|

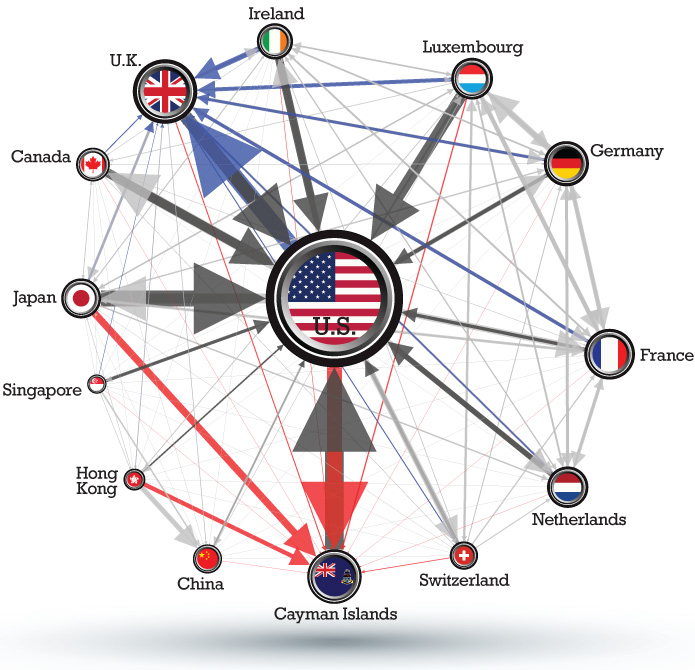

Multinational Tax Haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or Incorporation (business), incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero Corporation tax in the Republic of Ireland#Effective tax rate (ETR), effective tax rates, due to their need to encourage jurisdictions to enter into bilateral Tax treaty, tax treaties that accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multinational Corporation

A multinational corporation (MNC; also called a multinational enterprise (MNE), transnational enterprise (TNE), transnational corporation (TNC), international corporation, or stateless corporation, is a corporate organization that owns and controls the production of goods or services in at least one country other than its home country. Control is considered an important aspect of an MNC to distinguish it from international portfolio investment organizations, such as some international mutual funds that invest in corporations abroad solely to diversify financial risks. Most of the current largest and most influential companies are Public company, publicly traded multinational corporations, including Forbes Global 2000, ''Forbes'' Global 2000 companies. History Colonialism The history of multinational corporations began with the history of colonialism. The first multinational corporations were founded to set up colonial "factories" or port cities. The two main examples were the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Luxembourg

Luxembourg, officially the Grand Duchy of Luxembourg, is a landlocked country in Western Europe. It is bordered by Belgium to the west and north, Germany to the east, and France on the south. Its capital and most populous city, Luxembourg City, is one of the four institutional seats of the European Union and hosts several EU institutions, notably the Court of Justice of the European Union, the highest judicial authority in the EU. As part of the Low Countries, Luxembourg has close historic, political, and cultural ties to Belgium and the Netherlands. Luxembourg's culture, people, and languages are greatly influenced by France and Germany: Luxembourgish, a Germanic language, is the only recognized national language of the Luxembourgish people and of the Grand Duchy of Luxembourg; French is the sole language for legislation; and both languages along with German are used for administrative matters. With an area of , Luxembourg is Europe's seventh-smallest count ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Royalty Payment

A royalty payment is a payment made by one party to another that owns a particular asset, for the right to ongoing use of that asset. Royalties are typically agreed upon as a percentage of gross or net revenues derived from the use of an asset or a fixed price per unit sold of an item of such, but there are also other modes and metrics of compensation.Guidelines for Evaluation of Transfer of Technology Agreements, United Nations, New York, 1979 A royalty interest is the right to collect a stream of future royalty payments. A license agreement defines the terms under which a resource or property are licensed by one party ( party means the periphery behind it) to another, either without restriction or subject to a limitation on term, business or geographic territory, type of product, etc. License agreements can be regulated, particularly where a government is the resource owner, or they can be private contracts that follow a general structure. However, certain types of franchise ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contract Manufacturing

A contract manufacturer (CM) is a manufacturer that contracts with a firm for components or products (in which case it is a turnkey supplier). It is a form of outsourcing. A contract manufacturer performing packaging operations is called copacker or a contract packager. Brand name companies focus on product innovation, design and sales, while the manufacturing takes place in independent factories (the turnkey suppliers). Most turnkey suppliers specialize in simply manufacturing physical products, but some are also able to handle a significant part of the design and customization process if needed. Some turnkey suppliers specialize in one base component (e.g. memory chips) or a base process (e.g. plastic molding). Business model In a contract manufacturing business model, the hiring firm approaches the contract manufacturer with a design or formula. The contract manufacturer will quote the parts based on processes, labor, tooling, and material costs. Typically a hiring firm w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transfer Pricing

Transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. Because of the potential for cross-border controlled transactions to distort taxable income, tax authorities in many countries can adjust intragroup transfer prices that differ from what would have been charged by unrelated enterprises dealing at arm’s length (the arm’s-length principle). The OECD and World Bank recommend intragroup pricing rules based on the arm’s-length principle, and 19 of the 20 members of the G20 have adopted similar measures through bilateral treaties and domestic legislation, regulations, or administrative practice.World Bank pp. 35-51 Countries with transfer pricing legislation generally follow th''OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations''in most respects, although their rules can differ on some important details. Where adopted, transfer pricing rules allow tax au ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Inversion

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus moving its tax residence to the foreign country. Executives and operational headquarters can stay in the original country. The US definition requires that the original shareholders remain a majority control of the post-inverted company. In United States federal legislation, US federal legislation a company which has been restructured in this manner is referred to as an inverted domestic corporation, and the term "corporate expatriate" is also used, for example in the Homeland Security Act of 2002. The majority of the less than 100 material tax inversions recorded since 1993 have been of US corporations (85 inversions), seeking to pay less to the US corporate tax system. The only other jurisdiction to experience a material outflow of tax inv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gabriel Zucman

Gabriel Zucman (born 30 October 1986) is a French economist who is currently an associate professor of public policy and economics at the University of California, Berkeley‘s Goldman School of Public Policy, Chaired Professor at the Paris School of Economics, and Director of the EU Tax Observatory. Zucman is a major proponent of the idea behind the current push for a global wealth tax on centimillionaires and richer still high-net-worth individuals . The author of '' The Hidden Wealth of Nations: The Scourge of Tax Havens'' (2015), Zucman is known for his research on tax havens and corporate tax havens. Zucman's research has found that the leading corporate tax havens are all OECD–compliant, and that tax disputes between high–tax locations and havens are very rare. His papers are some of the most cited papers on research into tax havens. Zucman is also known for his work on the quantification of the financial scale of base erosion and profit shifting (BEPS) tax avo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Conduit And Sink OFCs

Conduit OFC and sink OFC is an empirical quantitative method of classifying corporate tax havens, offshore financial centres (OFCs) and tax havens. Traditional methods for identifying tax havens analyse tax and legal structures for base erosion and profit shifting (BEPS) tools. However, this approach follows a purely quantitative approach, ignoring any taxation or legal concepts, to instead follow a big data analysis of the ownership chains of 98 million global companies. The technique gives both a method of classification and a method of understanding the relative scale – but not absolute scale – of havens/OFCs. The results were published by the University of Amsterdam's CORPNET Group in 2017, and identified two classifications: * 24 global sink OFCs: jurisdictions in which a "disproportional amount of value disappears from the economic system" (i.e. the traditional tax havens). * Five global conduit OFCs: jurisdictions "through which a disproportional amount of valu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Treaty

A tax treaty, also called double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two countries to avoid or mitigate double taxation. Such treaties may cover a range of taxes including income taxes, inheritance taxes, value added taxes, or other taxes. Besides bilateral treaties, multilateral treaties are also in place. For example, European Union (EU) countries are parties to a multilateral agreement with respect to value added taxes under auspices of the EU, while a joint treaty on mutual administrative assistance of the Council of Europe and the Organisation for Economic Co-operation and Development (OECD) is open to all countries. Tax treaties tend to reduce taxes of one treaty country for residents of the other treaty country to reduce double taxation of the same income. The provisions and goals vary significantly, with very few tax treaties being alike. Most treaties: * define which taxes are covered and who is a resident and eligible ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Netherlands

, Terminology of the Low Countries, informally Holland, is a country in Northwestern Europe, with Caribbean Netherlands, overseas territories in the Caribbean. It is the largest of the four constituent countries of the Kingdom of the Netherlands. The Netherlands consists of Provinces of the Netherlands, twelve provinces; it borders Germany to the east and Belgium to the south, with a North Sea coastline to the north and west. It shares Maritime boundary, maritime borders with the United Kingdom, Germany, and Belgium. The official language is Dutch language, Dutch, with West Frisian language, West Frisian as a secondary official language in the province of Friesland. Dutch, English_language, English, and Papiamento are official in the Caribbean Netherlands, Caribbean territories. The people who are from the Netherlands is often referred to as Dutch people, Dutch Ethnicity, Ethnicity group, not to be confused by the language. ''Netherlands'' literally means "lower countries" i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taiwan

Taiwan, officially the Republic of China (ROC), is a country in East Asia. The main geography of Taiwan, island of Taiwan, also known as ''Formosa'', lies between the East China Sea, East and South China Seas in the northwestern Pacific Ocean, with the China, People's Republic of China (PRC) to the northwest, Japan to the northeast, and the Philippines to the south. It has an area of , with mountain ranges dominating the eastern two-thirds and plains in the western third, where its Urbanization by country, highly urbanized population is concentrated. The combined Free area of the Republic of China, territories under ROC control consist of list of islands of Taiwan, 168 islands in total covering . The Taipei–Keelung metropolitan area, largest metropolitan area is formed by Taipei (the capital), New Taipei City, and Keelung. With around 23.9 million inhabitants, Taiwan is among the List of countries and dependencies by population density, most densely populated countries. Tai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |