|

Haut Conseil Des Finances Publiques (France)

The High Council of Public Finances (HCFP) is an independent fiscal oversight body created by the Organic Law 2012-1403 in December 2012 by the french government in the framework European Union budgetary coordination. Its aim is to evaluate the assumptions made by the government in relation to the budgets and to ensure the coherence of public finances with the European budgetary agreements and pacts to which France is party. The HCFP operates under the responsibility of the Court of Audit (France), Court of Audit. Legal basis The HCFP operates under the authority granted to it by; * Organic Law 2012-1403 on public finances governance * European Fiscal Compact, European Budgetary Pact Objective The HCFP reports of the following variables used by the government when setting the budget; * GDP growth rate * Revenues & Spending by central & local government and public bodies * Revenues & Spending of the Social Security system * Deviations between previous year forecasts and ass ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Budget Of France

The budget of France, setting revenues and spending levels is set after approval of the national assembly and the senate. The Constitution of France, French Constitution provides for a maximum of 70 days between the budget being proposed to parliament and it being approved. Article 40 of the Constitution stops the National Assembly (France), National Assembly and Senate (France), Senate from making any amendments to the total spending and revenue amounts proposed by the government. Once approved by parliament, the government may make adjustments of up to 2% to the budget without having to seek further parliamentary approval. In 2011, the government introduced a bill to amend article 34 of the Constitution to ensure a balanced budget. The French budget concerns only spending and revenue by central government. It thus excludes the Social Security budget and regional and local authorities budgets. Public spending in 2013 See also * Decentralisation in France * Taxation in France ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Assembly Budget Office

The National Assembly Budget Office (NABO) supports the Korean National Assembly by analyzing and evaluating issues related to the national budget, fund and fiscal operations. History 2003. : Establishment of the National Assembly Budget Office 2007. : Initiation of government performance management evaluation program 2010. : Acquisition of access to national tax statistics 2012. : Publication of "Long-term Fiscal Projection 2012–2060" 2015. : Initiation of Special Taxation Evaluation Program : Initiation of the exclusive mandate to produce cost estimates of bills 2017. : Inauguration of the Seventh (current) Chief, Dr. Chunsoon Kim : Revision of Organization Rule (4 Department, 2 Deputy Directors General, 3 Directors, 17 Divisions and total of 138 staff) Mission The mission on the NABO is ''To support legislative activities through analysis and evaluation of national finances and policies''. Leadership The Speaker of the National Assembly appoints the Chief with the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Federalism

As a subfield of public economics, fiscal federalism is concerned with "understanding which functions and instruments are best centralized and which are best placed in the sphere of decentralized levels of government" (Oates, 1999). In other words, it is the study of how competencies (expenditure side) and fiscal instruments (revenue side) are allocated across different (vertical) layers of the administration. An important part of its subject matter is the system of transfer payments or grants by which a central government shares its revenues with lower levels of government. Federal governments use this power to enforce national rules and standards. There are two primary types of transfers, conditional and unconditional. A conditional transfer from a federal body to a province, or other territory, involves a certain set of conditions. If the lower level of government is to receive this type of transfer, it must agree to the spending instructions of the federal government. An example ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Policy And Political Reactions To The Eurozone Crisis

Policy is a deliberate system of guidelines to guide decisions and achieve rational outcomes. A policy is a statement of intent and is implemented as a procedure or protocol. Policies are generally adopted by a governance body within an organization. Policies can assist in both ''subjective'' and ''objective'' decision making. Policies used in subjective decision-making usually assist senior management with decisions that must be based on the relative merits of a number of factors, and as a result, are often hard to test objectively, e.g. work–life balance policy... Moreover, Governments and other institutions have policies in the form of laws, regulations, procedures, administrative actions, incentives and voluntary practices. Frequently, resource allocations mirror policy decisions. Policy is a blueprint of the organizational activities which are repetitive/routine in nature. In contrast, policies to assist in objective decision-making are usually operational in nature ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eurozone

The euro area, commonly called eurozone (EZ), is a currency union of 19 member states of the European Union (EU) that have adopted the euro (€) as their primary currency and sole legal tender, and have thus fully implemented EMU policies. The 19 eurozone members are Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. The eight non-eurozone members of the EU are Bulgaria, Czech Republic, Croatia, Denmark, Hungary, Poland, Romania, and Sweden. They continue to use their own national currencies, albeit all but Denmark are obliged to join once they meet the euro convergence criteria. Croatia will become the 20th member on 1 January 2023. Among non-EU member states, Andorra, Monaco, San Marino, and Vatican City have formal agreements with the EU to use the euro as their official currency and issue their own coins. In addition, Kosovo and Montenegro h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Agencies Established In 2012

A government is the system or group of people governing an organized community, generally a state. In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government is a means by which organizational policies are enforced, as well as a mechanism for determining policy. In many countries, the government has a kind of constitution, a statement of its governing principles and philosophy. While all types of organizations have governance, the term ''government'' is often used more specifically to refer to the approximately 200 independent national governments and subsidiary organizations. The major types of political systems in the modern era are democracies, monarchies, and authoritarian and totalitarian regimes. Historically prevalent forms of government include monarchy, aristocracy, timocracy, oligarchy, democracy, theocracy, and tyranny. These forms are not always mutually exclusive, and mixed governme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Office Of Budget Responsibility

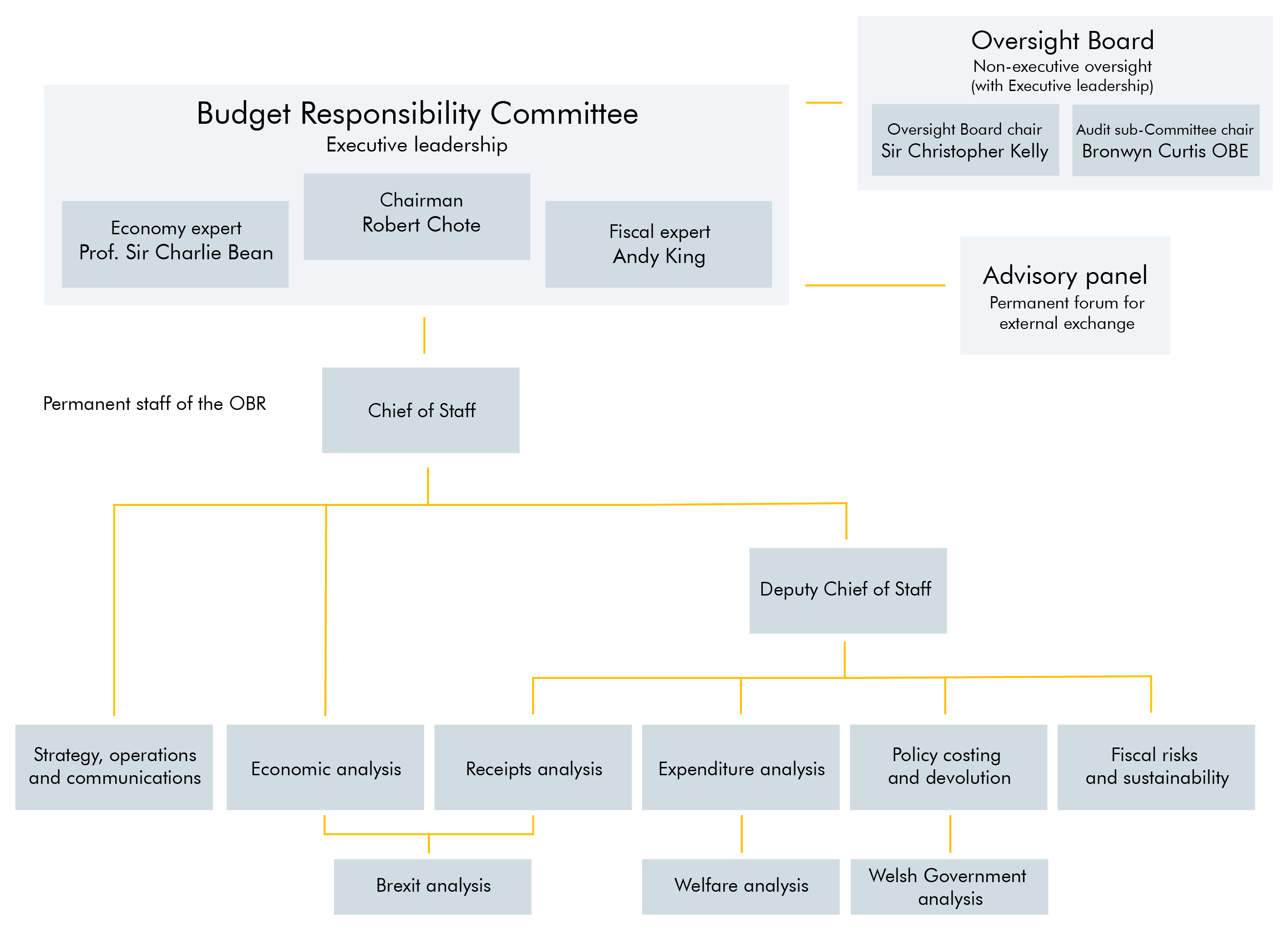

The Office for Budget Responsibility (OBR) is a non-departmental public body funded by the UK Treasury, that the UK government established to provide independent economic forecasts and independent analysis of the public finances. It was formally created in May 2010 following the general election (although it had previously been constituted in shadow form by the Conservative party opposition in December 2009) and was placed on a statutory footing by the Budget Responsibility and National Audit Act 2011. It is one of a growing number of official independent fiscal watchdogs around the world. Richard Hughes, former Director of Fiscal Policy at HM Treasury, has been head since October 2020. Functions The UK government created the OBR in 2010 with the goal of offering independent and authoritative analysis of the UK's public finances. To that end it produces two 5-year-ahead forecasts for the economy and the public finances each year, alongside the Budget and Spring Statements. In i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Independent Authority For Fiscal Responsibility (Spain)

The Independent Authority for Spanish Fiscal Responsibility (''Autoridad Independiente de Responsabilidad Fiscal española'', AIReF) is an independent List of agencies in Spain, agency for Public finance, fiscal control in Spain. It was created in 2013 by the Spanish government, Spanish Government, on the initiative of the European Union and to implement a constitutional mandate. The purpose of the Authority for Fiscal Responsibility is to oversee the sustainability of public finances as a means for ensuring economic growth and the wellbeing of Spanish society in the medium and long-term. It has its own legal personality and full public and private capacity. It carries out its functions autonomously and independently from the General Government and acts objectively, transparently and impartially. AIReF was set up in in implementation of the constitutional mandate set out in Article 135. On November 14th of that yearOrganic Law 6/2013 on the establishment of the Spanish Independe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bureau For Economic Policy Analysis

The Bureau for Economic Policy Analysis ( nl, Centraal Planbureau, CPB, literal translation: Central Planning Bureau) is a part of the Ministry of Economic Affairs and Climate Policy of the Netherlands. Its goal is to deliver economic analysis and forecasts. The CPB is an independent government agency founded at 15 September 1945 by Nobel laureate Jan Tinbergen. On 21 April 1947, it obtained its legal basis. It is located in The Hague, on Bezuidenhoutseweg. Clients of the CPB are mainly the cabinet of the Netherlands, politicians and political parties, ministries of the Netherlands, labour unions and employers' organisations. It also provides reports and advice for European Union initiatives. One of the government appointed members in the Social and Economic Council is Chair of the CPB. Status The CPB is financed by the Ministry of Economic Affairs, but it operates independently. This means it does have a stable income but also does not have to follow the ministry. This combinat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Budget Office

The Congressional Budget Office (CBO) is a federal agency within the legislative branch of the United States government that provides budget and economic information to Congress. Inspired by California's Legislative Analyst's Office that manages the state budget in a strictly nonpartisan fashion, the CBO was created as a nonpartisan agency by the Congressional Budget and Impoundment Control Act of 1974. Whereas politicians on both sides of the aisle have criticized the CBO when its estimates have been politically inconvenient, economists and other academics overwhelmingly reject that the CBO is partisan or that it fails to produce credible forecasts. There is a consensus among economists that "adjusting for legal restrictions on what the CBO can assume about future legislation and events, the CBO has historically issued credible forecasts of the effects of both Democratic and Republican legislative proposals." History The Congressional Budget Office was created by Title II of th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Parliamentary Budget Officer

The Office of the Parliamentary Budget Officer (OPBO; ) is an office of the Parliament of Canada which provides independent, authoritative and non-partisan financial and economic analysis. The office is led by the Parliamentary Budget Officer (PBO; ), an independent officer who supports parliamentarians in carrying out their constitutional roles of scrutinizing the raising and spending of public monies and generally overseeing the government's activities. History Creation of PBO (2006) The Parliamentary Budget Officer was established in 2006 by the Conservative government of Prime Minister Stephen Harper, as one of the independent oversight offices established by the '' Federal Accountability Act''. The act was the Harper government's first piece of legislation. The powers of the PBO are enshrined in the ''Parliament of Canada Act'' (Sections 79.1-79.5). The PBO's mission is to "support Parliament in exercising its oversight role in the government’s stewardship of public ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

France

France (), officially the French Republic ( ), is a country primarily located in Western Europe. It also comprises of Overseas France, overseas regions and territories in the Americas and the Atlantic Ocean, Atlantic, Pacific Ocean, Pacific and Indian Oceans. Its Metropolitan France, metropolitan area extends from the Rhine to the Atlantic Ocean and from the Mediterranean Sea to the English Channel and the North Sea; overseas territories include French Guiana in South America, Saint Pierre and Miquelon in the North Atlantic, the French West Indies, and many islands in Oceania and the Indian Ocean. Due to its several coastal territories, France has the largest exclusive economic zone in the world. France borders Belgium, Luxembourg, Germany, Switzerland, Monaco, Italy, Andorra, and Spain in continental Europe, as well as the Kingdom of the Netherlands, Netherlands, Suriname, and Brazil in the Americas via its overseas territories in French Guiana and Saint Martin (island), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.jpg)