|

Mortgage Analytics

Mortgage Analytics is defined as an array of analysis—organized by market and product—which provides insight into how pricing strategy and market conditions will affect mortgage volume and demand. Analytic reports include market response, price elasticity and general sensitivity studies seen both at the firm and market levels. Mortgage analytics experts use several types of data resources to create customized reports for their clients, commonly banks and lenders who seek up-to-date mortgage data in order to set appropriate loan rates and fees for borrowers. These data resources include records of delinquency rates, dealer loss information estimates, trend analysis, automated property valuation, property tax delinquency [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Loan

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or " repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Elasticity

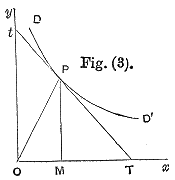

A good's price elasticity of demand (E_d, PED) is a measure of how sensitive the quantity demanded is to its price. When the price rises, quantity demanded falls for almost any good, but it falls more for some than for others. The price elasticity gives the percentage change in quantity demanded when there is a one percent increase in price, holding everything else constant. If the elasticity is −2, that means a one percent price rise leads to a two percent decline in quantity demanded. Other elasticities measure how the quantity demanded changes with other variables (e.g. the income elasticity of demand for consumer income changes). Price elasticities are negative except in special cases. If a good is said to have an elasticity of 2, it almost always means that the good has an elasticity of −2 according to the formal definition. The phrase "more elastic" means that a good's elasticity has greater magnitude, ignoring the sign. Veblen and Giffen goods are two classes of good ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Delinquency Rates

Delinquent or delinquents may refer to: * A person who commits a felony * A juvenile delinquent, often shortened as delinquent is a young person (under 18) who fails to do that which is required by law; see juvenile delinquency * A person who fails to pay a debt or other financial obligation * A person found guilty of serious misconduct, gross abuse of position, gross negligence, wilful misconduct or a breach of trust, can be declared a delinquent director (South Africa, by example) by the court Other * ''The Delinquents'' (1989 film), an Australian film directed by Chris Thomson starring Kylie Minogue and Charlie Schlatter * Delinquent (royalist) * The Delinquents (group) The Delinquents are a rap group from Oakland, California, composed of two members, Glen Jones a.k.a. G-Stack, Vidal Prevost a.k.a. V-White (formerly known as V-Dal) and Ghost Producer Gregory Turner a.k.a. Lord Gregory(formerly known as G-Black. ..., a rap group from Oakland, California See also * The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Valuation

Real estate appraisal, property valuation or land valuation is the process of developing an opinion of value for real property (usually market value). Real estate transactions often require appraisals because they occur infrequently and every property is unique (especially their condition, a key factor in valuation), unlike corporate stocks, which are traded daily and are identical (thus a centralized Walrasian auction like a stock exchange is unrealistic). The location also plays a key role in valuation. However, since property cannot change location, it is often the upgrades or improvements to the home that can change its value. Appraisal reports form the basis for mortgage loans, settling estates and divorces, taxation, and so on. Sometimes an appraisal report is used to establish a sale price for a property. Besides the mandatory educational grade, which can vary from Finance to Construction Technology, most, but not all, countries require appraisers to have the license for t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commercial Mortgage

A commercial mortgage is a mortgage loan secured by commercial property, such as an office building, shopping center, industrial warehouse, or apartment complex. The proceeds from a commercial mortgage are typically used to acquire, refinance, or redevelop commercial property. Commercial mortgages are structured to meet the needs of the borrower and the lender. Key terms include the loan amount (sometimes referred to as "loan proceeds"), interest rate, term (sometimes referred to as the "maturity"), amortization schedule, and prepayment flexibility. Commercial mortgages are generally subject to extensive underwriting and due diligence prior to closing. The lender's underwriting process may include a financial review of the property and the property owner (or "sponsor"), as well as commissioning and review of various third-party reports, such as an appraisal. There were $3.1 trillion of commercial and multifamily mortgages outstanding in the U.S. as of June 30, 2013. Of these ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

No Income No Asset

No income, no asset (NINA) is a term used in the United States mortgage industry to describe one of many documentation types which lenders may allow when underwriting a mortgage. A loan issued under such circumstances may be referred to as a NINA loan or NINJA loan. NINA programs are ostensibly created for those with hard to verify incomes (waiters, etc.) but in actuality have been popularly used in situations where aggressive mortgage lenders and brokers did not want any trouble qualifying otherwise non-qualifying loans, thus becoming a significant factor in the subprime lending crisis. A significant number of NINA loans were never possible for the applicant to repay and have resulted in defaults for this reason, as laid out in detail by investigative reporters, including the reporting of ''This American Life'' and ''Planet Money'' that culminated in the Peabody- and Polk- award winning episode "The Giant Pool of Money." No income, no job, no assets ("NINJA") A NINJA loan is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nonrecourse Debt

Nonrecourse debt or a nonrecourse loan (sometimes hyphenated as non-recourse) is a secured loan (debt) that is secured by a pledge of collateral, typically real property, but for which the borrower is not personally liable. If the borrower defaults, the lender can seize and sell the collateral, but if the collateral sells for less than the debt, the lender cannot seek that deficiency balance from the borrower—its recovery is limited only to the value of the collateral. Thus, nonrecourse debt is typically limited to 50% or 60% loan-to-value ratios, so that the property itself provides "overcollateralization" of the loan. The incentives for the parties are at an intermediate position between those of a full recourse secured loan and a totally unsecured loan. While the borrower is in first loss position, the lender also assumes significant risk, so the lender must underwrite the loan with much more care than in a full recourse loan. This typically requires that the lender have sign ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Refinancing

Refinancing is the replacement of an existing debt obligation with another debt obligation under a different term and interest rate. The terms and conditions of refinancing may vary widely by country, province, or state, based on several economic factors such as inherent risk, projected risk, political stability of a nation, currency stability, banking regulations, borrower's credit worthiness, and credit rating of a nation. In many industrialized nations, common forms of refinancing include primary residence mortgages and car loans. If the replacement of debt occurs under financial distress, refinancing might be referred to as debt restructuring. A loan (debt) might be refinanced for various reasons: #To take advantage of a better interest rate (a reduced monthly payment or a reduced term) #To consolidate other debt into one loan (a potentially longer/shorter term contingent on interest rate differential and fees) #To reduce the monthly repayment amount (often for a longer ter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |