|

Modified Gross National Income

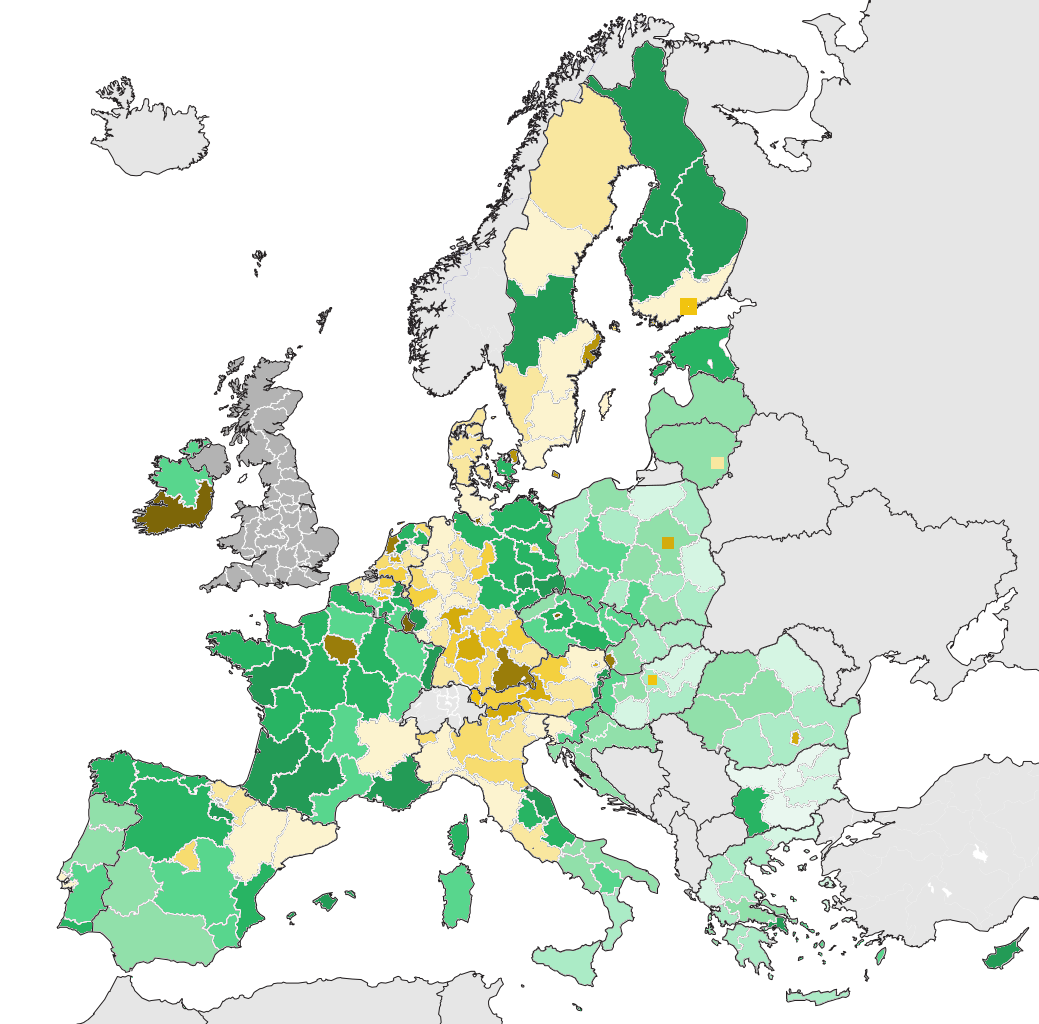

Modified gross national income (also Modified GNI or GNI*) is a metric used by the Central Statistics Office (Ireland) to measure the Irish economy rather than Gross national income, GNI or GDP. GNI* is GNI minus the depreciation on Intellectual Property, depreciation on leased aircraft and the net factor income of redomiciled PLCs. While "Tax haven#Inflated GDP-per-capita, Inflated GDP-per-capita" due to BEPS tools is a feature of tax havens, Ireland was the first to adjust its GDP metrics. Economists, including Eurostat, noted Irish Modified GNI (GNI*) is still distorted by Irish BEPS tools and US multinational tax planning activities in Ireland (e.g. contract manufacturing); and that Irish BEPS tools distort ''aggregate'' EU-28 data, and the EU-US trade deficit. In August 2018, the Central Statistics Office (Ireland) (CSO) restated table of Irish GDP versus Modified GNI (2009–2017) showed GDP was 162% of GNI* (EU-28 2017 GDP was 100% of GNI). Ireland's public differ drama ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

THE CENTRAL BANK OF IRELAND (NEW HEADQUARTER BUILDING ON NORTH WALL QUAY)- ALONG BOTANIC AVENUE (JANUARY 2018)-135339 (27856990779)

''The'' is a grammatical Article (grammar), article in English language, English, denoting nouns that are already or about to be mentioned, under discussion, implied or otherwise presumed familiar to listeners, readers, or speakers. It is the definite article in English. ''The'' is the Most common words in English, most frequently used word in the English language; studies and analyses of texts have found it to account for seven percent of all printed English-language words. It is derived from gendered articles in Old English which combined in Middle English and now has a single form used with nouns of any gender. The word can be used with both singular and plural nouns, and with a noun that starts with any letter. This is different from many other languages, which have different forms of the definite article for different genders or numbers. Pronunciation In most dialects, "the" is pronounced as (with the voiced dental fricative followed by a schwa) when followed by a con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ireland As A Tax Haven

Ireland has been labelled as a tax haven or corporate tax haven in multiple financial reports, an allegation which the state has rejected in response. Ireland is on all academic " tax haven lists", including the , and tax NGOs. Ireland does not meet the 1998 OECD definition of a tax haven, but no OECD member, including Switzerland, ever met this definition; only Trinidad & Tobago met it in 2017. Similarly, no EU–28 country is amongst the 64 listed in the 2017 EU tax haven blacklist and greylist. In September 2016, Brazil became the first G20 country to "blacklist" Ireland as a tax haven. Ireland's base erosion and profit shifting (BEPS) tools give some foreign corporates ' of 0% to 2.5% on global profits re-routed to Ireland via their tax treaty network. Ireland's ''aggregate '' for foreign corporates is 2.2–4.5%. Ireland's BEPS tools are the world's largest BEPS flows, exceed the entire Caribbean system, and artificially inflate the US–EU trade deficit. Ireland's ta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double Irish Arrangement

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mainly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. (The US was one of a small number of countries that did not use a "territorial" tax system, and taxed corporations on all profits, no matter whether the profit was made outside the US or not, in contrast to "territorial" tax systems which tax only profits made within that country.) It was the largest tax avoidance tool in history. By 2010, it was shielding US$100 billion annually in US multinational foreign profits from taxation, and was the main tool by which US multinationals built up untaxed offshore reserves of US$1 trillion from 2004 to 2018. Traditionally, it was also used with the Dutch Sandwich BEPS tool; however, 2010 changes to tax laws in Ireland dispensed with this requirement. Despite US knowledge of the Double Irish for a decade, it was the Eur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intellectual Property

Intellectual property (IP) is a category of property that includes intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The best-known types are patents, copyrights, trademarks, and trade secrets. The modern concept of intellectual property developed in England in the 17th and 18th centuries. The term "intellectual property" began to be used in the 19th century, though it was not until the late 20th century that intellectual property became commonplace in most of the world's List of national legal systems, legal systems."property as a common descriptor of the field probably traces to the foundation of the World Intellectual Property Organization (WIPO) by the United Nations." in Mark A. Lemley''Property, Intellectual Property, and Free Riding'', Texas Law Review, 2005, Vol. 83:1031, page 1033, footnote 4. Supporters of intellectual property laws often describe their main purpose as encouragin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intangible Assets

An intangible asset is an asset that lacks physical substance. Examples are patents, copyright, franchises, goodwill, trademarks, and trade names, reputation, R&D, know-how, organizational capital as well as any form of digital asset such as software and data. This is in contrast to physical assets (machinery, buildings, etc.) and financial assets (government securities, etc.). Intangible assets are usually very difficult to value. Today, a large part of the corporate economy (in terms of net present value) consists of intangible assets, reflecting the growth of information technology (IT) and organizational capital. Specifically, each dollar of IT has been found to be associated with and increase in firm market valuation of over $10, compared with an increase of just over $1 per dollar of investment in other tangible assets. Furthermore, firms that both make organizational capital investments and have a large computer capital stock have disproportionately higher market v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Allowance

Capital allowances is the practice of allowing tax payers to get tax relief on capital expenditure by allowing it to be deducted against their annual taxable income. Generally, expenditure qualifying for capital allowances will be incurred on specified capital assets, with the deduction available normally spread over many years. The term is used in the UK and in Ireland. Capital allowances are a replacement of accounting depreciation, which is not generally an allowable deduction in UK and Irish tax returns. Capital allowances can therefore be considered a form of 'tax depreciation', a term more widely used in other tax jurisdictions such as the US. If capital expenditure does not qualify for a form of capital allowance, then it means that the business gets no immediate tax relief on such expenditure. Categories of asset Capital allowances were introduced in the UK in 1946 and may be claimed for: * plant and machinery * structures and buildings * business premises reno ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EUROSTAT Ireland Gross Operating Surplus By Controlling Country, €million 2015

Eurostat ("European Statistical Office"; also DG ESTAT) is a department of the European Commission (Directorate-General), located in the Kirchberg quarter of Luxembourg City, Luxembourg. Eurostat's main responsibilities are to provide statistical information to the institutions of the European Union (EU) and to promote the harmonisation of statistical methods across its member states and candidates for accession as well as EFTA countries. The organisations in the different countries that cooperate with Eurostat are summarised under the concept of the European Statistical System. Organisation Eurostat operates pursuant to Regulation (EC) No 223/2009. Since the swearing in of the von der Leyen Commission in December 2019, Eurostat is allocated to the portfolio of the European Commissioner for the Economy, Paolo Gentiloni. The Director-General of Eurostat is Mariana Kotzeva, former Deputy Director-General of Eurostat and President of the National Statistical Institute of Bulga ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Post-2008 Irish Economic Downturn

The post-2008 Irish economic downturn in the Republic of Ireland, coincided with a Post-2008 Irish banking crisis, series of banking scandals, followed the 1990s and 2000s Celtic Tiger period of rapid real economic growth fuelled by foreign direct investment, a subsequent Irish property bubble, property bubble which rendered the real economy uncompetitive, and an expansion in bank lending in the early 2000s. An initial slowdown in economic growth during the 2008 financial crisis greatly intensified in late 2008 and the country fell into recession for the first time since the 1980s. Emigration, as well as unemployment (particularly in the construction sector), escalated to levels not seen since that decade. The Irish Stock Exchange (ISEQ) general index, which reached a peak of 10,000 points briefly in April 2007, fell to 1,987 points—a 14-year low—on 24 February 2009 (the last time it was under 2,000 being mid-1995). In September 2008, the Irish government—a Fianna Fáil–G ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Celtic Tiger

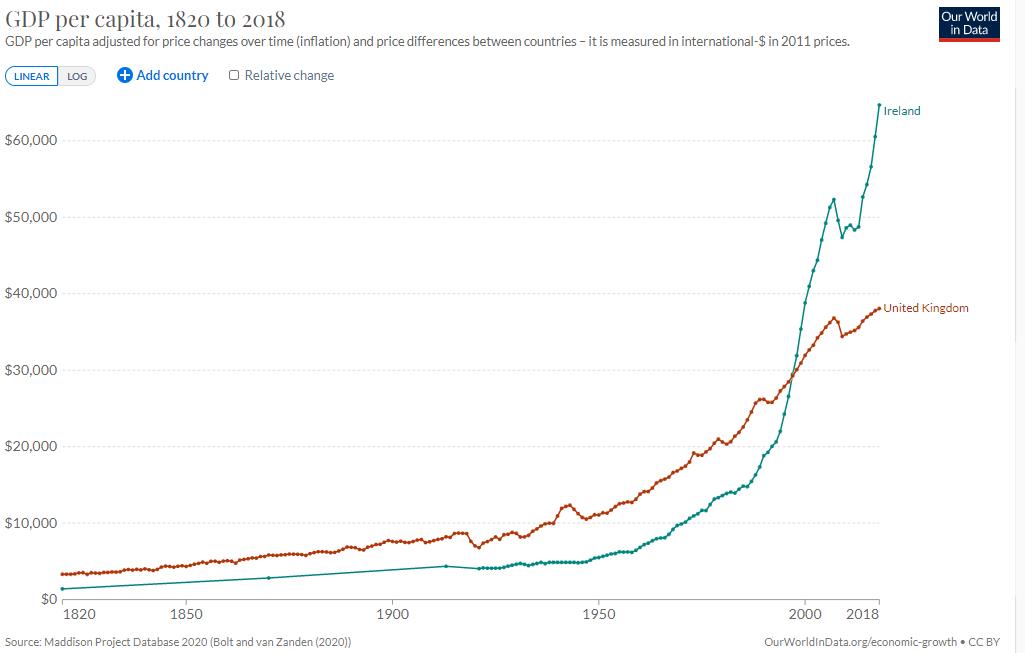

The "Celtic Tiger" () is a term referring to the economy of the Republic of Ireland, economy of Ireland from the mid-1990s to the late 2000s, a period of rapid real economic growth fuelled by foreign direct investment. The boom was dampened by a subsequent property bubble which resulted in a severe economic downturn. At the start of the 1990s, Ireland was a relatively poor country by Western European standards, with high poverty, high unemployment, inflation, and low economic growth. The Irish economy expanded at an average rate of 9.4% between 1995 and 2000, and continued to grow at an average rate of 5.9% during the following decade until 2008, when it Post-2008 Irish economic downturn, fell into recession. Ireland's rapid economic growth has been described as a rare example of a Western country matching the growth of East Asian nations, i.e. the 'Four Asian Tigers'. The economy underwent a dramatic reversal from 2008, affected by the Great Recession and ensuing European deb ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

McKinsey & Company

McKinsey & Company (informally McKinsey or McK) is an American multinational strategy and management consulting firm that offers professional services to corporations, governments, and other organizations. Founded in 1926 by James O. McKinsey, McKinsey is the oldest and largest of the " MBB" management consultancies. The firm mainly focuses on the finances and operations of their clients. Under the direction of Marvin Bower, McKinsey expanded into Europe during the 1940s and 1950s. In the 1960s, McKinsey's Fred Gluck—along with Boston Consulting Group's Bruce Henderson, Bill Bain at Bain & Company, and Harvard Business School's Michael Porter—initiated a program designed to transform corporate culture. A 1975 publication by McKinsey's John L. Neuman introduced the business practice of "overhead value analysis" that contributed to a downsizing trend that eliminated many jobs in middle management. McKinsey has been the subject of significant controversy and is the s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Feargal O'Rourke

Feargal O'Rourke (born 3 August 1964) is an Irish accountant and corporate tax expert, who was the managing partner of PwC in Ireland. He is considered the architect of the ''Double Irish'' tax scheme used by U.S. firms such as Apple, Google and Facebook in Ireland, and a leader in the development of corporate tax planning tools, and tax legislation, for U.S. multinationals in Ireland. Personal O'Rourke comes from an established Fianna Fáil political family. He is the son of former Irish minister Mary O'Rourke, nephew of former Irish Tánaiste Brian Lenihan Snr, and cousin of former Irish Finance Minister Brian Lenihan Jnr, and former Irish Minister of State Conor Lenihan. He chaired the college branch of Fianna Fáil at UCD and joined the national executive on graduation. Double Irish O'Rourke was once labeled the "great architect" of the ''Double Irish'' base erosion and profit shifting ("BEPS") tool, as used by U.S. multinationals in Ireland such as Google, a known cl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |