|

Loss Ratio

A loss ratio is a ratio of losses to gains, used normally in a financial context. It is the reciprocal of the gross profit ratio (commonly known as the ''gross profit margin''). Insurance loss ratio For insurance, the loss ratio is the ratio of total losses incurred (paid and reserved) in claims plus adjustment expenses divided by the total premiums earned. For example, if an insurance company pays $60 in claims for every $100 in collected premiums, then its loss ratio is 60% with a profit ratio/gross margin of 40% or $40. Some portion of those 40 dollars must pay all operating costs (things such as overhead and payroll), and what is left is the net profit. Loss ratios for property and casualty insurance (e.g. motor car insurance) typically range from 70% to 99%. Such companies are collecting premiums more than the amount paid in claims. Conversely, insurers that consistently experience high loss ratios may be in bad financial health. They may not be collecting enough premium t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit Margin

Profit margin is a financial ratio that measures the percentage of profit earned by a company in relation to its revenue. Expressed as a percentage, it indicates how much profit the company makes for every dollar of revenue generated. Profit margin is important because this percentage provides a comprehensive picture of the operating efficiency of a business or an industry. All margin changes provide useful indicators for assessing growth potential, investment viability and the financial stability of a company relative to its competitors. Maintaining a healthy profit margin will help to ensure the financial success of a business, which will improve its ability to obtain loans. It is calculated by finding the profit as a percentage of the revenue. \text = = For example, if a company reports that it achieved a 35% profit margin during the last quarter, it means that it netted $0.35 from each dollar of sales generated. Profit margins are generally distinct from rate of return. Pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

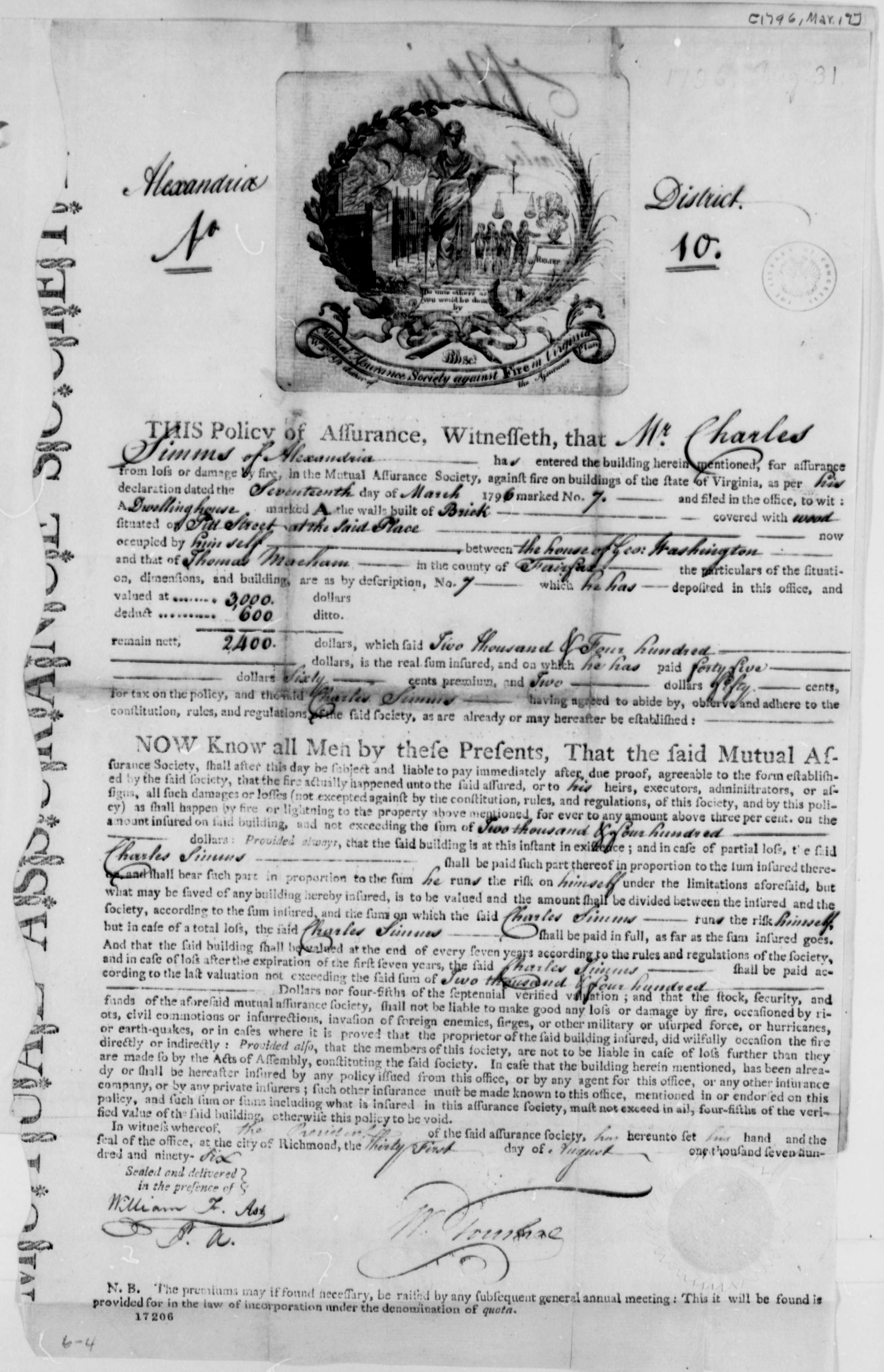

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overhead (business)

In business, an overhead or overhead expense is an ongoing expense of operating a business. Overheads are the expenditure which cannot be conveniently traced to or identified with any particular revenue unit, unlike operating expenses such as raw material and labor. Overheads cannot be immediately associated with the products or services being offered, and so do not directly generate profits. However, they are still vital to business operations as they provide critical support for the business to carry out profit making activities. One example would be the rent for a factory, which allows workers to manufacture products which can then be sold for a profit. Such expenses are incurred for output generally and not for particular work order; e.g., wages paid to watch and ward staff, heating and lighting expenses of factory, etc. Overheads are an important cost element, alongside direct materials and direct labor. Overheads are often related to accounting concepts such as fixed costs and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payroll

A payroll is a list of employment, employees of a company who are entitled to receive compensation as well as other work benefits, as well as the amounts that each should obtain. Along with the amounts that each employee should receive for time worked or tasks performed, payroll can also refer to a company's records of payments that were previously made to employees, including Salary, salaries and wages, Bonus payment, bonuses, and Withholding tax, withheld taxes, or the company's department that deals with Remuneration, compensation. A company may handle all aspects of the payroll process in-house or can outsource aspects to a payroll processing company. Payroll in the U.S. is subject to federal, state and local regulations including Fair Labor Standards Act of 1938, employee exemptions, Records management, record keeping, and Taxation in the United States, tax requirements. In recent years, there has been a significant shift towards cloud-based payroll solutions. These platfor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net Profit

In business and Accountancy, accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and Amortization (accounting), amortization, interest, and taxes, and other expenses for an accounting period. It is computed as the residual of all revenues and gains less all expenses and losses for the period,Weil, Schipper, Francis. (2009) Financial Accounting: An Introduction to Concepts, Methods, and Uses. Cengage Learning and has also been defined as the net increase in Equity (finance), shareholders' equity that results from a company's operations.Weil, Schipper, Francis. (2010) Financial Accounting. Cengage Learning. It is different from gross income, which only deducts the cost of goods sold from revenue. For Household, households and individuals, net income refers to the (gross) income minus taxes and other deductions (e.g. mandatory pension cont ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Insurance

Property insurance provides protection against most risks to property, such as fire, theft and some weather damage. This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or boiler insurance. Property is insured in two main ways—open perils and named perils. Open perils cover all the causes of loss not specifically excluded in the policy. Common exclusions on open peril policies include damage resulting from earthquakes, floods, nuclear incidents, acts of terrorism, and war. Named perils require the actual cause of loss to be listed in the policy for insurance to be provided. The more common named perils include such damage-causing events as fire, lightning, explosion, cyber-attack, and theft. History Property insurance can be traced to the Great Fire of London, which in 1666 devoured more than 13,000 houses. The devastating effects of the fire converted the development of insurance "from a matter of co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Vehicle Insurance

Vehicle insurance (also known as car insurance, motor insurance, or auto insurance) is insurance for automobile, cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against legal liability, liability that could also arise from incidents in a vehicle. Vehicle insurance may additionally offer financial protection against Motor vehicle theft, theft of the vehicle, and against damage to the vehicle sustained from events other than traffic collisions, such as vandalism, weather or natural disasters, and damage sustained by colliding with stationary objects. The specific terms of vehicle insurance vary with legal regulations in each region. History Widespread use of the motor car began after the First World War in urban areas. Cars were relatively fast and dangerous by that stage, yet there was still no compulsory form of car insurance anywhere in the world. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Insurance

Health insurance or medical insurance (also known as medical aid in South Africa) is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses. As with other types of insurance, risk is shared among many individuals. By estimating the overall risk of health risk and health system expenses over the risk pool, an insurer can develop a routine finance structure, such as a monthly premium or payroll tax, to provide the money to pay for the health care benefits specified in the insurance agreement. The benefit is administered by a central organization, such as a government agency, private business, or not-for-profit entity. According to the Health Insurance Association of America, health insurance is defined as "coverage that provides for the payments of benefits as a result of sickness or injury. It includes insurance for losses from accident, medical expense, disability, or accidental death and dismemberment". A health insurance policy i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Al Franken

Alan Stuart Franken (born May 21, 1951) is an American politician, comedian, and actor who served from 2009 to 2018 as a United States senator from Minnesota. A member of the Democratic Party (United States), Democratic Party, he worked as an entertainer, appearing on television and in films, before entering politics. Franken first gained fame as a writer and performer on the NBC sketch comedy series ''Saturday Night Live'', where he worked three stints. He first served as a writer for the show from 1975 to 1980, and returned from 1985 to 1995 as a writer and, briefly, a cast member. After his career in the entertainment industry, Franken became a Liberalism in the United States, liberal political activist, hosting a radio show and writing satirical books scrutinizing the American right. Though initially dismissed as a novelty candidate due to his background in comedy, Franken was elected to the United States Senate in 2008 United States Senate election in Minnesota, 2008, def ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Patient Protection And Affordable Care Act

A patient is any recipient of health care services that are performed by healthcare professionals. The patient is most often ill or injured and in need of treatment by a physician, nurse, optometrist, dentist, veterinarian, or other health care provider. Etymology The word patient originally meant 'one who suffers'. This English noun comes from the Latin word , the present participle of the deponent verb, , meaning , and akin to the Greek verb ( ) and its cognate noun (). This language has been construed as meaning that the role of patients is to passively accept and tolerate the suffering and treatments prescribed by the healthcare providers, without engaging in shared decision-making about their care. Outpatients and inpatients An outpatient (or out-patient) is a patient who attends an outpatient clinic with no plan to stay beyond the duration of the visit. Even if the patient will not be formally admitted with a note as an outpatient, their attendance is stil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |