|

Fisher Separation Theorem

In Economics, the Fisher separation theorem asserts that the primary objective of a corporation will be the maximization of its present value, regardless of the preferences of its shareholders. The theorem, therefore, separates management's "productive opportunities" from the entrepreneur's "market opportunities". It was proposed by—and is named after—the economist Irving Fisher. The theorem has its "clearest and most famous expositionin the ''Theory of Interest'' (1930); particularly in the "second approximation to the theory of interest"II:VI. {{Ref improve section, date=January 2011 The Fisher separation theorem states that: * the firm's Corporate_finance#The_investment_decision, investment decision is independent of the consumption preferences of the owner; * the investment decision is independent of the financing decision. * the value of a capital project (investment) is independent of the mix of methods – equity, debt, and/or cash – used to finance the project. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyses what is viewed as basic elements within economy, economies, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and Expenditure, investment expenditure interact; and the factors of production affecting them, such as: Labour (human activity), labour, Capital (economics), capital, Land (economics), land, and Entrepreneurship, enterprise, inflation, economic growth, and public policies that impact gloss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as "born out of statute"; a legal person in a legal context) and recognized as such in Corporate law, law for certain purposes. Early incorporated entities were established by charter (i.e., by an ''ad hoc'' act granted by a monarch or passed by a parliament or legislature). Most jurisdictions now allow the creation of new corporations through List of company registers, registration. Corporations come in many different types but are usually divided by the law of the jurisdiction where they are chartered based on two aspects: whether they can issue share capital, stock, or whether they are formed to make a profit (accounting), profit. Depending on the number of owners, a corporation can be classified as ''aggregate'' (the subject of this articl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Present Value

In economics and finance, present value (PV), also known as present discounted value (PDV), is the value of an expected income stream determined as of the date of valuation. The present value is usually less than the future value because money has interest-earning potential, a characteristic referred to as the time value of money, except during times of negative interest rates, when the present value will be equal or more than the future value. Time value can be described with the simplified phrase, "A dollar today is worth more than a dollar tomorrow". Here, 'worth more' means that its value is greater than tomorrow. A dollar today is worth more than a dollar tomorrow because the dollar can be invested and earn a day's worth of interest, making the total accumulate to a value more than a dollar by tomorrow. Interest can be compared to Renting, rent. Just as rent is paid to a landlord by a tenant without the ownership of the asset being transferred, interest is paid to a lender by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economist

An economist is a professional and practitioner in the social sciences, social science discipline of economics. The individual may also study, develop, and apply theories and concepts from economics and write about economic policy. Within this field there are many sub-fields, ranging from the broad philosophy, philosophical theory, theories to the focused study of minutiae within specific Market (economics), markets, macroeconomics, macroeconomic analysis, microeconomics, microeconomic analysis or financial statement analysis, involving analytical methods and tools such as econometrics, statistics, Computational economics, economics computational models, financial economics, regulatory impact analysis and mathematical economics. Professions Economists work in many fields including academia, government and in the private sector, where they may also "study data and statistics in order to spot trends in economic activity, economic confidence levels, and consumer attitudes. They ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Irving Fisher

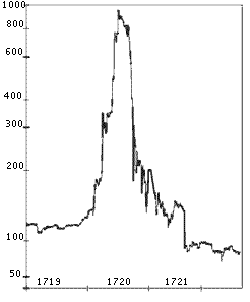

Irving Fisher (February 27, 1867 – April 29, 1947) was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school. Joseph Schumpeter described him as "the greatest economist the United States has ever produced", an assessment later repeated by James Tobin and Milton Friedman.Milton Friedman, ''Money Mischief: Episodes in Monetary History'', Houghton Mifflin Harcourt (1994) p. 37. Fisher made important contributions to utility theory and general equilibrium. He was also a pioneer in the rigorous study of intertemporal choice in markets, which led him to develop a theory of capital and interest rates. His research on the quantity theory of money inaugurated the school of macroeconomic thought known as "monetarism". Fisher was also a pioneer of econometrics, including the development of ind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Finance

Corporate finance is an area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to Shareholder value, maximize or increase valuation (finance), shareholder value.SeCorporate Finance: First Principles Aswath Damodaran, New York University's Stern School of Business Correspondingly, corporate finance comprises two main sub-disciplines. Capital budgeting is concerned with the setting of criteria about which value-adding Project#Corporate finance, projects should receive investment funding, and whether to finance that investment with ownership equity, equity or debt capital. Working capital management is the management of the company's monetary funds that deal with the short-term operating balance of current assets and Current liability, cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Modigliani–Miller Theorem

The Modigliani–Miller theorem (of Franco Modigliani, Merton Miller) is an influential element of economic theory; it forms the basis for modern thinking on capital structure. The basic theorem states that in the absence of taxes, bankruptcy costs, agency costs, and asymmetric information, and in an efficient market, the enterprise value of a firm is unaffected by how that firm is financed. This is not to be confused with the value of the equity of the firm. Since the value of the firm depends neither on its dividend policy nor its decision to raise capital by issuing shares or selling debt, the Modigliani–Miller theorem is often called the capital structure irrelevance principle. The key Modigliani–Miller theorem was developed for a world without taxes. However, if we move to a world where there are taxes, when the interest on debt is tax-deductible, and ignoring other frictions, the value of the company increases in proportion to the amount of debt used.Fernandes, Nuno. Fi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Theory Of Investment Value

''The'' is a grammatical article in English, denoting nouns that are already or about to be mentioned, under discussion, implied or otherwise presumed familiar to listeners, readers, or speakers. It is the definite article in English. ''The'' is the most frequently used word in the English language; studies and analyses of texts have found it to account for seven percent of all printed English-language words. It is derived from gendered articles in Old English which combined in Middle English and now has a single form used with nouns of any gender. The word can be used with both singular and plural nouns, and with a noun that starts with any letter. This is different from many other languages, which have different forms of the definite article for different genders or numbers. Pronunciation In most dialects, "the" is pronounced as (with the voiced dental fricative followed by a schwa) when followed by a consonant sound, and as (homophone of the archaic pronoun ''thee' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The New School

The New School is a Private university, private research university in New York City. It was founded in 1919 as The New School for Social Research with an original mission dedicated to academic freedom and intellectual inquiry and a home for progressive thinkers. Since then, the school has grown to house five divisions within the university. These include the Parsons School of Design, the Eugene Lang College of Liberal Arts, the College of Performing Arts at The New School, College of Performing Arts (which includes the Mannes School of Music), The New School for Social Research, and the Schools of Public Engagement. In addition, the university maintains the Parsons Paris campus and has also launched or housed a range of institutions, such as the international research institute World Policy Institute, the Vera List Center for Art and Politics, the India China Institute, the Observatory on Latin America, and the Center for New York City Affairs. It is Carnegie Classification of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internet Archive

The Internet Archive is an American 501(c)(3) organization, non-profit organization founded in 1996 by Brewster Kahle that runs a digital library website, archive.org. It provides free access to collections of digitized media including websites, Application software, software applications, music, audiovisual, and print materials. The Archive also advocates a Information wants to be free, free and open Internet. Its mission is committing to provide "universal access to all knowledge". The Internet Archive allows the public to upload and download digital material to its data cluster, but the bulk of its data is collected automatically by its web crawlers, which work to preserve as much of the public web as possible. Its web archiving, web archive, the Wayback Machine, contains hundreds of billions of web captures. The Archive also oversees numerous Internet Archive#Book collections, book digitization projects, collectively one of the world's largest book digitization efforts. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mark Rubinstein

Mark Edward Rubinstein (June 8, 1944 – May 9, 2019) was a leading financial economics, financial economist and financial engineering, financial engineer. He was Paul Stephens Professor of Applied Investment Analysis at the Haas School of Business of the University of California, Berkeley. He held various other professional offices, directing the American Finance Association, amongst others, especially portfolio insurance and the binomial options pricing model (also known as the John Carrington Cox, Cox-Stephen Ross (economist), Ross-Rubinstein model), as well as his work on discrete time stochastic calculus more generally. His book ''Option Markets'', was "the first work that popularized probabilistic and scientific methods in options, helping inaugurate the derivatives revolution." Along with fellow Berkeley finance professor Hayne E. Leland and adjunct professor John O'Brien, Rubinstein developed the portfolio insurance financial product in 1976. (This strategy later became ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |