|

Monetary System

A monetary system is a system where a government manages money in a country's economy. Modern monetary systems usually consist of the national treasury, the mint, the central banks and commercial banks. Commodity money system A commodity money system is a type of monetary system in which a commodity such as gold or seashells is made the unit of value and physically used as money. The money retains its value because of its physical properties. In some cases, a government may stamp a metal coin with a face, value or mark that indicates its weight or asserts its purity, but the value remains the same even if the coin is melted down. Commodity-backed money One step away from commodity money is "commodity-backed money", also known as "representative money". Many currencies have consisted of bank-issued notes which have no inherent physical value, but which may be exchanged for a precious metal, such as gold. This is known as the gold standard. A silver standard was widespread ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government

A government is the system or group of people governing an organized community, generally a State (polity), state. In the case of its broad associative definition, government normally consists of legislature, executive (government), executive, and judiciary. Government is a means by which organizational policies are enforced, as well as a mechanism for determining policy. In many countries, the government has a kind of constitution, a statement of its governing principles and philosophy. While all types of organizations have governance, the term ''government'' is often used more specifically to refer to the approximately 200 list of sovereign states, independent national governments and government agency, subsidiary organizations. The main types of modern political systems recognized are democracy, democracies, totalitarian regimes, and, sitting between these two, authoritarianism, authoritarian regimes with a variety of hybrid regimes. Modern classification systems also ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fractional Reserve Banking

Fractional-reserve banking is the system of banking in all countries worldwide, under which banks that take deposits from the public keep only part of their deposit liabilities in liquid assets as a reserve, typically lending the remainder to borrowers. Bank reserves are held as cash in the bank or as balances in the bank's account at the central bank. Fractional-reserve banking differs from the hypothetical alternative model, full-reserve banking, in which banks would keep all depositor funds on hand as reserves. The country's central bank may determine a minimum amount that banks must hold in reserves, called the " reserve requirement" or "reserve ratio". Most commercial banks hold more than this minimum amount as excess reserves. Some countries, e.g. the core Anglosphere countries of the United States, the United Kingdom, Canada, Australia, and New Zealand, and the three Scandinavian countries, do not impose reserve requirements at all. Bank deposits are usually of a r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

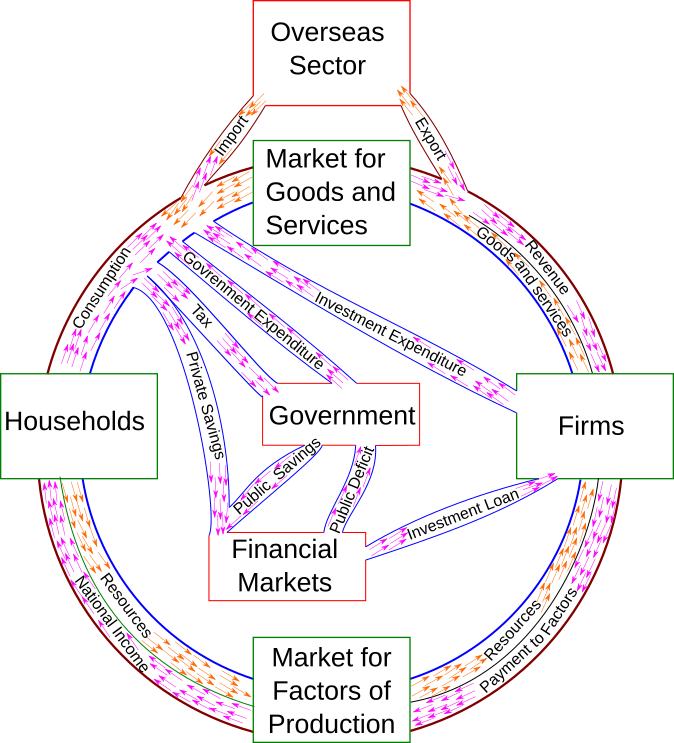

Circular Flow Of Income

The circular flow of income or circular flow is a economic model, model of the economy in which the major exchanges are represented as flows of money, Good (economics), goods and Service (economics), services, etc. between economic agents. The flows of money and goods exchanged in a closed circuit correspond in value, but run in the opposite direction. The circular flow analysis is the basis of national accounts and hence of macroeconomics. The idea of the circular flow was already present in the work of Richard Cantillon.Antoin E. Murphy. "John Law and Richard Cantillon on the circular flow of income." ''Journal of the History of Economic Thought.'' 1.1 (1993): 47–62. François Quesnay developed and visualized this concept in the so-called Tableau économique.Backhouse, Roger E., and Yann Giraud. "Circular flow diagrams." in: ''Famous Figures and Diagrams in Economics'' (2010): 221–230. Chapter 23. Important developments of Quesnay's tableau were Karl Marx's reproduction sch ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Notgeld

(German language, German for 'emergency money' or 'necessity money') is money issued by an institution in a time of economic or political crisis. The issuing institution is usually one without official sanction from the central government. This usually occurs when not enough state-produced money is available from the central bank. In particular, generally refers to money produced in German Empire, Germany and Austria-Hungary, Austria during World War I and the Interwar period. Issuing institutions could be a town's savings banks, municipality, municipalities and private or state-owned firms. Nearly all issues contained an expiry date, after which time they were invalid. Issues without dates ordinarily had an expiry announced in a newspaper or at the place of issuance. was mainly issued in the form of (paper) banknotes. Sometimes other forms were also used: coins, leather, silk, linen, wood, postage stamps, aluminium foil, coal, and porcelain; there are also reports of elemental ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Premium

A risk premium is a measure of excess return that is required by an individual to compensate being subjected to an increased level of risk. It is used widely in finance and economics, the general definition being the expected risky Rate of return, return less the Risk-free interest rate, risk-free return, as demonstrated by the formula below. Risk \ premium = E(r) - r_f Where E(r) is the risky expected rate of return and r_f is the risk-free return. The inputs for each of these variables and the ultimate interpretation of the risk premium value differs depending on the application as explained in the following sections. Regardless of the application, the market premium can be volatile as both comprising variables can be impacted independent of each other by both cyclical and abrupt changes. This means that the market premium is dynamic in nature and ever-changing. Additionally, a general observation regardless of application is that the risk premium is larger during economic do ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zero Interest-rate Policy

Zero interest-rate policy (ZIRP) is a macroeconomic concept describing conditions with a very low nominal interest rate, such as those in contemporary Bank of Japan, Japan and in the Federal Reserve System, United States from December 2008 through December 2015 and again from March 2020 until March 2022 amid the COVID-19 pandemic. ZIRP is considered to be an Monetary policy#Unconventional monetary policy at the zero bound, unconventional monetary policy instrument and can be associated with slow economic growth, deflation and Deleveraging, deleverage. ZIRP could also describe an interest-free economy. Overview Under ZIRP, the central bank maintains a 0% nominal interest rate. The ZIRP is an important milestone in monetary policy because the central bank is typically no longer able to reduce nominal interest rates. ZIRP is very closely related to the problem of a liquidity trap, where nominal interest rates cannot adjust downward at a time when savings exceed investment. Howe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Acting as a provider of loans is one of the main activities of financial institutions such as banks ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation Target

In macroeconomics, inflation targeting is a monetary policy where a central bank follows an explicit target for the inflation rate for the medium-term and announces this inflation target to the public. The assumption is that the best that monetary policy can do to support long-term growth of the economy is to maintain price stability, and price stability is achieved by controlling inflation. The central bank uses interest rates as its main short-term monetary instrument. An inflation-targeting central bank will raise or lower interest rates based on above-target or below-target inflation, respectively. The conventional wisdom is that raising interest rates usually cools the economy to rein in inflation; lowering interest rates usually accelerates the economy, thereby boosting inflation. The first three countries to implement fully-fledged inflation targeting were New Zealand, Canada and the United Kingdom in the early 1990s, although Germany had adopted many elements of inflatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Silvio Gesell

Johann Silvio Gesell (; 17 March 1862 – 11 March 1930) was a German-Argentine economist, entrepreneur, and social reformer. He was the founder of (German language, German for "free economy"), an economic model for market socialism. In 1900, he founded the magazine ''The Money and Land Reform'' (), but it soon closed for financial reasons. During his time in Oranienburg, Gesell started the magazine ''Der Physiokrat'' together with . In 1914, it closed due to censorship. In 1916, he published his most famous work, ''The Natural Economic Order''. Gesell is mainly known for his monetary theory. In particular, he noticed that there is an asymmetry between the durability and Hoarding (economics), hoardability of money versus the fragility and depreciation of goods and services that lose value due to entropy and the passage of time. He believed that people who own or hoard money have an unfair economic advantage over people who are dependent on producing and selling decayable goods ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stamp Scrip

A scrip (or '' chit'' in India) is any substitute for legal tender. It is often a form of credit. Scrips have been created and used for a variety of reasons, including exploitative payment of employees under truck systems; or for use in local commerce at times when regular currency was unavailable, for example in remote coal towns, military bases, ships on long voyages, or occupied countries in wartime. Besides company scrip, other forms of scrip include land scrip, vouchers, token coins such as subway tokens, IOUs, arcade tokens and tickets, and points on some credit cards. Scrips have gained historical importance and become a subject of study in numismatics and exonumia due to their wide variety and recurring use. Scrip behaves similarly to a currency, and as such can be used to study monetary economics. History A variety of forms of scrip were used at various times in the 19th and 20th centuries. Company scrip Company scrip is a substitute for currency to pay a compan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage-backed Security

A mortgage-backed security (MBS) is a type of asset-backed security (an "Financial instrument, instrument") which is secured by a mortgage loan, mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitization, securitizes, or packages, the loans together into a security that investors can buy. Bonds securitizing mortgages are usually treated as a separate class, termed Residential mortgage-backed security, residential; another class is Commercial mortgage-backed security, commercial, depending on whether the underlying asset is mortgages owned by borrowers or assets for commercial purposes ranging from office space to multi-dwelling buildings. The structure of the MBS may be known as pass-through security, "pass-through", where the interest and principal payments from the borrower or homebuyer pass through it to the MBS holder, or it may be more complex, made up of a pool of other MBSs ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Bond

A government bond or sovereign bond is a form of Bond (finance), bond issued by a government to support government spending, public spending. It generally includes a commitment to pay periodic interest, called Coupon (finance), coupon payments'','' and to repay the face value on the Maturity (finance), maturity date. For example, a bondholder invests $20,000, called face value or principal, into a 10-year government bond with a 10% annual coupon; the government would pay the bondholder 10% interest ($2000 in this case) each year and repay the $20,000 original face value at the date of maturity (i.e. after 10 years). Government bonds can be denominated in a foreign currency or the government's domestic currency. Countries with less stable economies tend to denominate their bonds in the currency of a country with a more stable economy (i.e. a hard currency). All government bonds carry Default (finance), default risk; that is, the possibility that the government will be unable to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |