|

Debt Consolidation

Debt consolidation is a form of debt refinancing that entails taking out one loan to pay off many others. This commonly refers to a personal finance process of individuals addressing high consumer debt, but occasionally it can also refer to a country's fiscal approach to consolidate corporate debt or government debt. The process can secure a lower overall interest rate to the entire debt load and provide the convenience of servicing only one loan or debt. Debt consolidation is sometimes offered by loan sharks, charging clients exorbitant interest rates. Further regulation has been discussed as a result. Overview Debt generally refers to money owed by one party, the debtor, to a second party, the creditor. It is generally subject to repayments of principal and interest. Interest is the fee charged by the creditor to the debtor, generally calculated as a percentage of the principal sum per year known as an interest rate and generally paid periodically at intervals, such as monthl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Refinancing

Refinancing is the replacement of an existing debt obligation with another debt obligation under a different term and interest rate. The terms and conditions of refinancing may vary widely by country, province, or state, based on several economic factors such as inherent risk, projected risk, political stability of a nation, currency stability, banking regulations, borrower's credit worthiness, and credit rating of a nation. In many industrialized nations, common forms of refinancing include primary residence mortgages and car loans. If the replacement of debt occurs under financial distress, refinancing might be referred to as debt restructuring. A loan (debt) might be refinanced for various reasons: #To take advantage of a better interest rate (a reduced monthly payment or a reduced term) #To consolidate other debt into one loan (a potentially longer/shorter term contingent on interest rate differential and fees) #To reduce the monthly repayment amount (often for a longer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Card Debt

Credit card debt results when a client of a credit card company purchases an item or service through the card system. Debt grows through the accrual of interest and penalties when the consumer fails to repay the company for the money they have spent. If the debt is not paid on time, the company will charge a late-payment penalty and report the late payment to credit rating agencies. Late payment is sometimes referred to as " default". The late-payment penalty increases the customer's total debt. A customer's interest rate may be significantly increased as a result of them missing multiple payments. The penalty Annual percentage rate (APR) varies between card-issuing companies and is usually disclosed in literature at the time of a credit card application, and also on a paper notification that is sent with the credit card to the customer's residence. Research shows people with credit card debt are more likely than others to forgo medical care than others and that the likelih ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Home Equity Line Of Credit

A home equity line of credit, or HELOC ( /ˈhiːˌlɒk/ ''HEE-lok''), is a revolving type of secured loan in which the lender agrees to lend a maximum amount within an agreed period (called a term), where the collateral is the borrower's property (akin to a second mortgage). Because a home often is a consumer's most valuable asset, many homeowners use their HELOC for major purchases or projects, such as home improvements, education, property investment or medical bills, and choose not to use them for day-to-day expenses. A reason for the popularity of HELOCs is their flexibility, both in terms of borrowing and repaying. Furthermore, their popularity may also stem from having a better image than a " second mortgage", a term which can more directly imply an undesirable level of debt. However, within the lending industry itself, HELOCs are categorized as a second mortgage. HELOCs are usually offered at attractive interest rates. This is because they are secured against a borrower� ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Second Mortgage

Second mortgages, commonly referred to as junior liens, are loans secured by a property in addition to the primary Mortgage loan, mortgage. Depending on the time at which the second mortgage is originated, the loan can be structured as either a standalone second mortgage or piggyback second mortgage. Whilst a standalone second mortgage is opened subsequent to the primary loan, those with a piggyback loan structure are originated simultaneously with the primary mortgage. With regard to the method in which funds are withdrawn, second mortgages can be arranged as home equity loans or Home equity line of credit, home equity lines of credit. Home equity loans are granted for the full amount at the time of loan origination in contrast to home equity lines of credit which permit the homeowner access to a predetermined amount which is repaid during the Repayment mortgage, repayment period. Depending on the type of loan, interest rates charged on the second mortgage may be Fixed interest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Institution

A financial institution, sometimes called a banking institution, is a business entity that provides service as an intermediary for different types of financial monetary transactions. Broadly speaking, there are three major types of financial institution: # Depository institution – deposit (finance), deposit-taking institution that accepts and manages deposits and makes loans, including bank, building society, credit union, trust company, and mortgage broker; # Contractual institution – insurance company and pension fund # Investment institution – investment banking, investment bank, underwriter, and other different types of financial entities managing investments. Financial institutions can be distinguished broadly into two categories according to ownership structure: * commercial bank * cooperative banking, cooperative bank Some experts see a trend toward homogenisation of financial institutions, meaning a tendency to invest in similar areas and have similar business str ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt Settlement

Debt settlement (also called debt reduction, debt negotiation or debt resolution) is a settlement negotiated with a debtor's unsecured creditor. Commonly, creditors agree to forgive a large part of the debt: perhaps around half, though results can vary widely. When settlements are finalized, the terms are put in writing. It is common that the debtor makes one lump-sum payment in exchange for the creditor agreeing that the debt is now cancelled and the matter closed. Some settlements are paid out over a number of months. In either case, as long as the debtor does what is agreed in the negotiation, no outstanding debt will appear on the former debtor's credit report. History As a concept, lenders have been practicing debt settlement for thousands of years. However, the business of debt settlement became prominent in the USA during the late 1980s and early 1990s, when bank deregulation, which loosened consumer lending practices, followed by an economic recession, placed consumers in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Bankruptcy

Personal bankruptcy law allows, in certain jurisdictions, an individual to be declared bankrupt. Virtually every country with a modern legal system features some form of debt relief for individuals. Personal bankruptcy is distinguished from corporate bankruptcy. By country The DICE report 2006 of Munich's ifo Economic Research compared international personal bankruptcy in selected OECD-countries. United States In the United States, the same chapters of the Bankruptcy Code are applied in both personal and corporate bankruptcies. Most individuals who enter bankruptcy do so under Chapter 13 (a "reorganization" plan) or Chapter 7 (a "liquidation" of debtor's assets). More rarely, personal bankruptcy proceedings are carried out under Chapter 11 Chapter 11 of the United States Bankruptcy Code ( Title 11 of the United States Code) permits reorganization under the bankruptcy laws of the United States. Such reorganization, known as Chapter 11 bankruptcy, is available to every busi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Counseling

Credit counseling (known in the United Kingdom as debt counseling) is a process used to help individual debtors overcome their debt through financial education, budgeting, debt management plans (DMPs) – known in the United Kingdom as the individual voluntary arrangement (IVA) – and a variety of other tools with the goal of reducing and ultimately eliminating debt. Credit counseling is often provided by credit counseling agencies (CCAs). These agencies work with consumers to help them understand their financial situations and explore the best ways to repay their debts. Regulations on credit counseling and credit counseling agencies vary by country and sometimes within regions of the countries themselves. In the United States, individuals filing bankruptcy are required to receive credit counseling. Overview In the United States, the modern practice known as ‘‘credit counseling’’ was initiated by creditor banks and credit card companies during the mid-1960s to addres ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insolvency

In accounting, insolvency is the state of being unable to pay the debts, by a person or company ( debtor), at maturity; those in a state of insolvency are said to be ''insolvent''. There are two forms: cash-flow insolvency and balance-sheet insolvency. Cash-flow insolvency is when a person or company has enough assets to pay what is owed, but does not have the appropriate form of payment. For example, a person may own a large house and a valuable car, but not have enough liquid assets to pay a debt when it falls due. Cash-flow insolvency can usually be resolved by negotiation. For example, the bill collector may wait until the car is sold and the debtor agrees to pay a penalty. Balance-sheet insolvency is when a person or company does not have enough assets to pay all of their debts. The person or company might enter bankruptcy, but not necessarily. Once a loss is accepted by all parties, negotiation is often able to resolve the situation without bankruptcy. A company ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor. Bankrupt is not the only legal status that an insolvent person may have, meaning the term ''bankruptcy'' is not a synonym for insolvency. Etymology The word ''bankruptcy'' is derived from Italian language, Italian , literally meaning . The term is often described as having originated in Renaissance Italy, where there allegedly existed the tradition of smashing a banker's bench if he defaulted on payment. However, the existence of such a ritual is doubted. History In Ancient Greece, bankruptcy did not exist. If a man owed and he could not pay, he and his wife, children or servants were forced into "debt slavery" until the creditor recouped losses through their Manual labour, physical labour. Many city-states in ancient Greece lim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

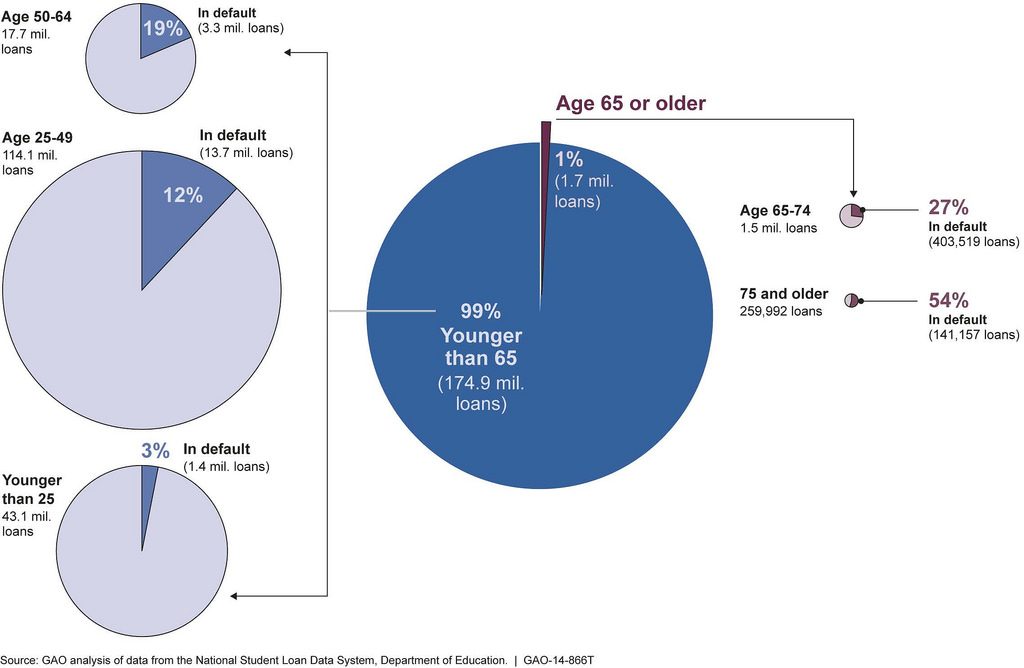

Student Loan

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. It also differs in many countries in the strict laws regulating renegotiating and bankruptcy. This article highlights the differences of the student loan system in several major countries. Australia Tertiary student places in Australia are usually funded through the HECS-HELP scheme. This funding is in the form of loans that are not normal debts. They are repaid over time via a supplementary tax, using a sliding scale based on taxable income. As a consequence, loan repayments are only made when the former student has income to support the repayments. Discounts are available for early repayment. The scheme is available to ci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |