|

Expected Shortfall

Expected shortfall (ES) is a risk measure—a concept used in the field of financial risk measurement to evaluate the market risk or credit risk of a portfolio. The "expected shortfall at q% level" is the expected return on the portfolio in the worst q\% of cases. ES is an alternative to value at risk that is more sensitive to the shape of the tail of the loss distribution. Expected shortfall is also called conditional value at risk (CVaR), average value at risk (AVaR), expected tail loss (ETL), and superquantile. ES estimates the risk of an investment in a conservative way, focusing on the less profitable outcomes. For high values of q it ignores the most profitable but unlikely possibilities, while for small values of q it focuses on the worst losses. On the other hand, unlike the discounted maximum loss, even for lower values of q the expected shortfall does not consider only the single most catastrophic outcome. A value of q often used in practice is 5%. Expected shortfall is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Measure

In financial mathematics, a risk measure is used to determine the amount of an asset or set of assets (traditionally currency) to be kept in reserve. The purpose of this reserve is to make the downside risk, risks taken by financial institutions, such as banks and insurance companies, acceptable to the regulator (economics), regulator. In recent years attention has turned to coherent risk measure, convex and coherent risk measurement. Mathematically A risk measure is defined as a mapping from a set of random variables to the real numbers. This set of random variables represents portfolio returns. The common notation for a risk measure associated with a random variable X is \rho(X). A risk measure \rho: \mathcal \to \mathbb \cup \ should have certain properties: ; Normalized : \rho(0) = 0 ; Translative : \mathrm\; a \in \mathbb \; \mathrm \; Z \in \mathcal ,\;\mathrm\; \rho(Z + a) = \rho(Z) - a ; Monotone : \mathrm\; Z_1,Z_2 \in \mathcal \;\mathrm\; Z_1 \leq Z_2 ,\; \mathrm \ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Distortion Risk Measure

In financial mathematics and economics, a distortion risk measure is a type of risk measure which is related to the cumulative distribution function of the return of a financial portfolio. Mathematical definition The function \rho_g: L^p \to \mathbb associated with the distortion function g: ,1\to ,1/math> is a ''distortion risk measure'' if for any random variable of gains X \in L^p (where L^p is the Lp space) then : \rho_g(X) = -\int_0^1 F_^(p) d\tilde(p) = \int_^0 \tilde(F_(x))dx - \int_0^ g(1 - F_(x)) dx where F_ is the cumulative distribution function for -X and \tilde is the dual distortion function \tilde(u) = 1 - g(1-u). If X \leq 0 almost surely then \rho_g is given by the Choquet integral, i.e. \rho_g(X) = -\int_0^ g(1 - F_(x)) dx. Equivalently, \rho_g(X) = \mathbb^ X/math> such that \mathbb is the probability measure generated by g, i.e. for any A \in \mathcal the sigma-algebra then \mathbb(A) = g(\mathbb(A)). Properties In addition to the properties of genera ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exponential Distribution

In probability theory and statistics, the exponential distribution or negative exponential distribution is the probability distribution of the distance between events in a Poisson point process, i.e., a process in which events occur continuously and independently at a constant average rate; the distance parameter could be any meaningful mono-dimensional measure of the process, such as time between production errors, or length along a roll of fabric in the weaving manufacturing process. It is a particular case of the gamma distribution. It is the continuous analogue of the geometric distribution, and it has the key property of being memoryless. In addition to being used for the analysis of Poisson point processes it is found in various other contexts. The exponential distribution is not the same as the class of exponential families of distributions. This is a large class of probability distributions that includes the exponential distribution as one of its members, but also includ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Logistic Distribution

In probability theory and statistics, the logistic distribution is a continuous probability distribution. Its cumulative distribution function is the logistic function, which appears in logistic regression and feedforward neural networks. It resembles the normal distribution in shape but has heavier tails (higher kurtosis). The logistic distribution is a special case of the Tukey lambda distribution. Specification Cumulative distribution function The logistic distribution receives its name from its cumulative distribution function, which is an instance of the family of logistic functions. The cumulative distribution function of the logistic distribution is also a scaled version of the Hyperbolic function, hyperbolic tangent. :F(x; \mu, s) = \frac = \frac12 + \frac12 \operatorname \left(\frac\right). In this equation is the mean, and is a scale parameter proportional to the standard deviation. Probability density function The probability density function is the partia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Laplace Distribution

In probability theory and statistics, the Laplace distribution is a continuous probability distribution named after Pierre-Simon Laplace. It is also sometimes called the double exponential distribution, because it can be thought of as two exponential distributions (with an additional location parameter) spliced together along the x-axis, although the term is also sometimes used to refer to the Gumbel distribution. The difference between two Independent identically-distributed random variables, independent identically distributed exponential random variables is governed by a Laplace distribution, as is a Brownian motion evaluated at an exponentially distributed random time. Increments of Laplace motion or a variance gamma process evaluated over the time scale also have a Laplace distribution. Definitions Probability density function A random variable has a \operatorname(\mu, b) distribution if its probability density function is : f(x \mid \mu, b) = \frac \exp\left( -\frac \rig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student's T-distribution

In probability theory and statistics, Student's distribution (or simply the distribution) t_\nu is a continuous probability distribution that generalizes the Normal distribution#Standard normal distribution, standard normal distribution. Like the latter, it is symmetric around zero and bell-shaped. However, t_\nu has Heavy-tailed distribution, heavier tails, and the amount of probability mass in the tails is controlled by the parameter \nu. For \nu = 1 the Student's distribution t_\nu becomes the standard Cauchy distribution, which has very fat-tailed distribution, "fat" tails; whereas for \nu \to \infty it becomes the standard normal distribution \mathcal(0, 1), which has very "thin" tails. The name "Student" is a pseudonym used by William Sealy Gosset in his scientific paper publications during his work at the Guinness Brewery in Dublin, Ireland. The Student's distribution plays a role in a number of widely used statistical analyses, including Student's t- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Normal Distribution

In probability theory and statistics, a normal distribution or Gaussian distribution is a type of continuous probability distribution for a real-valued random variable. The general form of its probability density function is f(x) = \frac e^\,. The parameter is the mean or expectation of the distribution (and also its median and mode), while the parameter \sigma^2 is the variance. The standard deviation of the distribution is (sigma). A random variable with a Gaussian distribution is said to be normally distributed, and is called a normal deviate. Normal distributions are important in statistics and are often used in the natural and social sciences to represent real-valued random variables whose distributions are not known. Their importance is partly due to the central limit theorem. It states that, under some conditions, the average of many samples (observations) of a random variable with finite mean and variance is itself a random variable—whose distribution c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Copula (probability Theory)

In probability theory and statistics, a copula is a multivariate cumulative distribution function for which the marginal probability distribution of each variable is uniform on the interval , 1 Copulas are used to describe / model the dependence (inter-correlation) between random variables. Their name, introduced by applied mathematician Abe Sklar in 1959, comes from the Latin for "link" or "tie", similar but only metaphoricly related to grammatical copulas in linguistics. Copulas have been used widely in quantitative finance to model and minimize tail risk and portfolio-optimization applications. Sklar's theorem states that any multivariate joint distribution can be written in terms of univariate marginal distribution functions and a copula which describes the dependence structure between the variables. Copulas are popular in high-dimensional statistical applications as they allow one to easily model and estimate the distribution of random vectors by estimati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

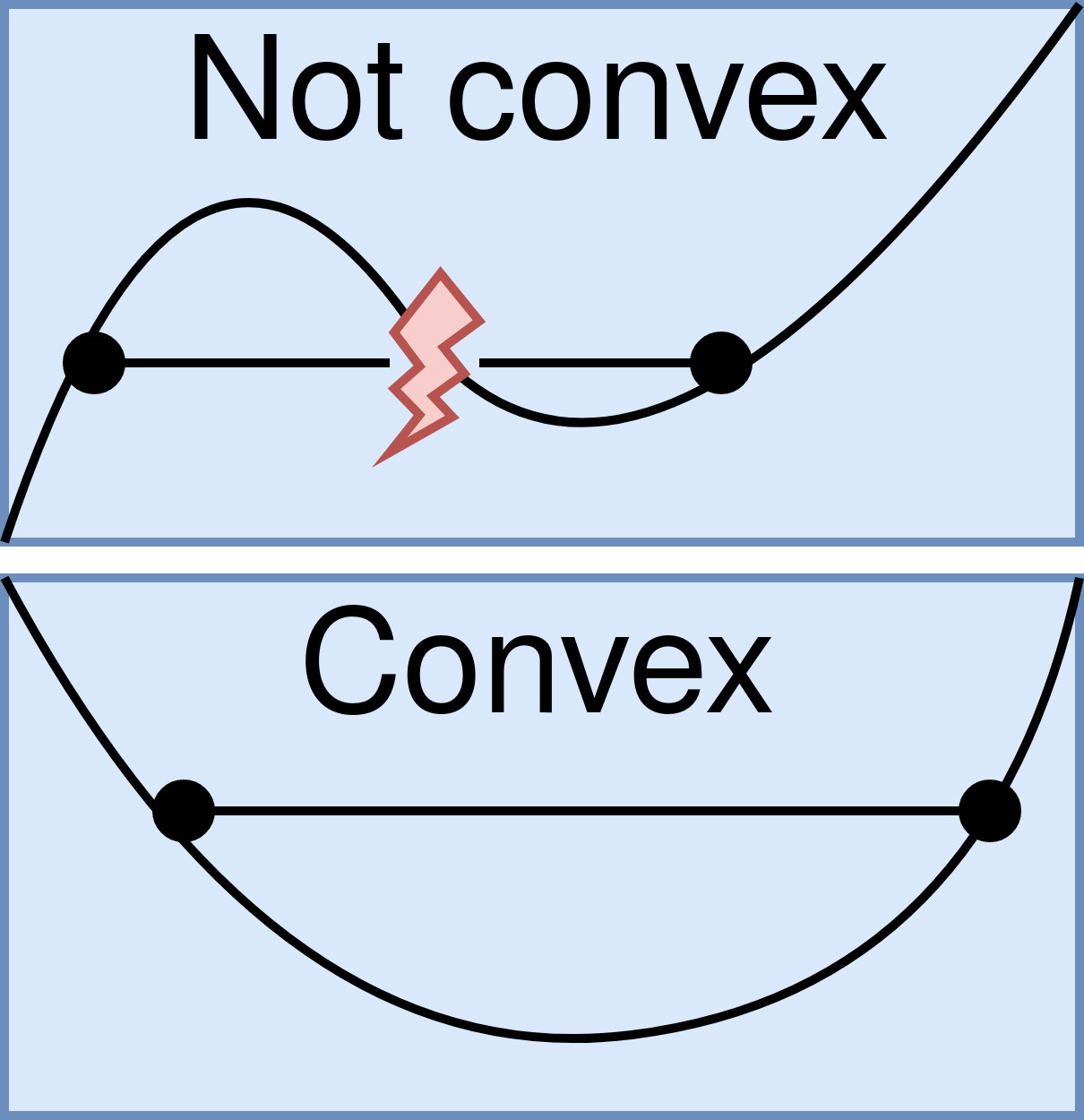

Convex Function

In mathematics, a real-valued function is called convex if the line segment between any two distinct points on the graph of a function, graph of the function lies above or on the graph between the two points. Equivalently, a function is convex if its epigraph (mathematics), ''epigraph'' (the set of points on or above the graph of the function) is a convex set. In simple terms, a convex function graph is shaped like a cup \cup (or a straight line like a linear function), while a concave function's graph is shaped like a cap \cap. A twice-differentiable function, differentiable function of a single variable is convex if and only if its second derivative is nonnegative on its entire domain of a function, domain. Well-known examples of convex functions of a single variable include a linear function f(x) = cx (where c is a real number), a quadratic function cx^2 (c as a nonnegative real number) and an exponential function ce^x (c as a nonnegative real number). Convex functions pl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Portfolio Optimization

Portfolio optimization is the process of selecting an optimal portfolio (asset distribution), out of a set of considered portfolios, according to some objective. The objective typically maximizes factors such as expected return, and minimizes costs like financial risk, resulting in a multi-objective optimization problem. Factors being considered may range from tangible (such as assets, liabilities, earnings or other fundamentals) to intangible (such as selective divestment). Modern portfolio theory Modern portfolio theory was introduced in a 1952 doctoral thesis by Harry Markowitz, where the Markowitz model was first defined. The model assumes that an investor aims to maximize a portfolio's expected return contingent on a prescribed amount of risk. Portfolios that meet this criterion, i.e., maximize the expected return given a prescribed amount of risk, are known as efficient portfolios. By definition, any other portfolio yielding a higher amount of expected return must also h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Modern Portfolio Theory

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of Diversification (finance), diversification in investing, the idea that owning different kinds of financial assets is less risky than owning only one type. Its key insight is that an asset's risk and return should not be assessed by itself, but by how it contributes to a portfolio's overall risk and return. The variance of return (or its transformation, the standard deviation) is used as a measure of risk, because it is tractable when assets are combined into portfolios. Often, the historical variance and covariance of returns is used as a proxy for the forward-looking versions of these quantities, but other, more sophisticated methods are available. Economist Harry Markowitz introduced MPT in a 1952 paper, for which he was later awarded a Nobel Memorial ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Linear Programming

Linear programming (LP), also called linear optimization, is a method to achieve the best outcome (such as maximum profit or lowest cost) in a mathematical model whose requirements and objective are represented by linear function#As a polynomial function, linear relationships. Linear programming is a special case of mathematical programming (also known as mathematical optimization). More formally, linear programming is a technique for the mathematical optimization, optimization of a linear objective function, subject to linear equality and linear inequality Constraint (mathematics), constraints. Its feasible region is a convex polytope, which is a set defined as the intersection (mathematics), intersection of finitely many Half-space (geometry), half spaces, each of which is defined by a linear inequality. Its objective function is a real number, real-valued affine function, affine (linear) function defined on this polytope. A linear programming algorithm finds a point in the po ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |