|

Local Taxation

A comparison of tax rates by countries is difficult and somewhat subjective, as tax laws in most countries are extremely complex and the Tax incidence, tax burden falls differently on different groups in each country and sub-national unit. The list focuses on the main types of taxes: corporate tax, Income tax, individual income tax, capital gains tax, wealth tax (excl. property tax), property tax, inheritance tax and sales tax (incl. Value-added tax, VAT and GST). Personal income tax includes all applicable taxes, including all unvested social security contributions. Vested social security contributions are not included as they contribute to the personal wealth and will be paid back upon retirement or emigration, either as lump sum or as pension. Only social security contributions without a ceiling can be included in the highest marginal tax rate as only those are effectively a tax for general distribution among the population. The table is not exhaustive in representing the t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Sales Taxes

Federal or foederal (archaic) may refer to: Politics General *Federal monarchy, a federation of monarchies *Federation, or ''Federal state'' (federal system), a type of government characterized by both a central (federal) government and states or regional governments that are partially self-governing; a union of states *Federal republic, a federation which is a republic *Federalism, a political philosophy *Federalist, a political belief or member of a political grouping *Federalization, implementation of federalism Particular governments *Government of Argentina *Government of Australia *Federal government of Brazil *Government of Canada *Cabinet of Germany *Federal government of Iraq *Government of India *Federal government of Mexico *Federal government of Nigeria *Government of Pakistan *Government of the Philippines *Government of Russia *Government of South Africa *Federal government of the United States **United States federal law **United States federal courts *Federal gover ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance Tax

International tax law distinguishes between an estate tax and an inheritance tax. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died. However, this distinction is not always observed; for example, the UK's "inheritance tax" is a tax on the assets of the deceased, and strictly speaking is therefore an estate tax. Inheritance taxes vary widely between countries. History There was a steep increase in the number of countries that implemented inheritance taxes throughout the 19th and early 20th century. From 1960 onwards, inheritance taxes declined in prevalence as numerous countries repealed theirs. For historical reasons, the term "death duty" is still used colloquially (though not legally) in the UK and some Commonwealth countries. The estate tax in the United States is sometimes referred as "death tax". Other taxation applied to inherita ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Aruba

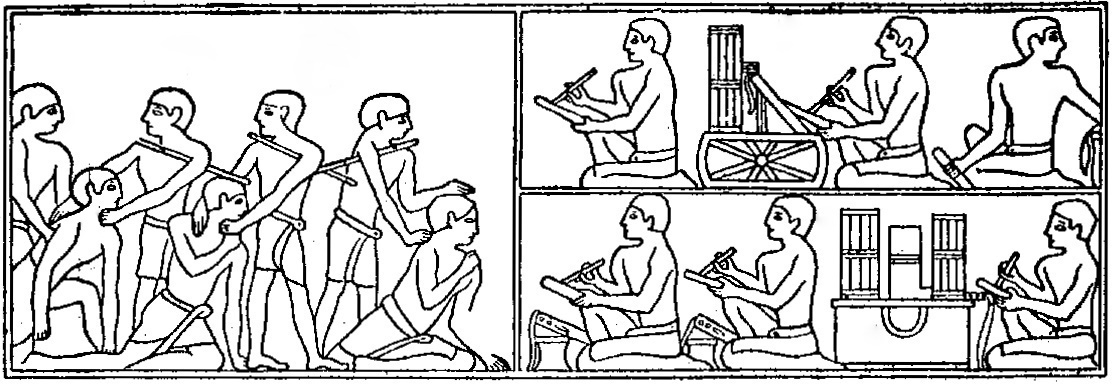

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat percentage rate of taxation on personal annual income, but most scale taxes are progressive based on brackets of yearly income amounts. Most countries charge a tax on an individual's income and corporate income. Cou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Armenia

Taxation in Armenia is regulated by the State Revenue Committee, which is the tax authority of the Armenian government. Meanwhile, the Armenian Tax Service is responsible for the collection of taxes, providing revenue services, preventing tax fraud and tax evasion, and implementing various tax reform programs in conjunction with the State Revenue Committee. Type of tax Employee income tax From 1 January 2020, Armenia switched to a flat income taxation system, which, regardless of the amount, will tax wages at 23%. Moreover, until 2023 the taxation rate will gradually decrease from 23% to 20%. Corporate income tax Reforms adopted in June 2019, aims to boost medium-term economic activity and to increase tax compliance. Among other measures, the corporate income tax was reduced by two percentage points to 18.0 per cent and the tax on dividends for non-resident organizations halved to 5.0 per cent. Special taxation for small business From 1 January 2020, Armenia abandoned ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Argentina

Due to the absence of the tax code in Argentina, the tax regulation takes place in accordance with separate laws, which, in turn, are supplemented by provisions of normative acts adopted by the executive authorities. The powers of the executive authority include levying a tax on profits, property and added value throughout the national territory. In Argentina, the tax policy is implemented by the Federal Administration of Public Revenue, which is subordinate to the Ministry of Economy. The Federal Administration of Public Revenues (AFIP) is an independent service, which includes: the General Tax Administration, the General Customs Office and the General Directorate for Social Security. AFIP establishes the relevant legal norms for the calculation, payment and administration of taxes: * taxes levied on operations carried out on the national territory of the country and in marine areas fully covered by the national tax policy; * taxes, which are imposed on import and export operation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Antigua And Barbuda

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat percentage rate of taxation on personal annual income, but most scale taxes are progressive based on brackets of yearly income amounts. Most countries charge a tax on an individual's income and corporate income. Cou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Anguilla

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat percentage rate of taxation on personal annual income, but most scale taxes are progressive based on brackets of yearly income amounts. Most countries charge a tax on an individual's income and corporate income. Count ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Andorra

The tax system of Andorra has evolved according to the country's economic activity and structure, and the tax bases have been expanded to optimally distribute the weight of the tax burden, going from an almost exclusively indirect tax system to a system with direct taxation that can be approved at the international level. Despite its taxes, Andorra ceased to be a tax haven for its neighboring countries years ago, and for the European Union and OECD recently. In accordance with the mandate established in the 1993 Constitution, tax powers are divided between the ''Comuns'' — town councils – and the Government. History After the Andorran Constitution came into force, the qualified law delimiting the powers of the ''Comuns'', of November 4, 1993, configures and delimits the powers of the commons within the framework of their self-government. During the period 1994–1996, an important activity of tax development was observed with the creation of five new taxes: * Vehicle o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In American Samoa

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat percentage rate of taxation on personal annual income, but most scale taxes are progressive based on brackets of yearly income amounts. Most countries charge a tax on an individual's income and corporate income. Countr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Algeria

In Algeria, the most important sources of government revenue have been oil and gas royalties. Taxation The current Algerian tax system consists of 2 regimes, the real and fixed regimes. This distinction issued from the reform implemented in 2007 when the taxation was revised. The main incentive to review the taxes was that after the 2000s energy crisis, taxes became the main resource of national income. That is why the incentive to work on its effectivity and to optimize it appeared in government. The fixed regime relies on the single fixed tax (the main change and innovation made by this reform) and the real regime consist of different taxes levied on taxpayer. History From the historical point of view thAlgerian tax systemseems to be inspired by its former coloniser- France. Actually as a whole system it looks to be the reproduction of the French base by implementing different modalities of taxation (imposition). There are different taxes levied: * Income tax; this one ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Albania

In Albania, taxes are levied by both national and local governments. Most important revenue sources, include the income tax, social security, corporate tax and the value added tax, which are all applied on the national level. The Albanian Taxation Office is the revenue service of Albania. , income tax is progressive, with three brackets. Earlier, Albania had a flat tax A flat tax (short for flat-rate tax) is a tax with a single rate on the taxable amount, after accounting for any deductions or exemptions from the tax base. It is not necessarily a fully proportional tax. Implementations are often progressi ... of 10%, which was implemented in 2008. Value-Added Tax is levied at two different rates of 20% as standard rate, and 10% on medicinal products. Social security and health insurance contributions are paid on employment, civil and management income. Contributions is paid on a monthly income, from a minimum of 22,000 to a maximum amount of 95,130. The employees cont ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |