|

Individually Purchased Health Insurance

In the United States, individually purchased health insurance is health insurance purchased directly by individuals, and not those provided through employers. Self-employed individuals receive a tax deduction for their health insurance and can buy health insurance with additional tax benefits. According to the US Census Bureau, about 9% of Americans are covered under individual health insurance. In the individual market, consumers pay the entire premium without an employer contribution, and most do not receive any tax benefit. The range of products available is similar to those provided through employers. However, average out-of-pocket spending is higher in the individual market, with higher deductibles, co-payments and other cost-sharing provisions. Major medical is the most commonly purchased form of individual health insurance. Economics Premiums can vary significantly by age. In states that allow medical underwriting, an individual's health information may be used in determini ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Insurance

Health insurance or medical insurance (also known as medical aid in South Africa) is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses. As with other types of insurance, risk is shared among many individuals. By estimating the overall risk of health risk and health system expenses over the risk pool, an insurer can develop a routine finance structure, such as a monthly premium or payroll tax, to provide the money to pay for the health care benefits specified in the insurance agreement. The benefit is administered by a central organization, such as a government agency, private business, or not-for-profit entity. According to the Health Insurance Association of America, health insurance is defined as "coverage that provides for the payments of benefits as a result of sickness or injury. It includes insurance for losses from accident, medical expense, disability, or accidental death and dismemberment". Background A healt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Hartford Courant

The ''Hartford Courant'' is the largest daily newspaper in the U.S. state of Connecticut, and is considered to be the oldest continuously published newspaper in the United States. A morning newspaper serving most of the state north of New Haven and east of Waterbury, Connecticut, Waterbury, its headquarters on Broad Street in Hartford, Connecticut is a short walk from the Connecticut State Capitol, state capitol. It reports regional news with a chain of bureaus in smaller cities and a series of local editions. It also operates ''CTNow'', a free local weekly newspaper and website. The ''Courant'' began as a weekly called the ''Connecticut Courant'' on October 29, 1764, becoming daily in 1837. In 1979, it was bought by the Times Mirror Company. In 2000, Times Mirror was acquired by the Tribune Company, which later combined the paper's management and facilities with those of a Tribune-owned Hartford WTIC-TV, television station. The ''Courant'' and other Tribune print properties we ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Insurance Marketplace

In the United States, health insurance marketplaces, also called health exchanges, are organizations in each state through which people can purchase health insurance. People can purchase health insurance that complies with the Patient Protection and Affordable Care Act (ACA, known colloquially as "Obamacare") at ACA health exchanges, where they can choose from a range of government-regulated and standardized health care plans offered by the insurers participating in the exchange. ACA health exchanges were fully certified and operational by January 1, 2014, under federal law. Enrollment in the marketplaces started on October 1, 2013, and continued for six months. 8.02 million people had signed up through the health insurance marketplaces. An additional 4.8 million joined Medicaid. Enrollment for 2015 began on November 15, 2014 and ended on December 15, 2014. As of April 14, 2020, 11.41 million people had signed up through the health insurance marketplaces. Private non-ACA heal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Insurance Coverage In The United States

Health insurance coverage in the United States is provided by several public and private sources. During 2019, the U.S. population overall was approximately 330 million, with 59 million people 65 years of age and over covered by the federal Medicare program. The 273 million non-institutionalized persons under age 65 either obtained their coverage from employer-based (159 million) or non-employer based (84 million) sources, or were uninsured (30 million). During the year 2019, 89% of the non-institutionalized population had health insurance coverage. Separately, approximately 12 million military personnel (considered part of the "institutional" population) received coverage through the Veteran's Administration and Military Health System. Despite being among the top world economic powers, the US remains the sole industrialized nation in the world without universal health care coverage. Prohibitively high cost is the primary reason Americans give for problems accessing health ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Insurance In The United States

Health insurance in the United States is any program that helps pay for medical expenses, whether through privately purchased insurance, social insurance, or a social welfare program funded by the government. Synonyms for this usage include "health coverage", "health care coverage", and "health benefits". In a more technical sense, the term "health insurance" is used to describe any form of insurance providing protection against the costs of medical services. This usage includes both private insurance programs and social insurance programs such as Medicare, which pools resources and spreads the financial risk associated with major medical expenses across the entire population to protect everyone, as well as social welfare programs like Medicaid and the Children's Health Insurance Program, which both provide assistance to people who cannot afford health coverage. In addition to medical expense insurance, "health insurance" may also refer to insurance covering disability or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Medigap

Medigap (also called Medicare supplement insurance or Medicare supplemental insurance) refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to cover the difference or "gap" between the expenses reimbursed to providers by Medicare Parts A and B for services and the total amount allowed to be charged for those services by the United States Centers for Medicare and Medicaid Services (CMS). Over 14 million Americans had Medicare Supplement insurance in 2018 according to a report by thAmerican Association for Medicare Supplement Insurance Eligibility Medicare eligibility can start for Americans when they turn at least 64 years & nine months old or upon retir ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fair Credit Reporting Act

The Fair Credit Reporting Act (FCRA), 15 U.S.C. § 1681 ''et seq'', is U.S. Federal Government legislation enacted to promote the accuracy, fairness, and privacy of consumer information contained in the files of consumer reporting agencies. It was intended to shield consumers from the willful and/or negligent inclusion of erroneous data in their credit reports. To that end, the FCRA regulates the collection, dissemination, and use of consumer information, including consumer credit information. Together with the Fair Debt Collection Practices Act (FDCPA), the FCRA forms the foundation of consumer rights law in the United States. It was originally passed in 1970, and is enforced by the U.S. Federal Trade Commission, the Consumer Financial Protection Bureau and private litigants. History Before standardization of credit scoring, statements of character were integral to credit reports well into the 1960s. With credit reports containing probing details about personality, habits, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Women's Health And Cancer Rights Act

The U.S. Women's Health and Cancer Rights Act, also known as , signed into law on October 21, 1998 as part of the 1999 omnibus bill (), contains protections for patients who elect breast reconstruction in connection with a mastectomy. This law, which is administered by the Department of Labor and Health and Human Services, states that group health plans, insurance companies, and health maintenance organizations (HMOs) must provide coverage for reconstructive surgery after mastectomy for breast cancer and prohibited "drive-through" mastectomies, where breast cancer patient's hospital stays were limited by their carriers. The required coverage includes all stages of reconstruction of the breast on which the mastectomy was performed, surgery and reconstruction of the other breast to produce a symmetrical appearance, prostheses, and treatment of physical complications of the mastectomy, including lymphedema. Importantly, second opinions in or out of network for all cancer patients were ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Newborns' And Mothers' Health Protection Act

The Newborns' and Mothers' Health Protection Act of 1996 (passed as part of the ''Departments of Veterans Affairs and Housing and Urban Development, and Independent Agencies Appropriations Act, 1997'' {{uspl, 104, 204) is a piece of legislation relating to the coverage of maternity by health insurance plans in the United States. It was signed into law on September 26, 1996, and requires plans that offer maternity coverage to pay for at least a 48-hour hospital stay following childbirth (96-hour stay in the case of a cesarean section). Provisions of the Act This law was effective for group health plans for plan years beginning on or after January 1, 1998. On October 27, 1998, the Department of Labor, in conjunction with the Departments of the US Treasury and Health and Human Services The United States Department of Health and Human Services (HHS) is a cabinet-level executive branch department of the U.S. federal government created to protect the health of all Americans a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Insurance Portability And Accountability Act

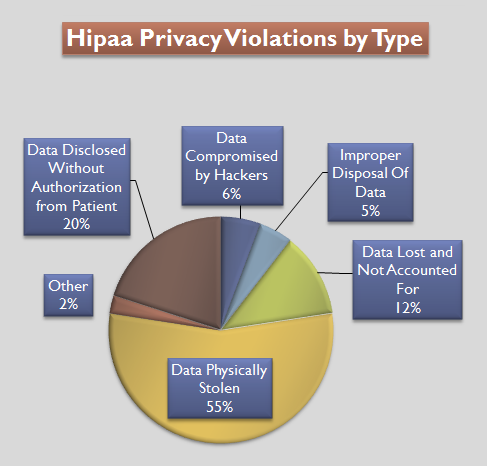

The Health Insurance Portability and Accountability Act of 1996 (HIPAA or the Kennedy– Kassebaum Act) is a United States Act of Congress enacted by the 104th United States Congress and signed into law by President Bill Clinton on August 21, 1996. It modernized the flow of healthcare information, stipulates how personally identifiable information maintained by the healthcare and healthcare insurance industries should be protected from fraud and theft, and addressed some limitations on healthcare insurance coverage. It generally prohibits healthcare providers and healthcare businesses, called ''covered entities'', from disclosing protected information to anyone other than a patient and the patient's authorized representatives without their consent. With limited exceptions, it does not restrict patients from receiving information about themselves. It does not prohibit patients from voluntarily sharing their health information however they choose, nor does it require confidentiali ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Association Of Insurance Commissioners

The National Association of Insurance Commissioners (NAIC) is the U.S. standard-setting and regulatory support organization created and governed by the chief insurance regulators from the 50 states, the District of Columbia, and five U.S. territories. Mission and function Through the NAIC, state insurance regulators establish standards and best practices, conduct peer review, and coordinate their regulatory oversight. NAIC staff supports these efforts and represents the collective views of state regulators domestically and internationally. NAIC members, together with the central resources of the NAIC, form the national system of state-based insurance regulation in the U.S. The NAIC is an Internal Revenue Code Section 501(c)(3) non-profit organization. The NAIC acts as a forum for the creation of model laws and regulations. Each state decides whether to pass each NAIC model law or regulation, and each state may make changes in the enactment process, but the models are widely, alb ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |