|

Accounting In Canada

Accounting, also known as accountancy, is the process of recording and processing information about economic entities, such as businesses and corporations. Accounting measures the results of an organization's economic activities and conveys this information to a variety of stakeholders, including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms "accounting" and "financial reporting" are often used interchangeably. Accounting can be divided into several fields including financial accounting, management accounting, tax accounting and cost accounting. Financial accounting focuses on the reporting of an organization's financial information, including the preparation of financial statements, to the external users of the information, such as investors, regulators and suppliers. Management accounting focuses on the measurement, analysis and reporting of information for internal use by management to enhance business op ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Entity

An economic entity is one of the assumptions made in generally accepted accounting principles. Almost any type of organization or unit in society can be an economic entity. Examples of economic entities in accounting are hospitals, companies, municipalities, and federal agencies. The "Economic entity assumption" states that the activities of the entity are to be kept separate from the activities of its owner and all other economic entities. See also * Piercing the corporate veil References Financial accounting {{accounting-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting Information System

An accounting information system (AIS) is a system of collecting, storing and processing financial and accounting data that are used by decision makers. An accounting information system is generally a computer-based method for tracking accounting activity in conjunction with information technology resources. The resulting financial reports can be used internally by management or externally by other interested parties including investors, creditors and tax authorities. Accounting information systems are designed to support all accounting functions and activities including auditing, financial accounting porting, -managerial/ management accounting and tax. The most widely adopted accounting information systems are auditing and financial reporting modules. History Traditionally, accounting is purely based on a manual approach. The experience and skillfulness of an individual accountant are critical in accounting processes. Even using the manual approach can be ineffective and inef ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pacioli

Luca Bartolomeo de Pacioli, Order of Friars Minor, O.F.M. (sometimes ''Paccioli'' or ''Paciolo''; 1447 – 19 June 1517) was an Italian mathematician, Order of Friars Minor, Franciscan friar, collaborator with Leonardo da Vinci, and an early contributor to the field now known as accounting. He is referred to as the father of accounting and bookkeeping and he was the first person to publish a work on the Double-entry bookkeeping system, double-entry system of book-keeping on the continent. He was also called Luca di Borgo after his birthplace, Sansepolcro, Borgo Sansepolcro, Tuscany. Life Luca Pacioli was born between 1446 and 1448 in the Tuscan town of Sansepolcro where he received an Abacus school, abbaco education. This was education in the vernacular (''i.e.'', the local tongue) rather than Latin and focused on the knowledge required of merchants. His father was Bartolomeo Pacioli; however, Luca Pacioli was said to have lived with the Befolci family as a child in his birth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Accounting Standards Board

The International Accounting Standards Board (IASB) is the independent accounting standard-setting body of the IFRS Foundation. The IASB was founded on April 1, 2001, as the successor to the International Accounting Standards Committee (IASC). It is responsible for developing International Financial Reporting Standards (IFRS) and for promoting their use and application. Background and semantics The International Accounting Standards Committee (IASC) had been established in 1973 and had issued a number of standards known as International Accounting Standards (IAS). As the organization was reformed in 2001, it changed the name of the standard-setting body from IASC to IASB, and established a foundation to oversee it, initially known as the IASC Foundation and renamed the IFRS Foundation in mid-2010. Also in 2001, it was decided that newly issued standards would be labeled IFRS instead of IAS, and that the entire set of IASC/IASB standards (including the IAS issued until 2001 an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IFRS Foundation

The International Financial Reporting Standards Foundation or IFRS Foundation (sometimes IFRSF) is a nonprofit organization that sets corporate reporting standards for the capital markets globally. Its main objectives include the development and promotion of International Financial Reporting Standards (IFRS Standards), through the International Accounting Standards Board (IASB) for accounting standards and the International Sustainability Standards Board (ISSB) for sustainability-related disclosure standards. The IFRS Foundation states that its mission is to develop IFRSs that bring transparency, accountability and efficiency to capital markets around the world, and that their work serves the public interest by fostering trust, growth and long-term financial stability in the global economy.IFRS FoundationAbout the IFRS Foundation and the IASB Retrieved June 20, 2024. The Foundation is governed by a group of 22 trustees,Deloitte Global Services Limited, 2012IFRS Foundation Retrie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Financial Reporting Standards

International Financial Reporting Standards, commonly called IFRS, are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB). They constitute a standardised way of describing the company's financial performance and position so that company financial statements are understandable and comparable across international boundaries. They are particularly relevant for companies with shares or securities publicly listed. IFRS have replaced many different national accounting standards around the world but have not replaced the separate accounting standards in the United States where US GAAP is applied. History The International Accounting Standards Committee (IASC) was established in June 1973 by accountancy bodies representing ten countries. It devised and published International Accounting Standards (IAS), interpretations and a conceptual framework. These were looked to by many national accounting standard-setters in developing n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Convergence (accounting)

The convergence of accounting standards refers to the goal of establishing a single set of accounting standards that will be used internationally.FASB, 2012International Convergence of Accounting Standards—Overview Retrieved on April 27, 2012. Convergence in some form has been taking place for several decades, and efforts today include projects that aim to reduce the differences between accounting standards. Convergence is driven by several factors, including the belief that having a single set of accounting requirements would increase the comparability of different entities' accounting numbers, which will contribute to the flow of international investment and benefit a variety of stakeholders. Criticisms of convergence include its cost and pace, and the idea that the link between convergence and comparability may not be strong. Overview The international convergence of accounting standards refers to the goal of establishing a single set of high-quality accounting standards to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

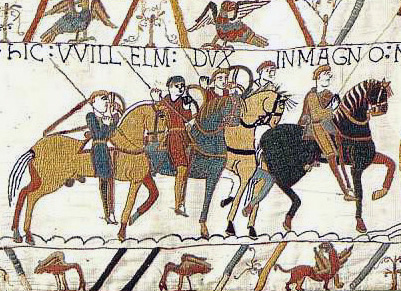

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The UK includes the island of Great Britain, the north-eastern part of the island of Ireland, and most of List of islands of the United Kingdom, the smaller islands within the British Isles, covering . Northern Ireland shares Republic of Ireland–United Kingdom border, a land border with the Republic of Ireland; otherwise, the UK is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. It maintains sovereignty over the British Overseas Territories, which are located across various oceans and seas globally. The UK had an estimated population of over 68.2 million people in 2023. The capital and largest city of both England and the UK is London. The cities o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Accounting Standards Board

The Financial Accounting Standards Board (FASB) is a private standard-setting body whose primary purpose is to establish and improve Generally Accepted Accounting Principles (GAAP) within the United States in the public's interest. The Securities and Exchange Commission (SEC) designated the FASB as the organization responsible for setting accounting standards for public companies in the U.S. The FASB replaced the American Institute of Certified Public Accountants' (AICPA) Accounting Principles Board (APB) on July 1, 1973. The FASB is run by the nonprofit Financial Accounting Foundation. FASB accounting standards are accepted as authoritative by many organizations, including state Boards of Accountancy and the American Institute of CPAs (AICPA). Structure The FASB is based in Norwalk, Connecticut, and is led by seven full-time Board members,Spiceland, David; Sepe, James; Nelson, Mark; & Tomassini, Lawrence (2009). ''Intermediate Accounting'' (5th Edition). McGraw-Hill/ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting Standard

Publicly traded companies typically are subject to rigorous standards. Small and midsized businesses often follow more simplified standards, plus any specific disclosures required by their specific lenders and shareholders. Some firms operate on the cash method of accounting which can often be simple and straightforward. Larger firms most often operate on an Basis of accounting, accrual basis. Accrual basis is one of the fundamental accounting assumptions, and if it is followed by the company while preparing the financial statements, then no further disclosure is required. Accounting standards prescribe in considerable detail what accruals must be made, how the financial statements are to be presented, and what additional disclosures are required. The term ''generally accepted accounting principles'' (GAAP) was popularized in the late 1930s. Some important elements that accounting standards cover include identifying the exact entity which is reporting, discussing any "going concern ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Professional Accounting Body

A professional accounting body is an organization or association of accountants in a particular jurisdiction. Usually a person needs to be a member of such professional body to hold out to the public of the jurisdiction as an accountant. The designations for qualified accountants vary from jurisdiction to jurisdiction, such as Cost and Management Accountant (CMA), Chartered Accountant (CA/ACA), Chartered Certified Accountant (CCA), Chartered Professional Accountant (CPA), Certified Public Accountant (CPA), Certified Practising Accountant (CPA), Certified Management Accountant (CMA), Chartered Management Accountant (ACMA) or Chartered Public Finance Accountant (CPFA). Some countries have a single professional accounting body while others have several. If there is more than one body, such bodies may or may not compete with each other; in some countries, professional accounting bodies are divided according to their field of activity. For example, India has two professional ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting Networks And Associations

An accounting network or accounting association is a professional services network whose principal purpose is to provide members resources to assist the clients around the world and hence reduce the uncertainty by bringing together a greater number of resources to work on a problem. The networks and associations operate independently of the independent members. The largest accounting networks are known as the Big Four. The Big Four History of accounting networks and associations Foundations Accounting networks were created to meet a specific need. “The accounting profession in the U.S. was built upon a state-established monopoly for audits of financial statements.” Accounting networks arose out of the necessity for public American companies to have audited financial statements for the Securities and Exchange Commission (SEC). For over 70 years, the SEC has continually sought for greater coordination and consistent quality in audits everywhere in the world. Network ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |