|

Banking In India

Modern banking in India originated in the mid of 18th century. Among the first banks were the Bank of Hindustan, which was established in 1770 and liquidated in 1829–32; and the General Bank of India, established in 1786 but failed in 1791. The largest and the oldest bank which is still in existence is the State Bank of India (SBI). It originated and started working as the Bank of Calcutta in mid-June 1806. In 1809, it was renamed as the Bank of Bengal. This was one of the three banks founded by a presidency government, the other two were the Bank of Bombay in 1840 and the Bank of Madras in 1843. The three banks were merged in 1921 to form the Imperial Bank of India, which upon India's independence, became the State Bank of India in 1955. For many years, the presidency banks had acted as quasi-central banks, as did their successors, until the Reserve Bank of India was established in 1935, under the Reserve Bank of India Act, 1934. In 1960, the State Banks of India ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

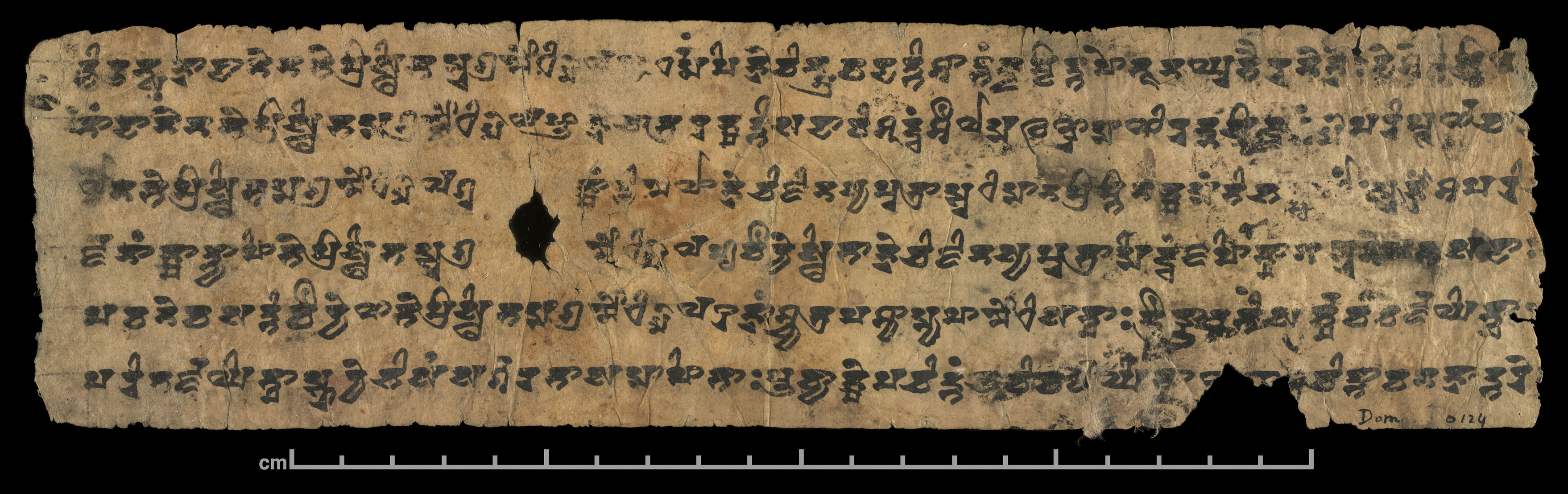

Sutra

''Sutra'' ()Monier Williams, ''Sanskrit English Dictionary'', Oxford University Press, Entry fo''sutra'' page 1241 in Indian literary traditions refers to an aphorism or a collection of aphorisms in the form of a manual or, more broadly, a condensed manual or text. Sutras are a genre of ancient and medieval Indian texts found in Hinduism, Buddhism and Jainism. In Hinduism, sutras are a distinct type of literary composition, a compilation of short aphoristic statements.Gavin Flood (1996), ''An Introduction to Hinduism'', Cambridge University Press, , pages 54–55 Each sutra is any short rule, like a theorem distilled into few words or syllables, around which teachings of ritual, philosophy, grammar, or any field of knowledge can be woven. The oldest sutras of Hinduism are found in the Brahmana and Aranyaka layers of the Vedas. Every school of Hindu philosophy, Vedic guides for rites of passage, various fields of arts, law, and social ethics developed respective sutras, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

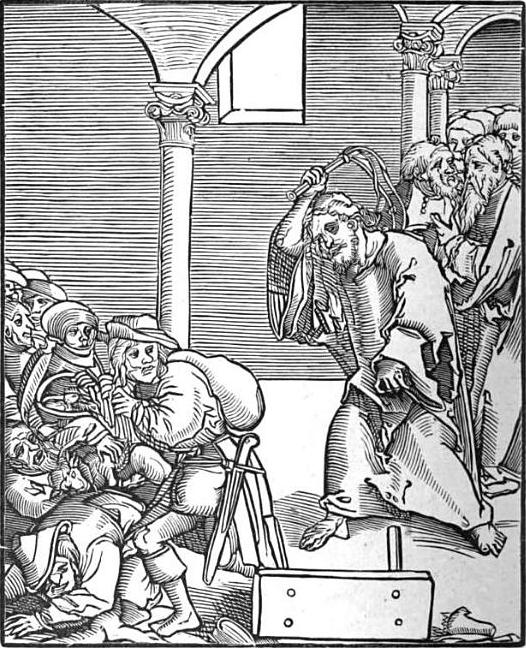

Usury

Usury () is the practice of making loans that are seen as unfairly enriching the lender. The term may be used in a moral sense—condemning taking advantage of others' misfortunes—or in a legal sense, where an interest rate is charged in excess of the maximum rate that is allowed by law. A loan may be considered usurious because of excessive or abusive interest rates or other factors defined by the laws of a state. Someone who practices usury can be called a ''usurer'', but in modern colloquial English may be called a ''loan shark''. In many historical societies including ancient Christian, Jewish, and Islamic societies, usury meant the charging of interest of any kind, and was considered wrong, or was made illegal. During the Sutra period in India (7th to 2nd centuries BC) there were laws prohibiting the highest castes from practicing usury. Similar condemnations are found in religious texts from Buddhism, Judaism ('' ribbit'' in Hebrew), Christianity, and Islam (''rib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

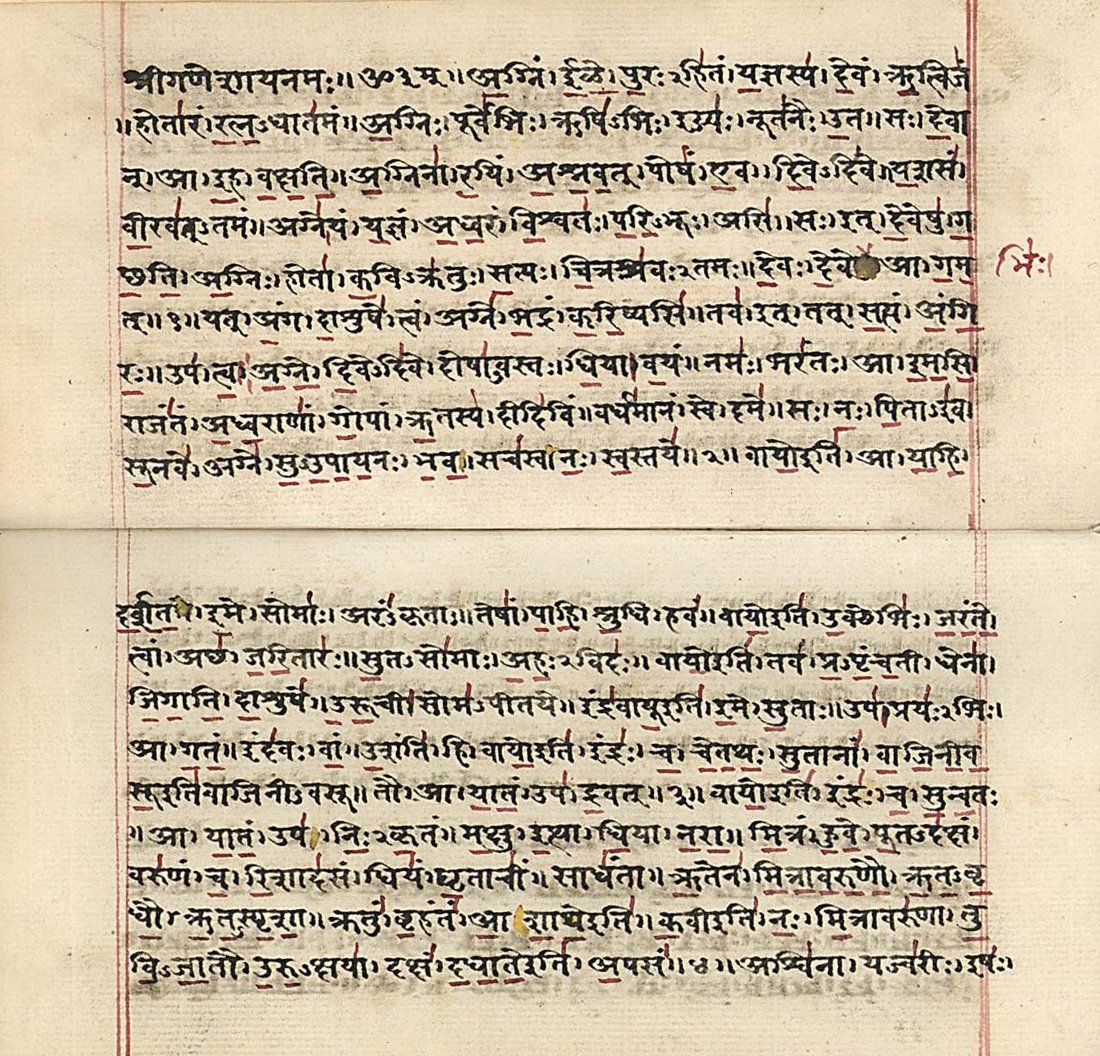

Vedas

FIle:Atharva-Veda samhita page 471 illustration.png, upright=1.2, The Vedas are ancient Sanskrit texts of Hinduism. Above: A page from the ''Atharvaveda''. The Vedas ( or ; ), sometimes collectively called the Veda, are a large body of religious texts originating in ancient India. Composed in Vedic Sanskrit, the texts constitute the oldest layer of Sanskrit literature and the oldest Hindu texts, scriptures of Hinduism. There are four Vedas: the Rigveda, the Yajurveda, the Samaveda and the Atharvaveda. Each Veda has four subdivisions – the Samhitas (mantras and benedictions), the Brahmanas (commentaries on and explanation of rituals, ceremonies and sacrifices – Yajñas), the Aranyakas (text on rituals, ceremonies, sacrifices and symbolic-sacrifices), and the Upanishads (texts discussing meditation, philosophy and spiritual knowledge).Gavin Flood (1996), ''An Introduction to Hinduism'', Cambridge University Press, , pp. 35–39A Bhattacharya (2006), ''Hindu Dharma: Introduc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquid Capital

Liquid capital or fluid capital is the part of a firm's assets that it holds as money. It includes cash balances, bank deposits, and money market investments. See also * Circulating capital * High quality liquid assets * Fixed asset * Liquidity Liquidity is a concept in economics involving the convertibility of assets and obligations. It can include: * Market liquidity In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quic ... References Capital management Corporate development {{finance-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SEBI

The Securities and Exchange Board of India (SEBI) is the regulatory body for securities and commodity market in India under the administrative domain of Ministry of Finance within the Government of India. It was established on 12 April 1988 as an executive body and was given statutory powers on 30 January 1992 through the SEBI Act, 1992. History The Securities and Exchange Board of India (SEBI) was first established in 1988 as a non-statutory body for regulating the securities market. Before it came into existence, the Controller of Capital Issues was the market's regulatory authority, and derived power from the Capital Issues (Control) Act, 1947. SEBI became an autonomous body on 30 January 1992 and was accorded statutory powers with the passing of the SEBI Act, 1992 by the Parliament of India. It has its headquarters at the business district of Bandra Kurla Complex in Mumbai and has Northern, Eastern, Southern and Western Regional Offices in New Delhi, Kolkata, Chennai, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deposit Account

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained below. Transactions on deposit accounts are recorded in a bank's books, and the resulting balance is recorded as a liability of the bank and represents an amount owed by the bank to the customer. In other words, the banker-customer (depositor) relationship is one of debtor-creditor. Some banks charge fees for transactions on a customer's account. Additionally, some banks pay customers interest on their account balances. Types of accounts * How banking works In banking, the verbs "deposit" and "withdraw" mean a customer paying money into, and taking money out of, an account, respectively. From a legal and financial accounting standpoint, the noun "deposit" is used by the banking industry in financial statements to describe the liability ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Savings Account

A savings account is a bank account at a retail banking, retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditionally, transactions on savings accounts were widely recorded in a passbook, and were sometimes called passbook savings accounts, and bank statements were not provided; however, currently such transactions are commonly recorded electronically and accessible online. People deposit funds in savings account for a variety of reasons, including a safe place to hold their cash. Savings accounts normally pay interest as well: almost all of them accrue compound interest over time. Several countries require savings accounts to be protected by deposit insurance and some countries provide a government guarantee for at least a portion of the account balance. There are many types of savings accounts, often serving particular purposes. These may includ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Current Accounts

A transaction account (also called a checking account, cheque account, chequing account, current account, demand deposit account, or share account at credit unions) is a deposit account or bank account held at a bank or other financial institution. It is available to the account owner "on demand" and is available for frequent and immediate access by the account owner or to others as the account owner may direct. Access may be in a variety of ways, such as cash withdrawals, use of debit cards, cheques and electronic transfer. In economic terms, the funds held in a transaction account are regarded as liquid funds. In accounting terms, they are considered as cash. Transaction accounts are known by a variety of descriptions, including a current account (British English), chequing account or checking account when held by a bank, share draft account when held by a credit union in North America. In the Commonwealth of Nations, United Kingdom, Hong Kong, India, Ireland, Australia, New Ze ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Deposits

A fixed deposit (FD) is a tenured deposit account provided by banks or non-bank financial institutions which provides investors a higher rate of interest than a regular savings account, until the given maturity date. It may or may not require the creation of a separate account. The term fixed deposit is most commonly used in India and the United States. It is known as a term deposit or time deposit in Canada, Australia, New Zealand, and as a bond in the United Kingdom. A fixed deposit means that the money cannot be withdrawn before maturity unlike a recurring deposit or a demand deposit. Due to this limitation, some banks offer additional services to FD holders such as loans against FD certificates at competitive interest rates. Banks may offer lesser interest rates under uncertain economic conditions. The tenure of an FD can vary from 7, 15 or 45 days to 1.5 years and can be as high as 10 years. In India these investments can be safer than Post Office Schemes as they a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microfinance

Microfinance consists of financial services targeting individuals and small businesses (SMEs) who lack access to conventional banking and related services. Microfinance includes microcredit, the provision of small loans to poor clients; savings account, savings and checking accounts; microinsurance; and payment systems, among other services. Microfinance product and services in MFI include: # Savings # Microcredit # Microinsurance # Microleasing and # Fund transfer/remittance. Microfinance services are designed to reach excluded customers, usually low income population segments, possibly socially marginalized, or geographically more isolated, and to help them become self-sufficient.Peck Christen, Robert; Rosenberg, Richard; Jayadeva, Veena. ''Financial institutions with a double-bottom line: Implications for the future of microfinance''. CGAP, Occasional Papers series, July 2004, pp. 2–3. ID Ghana is an example of a microfinance institution. Microfinance initially had a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |