|

Good Standing

A person or organization in good standing is regarded as having no financial obligations. A business entity that is in good standing has unabated powers to conduct its activities, which can include business endeavors. Similarly, a person who is in good standing within an organization or educational institution may take advantage of the benefits of membership or enrollment. In business United States In the USA, a business entity which is either registered with or chartered by a government agency such as a corporation, limited liability company, limited partnership, limited liability partnership, or limited liability limited partnership is said to be in good standing if it has filed and continued to file all appropriate paperwork with the government agency which provides its charter, and has paid all fees which are due for its charter or the renewal thereof. When an entity is in good standing with the chartering agency, it may obtain a "certificate of good standing" which indica ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as "born out of statute"; a legal person in a legal context) and recognized as such in Corporate law, law for certain purposes. Early incorporated entities were established by charter (i.e., by an ''ad hoc'' act granted by a monarch or passed by a parliament or legislature). Most jurisdictions now allow the creation of new corporations through List of company registers, registration. Corporations come in many different types but are usually divided by the law of the jurisdiction where they are chartered based on two aspects: whether they can issue share capital, stock, or whether they are formed to make a profit (accounting), profit. Depending on the number of owners, a corporation can be classified as ''aggregate'' (the subject of this articl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Liability Company

A limited liability company (LLC) is the United States-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. An LLC is not a corporation under the laws of every state; it is a legal form of a company that provides limited liability to its owners in many jurisdictions. LLCs are well known for the flexibility that they provide to business owners; depending on the situation, an LLC may elect to use corporate tax rules instead of being treated as a partnership, and, under certain circumstances, LLCs may be organized as not-for-profit. In certain U.S. states (for example, Texas), businesses that provide professional services requiring a state professional license, such as legal or medical services, may not be allowed to form an LLC but may be required to form a similar entity called a professional limited liability company (PLLC). An ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Partnership

A limited partnership (LP) is a type of partnership with general partners, who have a right to manage the business, and limited partners, who have no right to manage the business but have only limited liability for its debts. Limited partnerships are distinct from limited liability partnerships in which all partners have limited liability. The general partners (GPs) are, in all major respects, in the same legal position as partners in a conventional firm: they have management control, share the right to use partnership property, share the profits of the firm in predefined proportions, and have joint and several liability for the debts of the partnership. As in a general partnership, the GPs have actual authority, as agency law, agents of the firm, to bind the partnership in contracts with third parties that are in the ordinary course of the partnership's business. As with a general partnership, "an act of a general partner which is not apparently for carrying on in the ordinary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Liability Partnership

A limited liability partnership (LLP) is a partnership in which some or all partners (depending on the jurisdiction) have limited liabilities. It therefore can exhibit aspects of both partnerships and corporations. In an LLP, each partner is not responsible or liable for another partner's misconduct or negligence. This distinguishes an LLP from a traditional partnership under the UK Partnership Act 1890, in which each partner has joint (but not several) liability. In an LLP, some or all partners have a form of limited liability similar to that of the shareholders of a corporation. Depending on the jurisdiction, however, the limited liability may extend only to the negligence or misconduct of the other partners, and the partners may be personally liable for other liabilities of the firm or partners. Unlike corporate shareholders, the partners have the power to manage the business directly. In contrast, corporate shareholders must elect a board of directors under the laws of v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Liability Limited Partnership

The limited liability limited partnership (LLLP) is a relatively new modification of the limited partnership. The LLLP form of business entity is recognized under United States commercial law. An LLLP is a limited partnership A limited partnership (LP) is a type of partnership with general partners, who have a right to manage the business, and limited partners, who have no right to manage the business but have only limited liability for its debts. Limited partnership ..., and it consists of one or more general partners who are liable for the obligations of the entity, as well as or more protected-liability limited partners. Typically, general partners manage the LLLP, while the limited partners' interest is purely financial. Thus, the most common use of limited partnership is for purposes of investment. LLLP versus LP In a traditional limited partnership, the general partners are jointly and severally liable for their debts and obligations. Limited partners are not liable f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trust-fund Tax

A trust-fund tax is any type of tax in which the person or entity who is liable for the tax obtains it by collecting it from another party and holding the tax until paid to the particular government to which it is owed. For example a merchant collecting sales tax or an employer collecting payroll tax. The party collecting the tax is presumed to hold it ''in trust'' for the benefit of the government to whom it is due. They become liable for payment of the tax. A trust-fund tax is a type of tax or debt where (absent a personal guarantee) the management or responsible employees of a corporation or other entity with limited liability can be held personally liable for its non-payment. Trust-fund taxes include fuel taxes, sales taxes, excise taxes, and certain payroll taxes. Generally, any tax required to be withheld from an employee's paycheck (or required to be matched by the employer and additionally paid) for which the employee is liable for (or employer, for matching contributions), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies House

Companies House is the executive agency of the British Government that maintains the Company register, register of companies, employs the company registrars and is responsible for Incorporation (business), incorporating all forms of Company, companies in the United Kingdom. Prior to 1844, no central company register existed and Company, companies could only be Incorporation (business), incorporated through letters patent and Act of Parliament (UK), legislation. At the time, few incorporated companies existed; between 1801 and 1844, only about 100 companies were incorporated. The Joint Stock Companies Act 1844 created a centralised register of companies, enabled companies to be incorporated by registration, and established the office of the registrar; the Joint Stock Companies Act 1856 mandated separate registrars for each of the three Jurisdictions of the United Kingdom, UK jurisdictions. Initially just a brand, Companies House became an official executive agency in 1988. All P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Incorporation (business)

Incorporation is the formation of a new corporation. The corporation may be a business, a nonprofit organization, sports club, or a local government of a new city or town. In the United States Specific incorporation requirements in the United States differ on a state by state basis. However, there are common pieces of information that states require to be included in the certificate of incorporation. *Business purpose *Corporation name *Registered agent *Inc. *Share par value *Number of authorized shares of stock *Directors *Preferred shares *Officers *Legal address A business purpose describes the incorporated tasks a company has to do or provide. The purpose can be general, indicating that the budding company has been formed to carry out "all lawful business" in the region. Alternatively, the purpose can be specific, furnishing a more detailed explanation of the products and/or services to be offered by their company. The chosen name should be followed with a corporate iden ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Register Of Companies

This is a list of official business registers around the world. There are many types of official business registers, usually maintained for various purposes by a state authority, such as a government agency, or a court of law. In some cases, it may also be devolved to self-governing bodies, either commercial (a chamber of commerce) or professional (a regulatory college); or to a dedicated, highly regulated company (i.e., operator of a stock exchange, a multilateral trading facility, a central securities depository or an alternative trading system). The following is an incomplete list of official business registers by country. Types of registers A business register may include data on entities, as well as on their status for various purposes. Examples of such registers include: * company register — a register of legal entities in the jurisdiction they operate under, for the purpose of establishing, dissolving, acquisition of legal capacity and (in some cases) juridical ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Voluntary Associations

A voluntary group or union (also sometimes called a voluntary organization, common-interest association, association, or society) is a group of individuals who enter into an agreement, usually as volunteers, to form a body (or organization) to accomplish a purpose. Common examples include trade associations, trade unions, learned societies, professional associations, and environmental groups. All such associations reflect freedom of association in ultimate terms (members may choose whether to join or leave), although membership is not necessarily voluntary in the sense that one's employment may effectively require it via occupational closure. For example, in order for particular associations to function effectively, they might need to be mandatory or at least strongly encouraged, as is true of trade unions. Because of this, some people prefer the term common-interest association to describe groups which form out of a common interest, although this term is not widely used or unde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

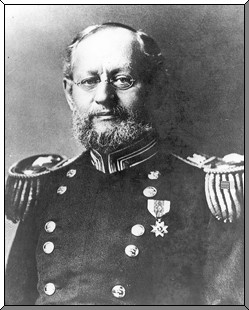

Robert's Rules Of Order

''Robert's Rules of Order'', often simply referred to as ''Robert's Rules'', is a manual of parliamentary procedure by U.S. Army officer Henry Martyn Robert (1837–1923). "The object of Rules of Order is to assist an assembly to accomplish the work for which it was designed [...] Where there is no law [...] there is the least of real liberty." The term ''Robert's Rules of Order'' is also used more generically to refer to any of the more recent editions, by various editors and authors, based on any of Robert's original editions, and the term is used more generically in the United States to refer to parliamentary procedure. It was written primarily to help guide voluntary associations in their operations of governance. Robert's manual was first published in 1876 as an adaptation of the rules and practice of the United States Congress to suit the needs of non-legislative societies. ''Robert's Rules'' is the most widely used manual of parliamentary procedure in the United States. I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fraud

In law, fraud is intent (law), intentional deception to deprive a victim of a legal right or to gain from a victim unlawfully or unfairly. Fraud can violate Civil law (common law), civil law (e.g., a fraud victim may sue the fraud perpetrator to avoid the fraud or recover monetary compensation) or criminal law (e.g., a fraud perpetrator may be prosecuted and imprisoned by governmental authorities), or it may cause no loss of money, property, or legal right but still be an element of another civil or criminal wrong. The purpose of fraud may be monetary gain or other benefits, such as obtaining a passport, travel document, or driver's licence. In cases of mortgage fraud, the perpetrator may attempt to qualify for a mortgage by way of false statements. Terminology Fraud can be defined as either a civil wrong or a criminal act. For civil fraud, a government agency or person or entity harmed by fraud may bring litigation to stop the fraud, seek monetary damages, or both. For cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |