|

Macroeconomic Policy Instruments

Macroeconomic policy instruments are macroeconomic quantities that can be directly controlled by an economic policy maker. Instruments can be divided into two subsets: a) monetary policy instruments and b) fiscal policy instruments. Monetary policy is conducted by the central bank of a country (such as the Federal Reserve in the U.S.) or of a supranational region (such as the Euro zone). Fiscal policy is conducted by the executive and legislative branches of the government and deals with managing a nation’s budget. Monetary policy {{Main, Central bank#Policy instruments Monetary policy instruments are used for managing short-term rates (the federal funds rate and discount rates in the U.S.), and changing reserve requirements for commercial banks. Monetary policy can be either expansive for the economy (short-term rates low relative to the inflation rate) or restrictive for the economy (short-term rates high relative to the inflation rate). Historically, the major objective ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often as an attempt to reduce inflation or the interest rate, to ensure price stability and general trust of the value and stability of the nation's currency. Monetary policy is a modification of the supply of money, i.e. "printing" more money, or decreasing the money supply by changing interest rates or removing excess reserves. This is in contrast to fiscal policy, which relies on taxation, government spending, and government borrowing as methods for a government to manage business cycle phenomena such as recessions. Further purposes of a monetary policy are usually to contribute to the stability of gross domestic product, to achieve and maintain low unemployment, and to maintain predictable exchange rates with other currencies. Monetary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation Rate

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be attri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with the production, use, and management of scarce resources'. A given economy is a set of processes that involves its culture, values, education, technological evolution, history, social organization, political structure, legal systems, and natural resources as main factors. These factors give context, content, and set the conditions and parameters in which an economy functions. In other words, the economic domain is a social domain of interrelated human practices and transactions that does not stand alone. Economic agents can be individuals, businesses, organizations, or governments. Economic transactions occur when two groups or parties agree to the value or price of the transacted good or service, commonly expressed in a certain currency. Ho ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Budget Deficit

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. Government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression. It is a central point of controversy in economics, as discussed below. Controversy Government deficit spending is a central point of controversy in economics, with prominent economists holding differing views. The mainstream economics position is that deficit spending is desirable and necessary as part of countercyclical fiscal policy, but that there should not be a structural deficit (i.e., permanent deficit): The government should run deficits during recessions to compensate for the shortfall in aggregate demand, but should run surpluses in boom tim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Treasury Security

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. government debt has been managed by the Bureau of the Fiscal Service, succeeding the Bureau of the Public Debt. There are four types of marketable Treasury securities: Treasury bills, Treasury notes, Treasury bonds, and Treasury Inflation Protected Securities (TIPS). The government sells these securities in auctions conducted by the Federal Reserve Bank of New York, after which they can be traded in secondary markets. Non-marketable securities include savings bonds, issued to the public and transferable only as gifts; the State and Local Government Series (SLGS), purchaseable only with the proceeds of state and municipal bond sales; and the Government Account Series, purchased by units of the federal government. Treasury securities are b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity. The term can also be used metaphorically to cover moral obligations and other interactions not based on a monetary value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person. Etymology The English term "debt" was first used in the late 13th century. The term "debt" comes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxes

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner ( non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Growth

Economic growth can be defined as the increase or improvement in the inflation-adjusted market value of the goods and services produced by an economy in a financial year. Statisticians conventionally measure such growth as the percent rate of increase in the real gross domestic product, or real GDP. Growth is usually calculated in real terms – i.e., inflation-adjusted terms – to eliminate the distorting effect of inflation on the prices of goods produced. Measurement of economic growth uses national income accounting. Since economic growth is measured as the annual percent change of gross domestic product (GDP), it has all the advantages and drawbacks of that measure. The economic growth-rates of countries are commonly compared using the ratio of the GDP to population (per-capita income). The "rate of economic growth" refers to the geometric annual rate of growth in GDP between the first and the last year over a period of time. This growth rate represents the trend in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Requirement

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the central bank on the basis of a specified proportion of deposit liabilities of the bank. This rate is commonly referred to as the reserve ratio. Though the definitions vary, the commercial bank's reserves normally consist of cash held by the bank and stored physically in the bank vault (vault cash), plus the amount of the bank's balance in that bank's account with the central bank. A bank is at liberty to hold in reserve sums above this minimum requirement, commonly referred to as ''excess reserves''. The reserve ratio is sometimes used by a country’s monetary authority as a tool in monetary policy, to influence the country's money supply by limiting or expanding the amount of lending by the banks. Monetary authorities increase the reserve r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Policy

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorised that government changes in the levels of taxation and government spending influence aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation (which is considered "healthy" at the level in the range 2%–3%) and to increase employment. Additionally, it is designed to try to k ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discount Window

The discount window is an instrument of monetary policy (usually controlled by central banks) that allows eligible institutions to borrow money from the central bank, usually on a short-term basis, to meet temporary shortages of liquidity caused by internal or external disruptions. The term originated with the practice of sending a bank representative to a reserve bank teller window when a bank needed to borrow money. The interest rate charged on such loans by a central bank is called the discount rate, policy rate, base rate, or repo rate, and is separate and distinct from the prime rate. It is also not the same thing as the federal funds rate or its equivalents in other currencies, which determine the rate at which banks lend money to ''each other''. In recent years, the discount rate has been approximately a percentage point above the federal funds rate (see Lombard credit). Because of this, it is a relatively unimportant factor in the control of the money supply and is only t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Funds Rate

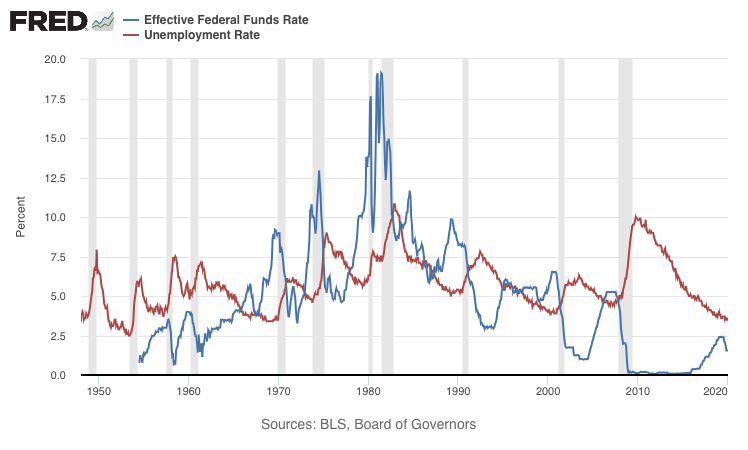

In the United States, the federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight on an uncollateralized basis. Reserve balances are amounts held at the Federal Reserve to maintain depository institutions' reserve requirements. Institutions with surplus balances in their accounts lend those balances to institutions in need of larger balances. The federal funds rate is an important benchmark in financial markets. The effective federal funds rate (EFFR) is calculated as the effective median interest rate of overnight federal funds transactions during the previous business day. It is published daily by the Federal Reserve Bank of New York. The federal funds target range is determined by a meeting of the members of the Federal Open Market Committee (FOMC) which normally occurs eight times a year about seven weeks apart. The committee may also hold additional meetings an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_per_capita_in_2020.png)