|

Islamic Taxes

Islamic taxes are taxes sanctioned by Islamic law. They are based on both "the legal status of taxable land" and on "the communal or religious status of the taxpayer". Islamic taxes include *''zakat'' - one of the five pillars of Islam. Only imposed on Muslims, it is generally described as a 2.5% tax on savings for charity. As stated in the Quran 9:60, "Indeed, rescribedcharitable offerings are only o be givento the poor and the indigent, and to those who work on dministeringit, and to those whose hearts are to be reconciled, and to reethose in bondage, and to the debt-ridden, and for the cause of God, and to the wayfarer. his isan obligation from God. And God is all-knowing, all-wise." Outlined in this verse are the 8 categories where Zakat is eligible. *''jizya'' - a per capita yearly tax historically levied by Islamic states on certain non-Muslim subjects— dhimmis—permanently residing in Muslim lands under Islamic law, the tax excluded the poor, women, children and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jizya Document Chokmanovo 1615

Jizya (), or jizyah, is a type of taxation levied on non-Muslim subjects of a state governed by Islamic law. The Quran and hadiths mention jizya without specifying its rate or amount,Sabet, Amr (2006), ''The American Journal of Islamic Social Sciences'' 24:4, Oxford; pp. 99–100. and the application of jizya varied in the course of Islamic history. However, scholars largely agree that early Muslim rulers adapted some of the existing systems of taxation and modified them according to Islamic religious law.online Historically, the jizya tax has been understood in Islam as a fee for protection provided by the Muslim ruler to non-Muslims, for the exemption from military service for non-Muslims, for the permission to practice a non-Muslim faith with some communal autonomy in a Muslim state, and as material proof of the non-Muslims' allegiance to the Muslim state and its laws. The majority of Muslim jurists required adult, free, sane males among the dhimma community to pay the jizya, wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rashidun Caliphate

The Rashidun Caliphate () is a title given for the reigns of first caliphs (lit. "successors") — Abu Bakr, Umar, Uthman, and Ali collectively — believed to Political aspects of Islam, represent the perfect Islam and governance who led the Muslim community and polity from the death of the Islamic prophet Muhammad (in 632 AD), to the establishment of the Umayyad Caliphate (in 661 AD). The reign of these four caliphs is considered in Sunni Islam to have been "rightly-guided", meaning that it sunnah, constitutes a model to be followed and emulated from a religious point of view. This term is not used by Shia Muslims, who reject the rule of the first three caliphs as illegitimate. Following Muhammad's death in June 632, Muslim leaders debated who Succession to Muhammad, should succeed him. Unlike later caliphs, Rashidun were often chosen by some form of a small group of high-ranking companions of the Prophet in () or appointed by their predecessor. Muhammad's close companion A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ulema

In Islam, the ''ulama'' ( ; also spelled ''ulema''; ; singular ; feminine singular , plural ) are scholars of Islamic doctrine and law. They are considered the guardians, transmitters, and interpreters of religious knowledge in Islam. "Ulama" may refer broadly to the educated class of such religious scholars, including theologians, canon lawyers (muftis), judges ( qadis), professors, and high state religious officials. Alternatively, "ulama" may refer specifically to those holding governmental positions in an Islamic state. By longstanding tradition, ulama are educated in religious institutions (''madrasas''). The Quran and sunnah (authentic hadith) are the scriptural sources of traditional Islamic law. Traditional way of education Students of Islamic doctrine do not seek out a specific educational institution, but rather seek to join renowned teachers. By tradition, a scholar who has completed their studies is approved by their teacher. At the teacher's individual dis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Studia Islamica

''Studia Islamica'' is a biannual peer-reviewed academic journal covering Islamic studies focusing on the history, religion, law, literature, and language of the Muslim world, primarily of the Southwest Asian and Mediterranean regions. The editor-in-chief is Houari Touati (School for Advanced Studies in the Social Sciences). Articles are published in English or French. History The journal was established in 1953 by Robert Brunschvig and Joseph Schacht and was published by . Since 2013 it has been published by Brill Publishers Brill Academic Publishers () is a Dutch international academic publisher of books, academic journals, and Bibliographic database, databases founded in 1683, making it one of the oldest publishing houses in the Netherlands. Founded in the South .... Abstracting and indexing The journal is abstracted and indexed in: References External links *{{Official website, http://www.studiaislamica.com/ Academic journals established in 1953 Islamic studies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Raid (military)

Raiding, also known as depredation, is a military tactics, military tactic or operational warfare "smash and grab" mission which has a specific purpose. Raiders do not capture and hold a location, but quickly retreat to a previous defended position before enemy forces can respond in a coordinated manner or formulate a counter-attack. Raiders must travel swiftly and are generally too lightly equipped and supported to be able to hold ground. A raiding group may consist of combatants specially trained in this tactic, such as commandos, or as a special mission assigned to any Regular army, regular troops. Raids are often a standard tactic in irregular warfare, employed by warriors, guerrilla warfare, guerrilla fighters or other irregular military forces. Some raids are large, for example the Sullivan Expedition. The purposes of a raid may include: * to demoralization (warfare), demoralize, confuse, or exhaust the enemy; * to destroy specific goods or installations of military or econo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

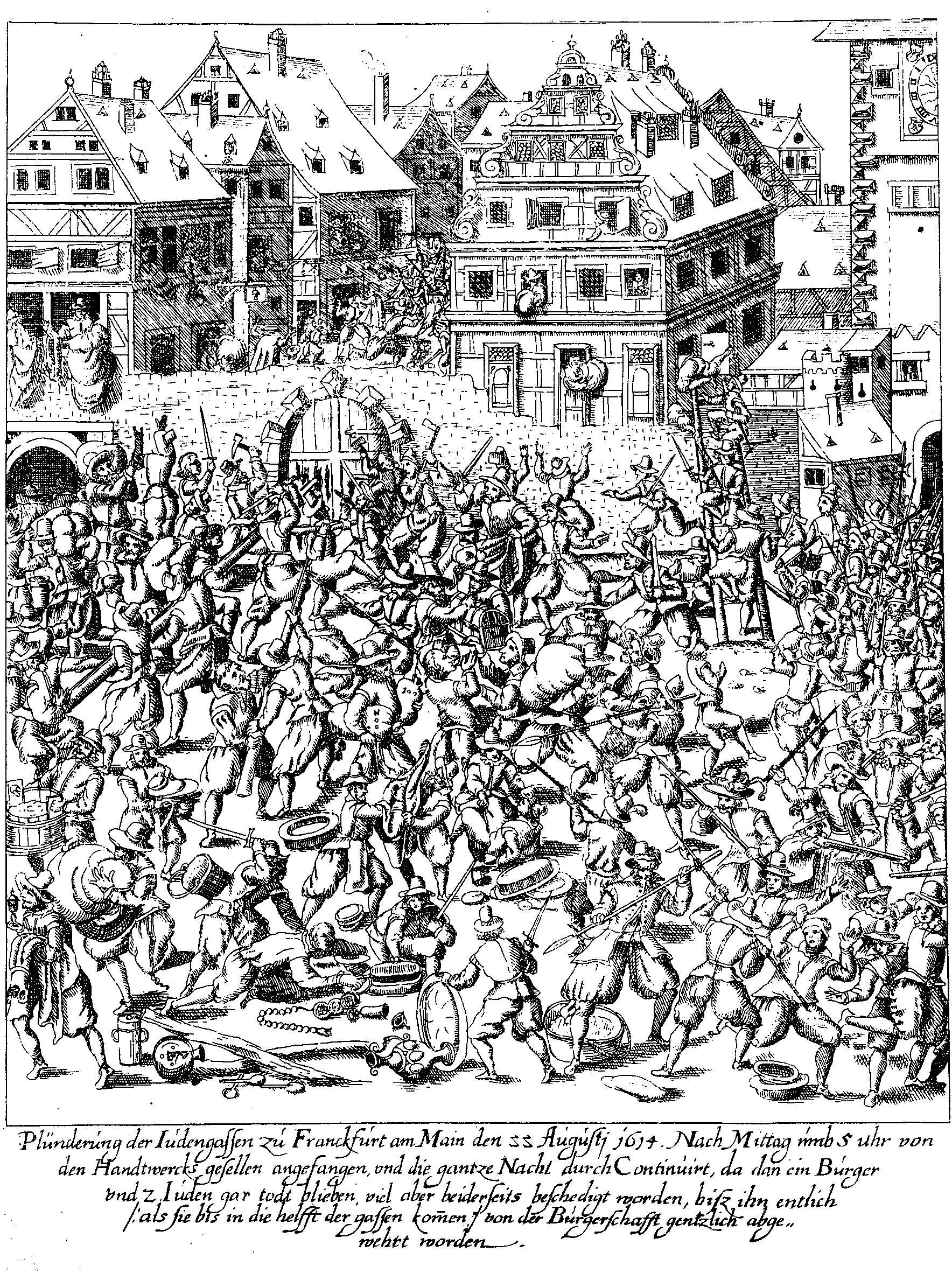

Looting

Looting is the act of stealing, or the taking of goods by force, typically in the midst of a military, political, or other social crisis, such as war, natural disasters (where law and civil enforcement are temporarily ineffective), or rioting. The proceeds of all these activities can be described as booty, loot, plunder, spoils, or pillage. Looting by a victorious army during war has been a common practice throughout recorded history. In the wake of the Napoleonic Wars and particularly after World War II, norms against wartime plunder became widely accepted. In modern armed conflicts, looting is prohibited by international law, and constitutes a war crime.Rule 52. Pillage is prohibited. ''Customary IHL Database'', International Committee of the Red Cross (ICRC)/Cambridge University Press. |

Ghanimah

In Islam, the spoils of war, also known as ''ghanimah'' (), refer to the wealth or property acquired by Muslims through jihad (warfare) against non-Muslims, including land, wealth, and material possessions like livestock, as well as captives. Etymology The term ghanimah is derived from the Arabic root that implies gain or profit, and it encompasses various forms of wealth, including material goods, land, and other resources captured during military campaigns. The concept of ghanimah has its roots in pre-Islamic Bedouin society, where raids ( ghazw) were a common practice for acquiring resources. Jurisprudence The rules for dividing the spoils date back to the Battle of Badr. The Quran explicitly addresses the distribution of ghanimah in Surah Al-Anfal (Chapter 8), where it is stated that one-fifth of the spoils (known as '' Khums'') belong to Allah and Muhammad, which is then used for community needs and distributed among specific groups such as the Prophet’s relatives, orp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Khums

In Islam, khums ( ) is a tax on Muslims which obligates them to pay one-fifth (20%) of their acquired wealth from the spoils of war and, according to most Muslim jurists, other specified types of income, towards various designated beneficiaries. In Islamic legal terminology, "spoils of war" ('' al-ghanima'') refers to property and wealth looted by the Muslim army after battling with non-Muslims or raiding them. Khums is the first Islamic tax, which was imposed in 2 AH/624 CE, after the Battle of Badr. It is separate from other Islamic taxes such as zakat and jizya.Zafar Iqbal and Mervyn Lewis, An Islamic Perspective on Governance, , pp. 102-3 It is treated differently in Sunni and Shia Islam; key topics of debate include the types of wealth subject to khums, the methods of its collection and distribution, and the categories of recipients (''asnāf''). Historically, one-fifth of the spoils of war (i.e., the khums) was placed at the disposal of the Islamic prophet Muhammad wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

`Umar

Umar ibn al-Khattab (; ), also spelled Omar, was the second Rashidun caliph, ruling from August 634 until his assassination in 644. He succeeded Abu Bakr () and is regarded as a senior companion and father-in-law of the Islamic prophet Muhammad. Initially, Umar opposed Muhammad, who was his distant Qurayshite kinsman. However, after converting to Islam in 616, he became the first Muslim to openly pray at the Kaaba. He participated in nearly all of Muhammad’s battles and expeditions, and Muhammad conferred upon him the title ''al-Fārūq'' ("the Distinguisher") for his sound judgement. After Muhammad’s death in June 632, Umar pledged allegiance to Abu Bakr as the first caliph and served as his chief adviser. In 634, shortly before his death, Abu Bakr nominated Umar as his successor. During Umar’s reign, the caliphate expanded at an unprecedented rate, conquering the Sasanian Empire and more than two-thirds of the Byzantine Empire. His campaigns against the Sasanians r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kharaj

Kharāj () is a type of individual Islamic tax on agricultural land and its produce, regardless of the religion of the owners, developed under Islamic law. With the first Muslim conquests in the 7th century, the ''kharaj'' initially was synonymous with '' jizyah'' and denoted a lump-sum duty levied upon the lands of conquered provinces, which was collected by hold-over officials of the defeated Byzantine Empire in the west and the Sassanid Empire in the east; later and more broadly, ''kharaj'' refers to a land-tax levied by Muslim rulers on their non-Muslim subjects, collectively known as '' dhimmi''. Muslim landowners, on the other hand, paid '' ushr'', a religious tithe on land, which carried a lower rate of taxation,Lewis (2002), p. 72 and ''zakat''. '' Ushr'' was a reciprocal 10% levy on agricultural land as well as merchandise imported from states that taxed Muslims on their products. Changes soon eroded the established tax base of the early Arab Caliphates. Additionally, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zakat

Zakat (or Zakāh زكاة) is one of the Five Pillars of Islam. Zakat is the Arabic word for "Giving to Charity" or "Giving to the Needy". Zakat is a form of almsgiving, often collected by the Muslim Ummah. It is considered in Islam a religious obligation, and by Quranic ranking, is next after prayer (''salat'') in importance. Eight heads of zakat are mentioned in the Quran. As one of the Five Pillars of Islam, zakat is a religious duty for all Muslims who meet the necessary criteria of wealth to help the needy. It is a mandatory charitable contribution, often considered to be a tax.Muḥammad ibn al-Ḥasan Ṭūsī (2010), ''Concise Description of Islamic Law and Legal Opinions'', , pp. 131–135. The payment and disputes on zakat have played a major role in the history of Islam, notably during the Ridda wars. Zakat on wealth is based on the value of all of one's possessions. It is customarily 2.5% (or ) of a Muslim's total savings and wealth above a minimum amount known ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |