|

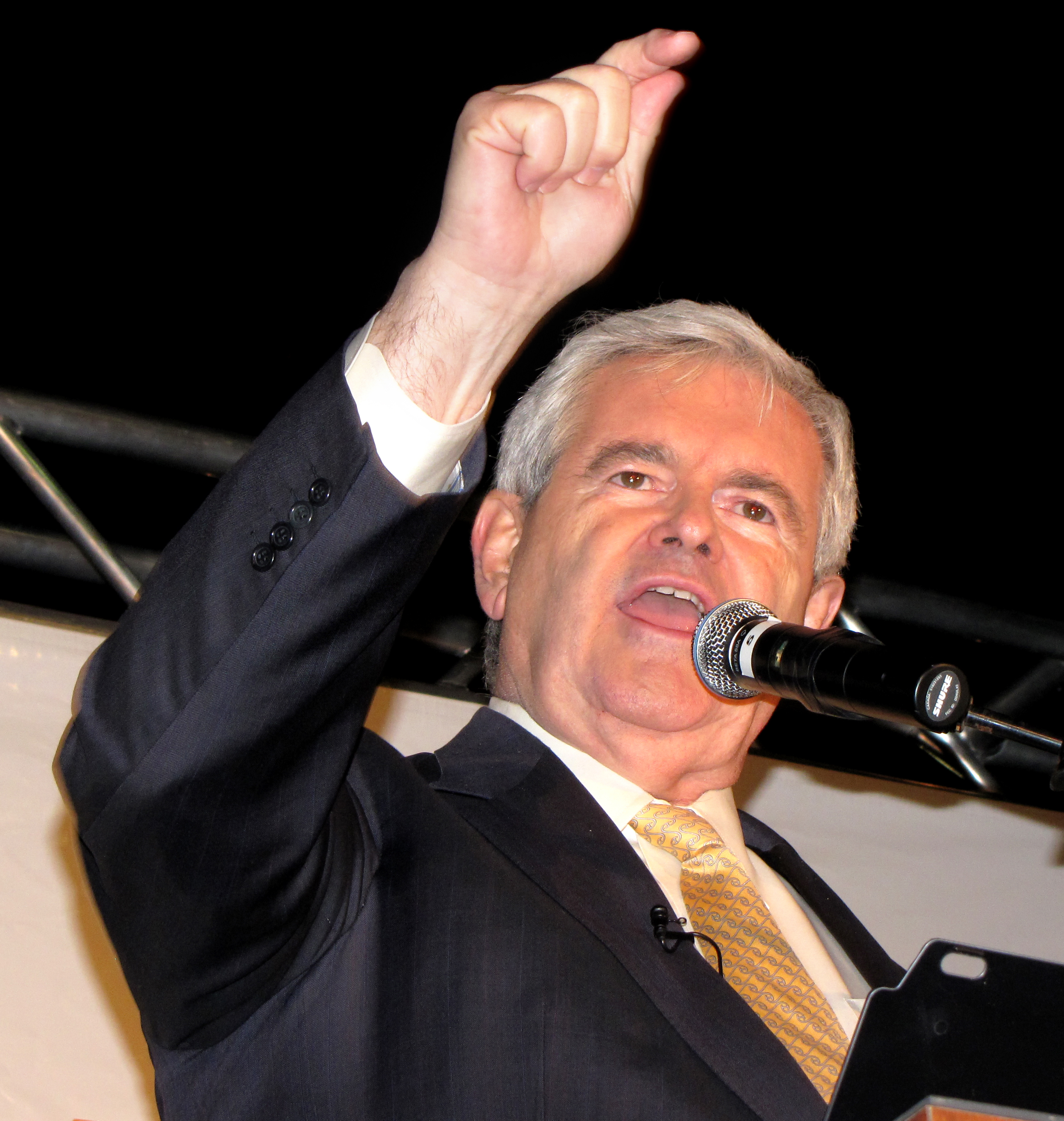

American Solutions For Winning The Future

American Solutions for Winning the Future (often referred to as American Solutions) was a 527 organization created by former Speaker of the United States House of Representatives Newt Gingrich. The group first received national attention for its 2008 effort, "Drill Here. Drill Now. Pay Less", focused on the issue of offshore drilling. The organization closed in July 2011. American Solutions was established by Gingrich in 2007.Kendra NarrFormer Gingrich 527 closes ''Politico'' (August 26, 2011). Gingrich served as chairman of the group. The group was a "fundraising juggernaut" that raised $52 million from major donors, such as Sheldon Adelson and the coal company Peabody Energy. The group promoted deregulation and increased offshore oil drilling and other fossil-fuel extraction and opposed the Employee Free Choice Act;Kathryn McGarr & Kenneth P. VogelNewt's big cash haul: $8 million ''Politico'' (July 31, 2009). ''Politico'' reported in 2009 that, "The operation, which includes a po ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

527 Organization

A 527 organization or 527 group is a type of U.S. tax-exempt organization organized under Section 527 of the U.S. Internal Revenue Code (). A 527 group is created primarily to influence the selection, nomination, election, appointment or defeat of candidates to federal, state or local public office. Technically, almost all political committees, including state, local, and federal candidate committees, traditional political action committees (PACs), " Super PACs", and political parties are "527s". However, in common practice the term is usually applied only to such organizations that are not regulated under state or federal campaign finance laws because they do not "expressly advocate" for the election or defeat of a candidate or party. There are no upper limits on contributions to 527s and no restrictions on who may contribute. There are no spending limits imposed on these organizations. The organizations must register with the Internal Revenue Service (IRS), publicly di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Huffington Post

''HuffPost'' (formerly ''The Huffington Post'' until 2017 and sometimes abbreviated ''HuffPo'') is an American progressive news website, with localized and international editions. The site offers news, satire, blogs, and original content, and covers politics, business, entertainment, environment, technology, popular media, lifestyle, culture, comedy, healthy living, women's interests, and local news featuring columnists. It was created to provide a progressive alternative to the conservative news websites such as the Drudge Report. The site offers content posted directly on the site as well as user-generated content via video blogging, audio, and photo. In 2012, the website became the first commercially run United States digital media enterprise to win a Pulitzer Prize. Founded by Andrew Breitbart, Arianna Huffington, Kenneth Lerer, and Jonah Peretti, the site was launched on May 9, 2005 as a counterpart to the Drudge Report. In March 2011, it was acquired by AOL for US$ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

District Of Columbia Superior Court

The Superior Court of the District of Columbia, commonly referred to as DC Superior Court, is the trial court for the District of Columbia, in the United States. It hears cases involving criminal and civil law, as well as family court, landlord and tenant, probate, tax and driving violations (no permit and DUI). All appeals of Superior Court decisions go to the District of Columbia Court of Appeals (though magistrate judge opinions are first appealed to a Superior Court Associate Judge). History The first judicial systems in the new District of Columbia were established by the United States Congress in 1801. The Circuit Court of the District of Columbia (not to be confused with the United States Court of Appeals for the District of Columbia Circuit, which it later evolved into) was both a trial court of general jurisdiction and an appellate court, and it heard cases under both local and federal law. Congress also established justices of the peace and an orphans' court, which ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure provided over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Constitut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Patient Protection And Affordable Care Act

The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act and colloquially known as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by President Barack Obama on March 23, 2010. Together with the Health Care and Education Reconciliation Act of 2010 amendment, it represents the U.S. healthcare system's most significant regulatory overhaul and expansion of coverage since the enactment of Medicare and Medicaid in 1965. The ACA's major provisions came into force in 2014. By 2016, the uninsured share of the population had roughly halved, with estimates ranging from 20 to 24 million additional people covered. The law also enacted a host of delivery system reforms intended to constrain healthcare costs and improve quality. After it went into effect, increases in overall healthcare spending slowed, including premiums for employer-based insurance plans. The increased coverage was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gains Tax

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property. Not all countries impose a capital gains tax and most have different rates of taxation for individuals versus corporations. Countries that do not impose a capital gains tax include Bahrain, Barbados, Belize, Cayman Islands, Isle of Man, Jamaica, New Zealand, Sri Lanka, Singapore, and others. In some countries, such as New Zealand and Singapore, professional traders and those who trade frequently are taxed on such profits as a business income. In Sweden, the Investment Savings Account (ISK – ''Investeringssparkonto'') was introduced in 2012 in response to a decision by Parliament to stimulate saving in funds and equities. There is no tax on capital gains in ISKs; instead, the saver pays an annual standard low rate of tax. Fund savers nowadays mainly choose to save in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Estate Tax In The United States

The estate tax in the United States is a federal tax on the transfer of the estate of a person who dies. The tax applies to property that is transferred by will or, if the person has no will, according to state laws of intestacy. Other transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts. The estate tax is part of the federal unified gift and estate tax in the United States. The other part of the system, the gift tax, applies to transfers of property during a person's life. In addition to this federal estate tax, many states have enacted similar taxes. These taxes may be termed " inheritance taxes" to the extent the tax is payable by a person who inherits money or property of a person who has died, as opposed to an estate tax, which is a levy on the estate (money and property) of a person who has died. The estate tax is often the subject of political debate, and opponents call it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation Tax In The Republic Of Ireland

Ireland's Corporate Tax System is a central component of Ireland's economy. In 2016–17, foreign firms paid 80% of Irish corporate tax, employed 25% of the Irish labour force (paid 50% of Irish salary tax), and created 57% of Irish OECD non-farm value-add. As of 2017, 25 of the top 50 Irish firms were U.S.–controlled businesses, representing 70% of the revenue of the top 50 Irish firms. By 2018, Ireland had received the most U.S. in history, and Apple was over one–fifth of Irish GDP. Academics rank Ireland as the largest tax haven; larger than the Caribbean tax haven system. Ireland's "headline" corporation tax rate is 12.5%, however, foreign multinationals pay an aggregate of 2.2–4.5% on global profits "shifted" to Ireland, via Ireland's global network of bilateral tax treaties. These lower effective tax rates are achieved by a complex set of Irish base erosion and profit shifting ("BEPS") tools which handle the largest BEPS flows in the world (e.g. the Double ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Income Tax In The United States

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Since January 1, 2018, the nominal federal corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules vary by jurisdiction, though many are based on federal concepts and definitions. Taxable income may differ from book income both as to timing of income and tax deductions and as to what is taxable. The corporate Alternative Minimum Tax was also eliminated by the 2017 reform, but some states have alternative taxes. Like individuals, corporations must file tax returns every year. They must make quarterly estimated tax payments. Groups of corporations controlled by the same owners may file a consolidated return. Some corporate transactions are not taxable. These include most formations and some types of mergers, acquisitions, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Insurance Contributions Act Tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) contribution directed towards both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers. Calculation Overview The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code. Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court ruled ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Milwaukee County Executive Scott Walker Runs For Governor Of Wisconsin In October 2010

Milwaukee ( ), officially the City of Milwaukee, is both the most populous and most densely populated city in the U.S. state of Wisconsin and the county seat of Milwaukee County. With a population of 577,222 at the 2020 census, Milwaukee is the 31st largest city in the United States, the fifth-largest city in the Midwestern United States, and the second largest city on Lake Michigan's shore behind Chicago. It is the main cultural and economic center of the Milwaukee metropolitan area, the fourth-most densely populated metropolitan area in the Midwest. Milwaukee is considered a global city, categorized as "Gamma minus" by the Globalization and World Cities Research Network, with a regional GDP of over $102 billion in 2020. Today, Milwaukee is one of the most ethnically and culturally diverse cities in the U.S. However, it continues to be one of the most racially segregated, largely as a result of early-20th-century redlining. Its history was heavily influenced by G ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Katon Dawson

Katon Edwards Dawson (born February 29, 1956) is an American politician from the state of South Carolina, former chairman of the South Carolina Republican Party and was a 2009 candidate for chairman of the Republican National Committee. Early life Dawson was born in Columbia, South Carolina in then-heavily Democratic South Carolina, his parents helped organize the state's first GOP precincts. Dawson says his political interest came from attending a Barry Goldwater speech in 1964, and first volunteered for Richard Nixon's 1968 presidential campaign. Dawson graduated from the University of South Carolina. Political career Dawson was elected Richland County GOP vice chairman in 1994 and state party chair 2002. In 2006, despite nationwide losses by the Republican party, the South Carolina GOP carried eight of nine statewide constitutional offices. In August 2007 Dawson drew national attention for his decision to move the 2008 South Carolina Republican presidential primary fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |