|

Financial Capital

Financial capital (also simply known as capital or equity in finance, accounting and economics) is any Economic resources, economic resource measured in terms of money used by entrepreneurs and businesses to buy what they need to make their products or to provide their services to the sector of the economy upon which their operation is based (e.g. retail, corporate, investment banking). In other words, financial capital is internal retained earnings generated by the entity or funds provided by lenders (and Investor, investors) to businesses in order to purchase real capital equipment or services for producing new Goods and services, goods or services. In contrast, real capital comprises physical goods that assist in the production of other goods and services (e.g. shovels for gravediggers, sewing machines for tailors, or machinery and tooling for factories). IFRS concepts of capital maintenance ''Financial capital'' generally refers to saved-up financial Wealth (economics), we ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Productive Capacity

Productive capacity is the maximum possible output (economics), output of an economy. According to the United Nations Conference on Trade and Development (UNCTAD), no agreed-upon definition of maximum output exists. UNCTAD itself proposes: "the productive ''resources'', entrepreneurial ''capabilities'' and production ''linkages'' which together determine the capacity of a country to produce goods and services." The term may also be applied to individual resources or assets; for instance the productive capacity of an area of farmland. Definition in more depth Productive capacity has a lot in common with a Production–possibility frontier, production possibility frontier (PPF) that is an answer to the question what the maximum production capacity of a certain economy is which means using as many economy’s resources to make the output as possible. In a standard PPF graph, two types of goods’ quantities are set. PPF expresses all the possibilities of a combination of these goods ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Loan

A mortgage loan or simply mortgage (), in civil law (legal system), civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "collateral (finance), secured" on the borrower's property through a process known as mortgage origination. This means that a Mortgage law, legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or "repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Legal professions in England and Wales, Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken throu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

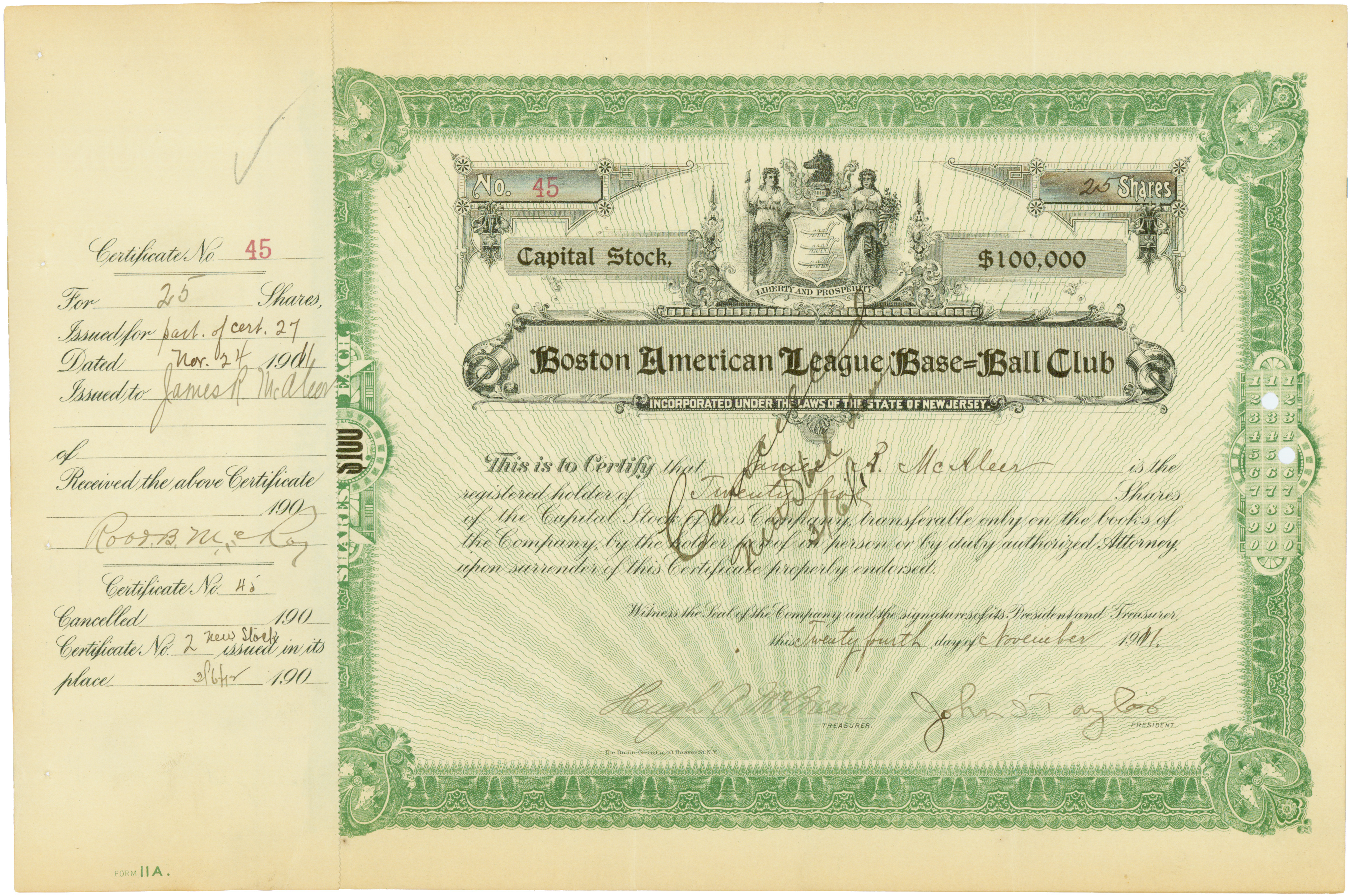

Share Capital

A corporation's share capital, commonly referred to as capital stock in the United States, is the portion of a corporation's equity that has been derived by the issue of shares in the corporation to a shareholder, usually for cash. ''Share capital'' may also denote the number and types of shares that compose a corporation's share structure. Definition In accounting, the share capital of a corporation is the nominal value of issued shares (that is, the sum of their par values, sometimes indicated on share certificates). If the allocation price of shares is greater than the par value, as in a rights issue, the shares are said to be sold at a premium (variously called share premium, additional paid-in capital or paid-in capital in excess of par). This equation shows the constituents that make up a company's real share capital: : \sum\text \times \text This is differentiated from share capital in the accounting sense, as it presents nominal share capital and does not take t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Requirement

A capital requirement (also known as regulatory capital, capital adequacy or capital base) is the amount of capital a bank or other financial institution has to have as required by its financial regulator. This is usually expressed as a capital adequacy ratio of equity as a percentage of risk-weighted assets. These requirements are put into place to ensure that these institutions do not take on excess leverage and risk becoming insolvent. Capital requirements govern the ratio of equity to debt, recorded on the liabilities and equity side of a firm's balance sheet. They should not be confused with reserve requirements, which govern the assets side of a bank's balance sheet—in particular, the proportion of its assets it must hold in cash or highly-liquid assets. Capital is a source of funds, not a use of funds. From the 1880s to the end of the First World War, the capital-to-assets ratios globally declined sharply, before remaining relatively steady during the 20th century. Reg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Signalling (economics)

Signalling (or signaling; see American and British English spelling differences#Doubled consonants, spelling differences) in contract theory is the idea that one party (the law of agency, agent) credibly conveys some information about itself to another party (the principal (commercial law), principal). Signalling was already discussed and mentioned in the seminal Theory of Games and Economic Behavior, which is considered to be the text that created the research field of game theory. Although signalling theory was initially developed by Michael Spence based on observed knowledge gaps between organisations and prospective employees, its intuitive nature led it to be adapted to many other domains, such as Human Resource Management, business, and financial markets. In Spence's job-market signaling model, (potential) employees send a signal about their ability level to the employer by acquiring education credentials. The informational value of the credential comes from the fact that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Productive Capital

In political philosophy, the means of production refers to the generally necessary assets and resources that enable a society to engage in production. While the exact resources encompassed in the term may vary, it is widely agreed to include the classical factors of production (land, labour, and capital) as well as the general infrastructure and capital goods necessary to reproduce stable levels of productivity. It can also be used as an abbreviation of the "means of production and distribution" which additionally includes the logistical distribution and delivery of products, generally through distributors; or as an abbreviation of the "means of production, distribution, and exchange" which further includes the exchange of distributed products, generally to consumers. The concept of "Means of Production" is used by researchers in various fields of study — including politics, economics, and sociology — to discuss, broadly, the relationship between anything that can have pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sociology Of Education (journal)

''Sociology of Education'' is a peer-reviewed academic journal that publishes papers in the fields of Sociology and Education. The journal's editor is Linda Renzulli ( Purdue University). It has been in publication since 1963 and is currently published by SAGE Publications in association with American Sociological Association. Publication history The journal was originally named ''The Journal of Educational Sociology,'' which began publication in 1927, sponsored by the Payne Educational Sociology Foundation of Phi Delta Kappa. The title was changed to ''Sociology of Education'' in 1963, and became sponsored by the American Sociological Association. The publication changed to a quarterly distribution schedule and continued the volume numbering of its predecessor.Dodson, Dan W. "Valedictory." ''The Journal of Educational Sociology'' 36, no. 9 (1963): 407-09. doi:10.2307/2264603. Scope ''Sociology of Education'' publishes research that aims to examine how social institutions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital (economics)

In economics, capital goods or capital are "those durable produced goods that are in turn used as productive inputs for further production" of goods and services. A typical example is the machinery used in a factory. At the macroeconomic level, "the nation's capital stock includes buildings, equipment, software, and inventories during a given year." The means of production is as a "... series of heterogeneous commodities, each having specific technical characteristics ..." "capital goods", are one of the three types of intermediate goods used in the production process, the other two being land and labour. The three are also known collectively as "primary factors of production". This classification originated during the classical economics period and has remained the dominant method for classification. Capital can be increased by the use of a production process (see production function and factors of production). Outputs of the production process are normally classif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wealth

Wealth is the abundance of valuable financial assets or physical possessions which can be converted into a form that can be used for transactions. This includes the core meaning as held in the originating Old English word , which is from an Indo-European word stem. The modern concept of wealth is of significance in all areas of economics, and clearly so for growth economics and development economics, yet the meaning of wealth is context-dependent. A person possessing a substantial net worth is known as ''wealthy''. Net worth is defined as the current value of one's assets less liabilities (excluding the principal in trust accounts). At the most general level, economists may define wealth as "the total of anything of value" that captures both the subjective nature of the idea and the idea that it is not a fixed or static concept. Various definitions and concepts of wealth have been asserted by various people in different contexts.Denis "Authentic Development: Is it Sustaina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Time Value Of Money

The time value of money refers to the fact that there is normally a greater benefit to receiving a sum of money now rather than an identical sum later. It may be seen as an implication of the later-developed concept of time preference. The time value of money refers to the observation that it is better to receive money sooner than later. Money you have today can be invested to earn a positive rate of return, producing more money tomorrow. Therefore, a dollar today is worth more than a dollar in the future. The time value of money is among the factors considered when weighing the opportunity costs of spending rather than saving or investing money. As such, it is among the reasons why interest is paid or earned: interest, whether it is on a bank deposit or debt, compensates the depositor or lender for the loss of their use of their money. Investors are willing to forgo spending their money now only if they expect a favorable net rate of return, return on their investment in the fut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |