|

Capital Gain

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares. A capital gain is only possible when the selling price of the asset is greater than the original purchase price. In the event that the purchase price exceeds the sale price, a capital loss occurs. Capital gains are often subject to taxation, of which rates and exemptions may differ between countries. The history of capital gain originates at the birth of the modern economic system and its evolution has been described as complex and multidimensional by a variety of economic thinkers. The concept of capital gain may be considered comparable with other key economic concepts such as profit and rate of return; however, its distinguishing feature is that individuals, not just businesses, can accrue capital gains through everyday acquisition a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Concept

Economics () is a behavioral science that studies the production, distribution, and consumption of goods and services. Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyses what is viewed as basic elements within economies, including individual agents and markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and investment expenditure interact; and the factors of production affecting them, such as: labour, capital, land, and enterprise, inflation, economic growth, and public policies that impact these elements. It also seeks to analyse and describe the global economy. Other broad distinctions within economics include those between positive economics, describing "what is", and normative economics, advocating " ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the United States Department of the Treasury, Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure funded over a fifth of the Union's war expens ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Irrationality

Irrationality is cognition, thinking, talking, or acting without rationality. Irrationality often has a negative connotation, as thinking and actions that are less useful or more illogical than other more rational alternatives. The concept of irrationality is especially important in Albert Ellis's rational emotive behavior therapy, where it is characterized specifically as the tendency and leaning that humans have to act, emote and think in ways that are inflexible, unrealistic, absolutist and most importantly self-defeating and socially defeating and destructive. However, irrationality is not always viewed as a negative. Much subject matter in literature can be seen as an expression of human longing for the irrational. The Romantics valued irrationality over what they perceived as the sterile, calculating and emotionless philosophy which they thought to have been brought about by the Age of Enlightenment and the Industrial Revolution. Dada Surrealist art movements embr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Human Psychology

Psychology is the scientific study of mind and behavior. Its subject matter includes the behavior of humans and nonhumans, both conscious and unconscious phenomena, and mental processes such as thoughts, feelings, and motives. Psychology is an academic discipline of immense scope, crossing the boundaries between the natural and social sciences. Biological psychologists seek an understanding of the emergent properties of brains, linking the discipline to neuroscience. As social scientists, psychologists aim to understand the behavior of individuals and groups.Hockenbury & Hockenbury. Psychology. Worth Publishers, 2010. A professional practitioner or researcher involved in the discipline is called a psychologist. Some psychologists can also be classified as behavioral or cognitive scientists. Some psychologists attempt to understand the role of mental functions in individual and social behavior. Others explore the physiological and neurobiological processes that underli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Disposition Effect

The disposition effect is an anomaly discovered in behavioral finance. It relates to the tendency of investors to sell assets that have increased in value, while keeping assets that have dropped in value. Hersh Shefrin and Meir Statman identified and named the effect in their 1985 paper, which found that people dislike losing significantly more than they enjoy winning. The disposition effect has been described as one of the foremost vigorous actualities around individual investors because investors will hold stocks that have lost value yet sell stocks that have gained value." In 1979, Daniel Kahneman and Amos Tversky traced the cause of the disposition effect to the so-called "prospect theory". The prospect theory proposes that when an individual is presented with two equal choices, one having possible gains and the other with possible losses, the individual is more likely to opt for the former choice even though both would yield the same economic result. The disposition effect ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

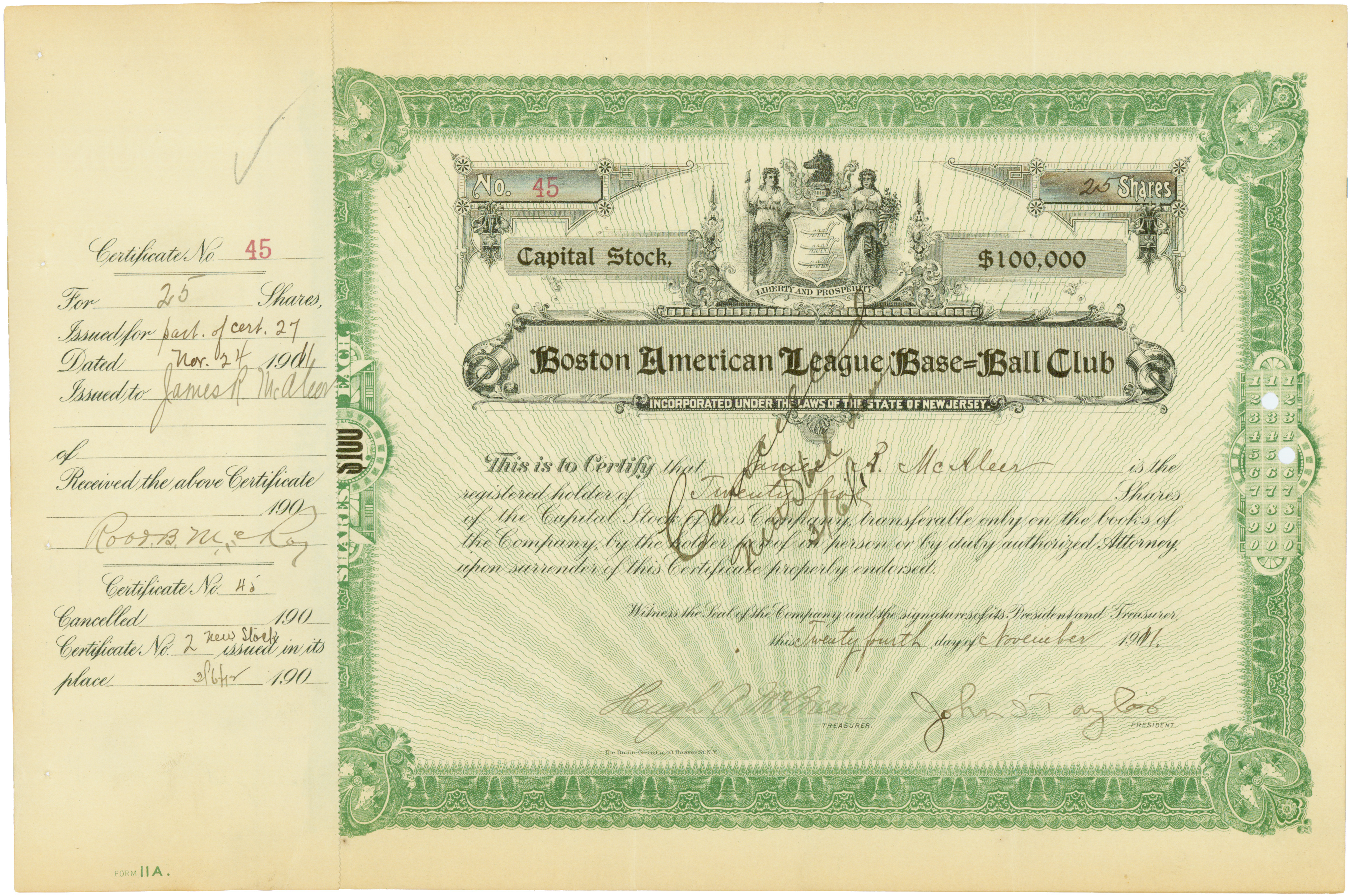

Share Capital

A corporation's share capital, commonly referred to as capital stock in the United States, is the portion of a corporation's equity that has been derived by the issue of shares in the corporation to a shareholder, usually for cash. ''Share capital'' may also denote the number and types of shares that compose a corporation's share structure. Definition In accounting, the share capital of a corporation is the nominal value of issued shares (that is, the sum of their par values, sometimes indicated on share certificates). If the allocation price of shares is greater than the par value, as in a rights issue, the shares are said to be sold at a premium (variously called share premium, additional paid-in capital or paid-in capital in excess of par). This equation shows the constituents that make up a company's real share capital: : \sum\text \times \text This is differentiated from share capital in the accounting sense, as it presents nominal share capital and does not take t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash

In economics, cash is money in the physical form of currency, such as banknotes and coins. In book-keeping and financial accounting, cash is current assets comprising currency or currency equivalents that can be accessed immediately or near-immediately (as in the case of money market accounts). Cash is seen either as a reserve for payments, in case of a structural or incidental negative cash flow or as a way to avoid a downturn on financial markets. Etymology The English word ''cash'' originally meant , and later came to have a secondary meaning . This secondary usage became the sole meaning in the 18th century. The word ''cash'' comes from the Middle French , which comes from the Old Italian , and ultimately from the Latin . History In Western Europe, after the fall of the Western Roman Empire, coins, silver jewelry and hacksilver (silver objects hacked into pieces) were for centuries the only form of money, until Venetian merchants started using silver bars for larg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as "born out of statute"; a legal person in a legal context) and recognized as such in Corporate law, law for certain purposes. Early incorporated entities were established by charter (i.e., by an ''ad hoc'' act granted by a monarch or passed by a parliament or legislature). Most jurisdictions now allow the creation of new corporations through List of company registers, registration. Corporations come in many different types but are usually divided by the law of the jurisdiction where they are chartered based on two aspects: whether they can issue share capital, stock, or whether they are formed to make a profit (accounting), profit. Depending on the number of owners, a corporation can be classified as ''aggregate'' (the subject of this articl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Income

In economics, personal income refers to the total earnings of an individual from various sources such as wages, investment ventures, and other sources of income. It encompasses all the products and money received by an individual. Personal income can be defined in different ways: * It refers to the income received by individuals or households in a country from all sources during a specific year. * It includes earned income or transferred income received by households within the country or even from outside sources. * It represents the total capital an individual receives from various sources over a certain period or throughout their life. Personal income encompasses various forms of income beyond just wages. It can include dividends, transfers, pension payments, government benefits, and rental income, among others. Taxes charged to an individual are typically not deducted when calculating personal income. Personal income serves as an indicator of the real well-being of people an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Income Tax

A corporate tax, also called corporation tax or company tax or corporate income tax, is a type of direct tax levied on the income or capital of corporations and other similar legal entities. The tax is usually imposed at the national level, but it may also be imposed at state or local levels in some countries. Corporate taxes may be referred to as income tax or capital tax, depending on the nature of the tax. The purpose of corporate tax is to generate revenue for the government by taxing the profits earned by corporations. The tax rate varies from country to country and is usually calculated as a percentage of the corporation's net income or capital. Corporate tax rates may also differ for domestic and foreign corporations. Some countries have tax laws that require corporations to pay taxes on their worldwide income, regardless of where the income is earned. However, most countries have territorial tax systems, which only require corporations to pay taxes on income earned within ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Share (finance)

In finance, financial markets, a share (sometimes referred to as stock or Equity (finance), equity) is a unit of Equity (finance), equity ownership in the Stock, capital stock of a corporation. It can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of an enterprise. The owner of shares in a company is a shareholder (or stockholder) of the corporation. A share expresses the ownership relationship between the company and the shareholder. The denominated value of a share is its face value, and the total of the face value of issued shares represent the Financial capital, capital of a company, which may not reflect the market value of those shares. The income received from the ownership of shares is a dividend. There are different types of shares such as equity shares, preference shares, deferred shares, redeemable shares, bonus shares, right shares, and employee stock option plan shares. Terminology ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |