|

Foundations Of Economic Analysis

''Foundations of Economic Analysis'' is a book by Paul A. Samuelson published in 1947 (Enlarged ed., 1983) by Harvard University Press. It is based on Samuelson's 1941 doctoral dissertation at Harvard University. The book sought to demonstrate a common mathematical structure underlying multiple branches of economics from two basic principles: maximizing behavior of agents (such as of utility by consumers and profits by firms) and stability of equilibrium as to economic systems (such as markets or economies). Among other contributions, it advanced the theory of index numbers and generalized welfare economics. It is especially known for definitively stating and formalizing qualitative and quantitative versions of the " comparative statics" method for calculating how a change in any parameter (say, a change in tax rates) affects an economic system. One of its key insights about comparative statics, called the correspondence principle, states that stability of equilibrium impli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Supply And Demand

In microeconomics, supply and demand is an economic model of price determination in a Market (economics), market. It postulates that, Ceteris_paribus#Applications, holding all else equal, the unit price for a particular Good (economics), good or other traded item in a perfect competition, perfectly competitive market, will vary until it settles at the market clearing, market-clearing price, where the quantity demanded equals the quantity supplied such that an economic equilibrium is achieved for price and quantity transacted. The concept of supply and demand forms the theoretical basis of modern economics. In situations where a firm has market power, its decision on how much output to bring to market influences the market price, in violation of perfect competition. There, a more complicated model should be used; for example, an oligopoly or product differentiation, differentiated-product model. Likewise, where a buyer has market power, models such as monopsony will be more a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Exogenous Variable

In an economic model, an exogenous variable is one whose measure is determined outside the model and is imposed on the model, and an exogenous change is a change in an exogenous variable.Mankiw, N. Gregory. ''Macroeconomics'', third edition, 1997.Varian, Hal R., ''Microeconomic Analysis'', third edition, 1992.Chiang, Alpha C. ''Fundamental Methods of Mathematical Economics'', third edition, 1984. In contrast, an endogenous variable is a variable whose measure is determined by the model. An endogenous change is a change in an endogenous variable in response to an exogenous change that is imposed upon the model. The term ' endogeneity' in econometrics has a related but distinct meaning. An endogenous random variable is correlated with the error term in the econometric model, while an exogenous variable is not. Examples In the LM model of interest rate determination, the supply of and demand for money Money is any item or verifiable record that is generally accepted as payment ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Consumer's Surplus

In mainstream economics, economic surplus, also known as total welfare or total social welfare or Marshallian surplus (after Alfred Marshall), is either of two related quantities: * Consumer surplus, or consumers' surplus, is the monetary gain obtained by consumers because they are able to purchase a product for a price that is less than the highest price that they would be willing to pay. * Producer surplus, or producers' surplus, is the amount that producers benefit by selling at a market price that is higher than the least that they would be willing to sell for; this is roughly equal to profit (since producers are not normally willing to sell at a loss and are normally indifferent to selling at a break-even price). The sum of consumer and producer surplus is sometimes known as social surplus or total surplus; a decrease in that total from inefficiencies is called deadweight loss. Overview In the mid-19th century, engineer Jules Dupuit first propounded the concept of econ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Marginal Utility

Marginal utility, in mainstream economics, describes the change in ''utility'' (pleasure or satisfaction resulting from the consumption) of one unit of a good or service. Marginal utility can be positive, negative, or zero. Negative marginal utility implies that every consumed additional unit of a commodity causes more harm than good, leading to a decrease in overall utility. In contrast, positive marginal utility indicates that every additional unit consumed increases overall utility. In the context of cardinal utility, liberal economists postulate a law of diminishing marginal utility. This law states that the first unit of consumption of a good or service yields more satisfaction or utility than the subsequent units, and there is a continuing reduction in satisfaction or utility for greater amounts. As consumption increases, the additional satisfaction or utility gained from each additional unit consumed falls, a concept known as ''diminishing marginal utility.'' This idea is us ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Cardinal Utility

In economics, a cardinal utility expresses not only which of two outcomes is preferred, but also the intensity of preferences, i.e. ''how much'' better or worse one outcome is compared to another. In consumer choice theory, economists originally attempted to replace cardinal utility with the apparently weaker concept of ordinal utility. Cardinal utility appears to impose the assumption that levels of absolute satisfaction exist, so magnitudes of increments to satisfaction can be compared across different situations. However, economists in the 1940s proved that under mild conditions, ordinal utilities imply cardinal utilities. This result is now known as the von Neumann–Morgenstern utility theorem; many similar utility representation theorems exist in other contexts. History In 1738, Daniel Bernoulli was the first to theorize about the marginal value of money. He assumed that the value of an additional amount is inversely proportional to the pecuniary possessions which a per ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Index (economics)

In economics, statistics, and finance, an index is a number that measures how a group of related data points—like prices, company performance, productivity, or employment—changes over time to track different aspects of economic health from various sources. Consumer-focused indices include the Consumer Price Index (CPI), which shows how retail prices for goods and services shift in a fixed area, aiding adjustments to salaries, Bond (finance), bond interest rates, and tax thresholds for inflation. The cost-of-living index (COLI) compares living expenses over time or across places.Turvey, Ralph. (2004) Consumer Price Index Manual: Theory And Practice.' Page 11. Publisher: International Labour Organization. . ''The Economist''’s Big Mac Index uses a Big Mac’s cost to explore currency values and purchasing power. Market performance indices track trends like company value or employment. Stock market index, Stock market indices include the Dow Jones Industrial Average and S&P 500, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Composite Good

In economics, a composite good is an abstraction that represents all but one of the goods in the relevant budget.* ''Deardorff's Glossary of International Economics''"Composite good."/ref> Purpose Consumer demand theory shows how the composite may be treated as if it were only a single good as to properties hypothesized about demand. The composite good represents what is given up along consumer's budget constraint to consume more of the first good. Reason for use Budget constraints are designed to show the maximum amount of a good, or combination of goods, that can be purchased by a consumer given a limited budget. In a single-good world, the cost of a good cannot be related to any other opportunities. Therefore, opportunity costs cannot be calculated. The addition of one new good to a single-good market allows for opportunity costs to be determined ''only'' in relation to that other good. However, its weakness is that it ignores ''all other possible choices''. Trying to solve t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

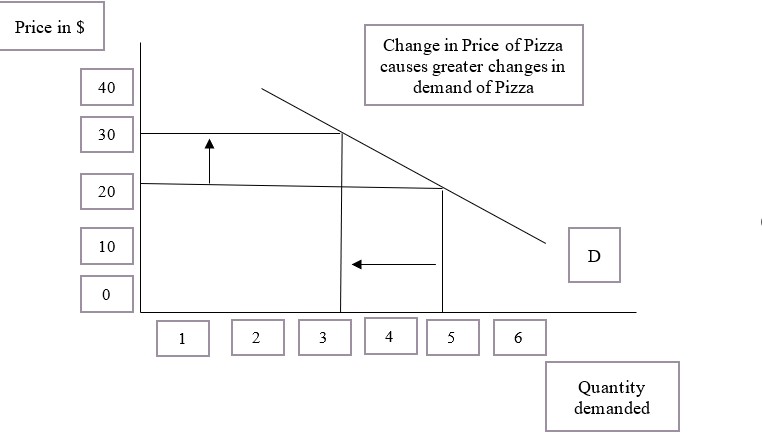

Elasticity (economics)

In economics, elasticity measures the responsiveness of one economic variable to a change in another. For example, if the price elasticity of the demand of a good is −2, then a 10% increase in price will cause the quantity demanded to fall by 20%. Elasticity in economics provides an understanding of changes in the behavior of the buyers and sellers with price changes. There are two types of elasticity for demand and supply, one is inelastic demand and supply and the other one is elastic demand and supply. Introduction The concept of price elasticity was first cited in an informal form in the book ''Principles of Economics (Marshall book), Principles of Economics'' published by the author Alfred Marshall in 1890. Subsequently, a major study of the price elasticity of supply and the price elasticity of demand for US products was undertaken by Joshua Levy and Trevor Pollock in the late 1960s. Elasticity is an important concept in neoclassical economic theory, and enables in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Consumer Theory

The theory of consumer choice is the branch of microeconomics that relates preferences to consumption expenditures and to consumer demand curves. It analyzes how consumers maximize the desirability of their consumption (as measured by their preferences subject to limitations on their expenditures), by maximizing utility subject to a consumer budget constraint. Factors influencing consumers' evaluation of the utility of goods include: income level, cultural factors, product information and physio-psychological factors. Consumption is separated from production, logically, because two different economic agents are involved. In the first case, consumption is determined by the individual. Their specific tastes or preferences determine the amount of utility they derive from goods and services they consume. In the second case, a producer has different motives to the consumer in that they are focussed on the profit they make. This is explained further by producer theory. The models ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |