|

Land Value Taxation

A land value tax (LVT) is a levy on the value of land without regard to buildings, personal property and other improvements upon it. Some economists favor LVT, arguing it does not cause economic inefficiency, and helps reduce economic inequality. A land value tax is a progressive tax, in that the tax burden falls on land owners, because land ownership is correlated with wealth and income. The land value tax has been referred to as "the perfect tax" and the economic efficiency of a land value tax has been accepted since the eighteenth century. Economists since Adam Smith and David Ricardo have advocated this tax because it does not hurt economic activity, and encourages development without subsidies. LVT is associated with Henry George, whose ideology became known as Georgism. George argued that taxing the land value is the most logical source of public revenue because the supply of land is fixed and because public infrastructure improvements would be reflected in (and thus pai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Land (economics)

In economics, land comprises all naturally occurring resources as well as geographic land. Examples include particular geographical locations, mineral deposits, forests, fish stocks, atmospheric quality, geostationary orbits, and portions of the electromagnetic spectrum. Supply of these resources is fixed. Factor of production Land is considered one of the three factors of production (also sometimes called the three producer goods) along with capital, and labor. Natural resources are fundamental to the production of all goods, including capital goods. While the particular role of land in the economy was extensively debated in classical economics it played a minor role in the neoclassical economics dominant in the 20th century. Income derived from ownership or control of natural resources is referred to as rent. Ownership Because no man created the land, it does not have a definite original proprietor, owner or user. Consequently, conflicting claims on geographic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Taiwan

Taxes provide an important source of revenue for various levels of the Government of the Republic of China. The tax revenue of Taiwan in 2015 amounted NT$2.1 trillion. Tax administration The Ministry of Finance, which is part of the Executive Yuan, is the highest government entity responsible for implementing taxation policies and overseeing the leveling and collection of taxes. Taxation occurs at both the national and local government level. National taxes Two broad categories of taxes exist at the national level: customs duties and inland taxes. Customs duties are administered by the Directorate-General of Customs, which has local offices throughout the country. Five national tax administrations who are directly subordinate to the central government handle oversight of all inland taxes. Inland taxes is a broad term that includes: *Income Tax; *Estate and Gift Tax; *Value-Added and Non-Value-Added Business Tax; *Tobacco and Alcohol Tax; *Commodity Tax; *Securities Transactio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William Vickrey

William Spencer Vickrey (21 June 1914 – 11 October 1996) was a Canadian-American professor of economics and Nobel Laureate. He was a lifelong faculty member at Columbia University. A theorist who worked on public economics and mechanism design, Vickrey primarily discussed public policy problems. He originated the Vickrey auction, introduced the concept of congestion pricing in networks, formalized arguments for marginal cost pricing, and contributed to optimal income taxation. James Tobin described him as "an applied economist’s theorist, as well as a theorist’s applied economist.” Vickrey was awarded the 1996 Nobel Memorial Prize in Economic Sciences with James Mirrlees for their research into the economic theory of incentives under asymmetric information. Vickrey never personally received the Prize; it was announced just three days prior to his death. Early years Vickrey was born in Victoria, British Columbia to Charles Vernon Vickrey, a Congregationalist minister, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deadweight Loss

In economics, deadweight loss is the loss of societal economic welfare due to production/consumption of a good at a quantity where marginal benefit (to society) does not equal marginal cost (to society). In other words, there are either goods being produced despite the cost of doing so being larger than the benefit, or additional goods are not being produced despite the fact that the benefits of their production would be larger than the costs. The deadweight loss is the net benefit that is missed out on. While losses to one entity often lead to gains for another, deadweight loss represents the loss that is not regained by anyone else. This loss is therefore attributed to both producers and consumers. Deadweight loss can also be a measure of lost economic efficiency when the socially optimal quantity of a good or a service is not produced. Non-optimal production can be caused by monopoly pricing in the case of artificial scarcity, a positive or negative externality, a tax or s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

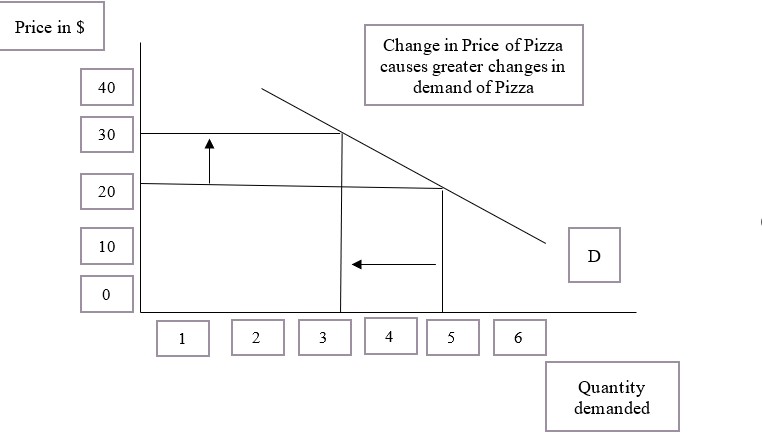

Demand Curve

A demand curve is a graph depicting the inverse demand function, a relationship between the price of a certain commodity (the ''y''-axis) and the quantity of that commodity that is demanded at that price (the ''x''-axis). Demand curves can be used either for the price-quantity relationship for an individual consumer (an individual demand curve), or for all consumers in a particular market (a market demand curve). It is generally assumed that demand curves slope down, as shown in the adjacent image. This is because of the law of demand: for most goods, the quantity demanded falls if the price rises. Certain unusual situations do not follow this law. These include Veblen goods, Giffen goods, and speculative bubbles where buyers are attracted to a commodity if its price rises. Demand curves are used to estimate behaviour in competitive markets and are often combined with supply curves to find the equilibrium price (the price at which sellers together are willing to sell the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Wealth Of Nations/Book V/Chapter 2

''The'' is a grammatical article in English, denoting nouns that are already or about to be mentioned, under discussion, implied or otherwise presumed familiar to listeners, readers, or speakers. It is the definite article in English. ''The'' is the most frequently used word in the English language; studies and analyses of texts have found it to account for seven percent of all printed English-language words. It is derived from gendered articles in Old English which combined in Middle English and now has a single form used with nouns of any gender. The word can be used with both singular and plural nouns, and with a noun that starts with any letter. This is different from many other languages, which have different forms of the definite article for different genders or numbers. Pronunciation In most dialects, "the" is pronounced as (with the voiced dental fricative followed by a schwa) when followed by a consonant sound, and as (homophone of the archaic pronoun ''thee' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Elasticity (economics)

In economics, elasticity measures the responsiveness of one economic variable to a change in another. For example, if the price elasticity of the demand of a good is −2, then a 10% increase in price will cause the quantity demanded to fall by 20%. Elasticity in economics provides an understanding of changes in the behavior of the buyers and sellers with price changes. There are two types of elasticity for demand and supply, one is inelastic demand and supply and the other one is elastic demand and supply. Introduction The concept of price elasticity was first cited in an informal form in the book ''Principles of Economics (Marshall book), Principles of Economics'' published by the author Alfred Marshall in 1890. Subsequently, a major study of the price elasticity of supply and the price elasticity of demand for US products was undertaken by Joshua Levy and Trevor Pollock in the late 1960s. Elasticity is an important concept in neoclassical economic theory, and enables in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Tax

A property tax (whose rate is expressed as a percentage or per mille, also called ''millage'') is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or Wealth tax, net wealth, taxes on the change of ownership of property through Inheritance tax, inheritance or Gift tax, gift and Financial transaction tax, taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or other Region, geographical region, or a Local government, municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted with a rent tax, which is based ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pennsylvania

Pennsylvania, officially the Commonwealth of Pennsylvania, is a U.S. state, state spanning the Mid-Atlantic (United States), Mid-Atlantic, Northeastern United States, Northeastern, Appalachian, and Great Lakes region, Great Lakes regions of the United States. It borders Delaware to its southeast, Maryland to its south, West Virginia to its southwest, Ohio and the Ohio River to its west, Lake Erie and New York (state), New York to its north, the Delaware River and New Jersey to its east, and the Provinces and territories of Canada, Canadian province of Ontario to its northwest via Lake Erie. Pennsylvania's most populous city is Philadelphia. Pennsylvania was founded in 1681 through a royal land grant to William Penn, the son of William Penn (Royal Navy officer), the state's namesake. Before that, between 1638 and 1655, a southeast portion of the state was part of New Sweden, a Swedish Empire, Swedish colony. Established as a haven for religious and political tolerance, the B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United States

The United States has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. Income tax in the United States, U.S. tax and transfer policies are Progressive tax, progressive and therefore reduce effective income inequality in the United States, income inequality, as rates of tax generally increase as taxable income increases. As a group, the lowest earning workers, especially those with dependents, pay no income taxes and may actually receive a small subsidy from the federal government (from child credits and the Earned Income Tax Credit). Taxes fall m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mexicali

Mexicali (; ) is the capital city of the States of Mexico, Mexican state of Baja California. The city, which is the seat of the Mexicali Municipality, has a population of 689,775, according to the 2010 census, while the Calexico–Mexicali, Calexico–Mexicali metropolitan area is home to 1,000,000 inhabitants on both sides of the Mexico–United States border. Mexicali is a regional economic and cultural hub for the border region of The Californias. Mexicali was founded at the turn of the 20th century, when the region's agricultural economy experienced a period of boom. The city rapidly expanded throughout the 20th century, owing to the proliferation of maquiladoras in the city, making the Mexicali economy more interconnected with businesses from across the border. Today, Mexicali is a major manufacturing center and an emerging tourist destination. History The Spaniards arrived in the area after crossing the Sonoran Desert's "Camino del Diablo" or Devil's Road. This led to t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |