|

Indiana State Teachers' Retirement Fund

The Indiana State Teachers’ Retirement Fund (TRF) was created by the Indiana General Assembly in 1921. Today, TRF manages and distributes the retirement benefits of educators in all public schools, as well as some charter schools and universities, throughout Indiana. Headed by a governor-appointed executive director and a six-member Board of Trustees, TRF aims to prudently manage the fund in accordance with fiduciary standards, provide quality benefits, and deliver a high level of service to TRF members while demonstrating responsibility to the citizens of the state. Members All legally qualified teachers who are regularly employed in the public school system of Indiana or in qualified positions at certain state institutions, as well as all TRF employees, must be members of TRF. Some legally qualified state employees and employers are eligible for optional enrollment. A legally qualified substitute teacher may become a member of TRF upon completion of one year of service (de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indiana General Assembly

The Indiana General Assembly is the state legislature, or legislative branch, of the U.S. state of Indiana. It is a bicameral legislature that consists of a lower house, the Indiana House of Representatives, and an upper house, the Indiana Senate. The General Assembly meets annually at the Indiana Statehouse in Indianapolis. Members of the General Assembly are elected from districts that are realigned every ten years. Representatives serve terms of two years and senators serve terms of four years. Both houses can create bills, but bills must pass both houses before they can be submitted to the governor and enacted into law. As of 2024, the Republican Party holds supermajorities in both chambers of the General Assembly. Republicans outnumber Democrats in the Senate by a 40–10 margin, and in the House of Representatives by a 70–30 margin. Structure The Indiana General Assembly is made up of two houses, the House of Representatives and the Senate. Indiana has a part-time ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public School (government Funded)

A state school, public school, or government school is a primary school, primary or secondary school that educates all students without charge. They are funded in whole or in part by taxation and operated by the government of the state. State-funded schools are global with each country showcasing distinct structures and curricula. Government-funded education spans from primary to secondary levels, covering ages 4 to 18. Alternatives to this system include homeschooling, Private school, private schools, Charter school, charter schools, and other educational options. By region and country Africa South Africa In South Africa, a state school or government school refers to a school that is state-controlled. These are officially called public schools according to the South African Schools Act of 1996, but it is a term that is not used colloquially. The Act recognised two categories of schools: public and independent. Independent schools include all private schools and schools t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Charter School

A charter school is a school that receives government funding but operates independently of the established state school system in which it is located. It is independent in the sense that it operates according to the basic principle of autonomy for accountability, that it is freed from the rules but accountable for results. Public vs. private school Charter schools are publicly funded schools that operate independently from their local district. Charter schools are often operated and maintained by a charter management organization (CMO). CMOs are typically non-profit organizations and provide centralized services for a group of charter schools. There are some for-profit education management organizations. Charter schools are held accountable by their authorizer. There is debate on whether charter schools should be described as private schools or state schools. Advocates of the charter model state that they are public schools because they are open to all students and do no ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Board Of Trustees

A board of directors is a governing body that supervises the activities of a business, a nonprofit organization, or a government agency. The powers, duties, and responsibilities of a board of directors are determined by government regulations (including the jurisdiction's corporate law) and the organization's own constitution and by-laws. These authorities may specify the number of members of the board, how they are to be chosen, and how often they are to meet. In an organization with voting members, the board is accountable to, and may be subordinate to, the organization's full membership, which usually elect the members of the board. In a stock corporation, non-executive directors are elected by the shareholders, and the board has ultimate responsibility for the management of the corporation. In nations with codetermination (such as Germany and Sweden), the workers of a corporation elect a set fraction of the board's members. The board of directors appoints the chief e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Levels Of Service

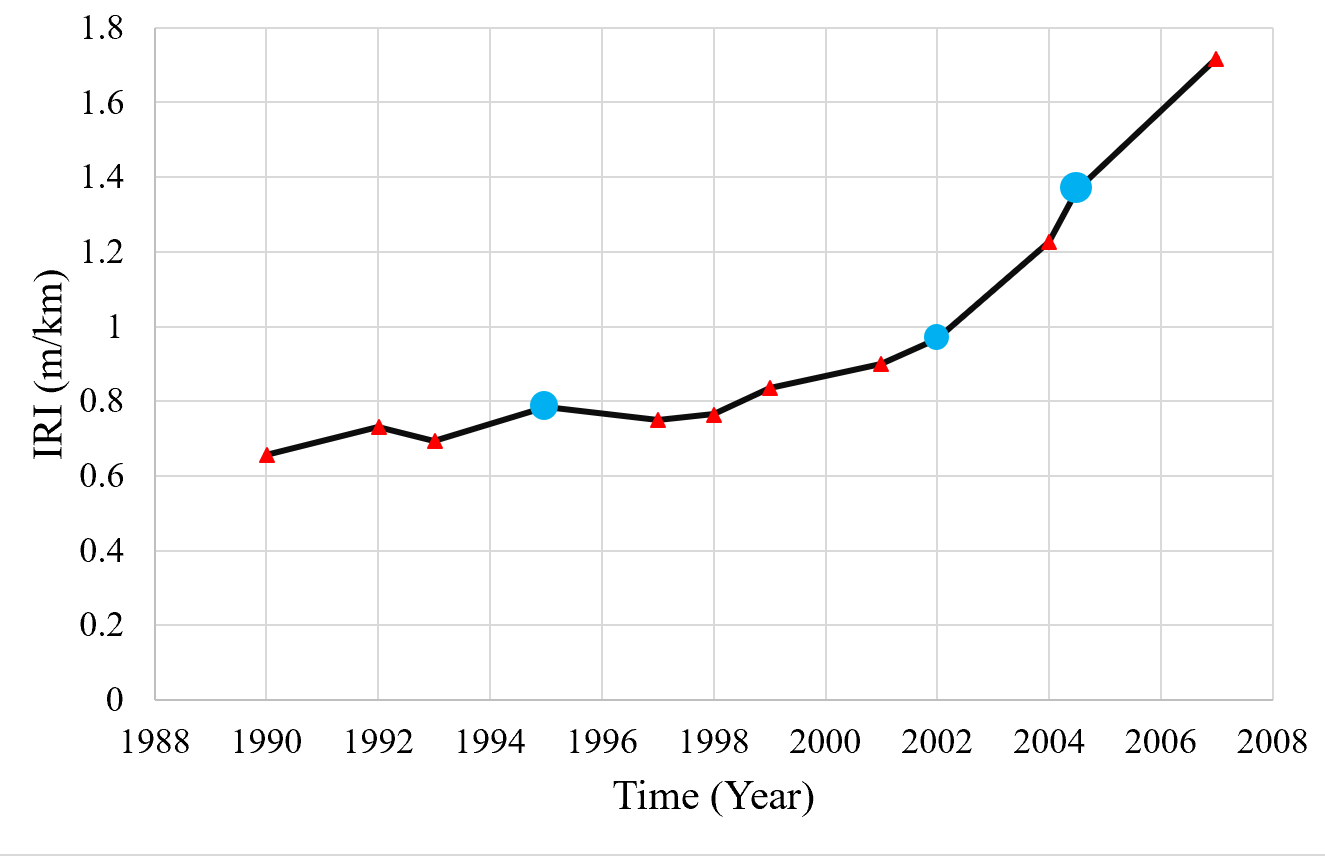

Levels of service (LOS) is a term in asset management referring to the quality of a given service. Defining and measuring levels of service is a key activity in developing infrastructure asset management plans. Levels of service may be tied to physical performance of assets or be defined via customer expectation and satisfaction. The latter is more service-centric rather than asset-centric. For instance, when measuring the LOS of a road A road is a thoroughfare used primarily for movement of traffic. Roads differ from streets, whose primary use is local access. They also differ from stroads, which combine the features of streets and roads. Most modern roads are paved. Th ..., it could be measured by a physical performance indicator such as Pavement Condition Index (PCI) or by a measure related to customer satisfaction such as the number of complaints per month about that certain road section. Or in the case of traffic level of service, it could be measured by the geom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Substitute Teacher

A substitute teacher is a person who teaches a school class when the regular teacher is absent or unavailable; e.g., because of illness, personal leave, maternal leave and so on. "Substitute teacher" (usually abbreviated as sub) is the most commonly used phrase in the United States, South Africa, Canada (except Ontario and New Brunswick), India and Ireland, while supply teacher is the most commonly used term in Great Britain and the Canadian provinces of Ontario and New Brunswick. The term cover teacher is also used in Great Britain. Common synonyms for substitute teacher include relief teacher or casual relief teacher (used in Australia and New Zealand, commonly appreciated as relief) and "emergency teacher" (used in some parts of the United States). Other terms, such as "guest teacher", are also used by some schools or districts. Regional variants in terminology are common, such as the use of the term teacher teaching on call (TTOC) in the Canadian province of British Columbi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Year

A fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations. Laws in many jurisdictions require company financial reports to be prepared and published on an annual basis but generally with the reporting period not aligning with the calendar year (1 January to 31 December). Taxation laws generally require accounting records to be maintained and taxes calculated on an annual basis, which usually corresponds to the fiscal year used for government purposes. The calculation of tax on an annual basis is especially relevant for direct taxes, such as income tax. Many annual government fees—such as council tax and license fees are also levied on a fiscal year basis, but others are charged on an anniversary basis. Some companies, such as Cisco Systems, end their fiscal year on the same day of the week each ye ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Individual Retirement Account

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. An individual retirement account is a type of individual retirement arrangement as described in IRS Publication 590, ''Individual Retirement Arrangements (IRAs)''. Other arrangements include individual retirement annuities and employer-established benefit trusts. Types There are several types of IRAs: * Traditional IRA – Contributions are mostly tax-deductible (often simplified as "money is deposited before tax" or "contributions are made with pre-tax assets"), no transactions within the IRA are taxed, and withdrawals in retirement are taxed as income (except for those portions of the withdrawal corresponding to contributions that were not deducted). Depending upon the nature ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security (United States)

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The Social Security Act was passed in 1935,Social Security Act of 1935 and the existing version of the Act, as amended, 2 USC 7 encompasses several social welfare and social insurance programs. The average monthly Social Security benefit for May 2025 was $1,903. This was raised from $1,783 in 2024. The total cost of the Social Security program for 2022 was $1.244 trillion or about 5.2 percent of U.S. gross domestic product (GDP). In 2025 there have been proposed budget cuts to social security. Social Security is funded primarily through payroll taxes called the Federal Insurance Contributions Act (FICA) or Self Employed Contributions Act (SECA). Wage and salary earnings from covered employment, up to an amount determined by law (see tax rate table), are subject to th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |