|

Capital Participation

Capital participation (sometimes also called ''equity participation'' or ''equity interest'') is a form of equity sharing not restricted to housing, in which a company, infrastructure, property or business is shared between different parties. Shareholders invest in a business for profit maximization and cost savings, e.g., through tax deduction. A visible and controversial form of capital participation can be found in public–private partnerships in which the private sector invests in public projects and usually receive a time-limited concession for ownership or operation to make profits from the acquired property. See also * Risk capital * Angel investor * Shareholder * Profit sharing * Private equity * Takeover * Mergers and acquisitions * Privatization Privatization (rendered privatisation in British English) can mean several different things, most commonly referring to moving something from the public sector into the private sector. It is also sometimes used as a syn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity Sharing

Equity sharing is another name for shared ownership or '' co-ownership''. It takes one property, more than one owner, and blends them to maximize profit and tax deductions. Typically, the parties find a home and buy it together as co-owners, but sometimes they join to co-own a property one of them already owns. At the end of an agreed term, they buy one another out or sell the property and split the equity. In England, equity sharing and shared ownership are not the same thing (see the United Kingdom and England sections below). Equity sharing in different countries United States Equity sharing became desirable in the United States when in 1981 Section 280A of the Internal Revenue Code allowed mixed tax use of a single property for the first time permitting the occupier to claim principal residence tax deductions and the investor to claim investment property tax deductions. Since shared ownership is conferred by the federal tax code, this ownership vehicle can be used in any ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shareholder

A shareholder (in the United States often referred to as stockholder) of corporate stock refers to an individual or legal entity (such as another corporation, a body politic, a trust or partnership) that is registered by the corporation as the legal owner of shares of the share capital of a public or private corporation. Shareholders may be referred to as members of a corporation. A person or legal entity becomes a shareholder in a corporation when their name and other details are entered in the corporation's register of shareholders or members, and unless required by law the corporation is not required or permitted to enquire as to the beneficial ownership of the shares. A corporation generally cannot own shares of itself. The influence of shareholders on the business is determined by the shareholding percentage owned. Shareholders of corporations are legally separate from the corporation itself. They are generally not liable for the corporation's debts, and the shareholders ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit Maximization

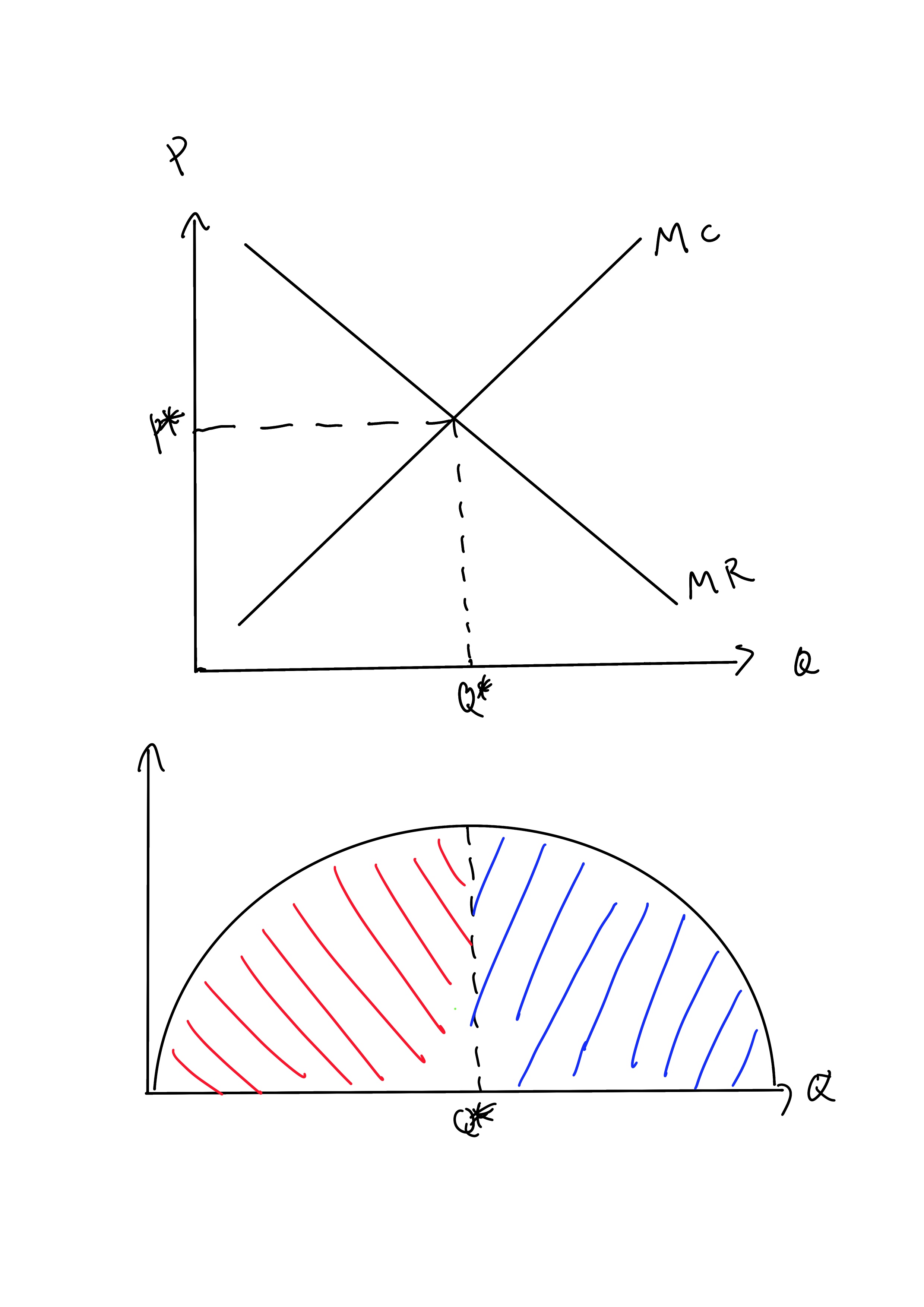

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit (or just profit in short). In neoclassical economics, which is currently the mainstream approach to microeconomics, the firm is assumed to be a " rational agent" (whether operating in a perfectly competitive market or otherwise) which wants to maximize its total profit, which is the difference between its total revenue and its total cost. Measuring the total cost and total revenue is often impractical, as the firms do not have the necessary reliable information to determine costs at all levels of production. Instead, they take more practical approach by examining how small changes in production influence revenues and costs. When a firm produces an extra unit of product, the additional revenue gained from selling it is called the marginal revenue (\text), and the additional cost to produce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Saving

Cost reduction is the process used by organisations aiming to reduce their costs and increase their profits, or to accommodate reduced income. Depending on a company’s services or products, the strategies can vary. Every decision in the product development process affects cost: design is typically considered to account for 70–80% of the final cost of a project such as an engineering project or the construction of a building. In the public sector, cost reduction programs can be used where income is reduced or to reduce debt levels. Importance Companies typically launch a new product without focusing too much on cost. Cost becomes more important when competition increases and PRICE becomes a differentiator in the market. The importance of cost reduction in relation to other strategic business goals is often debated. Examples of cost reduction strategies and programmes Commercial businesses Consultants Deloitte reported in 2006 that over three-quarters of the FTSE 100 listed co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Deduction

A tax deduction or benefit is an amount deducted from taxable income, usually based on expenses such as those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while credits reduce tax. Above and below the line Above and below the line refers to items above or below adjusted gross income, which is item 37 on the tax year 2017 1040 tax form. Tax deductions above the line lessen adjusted gross income, while deductions below the line can only lessen taxable income if the aggregate of those deductions exceeds the standard deduction, which in tax year 2018 in the U.S., for example, was $12,000 for a single taxpayer and $24,000 for married couple. Limitations Often, deductions are subject to conditions, such as being allowed only for expenses incurred that produce current benefits. Capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public–private Partnership

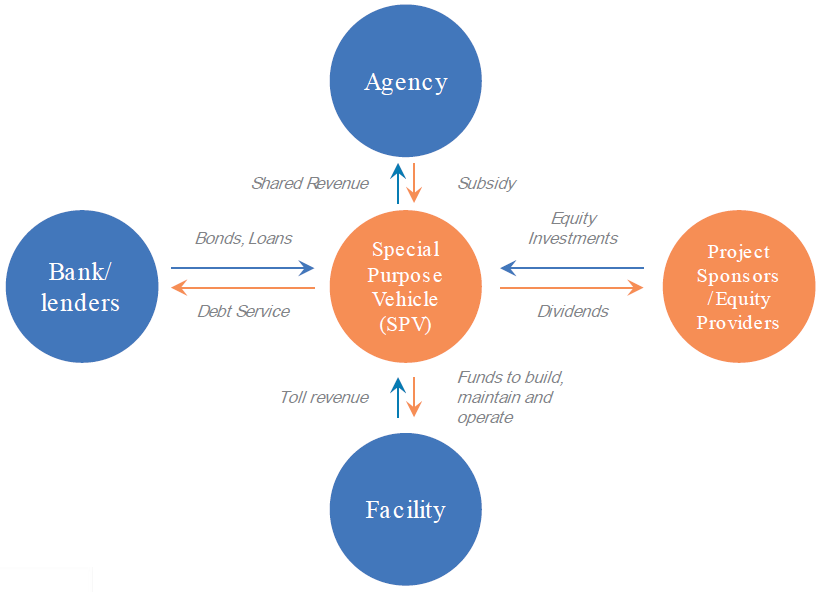

A public–private partnership (PPP, 3P, or P3) is a long-term arrangement between a government and private sectors, private sector institutions.Hodge, G. A and Greve, C. (2007), Public–Private Partnerships: An International Performance Review, Public Administration Review, 2007, Vol. 67(3), pp. 545–558 Typically, it involves private capital financing government projects and services up-front, and then drawing revenues from taxpayers and/or users for profit over the course of the PPP contract. Public–private partnerships have been implemented in Public–private partnerships by country, multiple countries and are primarily used for infrastructure projects. Although they are not compulsory, PPPs have been employed for building, equipping, operating and maintaining schools, hospitals, transport systems, and water and sewerage systems. Cooperation between private actors, corporations and governments has existed since the inception of sovereign states, notably for the purpose ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Concession (contract)

A concession or concession agreement is a grant of rights, land, property, or facility by a government, local authority, corporation, individual or other legal entity. Public services such as water supply may be operated as a concession. In the case of a public service concession, a private company enters into an agreement with the government to have the exclusive right to operate, maintain and carry out investment in a public utility (such as a water privatisation) for a given number of years. Other forms of contracts between public and private entities, namely lease contract and management contract (in the water sector often called by the French term ''affermage''), are closely related but differ from a concession in the rights of the operator and its remuneration. A lease gives a company the right to operate and maintain a public utility, but investment remains the responsibility of the public. Under a management contract the operator will collect the revenue only on behalf ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Capital

A capital requirement (also known as regulatory capital, capital adequacy or capital base) is the amount of capital a bank or other financial institution has to have as required by its financial regulator. This is usually expressed as a capital adequacy ratio of equity as a percentage of risk-weighted assets. These requirements are put into place to ensure that these institutions do not take on excess leverage and risk becoming insolvent. Capital requirements govern the ratio of equity to debt, recorded on the liabilities and equity side of a firm's balance sheet. They should not be confused with reserve requirements, which govern the assets side of a bank's balance sheet—in particular, the proportion of its assets it must hold in cash or highly-liquid assets. Capital is a source of funds, not a use of funds. From the 1880s to the end of the First World War, the capital-to-assets ratios globally declined sharply, before remaining relatively steady during the 20th century. Regu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Angel Investor

An angel investor (also known as a business angel, informal investor, angel funder, private investor, or seed investor) is an individual who provides capital to a business or businesses, including startups, usually in exchange for convertible debt or ownership equity. Angel investors often provide support to startups at a very early stage (when the risk of their failure is relatively high), once or in a consecutive manner, and when most investors are not prepared to back them. In a survey of 150 founders conducted by Wilbur Labs, about 70% of entrepreneurs will face potential business failure, and nearly 66% will face this potential failure within 25 months of launching their company. A small but increasing number of angel investors invest online through equity crowdfunding or organize themselves into angel groups or angel networks to share investment capital and provide advice to their portfolio companies. The number of angel investors has greatly increased since the mid-20th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit Sharing

Profit sharing refers to various incentive plans introduced by businesses which provide direct or indirect payments to employees, often depending on the company's profitability, employees' regular salaries, and bonuses. In publicly traded companies, these plans typically amount to allocation of shares to employees. The profit sharing plans are based on predetermined economic sharing rules that define the split of gains between the company as a principal and the employee as an agent.Moffatt, Mike. (2008) About.com Sharing Rule'' Economics Glossary; Terms Beginning with S. Accessed June 19, 2008. For example, suppose the profits are x, which might be a random variable. Before knowing the profits, the principal and agent might agree on a sharing rule s(x). Here, the agent will receive s(x) and the principal will receive the residual gain x-s(x). Profit-sharing tends to lead to less conflict and more cooperation between labor and their employers. History American politician A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

Private equity (PE) is stock in a private company that does not offer stock to the general public; instead it is offered to specialized investment funds and limited partnerships that take an active role in the management and structuring of the companies. In casual usage "private equity" can refer to these investment firms rather than the companies in which they invest. Private-equity capital (economics), capital is invested into a target company either by an investment management company (private equity firm), a venture capital fund, or an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Private equity can provide working capital to finance a target company's expansion, including the development of new products and services, operational restructuring, management changes, and shifts in ownership and control. As a financial product, a private-equity fund is private capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Takeover

In business, a takeover is the purchase of one company (the ''target'') by another (the ''acquirer'' or ''bidder''). In the UK, the term refers to the acquisition of a public company whose shares are publicly listed, in contrast to the acquisition of a private company. Management of the target company may or may not agree with a proposed takeover, and this has resulted in the following takeover classifications: friendly, hostile, reverse or back-flip. Financing a takeover often involves loans or bond issues which may include junk bonds as well as a simple cash offer. It can also include shares in the new company. Takeover types Friendly takeover A ''friendly takeover'' is an acquisition which is approved by the management of the target company. Before a bidder makes an offer for another company, it usually first informs the company's board of directors. In a private company, because the shareholders and the board are usually the same people or closely connected with on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |