-based element remains available. Eligibility for ESA An individual can put in a claim for ESA if they satisfy all of these conditions: * They live in the United Kingdom * They are over the age of sixteen * They have not reached their State Pension age * They have a sick-note from their doctor They will not be paid ESA if they are entitled to Statutory Sick Pay (which is paid out by a current employer) and it is not possible to receive ESA at the same time as the other main out-of-work benefits, i.e. Jobseekers Allowance or Income Support. Universal Credit, which is received ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Benefit In Kind

Employee benefits and benefits in kind (especially in British English), also called fringe benefits, perquisites, or perks, include various types of non-wage compensation provided to an employee by an employer in addition to their normal wage or salary. Instances where an employee exchanges (cash) wages for some other form of benefit is generally referred to as a " salary packaging" or "salary exchange" arrangement. In most countries, most kinds of employee benefits are taxable to at least some degree. Examples of these benefits include: housing (employer-provided or employer-paid) furnished or not, with or without free utilities; group insurance (health, dental, life, etc.); disability income protection; retirement benefits; daycare; tuition reimbursement; sick leave; vacation (paid and unpaid); social security; profit sharing; employer student loan contributions; conveyancing; long service leave; domestic help (servants); and other specialized benefits. The purpose of em ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK State Pension

The State Pension is an existing benefit that forms part of the United Kingdom Government's pension arrangements. Benefits vary depending on the age of the individual and their contribution record. Currently anyone can make a claim, provided they have a minimum number of qualifying years of contributions. Background Old State Pension The Old State Pension, consisting of the Basic State Pension (alongside the Graduated Retirement Benefit, the State Earnings-Related Pension Scheme, and the State Second Pension; collectively known as Additional State Pension), is a benefit payable to men born before 6 April 1951, and to women born before 6 April 1953. The maximum amount payable for the Basic State Pension component is £169.50 a week (April 2024 – April 2025). New State Pension The New State Pension is a benefit payable to men born on or after 6 April 1951, and to women born on or after 6 April 1953. The maximum amount payable is £221.20 a week (April 2024 – April 20 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retail Prices Index (United Kingdom)

In the United Kingdom, the Retail Prices Index or Retail Price Index (RPI) is a measure of inflation published monthly by the Office for National Statistics. It measures the change in the cost of a representative sample of retail goods and services. As the RPI was held not to meet international statistical standards, since 2013, the Office for National Statistics no longer classifies it as a "national statistic", emphasising the Consumer Price Index instead. However, as of 2018, the UK Treasury still uses the RPI measure of inflation for various index-linked tax rises. History RPI was first introduced in 1956, replacing the previous Interim Index of Retail Prices that had been in use since June 1947. It was once the principal official measure of inflation. It has been superseded in that regard by the Consumer Price Index (CPI). The RPI is still used by the government as a base for various purposes, such as the amounts payable on index-linked securities, including index-linked ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

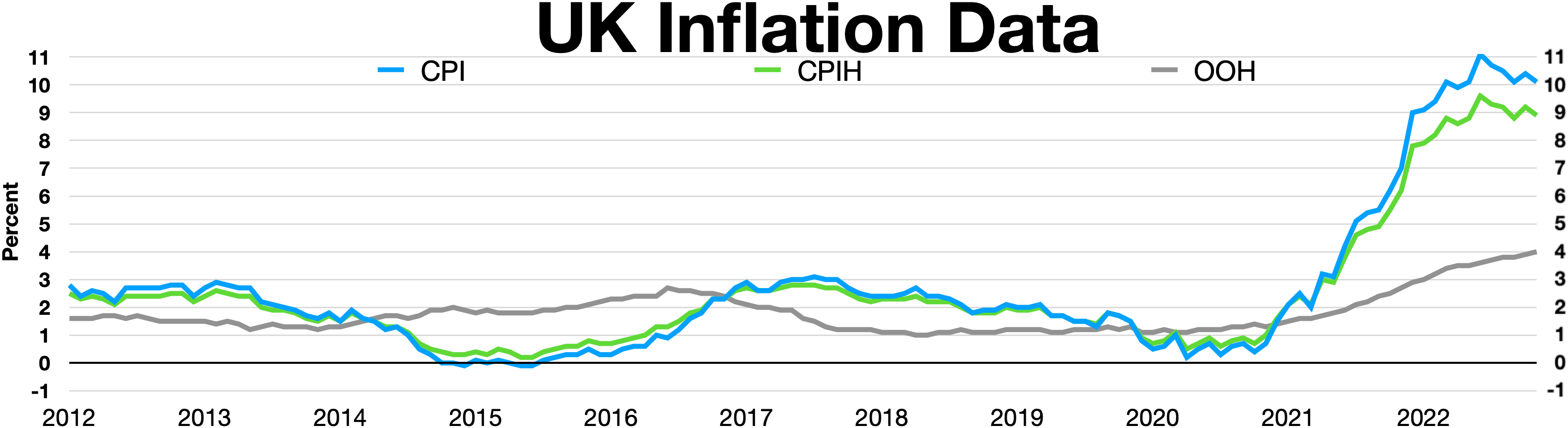

Consumer Price Index (United Kingdom)

The Consumer Price Index (CPI) is the official measure of inflation in consumer prices in the United Kingdom. It is also called the Harmonised Index of Consumer Prices (HICP). History The traditional measure of inflation in the UK for many years was the Retail Prices Index (RPI), which was first calculated in the early 20th century to evaluate the extent to which workers were affected by price changes during the First World War. The main index was described as the Interim Index of Retail Prices from 1947 to 1955. In January 1956, it was rebased and renamed the Index of Retail Prices. In January 1962, this was replaced by the General Index of Retail Prices, which was again rebased at that time. A further rebasing occurred in January 1987, subsequent to the issue of the first index-linked gilts. RPIX An explicit inflation target was first set in October 1992 by Chancellor of the Exchequer Norman Lamont, following the UK's departure from the Exchange Rate Mechanism. Initially, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |