|

LabEx ReFi - European Laboratory On Financial Regulation

Since the financial crisis, regulation of financial activities is at the center of economic and political events. The crisis has indeed led regulators but also the academic world to ask new questions about the effectiveness of regulation policies. To answer these questions, the French laboratory of excellence on financial regulation (Labex ReFi) was established at the initiative of the Conservatoire national des arts et métiers (CNAM), the Ecole Nationale d'Administration (ENA) and Pantheon-Sorbonne University and ESCP Europe (project leader) in the framework of the “Grand Emprunt”. Financed over 10 years, Labex ReFi will be evaluated by the National Research Agency (ANR). Purpose Governance LABEX ReFi is organized around a Scientific Council under the leadership of Prof. Christian de Boissieu, a Strategic Orientation Committee, chaired by Mr. Augustin de Romanet de Beaune, composed of regulators and professionals, as well as academic personalities and an Executive Committ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

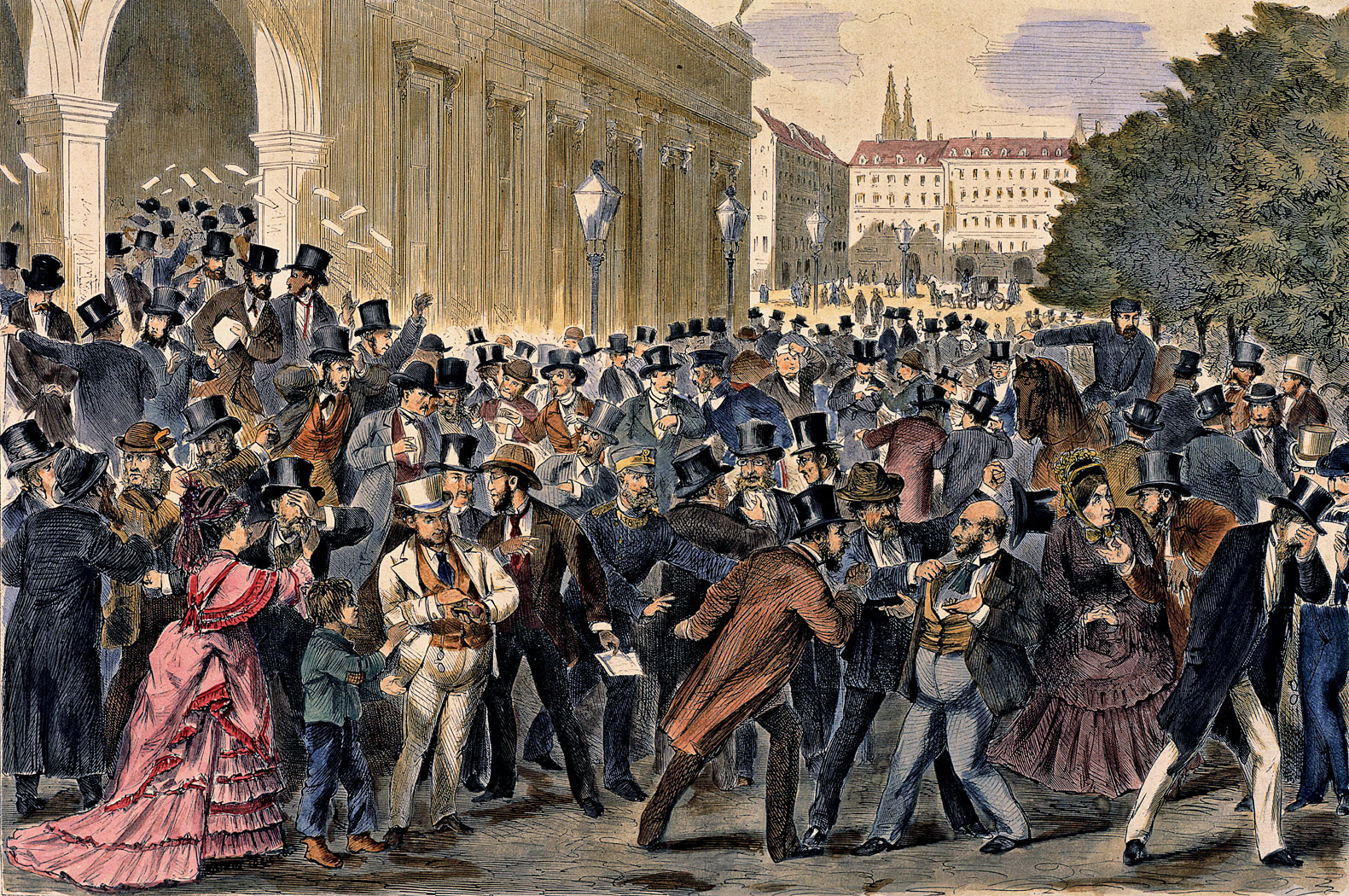

Financial Crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (e.g. the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is no consensus, however, and financial crises continue to occur from time to time. Types Banking crisis When a bank suffers a sudden rush of withdrawals by depositors, this is called a ''bank run''. Si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Global Financial System

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Research Institutes

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with the production, use, and management of scarce resources'. A given economy is a set of processes that involves its culture, values, education, technological evolution, history, social organization, political structure, legal systems, and natural resources as main factors. These factors give context, content, and set the conditions and parameters in which an economy functions. In other words, the economic domain is a social domain of interrelated human practices and transactions that does not stand alone. Economic agents can be individuals, businesses, organizations, or governments. Economic transactions occur when two groups or parties agree to the value or price of the transacted good or service, commonly expressed in a certain currency. Howev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Policy In Europe

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with the production, use, and management of scarce resources'. A given economy is a set of processes that involves its culture, values, education, technological evolution, history, social organization, political structure, legal systems, and natural resources as main factors. These factors give context, content, and set the conditions and parameters in which an economy functions. In other words, the economic domain is a social domain of interrelated human practices and transactions that does not stand alone. Economic agents can be individuals, businesses, organizations, or governments. Economic transactions occur when two groups or parties agree to the value or price of the transacted good or service, commonly expressed in a certain currency. Howev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regulatory Capture

In politics, regulatory capture (also agency capture and client politics) is a form of corruption of authority that occurs when a political entity, policymaker, or regulator is co-opted to serve the commercial, ideological, or political interests of a minor constituency, such as a particular geographic area, industry, profession, or ideological group. When regulatory capture occurs, a special interest is prioritized over the general interests of the public, leading to a net loss for society. The theory of client politics is related to that of rent-seeking and political failure; client politics "occurs when most or all of the benefits of a program go to some single, reasonably small interest (e.g., industry, profession, or locality) but most or all of the costs will be borne by a large number of people (for example, all taxpayers)". Theory For public choice theorists, regulatory capture occurs because groups or individuals with high-stakes interests in the outcome of policy or re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Market

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management. A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with central counterparty clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market. Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Organization Of Securities Commissions

The International Organization of Securities Commissions (IOSCO) is an association of organizations that regulate the world's securities and futures markets. Members are typically primary securities and/or futures regulators in a national jurisdiction or the main financial regulator from each country. Its mandate is to: * Develop, implement, and promote high standards of regulation to enhance investor protection and reduce systemic risk * Share information with exchanges and assist them with technical and operational issues * Establish standards toward monitoring global investment transactions across borders and markets IOSCO has members from over 100 countries, who regulate more than 95% of the world's securities markets. It has a permanent secretariat in Madrid, Spain. History IOSCO was born in 1983 from the transformation of its ancestor the "Inter-American Regional Association" (created in 1974) into a truly global cooperative. This decision to expand the organization beyond t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Centre For Financial Regulation

The International Centre for Financial Regulation (ICFR) (2009–12) was a UK-based non-partisan organisation focused entirely on financial regulation that operated between 2009 and 2012. History IFCR was the product of a collaboration between a number if international financial services institutions and the UK Government. The ICFR wanted to provide research, events and training on financial regulation whilst also acting as a catalyst for dialogue, thought leadership and scholarship in this critical area. The ICFR’s stated focus was to "shape regulatory thinking that not only addresses – but also anticipates – the evolution of financial markets at a global level, to bring consistency and cooperation between global regulators and policy makers through pro-active discussions, working groups and long-term research." The Centre also meant to support practical training initiatives on best practice and the latest regulatory changes both in developed and emerging markets. It was pu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Law

Insurance law is the practice of law surrounding insurance, including insurance policies and claims. It can be broadly broken into three categories - regulation of the business of insurance; regulation of the content of insurance policies, especially with regard to consumer policies; and regulation of claim handling wise. History The earliest form of insurance is probably marine insurance, although forms of mutuality (group self-insurance) existed before that. Marine insurance originated with the merchants of the Hanseatic league and the financiers of Lombardy in the 12th and 13th centuries, recorded in the name of Lombard Street in the City of London, the oldest trading insurance market. In those early days, insurance was intrinsically coupled with the expansion of mercantilism, and exploration (and exploitation) of new sources of gold, silver, spices, furs and other precious goods - including slaves - from the New World. For these merchant adventurers, insurance was the "mean ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Group Of Thirty

The Group of Thirty, often abbreviated to G30, is an international body of financiers and academics which aims to deepen understanding of economic and financial issues and to examine consequences of decisions made in the public and private sectors. Areas within the interest of the group include: the foreign exchange market, international capital markets, international financial institutions, central banks and their supervision of financial services and markets, and macroeconomic issues such as product and labor markets. The group is noted for its advocacy of changes in global clearing and settlement. History The Group of Thirty was founded in 1978 by Geoffrey Bell at the initiative of the Rockefeller Foundation, which also provided initial funding for the body. Its first chairman was Johannes Witteveen, the former managing director of the International Monetary Fund. The G30's current Chairman is Tharman Shanmugaratnam. Its current Chairman of the Board of Trustees is Jac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Repression

Financial repression comprises "policies that result in savers earning returns below the rate of inflation" to allow banks to "provide cheap loans to companies and governments, reducing the burden of repayments." It can be particularly effective at liquidating government debt denominated in domestic currency. It can also lead to large expansions in debt "to levels evoking comparisons with the excesses that generated Japan’s lost decade and the 1997 Asian financial crisis." The term was introduced in 1973 by Stanford economists Edward S. Shaw and Ronald I. McKinnon to "disparage growth-inhibiting policies in emerging markets." Mechanism Financial repression may consist of any of the following, alone or in combination.: #Explicit or indirect capping of interest rates, such as on government debt and deposit rates (e.g., Regulation Q). #Government ownership or control of domestic banks and financial institutions with barriers that limit other institutions from entering the mark ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_per_capita_in_2020.png)