|

Ex-dividend Date

The ex-dividend date (coinciding with the reinvestment date for shares held subject to a dividend reinvestment plan) is an investment term involving the timing of payment of dividends on stocks of corporation A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as ...s, income trusts, and other financial holdings, both publicly and privately held. The ex-date or ex-dividend date represents the date on or after which a security is traded without a previously declared dividend or distribution. The opening price on the ex-dividend date, in comparison to the previous closing price, can be expected to decrease by the amount of the dividend, although this change may be obscured by other influences on the stock's value. A person purchasing a stock before its ex-dividend date, and holding th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividend Reinvestment Plan

A dividend reinvestment program or dividend reinvestment plan (DRIP) is an equity investment option offered directly from the underlying company. The investor does not receive dividends directly as cash; instead, the investor's dividends are directly reinvested in the underlying equity. The investor must still pay tax annually on his or her dividend income, whether it is received as cash or reinvested. DRIPs allow the investment return from dividends to be immediately invested for the purpose of price appreciation and compounding, without incurring brokerage fees or waiting to accumulate enough cash for a full share of stock. Some DRIPs are free of charge for participants, while others do charge fees and/or proportional commissions. Similarly income trusts and closed-end funds, which are numerous in Canada, can offer a distribution reinvestment plan and a unit purchase plan which operate principally the same as other plans. Because DRIPs, by their nature, encourage long-term ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities And Exchange Commission

The United States Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street crash of 1929. Its primary purpose is to enforce laws against market manipulation. Created by Section 4 of the Securities Exchange Act of 1934 (now codified as and commonly referred to as the Exchange Act or the 1934 Act), the SEC enforces the Securities Act of 1933, the Trust Indenture Act of 1939, the Investment Company Act of 1940, the Investment Advisers Act of 1940, and the Sarbanes–Oxley Act of 2002, among other statutes. Overview The SEC has a three-part mission: to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation. To achieve its mandate, the SEC enforces the statutory requirement that public companies and other regulated entities submit quarterly and annual reports, as well as other periodic disclosures. In addition to annual financial re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividend Units

{{investment-stub ...

In finance, a dividend unit is the right to receive payments equal to actual dividends paid on a share or a stock. A dividend unit can be granted for a term, for example 20 years from the date of grant. In the United States, dividend units are sometimes offered to employees as part of their retirement plan. References Units Unit may refer to: General measurement * Unit of measurement, a definite magnitude of a physical quantity, defined and adopted by convention or by law **International System of Units (SI), modern form of the metric system **English units, histo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividend Tax

A dividend tax is a tax imposed by a jurisdiction on dividends paid by a corporation to its shareholders (stockholders). The primary tax liability is that of the shareholder, though a tax obligation may also be imposed on the corporation in the form of a withholding tax. In some cases the withholding tax may be the extent of the tax liability in relation to the dividend. A dividend tax is in addition to any tax imposed directly on the corporation on its profits. Some jurisdictions do not tax dividends. To avoid a dividend tax being levied, a corporation may distribute surplus funds to shareholders by way of a share buy-back. These, however, are normally treated as capital gains, but may offer tax benefits when the tax rate on capital gains is lower than the tax rate on dividends. Another potential strategy is for a corporation not to distribute surplus funds to shareholders, who benefit from an increase in the value of their shareholding. These may also be subject to capital gain ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

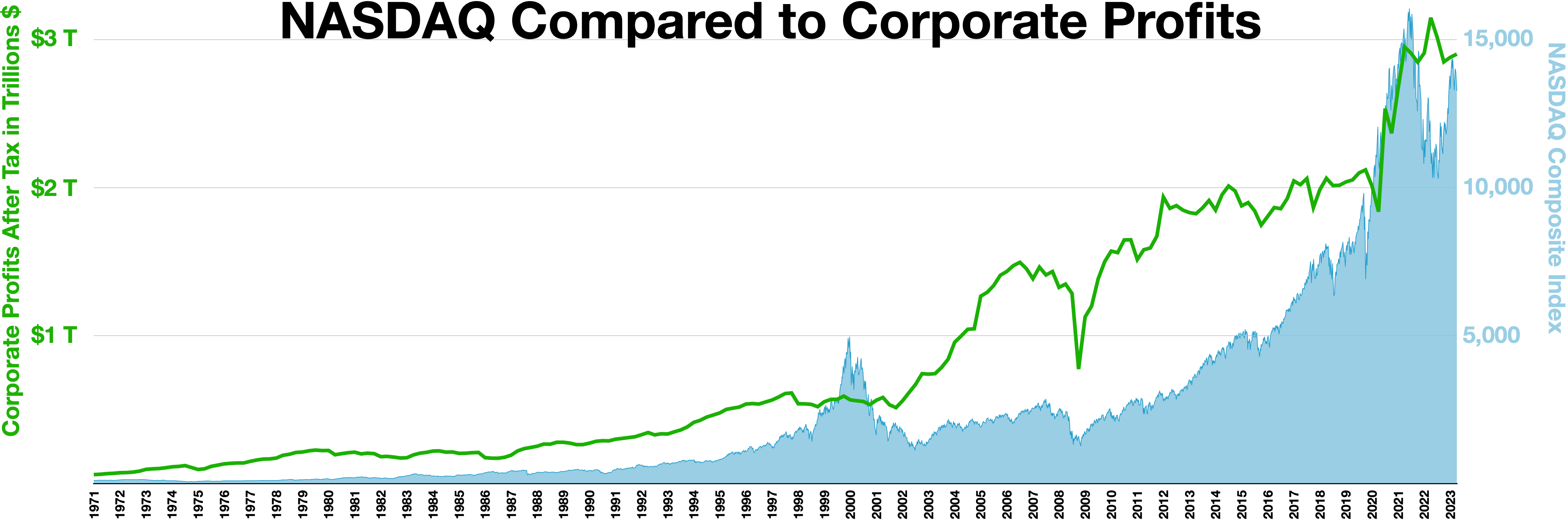

Nasdaq

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Splits

A stock split or stock divide increases the number of shares in a company. For example, after a 2-for-1 split, each investor will own double the number of shares, and each share will be worth half as much. A stock split causes a decrease of market price of individual shares, but does not change the total market capitalization of the company: stock dilution does not occur. A company may split its stock when the market price per share is so high that it becomes unwieldy when traded. One of the reasons is that a very high share price may deter small investors from buying the shares. Stock splits are usually initiated after a large run up in share price. Effects The main effect of stock splits is an increase in the liquidity of a stock: there are more buyers and sellers for 10 shares at $10 than 1 share at $100. Some companies avoid a stock split to obtain the opposite strategy: by refusing to split the stock and keeping the price high, they reduce trading volume. Berkshire Hathaw ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Special Dividend

A special dividend is a payment made by a company to its shareholders, that the company declares to be separate from the typical recurring dividend cycle, if any, for the company. Usually when a company raises the amount of its normal dividend, the investor expectation is that this marks a sustained increase. In the case of a special dividend, however, the company is signalling that this is a one-off payment. Therefore, special dividends do not markedly affect valuation or yield calculations, unless the amount is large—in which case they ''do'' markedly affect valuation as they are a direct and large depletion of the assets of the company. Typically, special dividends are distributed if a company has exceptionally strong earnings that it wishes to distribute to shareholders, or if it is making changes to its financial structure, such as debt ratio. A prominent example of a special dividend was the $3 dividend announced by Microsoft in 2004, to partially relieve its balanc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Estate Investment Trust

A real estate investment trust (REIT, pronounced "reet") is a company that owns, and in most cases operates, income-producing real estate. REITs own many types of real estate, including office and apartment buildings, studios, warehouses, hospitals, shopping centers, hotels and commercial forests. Some REITs engage in financing real estate. REITs act as a bridge from financial markets and institutional investors to housing and urban development. They are typically categorized into commercial REITs (C-REITs) and residential REITs (R-REITs), with the latter focusing on housing assets, such as apartments and single-family homes. Most countries' laws governing REITs entitle a real estate company to pay less in corporation tax and capital gains tax. REITs have been criticised as enabling speculation on housing, and reducing housing affordability, without increasing finance for building. REITs can be publicly traded on major exchanges, publicly registered but non-listed, or pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Fund

A mutual fund is an investment fund that pools money from many investors to purchase Security (finance), securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe ('investment company with variable capital'), and the open-ended investment company (OEIC) in the UK. Mutual funds are often classified by their principal investments: money market funds, bond fund, bond or fixed income funds, stock fund, stock or equity funds, or hybrid funds. Funds may also be categorized as index funds, which are passively managed funds that track the performance of an index, such as a stock market index or bond market index, or actively managed funds, which seek to outperform stock market indices but generally charge higher fees. The primary structures of mutual funds are open-end funds, closed-end funds, and unit investment trusts. Over long durations, passively managed funds consistently outperform actively m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Qualified Dividends

Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individual's ordinary income. The rates on qualified dividends range from 0 to 23.8%. The category of qualified dividend (as opposed to an ordinary dividend) was created in the Jobs and Growth Tax Relief Reconciliation Act of 2003 – previously, there was no distinction and all dividends were either untaxed or taxed together at the same rate. To qualify for the qualified dividend rate, the payee must own the stock for a long enough time, generally 60 days for common stock and 90 days for preferred stock. To qualify for the qualified dividend rate, the dividend must also be paid by a corporation in the U.S. or with certain ties to the U.S. Requirements To be taxed at the qualified dividend rate, the dividend must: * be paid after December 31, 2002 * be paid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Veterans Day (United States)

Veterans Day (originally known as Armistice Day) is a federal holidays in the United States, federal holiday in the United States observed annually on November 11, for honoring Veteran, military veterans of the United States Armed Forces. It coincides with holidays in several countries, including Armistice Day and Remembrance Day, which also occur on the anniversary of the end of World War I. Major hostilities of World War I were formally ended at the 11th hour of the 11th day of the 11th month of 1918 when the Armistice with Germany went into effect. At the urging of major U.S. veteran organizations, Armistice Day was renamed Veterans Day in 1954. Veterans Day is distinct from Memorial Day, a U.S. public holiday in May: Veterans Day commemorates the service of all U.S. veterans, while the older Memorial Day, which grew out of Civil War commemorations, specifically honors those who have died while in military service. Another military holiday that also occurs in May, Armed For ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Columbus Day

Columbus Day is a national holiday in many countries of the Americas and elsewhere, and a federal holiday in the United States, which officially celebrates the anniversary of Christopher Columbus's arrival in the Americas. He went ashore at Guanahaní, an island in the Bahamas, on October 12, 1492 S On his return in 1493, he moved his coastal base of operations 70 miles east to the island of Hispaniola, what is now the Dominican Republic and established the settlement of La Isabela, the first permanent Spanish settlement in the Americas. Christopher Columbus ( ) was an Italian explorer from Genoa who led a Spanish maritime expedition to cross the Atlantic Ocean in search of an alternative route to the Far East. Columbus believed he sailed his crew to the East Indies, but Europeans realized years later that his voyages landed them in the New World. His first voyage to the New World was made on the Spanish ships '' ''Niña'''', ''Pinta'', and ''Santa María'' and took abou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |